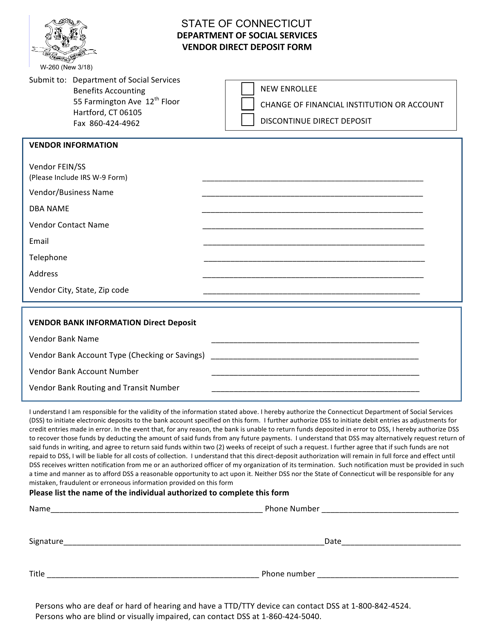

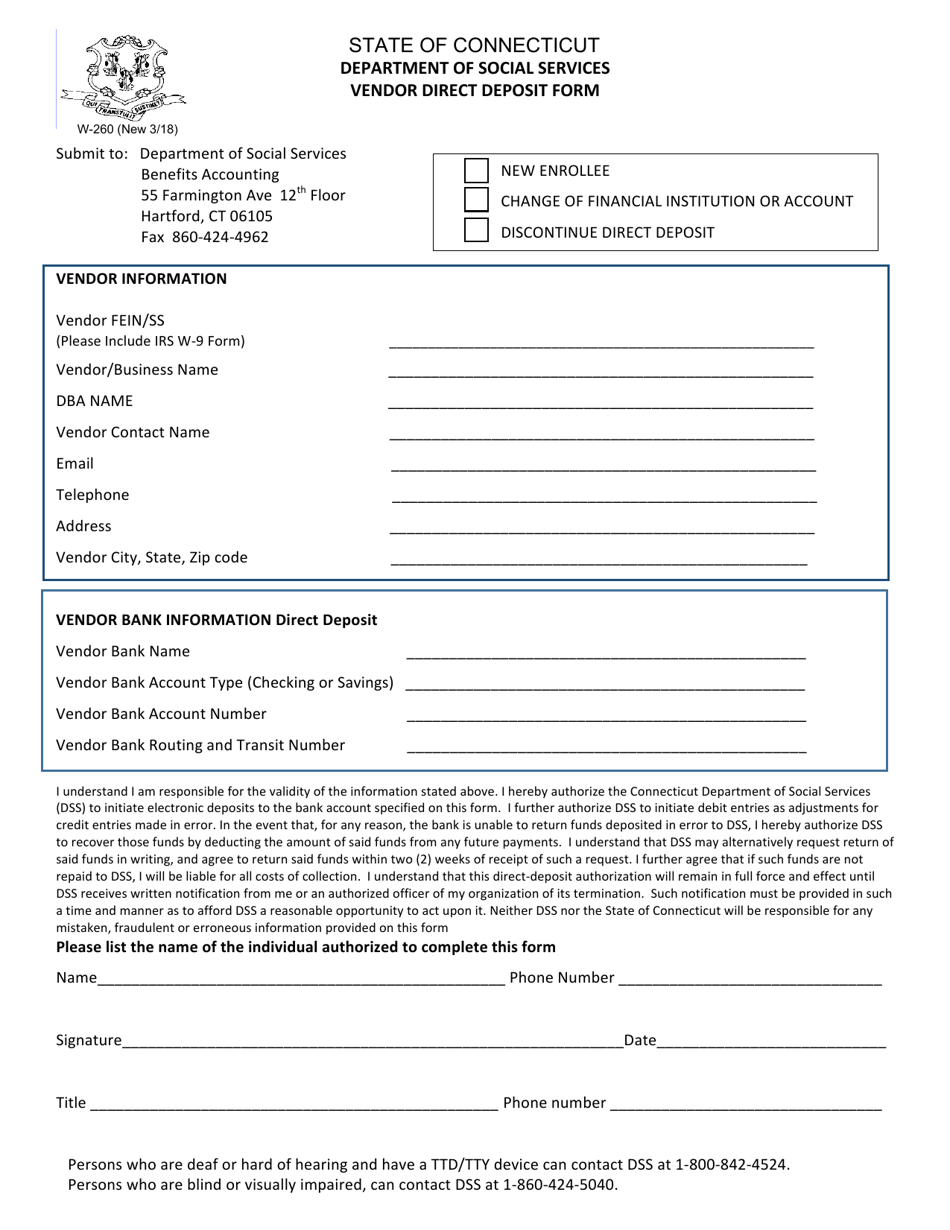

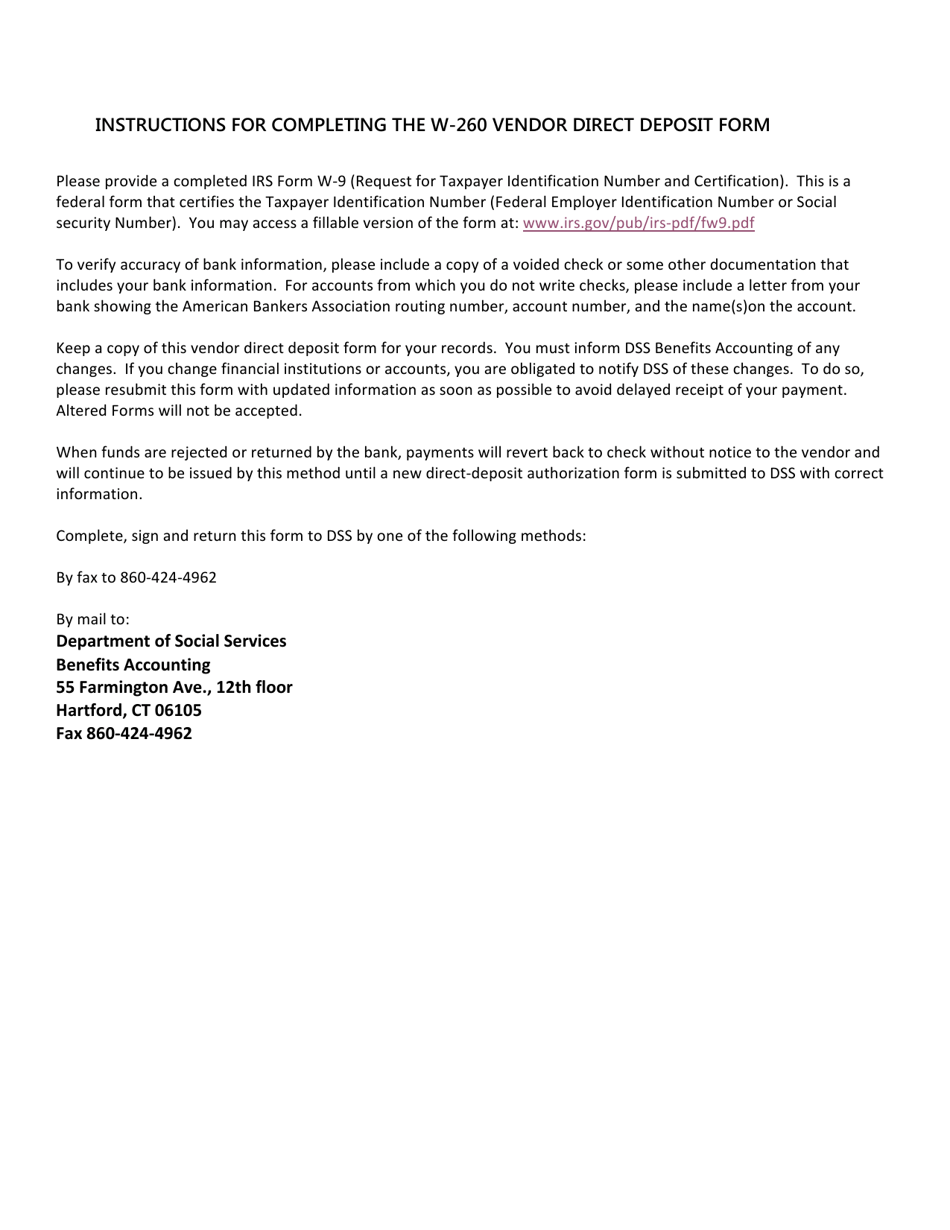

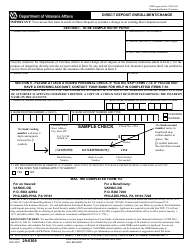

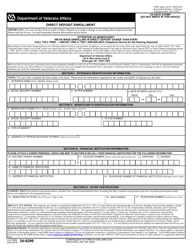

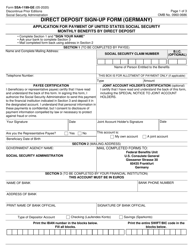

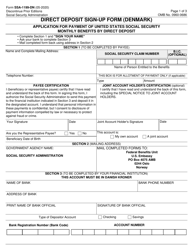

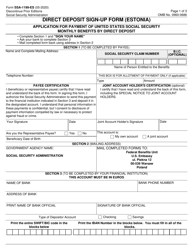

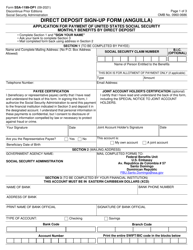

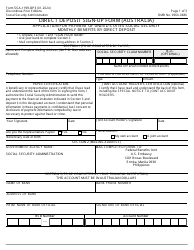

Form W-260 Vendor Direct Deposit Form - Connecticut

What Is Form W-260?

This is a legal form that was released by the Connecticut State Department of Social Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-260?

A: Form W-260 is the Vendor Direct Deposit Form used in Connecticut.

Q: Who needs to use Form W-260?

A: Vendors who want to set up direct deposit for payments in Connecticut need to use Form W-260.

Q: What is the purpose of Form W-260?

A: The purpose of Form W-260 is to authorize the State of Connecticut to electronically deposit payments into a vendor's bank account.

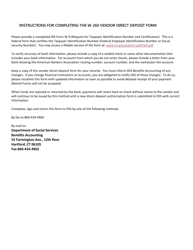

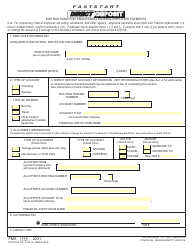

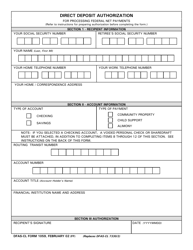

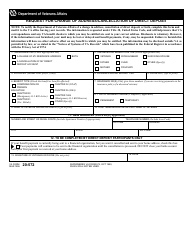

Q: How do I fill out Form W-260?

A: You need to provide your vendor information, including your name, address, taxpayer identification number, and banking information. You also need to sign and date the form.

Q: Is there a deadline for submitting Form W-260?

A: The deadline for submitting Form W-260 varies depending on the agency's requirements. Check with the agency to determine the deadline.

Q: What if I need to change my banking information?

A: If you need to change your banking information, you should contact the agency that requested the form and provide them with the updated information.

Q: Can I cancel my direct deposit authorization?

A: Yes, you can cancel your direct deposit authorization by contacting the agency that requested the form.

Q: Is Form W-260 for personal use only?

A: Form W-260 is typically used by vendors for business purposes, not for personal use.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Connecticut State Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-260 by clicking the link below or browse more documents and templates provided by the Connecticut State Department of Social Services.