This version of the form is not currently in use and is provided for reference only. Download this version of

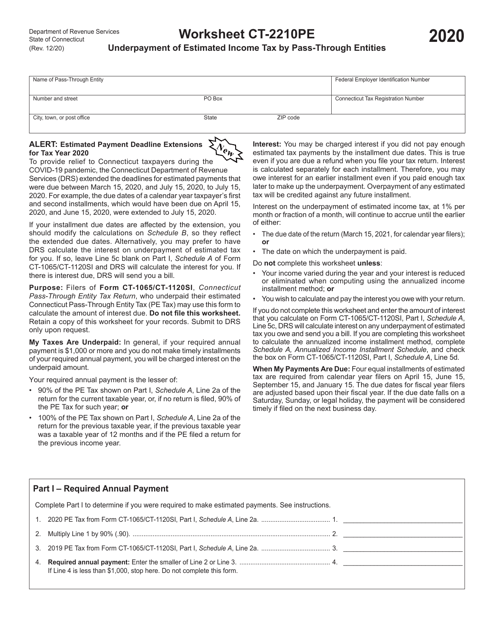

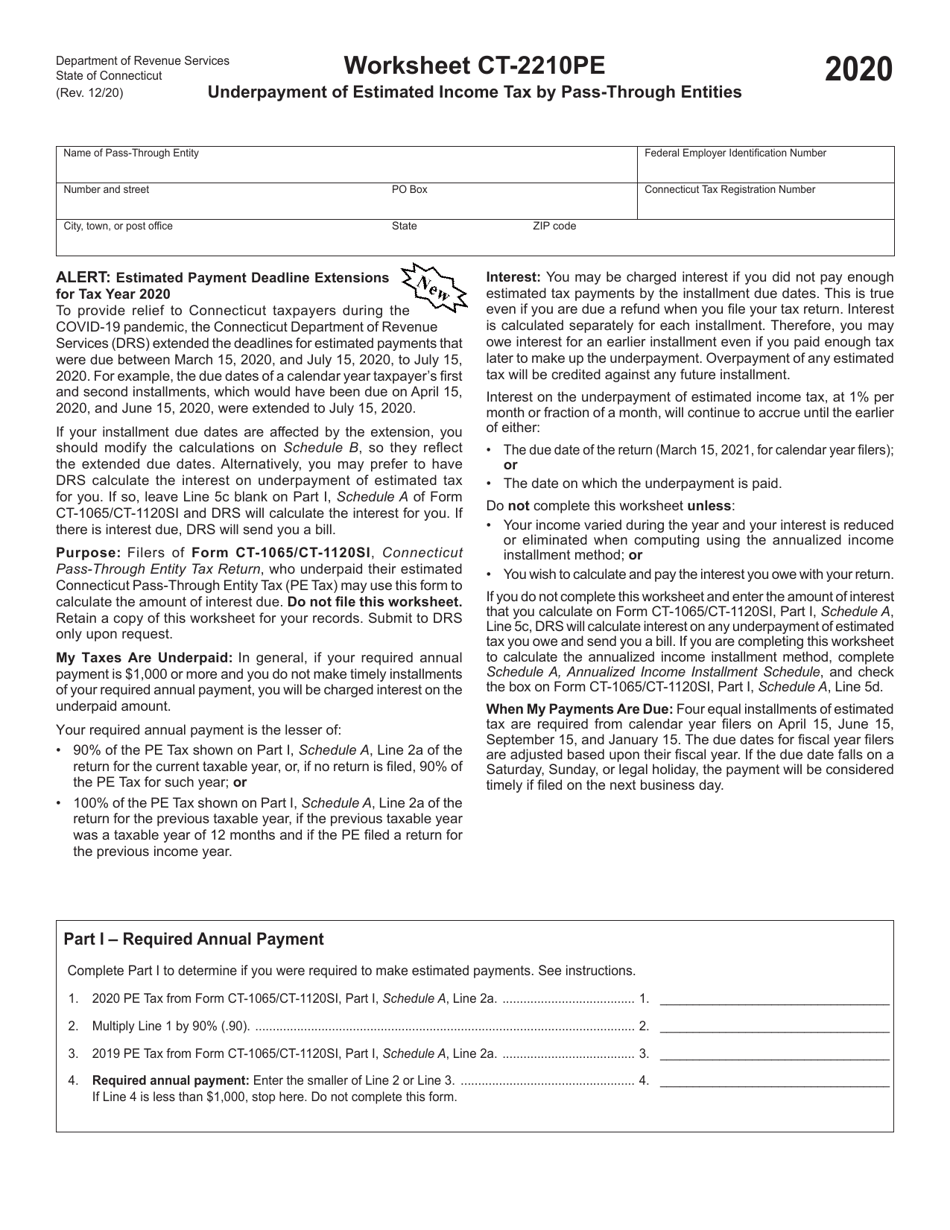

Worksheet CT-2210PE

for the current year.

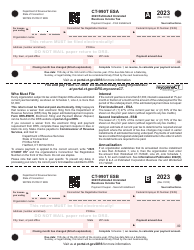

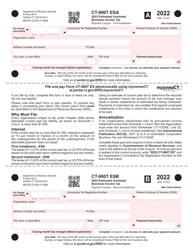

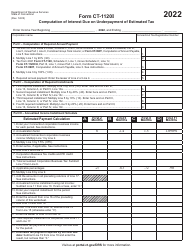

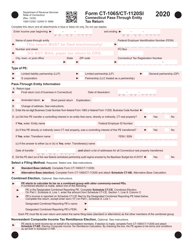

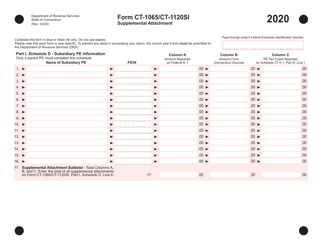

Worksheet CT-2210PE Underpayment of Estimated Income Tax by Pass-Through Entities - Connecticut

What Is Worksheet CT-2210PE?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CT-2210PE?

A: CT-2210PE is a worksheet used for calculating the underpayment of estimated income tax by pass-through entities in Connecticut.

Q: What is the purpose of CT-2210PE?

A: The purpose of CT-2210PE is to determine if a pass-through entity owes any additional tax due to underpayment of estimated income tax.

Q: Who needs to use CT-2210PE?

A: Pass-through entities in Connecticut need to use CT-2210PE if they have underpaid their estimated income tax.

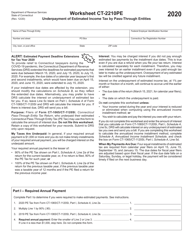

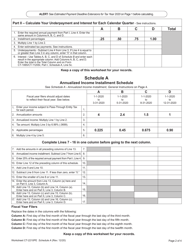

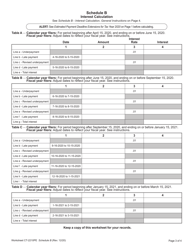

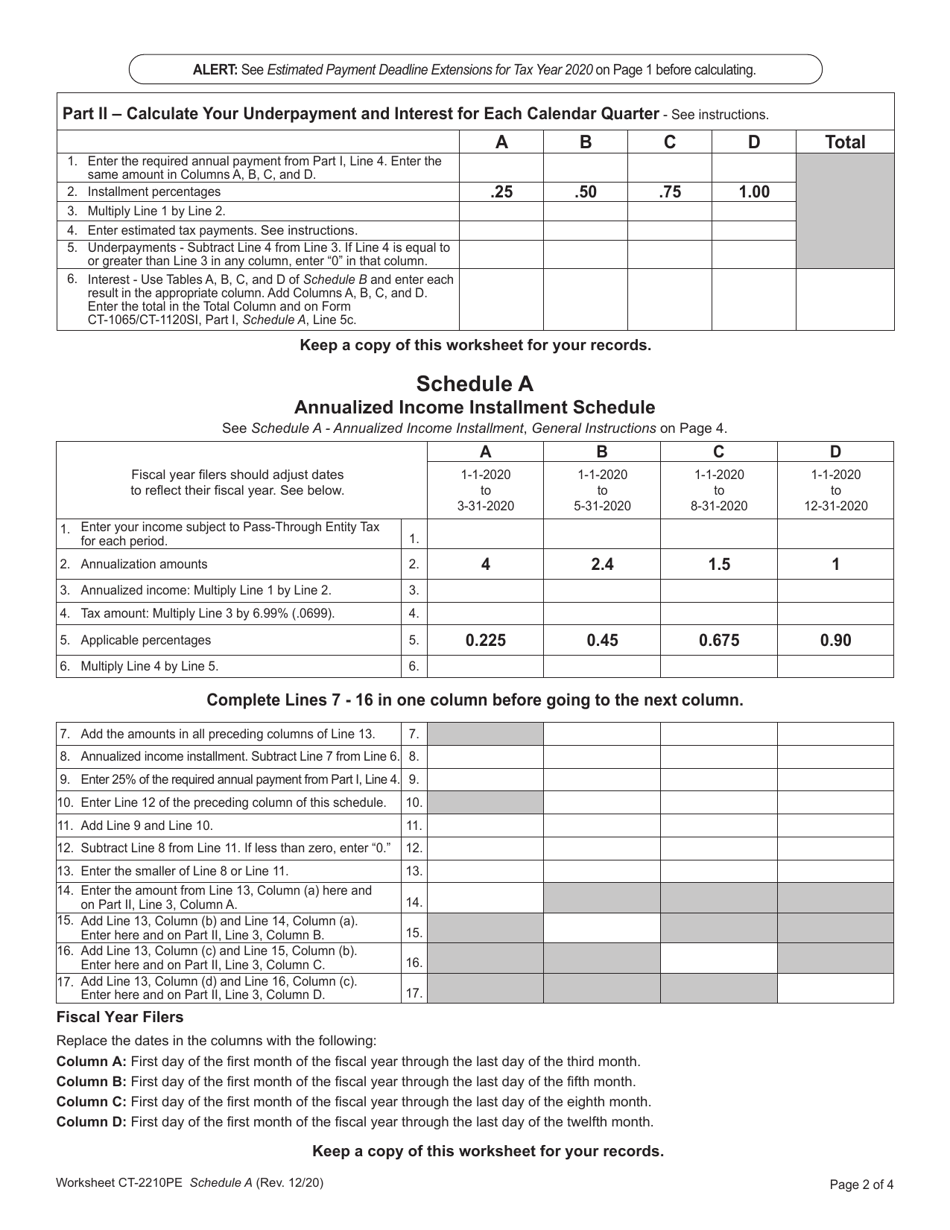

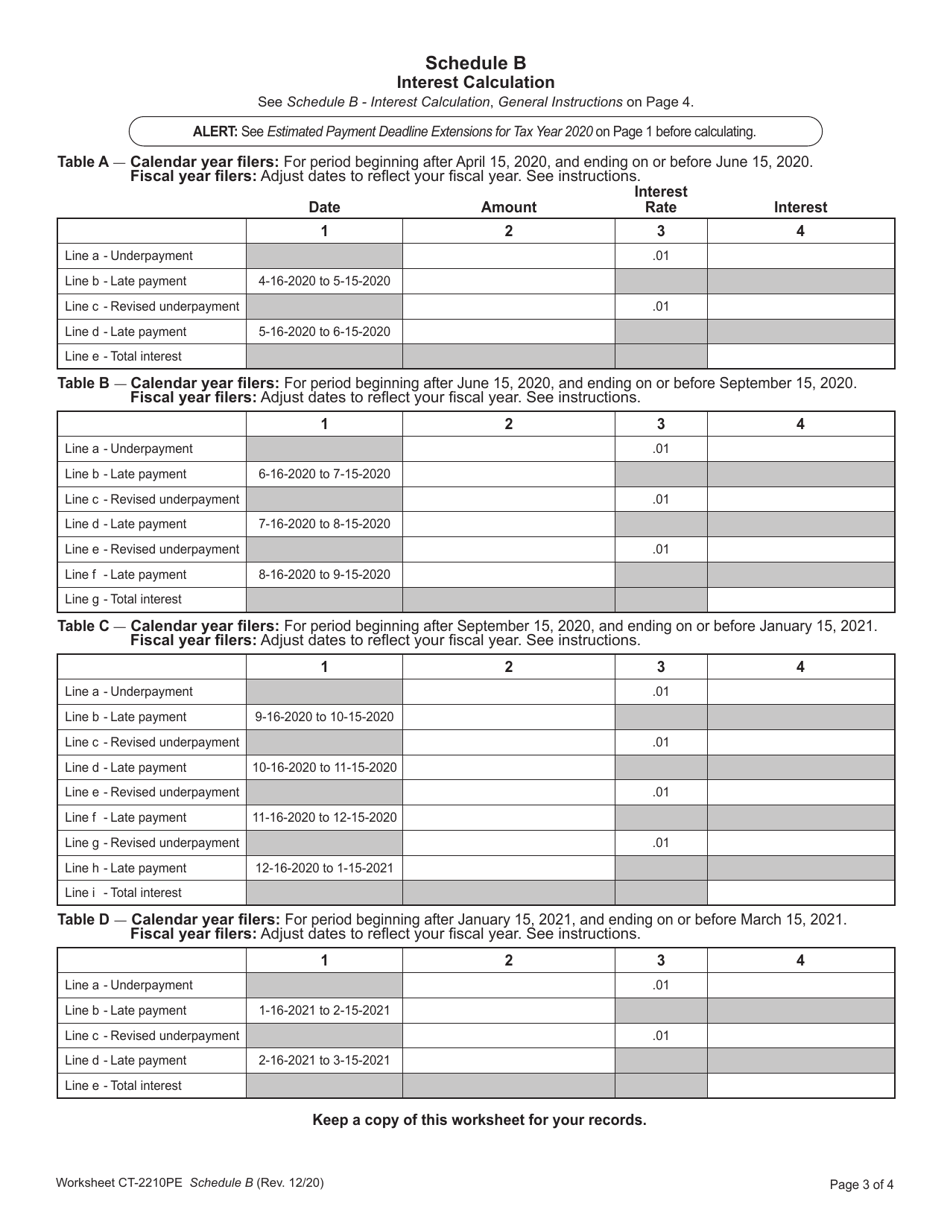

Q: How is the underpayment of estimated income tax calculated?

A: The underpayment of estimated income tax is calculated by comparing the amount of estimated tax payments made with the required annual payment.

Q: What are the consequences of underpayment?

A: Underpayment may result in penalties and interest charges.

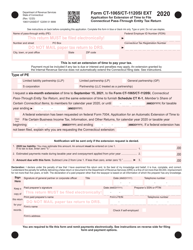

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Worksheet CT-2210PE by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.