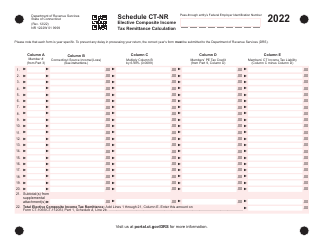

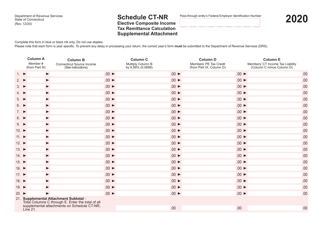

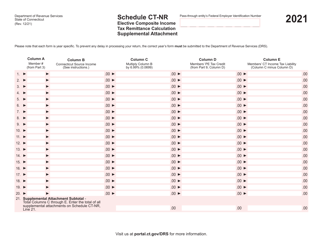

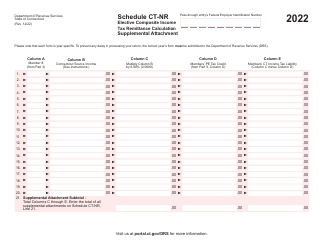

This version of the form is not currently in use and is provided for reference only. Download this version of

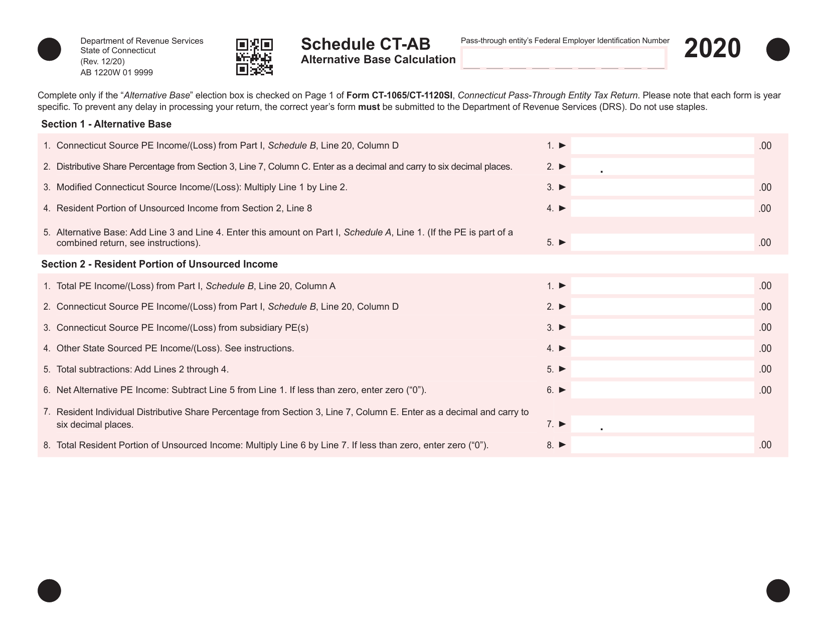

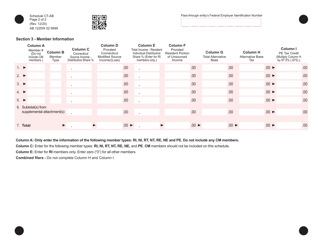

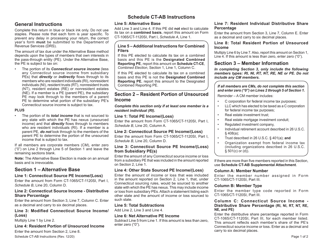

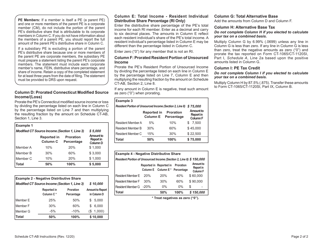

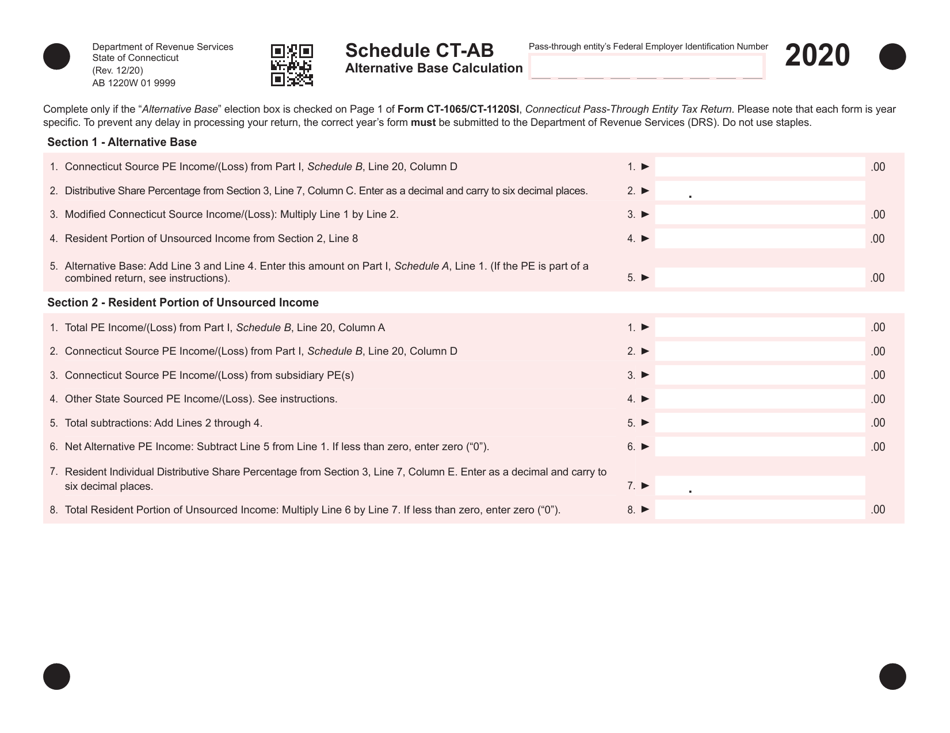

Schedule CT-AB

for the current year.

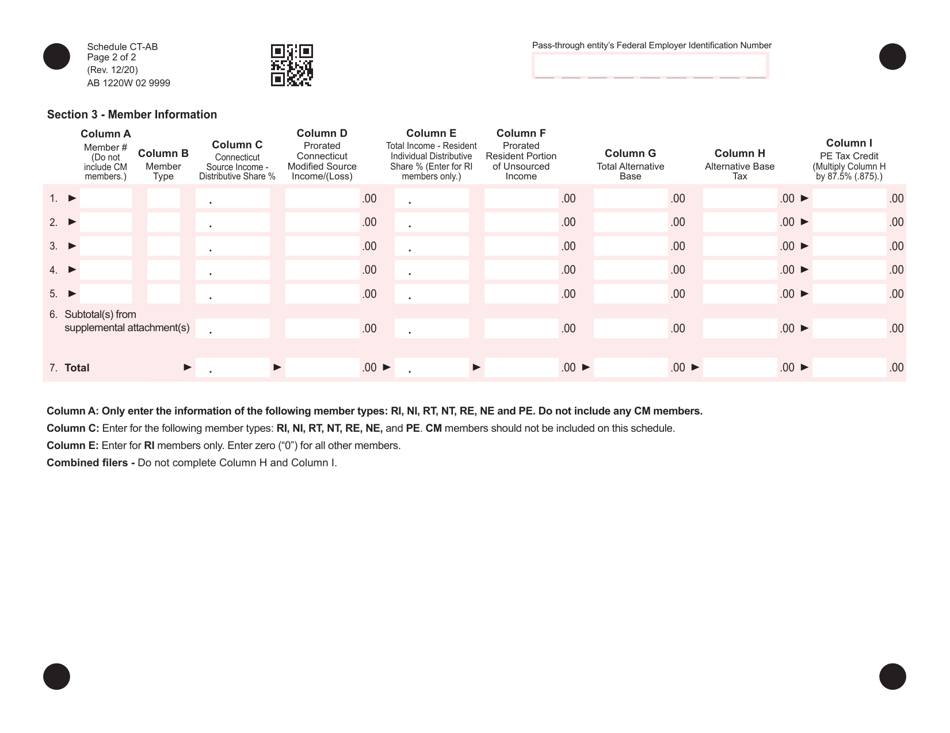

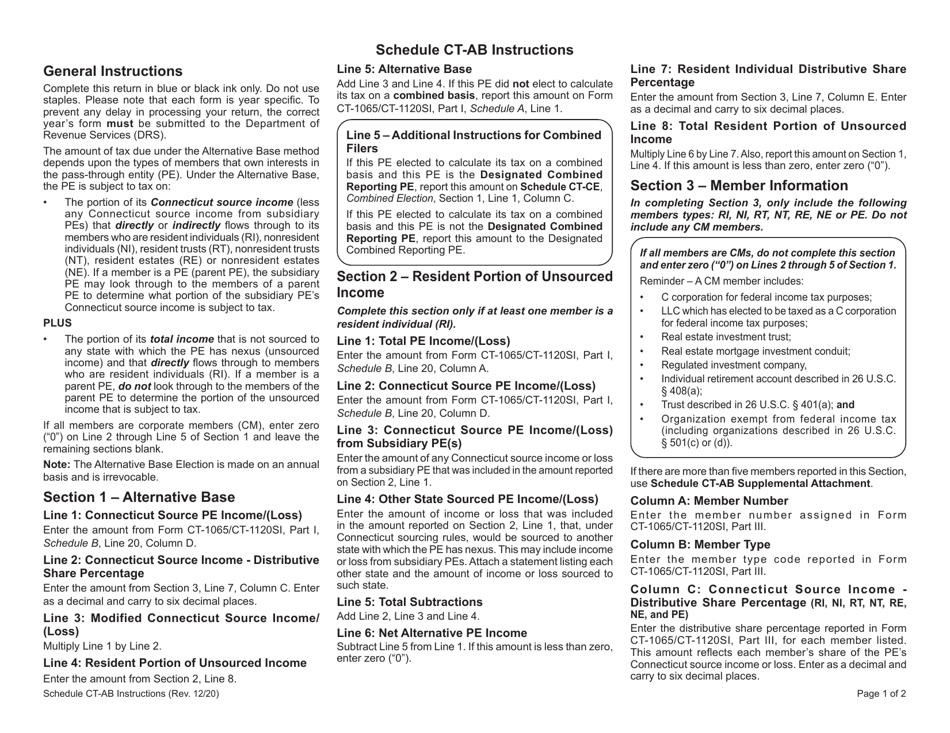

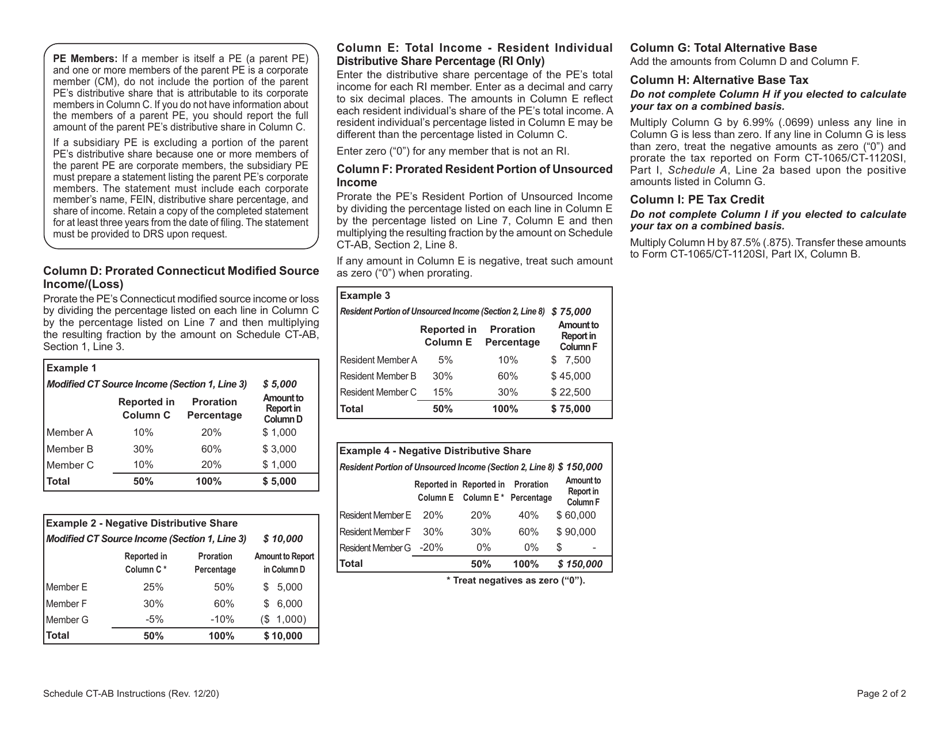

Schedule CT-AB Alternative Base Calculation - Connecticut

What Is Schedule CT-AB?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CT-AB alternative base calculation?

A: The CT-AB alternative base calculation is a method used by the state of Connecticut to determine the taxable value of certain commercial and industrial properties.

Q: How is the alternative base calculation determined?

A: The alternative base calculation is determined by assessing the property's fair market value on the alternate valuation date provided by the state.

Q: Which properties are subject to the alternative base calculation?

A: Certain commercial and industrial properties are subject to the alternative base calculation, including those that have been improved or substantially renovated.

Q: What is the purpose of the alternative base calculation?

A: The purpose of the alternative base calculation is to provide a fair and equitable method for assessing the taxable value of commercial and industrial properties in Connecticut.

Q: Are there any exemptions or limitations to the alternative base calculation?

A: Yes, there are exemptions and limitations to the alternative base calculation, which are determined by the state's Department of Revenue Services.

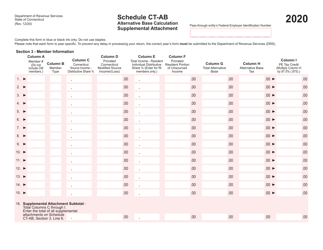

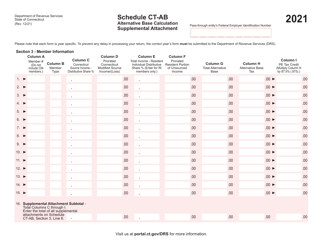

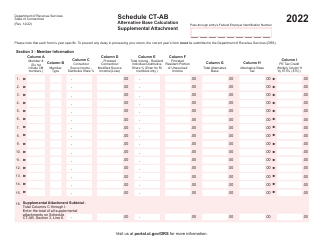

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-AB by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.