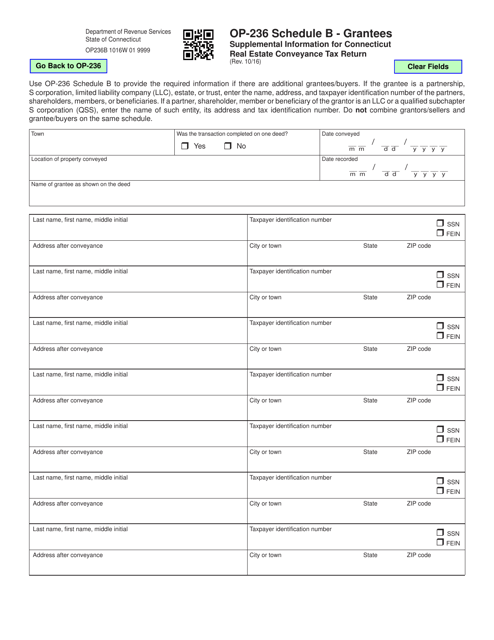

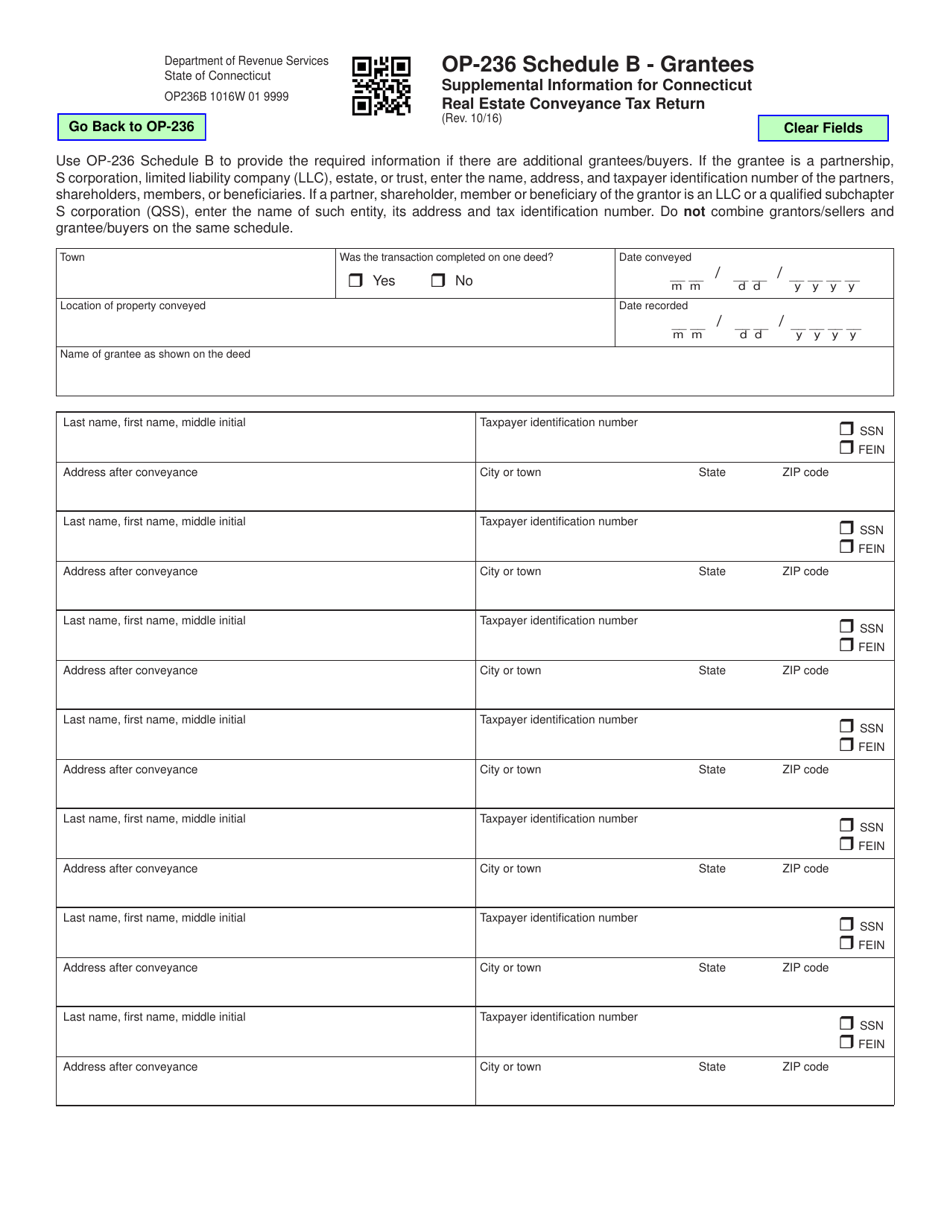

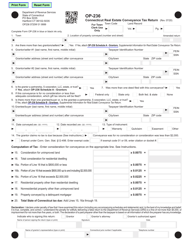

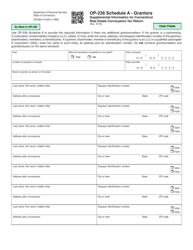

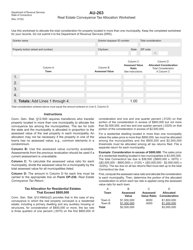

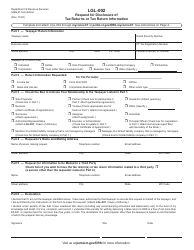

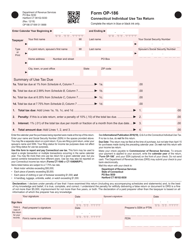

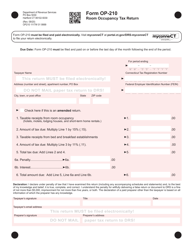

Form OP-236 Schedule B Supplemental Information for Connecticut Real Estate Conveyance Tax Return - Connecticut

What Is Form OP-236 Schedule B?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut.The document is a supplement to Form OP-236, Connecticut Real Estate Conveyance Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-236?

A: Form OP-236 is the Schedule B Supplemental Information for the Connecticut Real Estate Conveyance Tax Return.

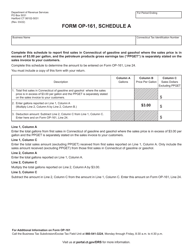

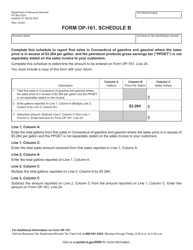

Q: What is the purpose of Form OP-236?

A: Form OP-236 is used to provide additional information related to a real estate conveyance in Connecticut.

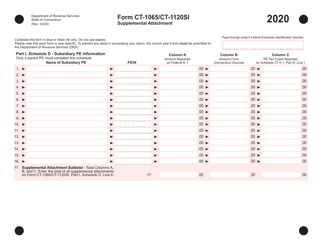

Q: When is Form OP-236 required to be filed?

A: Form OP-236 is required to be filed along with the Connecticut Real Estate Conveyance Tax Return.

Q: Who needs to fill out Form OP-236?

A: Anyone who is filing a Connecticut Real Estate Conveyance Tax Return and needs to provide supplemental information must fill out Form OP-236.

Q: Are there any filing fees associated with Form OP-236?

A: No, there are no filing fees associated with Form OP-236.

Q: What information is required on Form OP-236?

A: Form OP-236 requires information such as property details, conveyance information, and certain exemptions, if applicable.

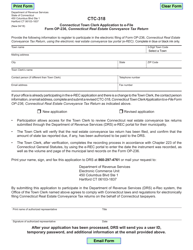

Q: Can Form OP-236 be filed electronically?

A: No, Form OP-236 cannot be filed electronically. It must be filed by mail or in person.

Q: Is Form OP-236 specific to Connecticut?

A: Yes, Form OP-236 is specific to the state of Connecticut and is used in conjunction with the Connecticut Real Estate Conveyance Tax Return.

Q: What is the deadline for filing Form OP-236?

A: Form OP-236 must be filed at the same time as the Connecticut Real Estate Conveyance Tax Return, which is typically due within 30 days of the conveyance.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OP-236 Schedule B by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.