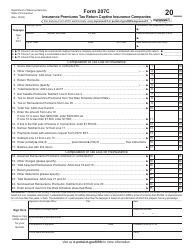

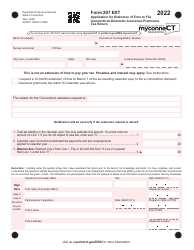

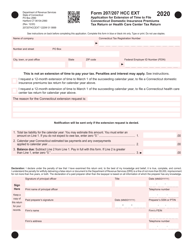

This version of the form is not currently in use and is provided for reference only. Download this version of

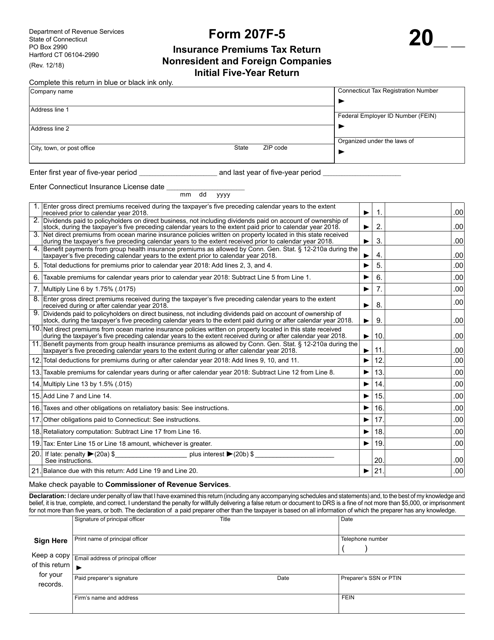

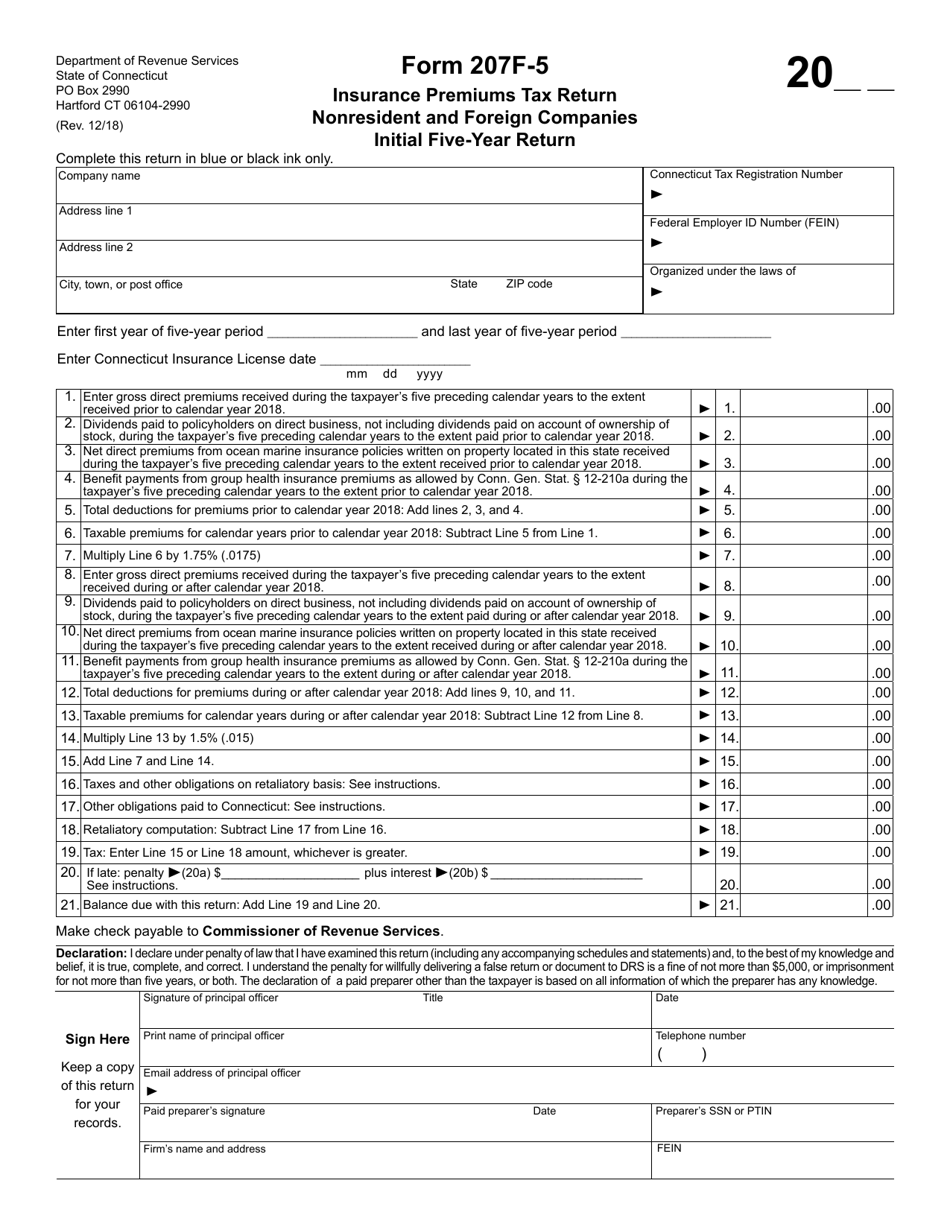

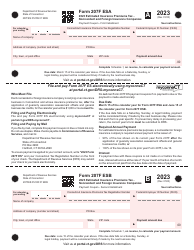

Form 207F-5

for the current year.

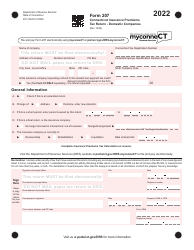

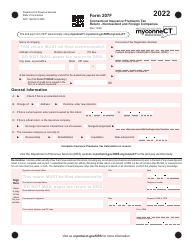

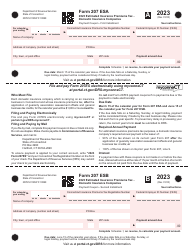

Form 207F-5 Insurance Premiums Tax Return Nonresident and Foreign Companies Initial Five-Year Return - Connecticut

What Is Form 207F-5?

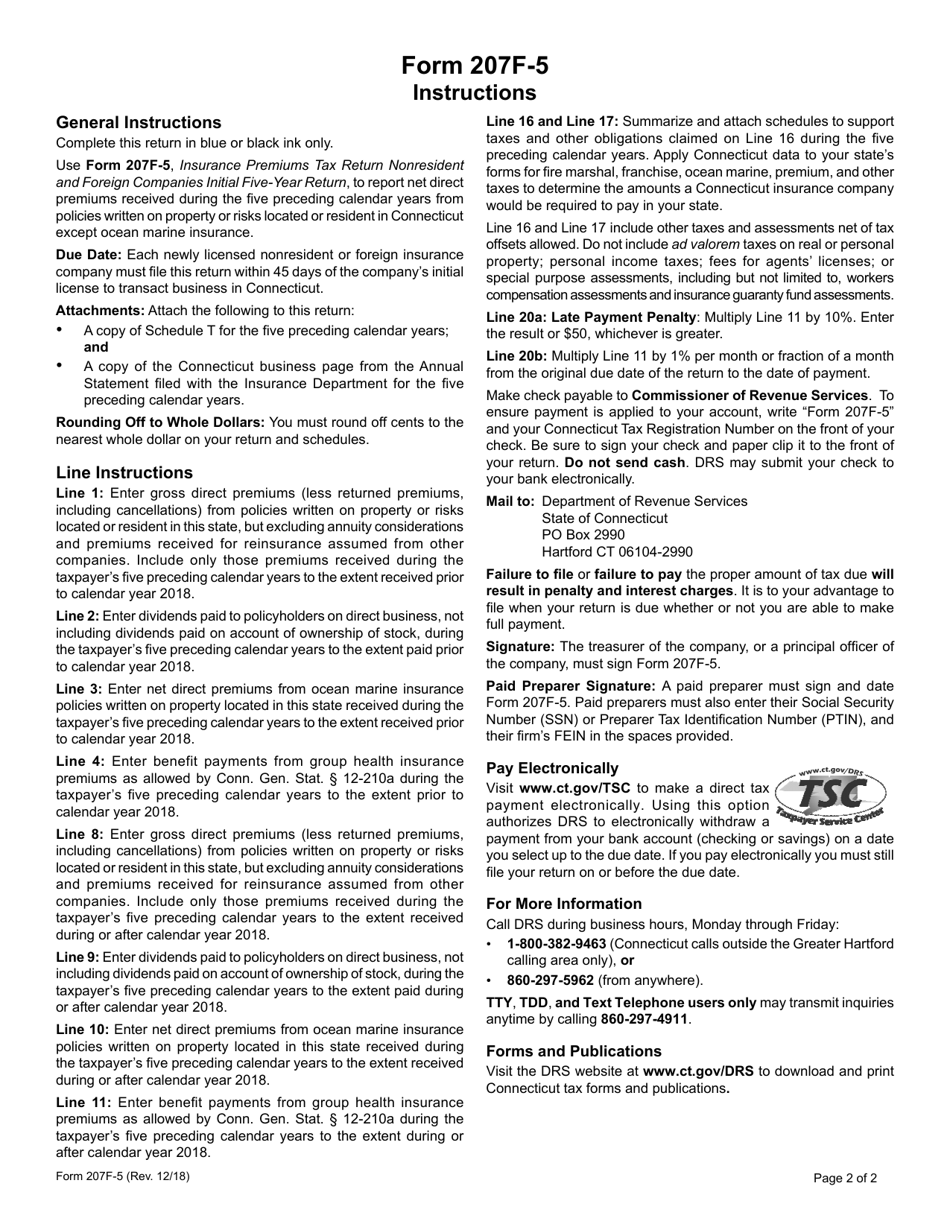

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 207F-5?

A: Form 207F-5 is the Insurance Premiums Tax Return Nonresident and Foreign Companies Initial Five-Year Return for Connecticut.

Q: Who needs to file Form 207F-5?

A: Nonresident and foreign insurance companies who are filing their initial five-year tax return for Connecticut need to file Form 207F-5.

Q: What is the purpose of Form 207F-5?

A: The purpose of Form 207F-5 is for nonresident and foreign insurance companies to report and pay their insurance premiums tax in Connecticut.

Q: How often do I need to file Form 207F-5?

A: Form 207F-5 is initially filed as a five-year return for nonresident and foreign insurance companies.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 207F-5 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.