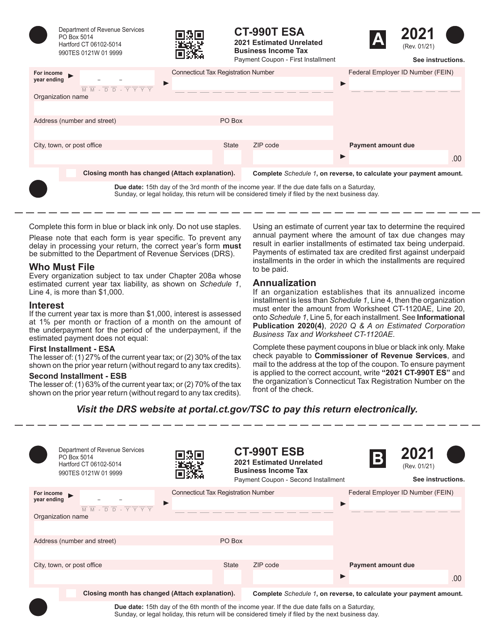

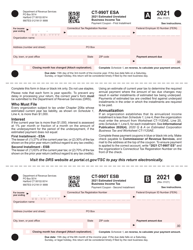

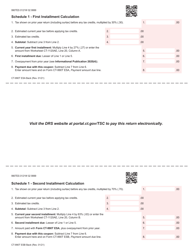

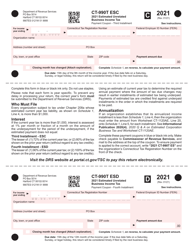

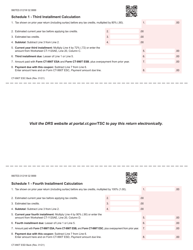

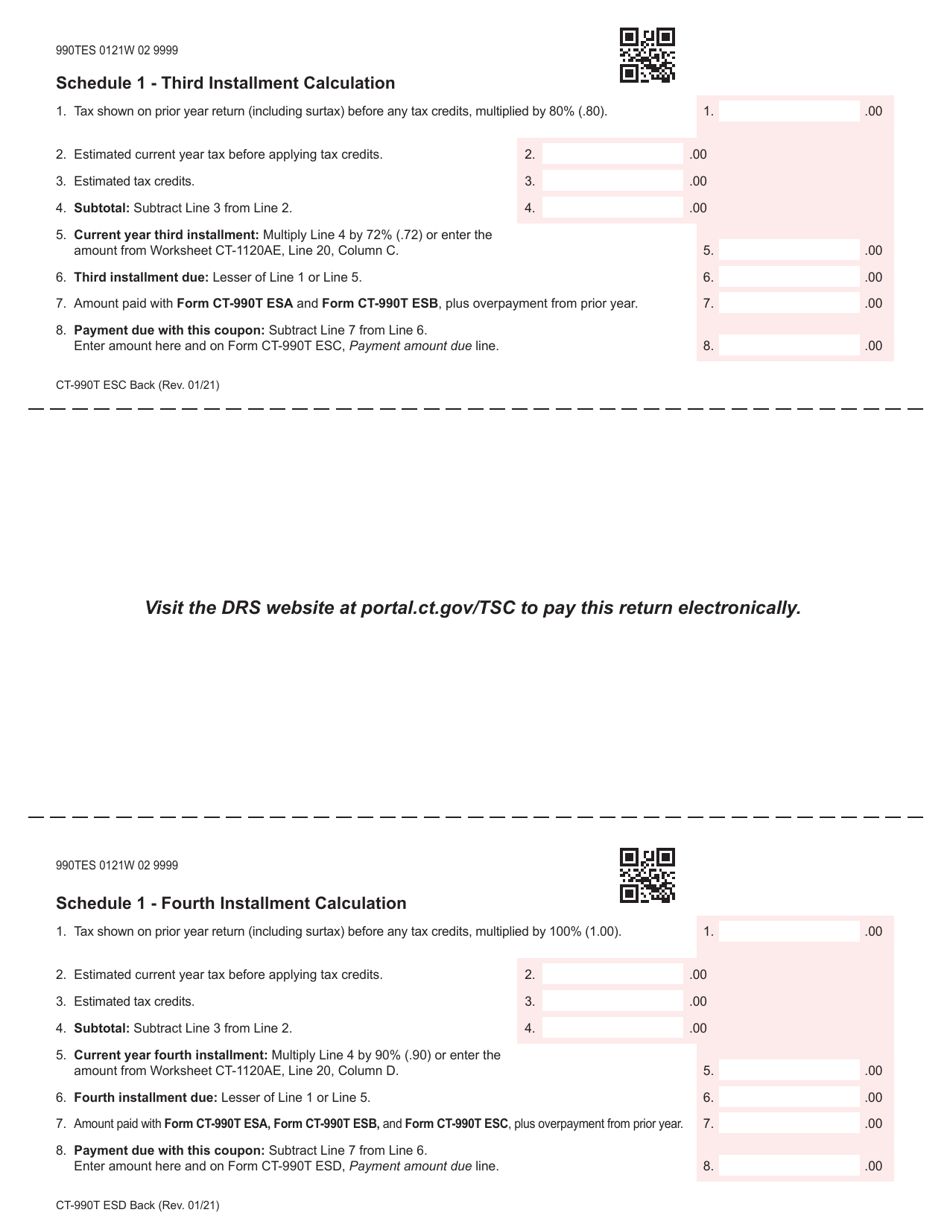

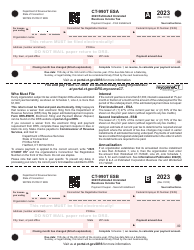

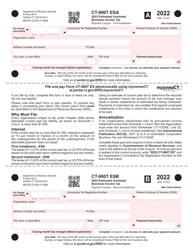

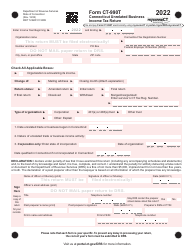

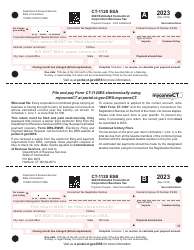

Form CT-990 ES Estimated Unrelated Business Income Tax - Connecticut

What Is Form CT-990 ES?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-990 ES?

A: Form CT-990 ES is used to estimate and pay the Estimated Unrelated Business Income Tax in Connecticut.

Q: Who needs to file Form CT-990 ES?

A: Tax-exempt organizations engaged in unrelated business activities in Connecticut need to file Form CT-990 ES.

Q: What is Unrelated Business Income Tax?

A: Unrelated Business Income Tax (UBIT) is a tax imposed on the income earned by tax-exempt organizations from unrelated business activities.

Q: Why do I need to estimate and pay UBIT?

A: Organizations engaged in unrelated business activities are required to estimate and pay UBIT to meet their tax obligations.

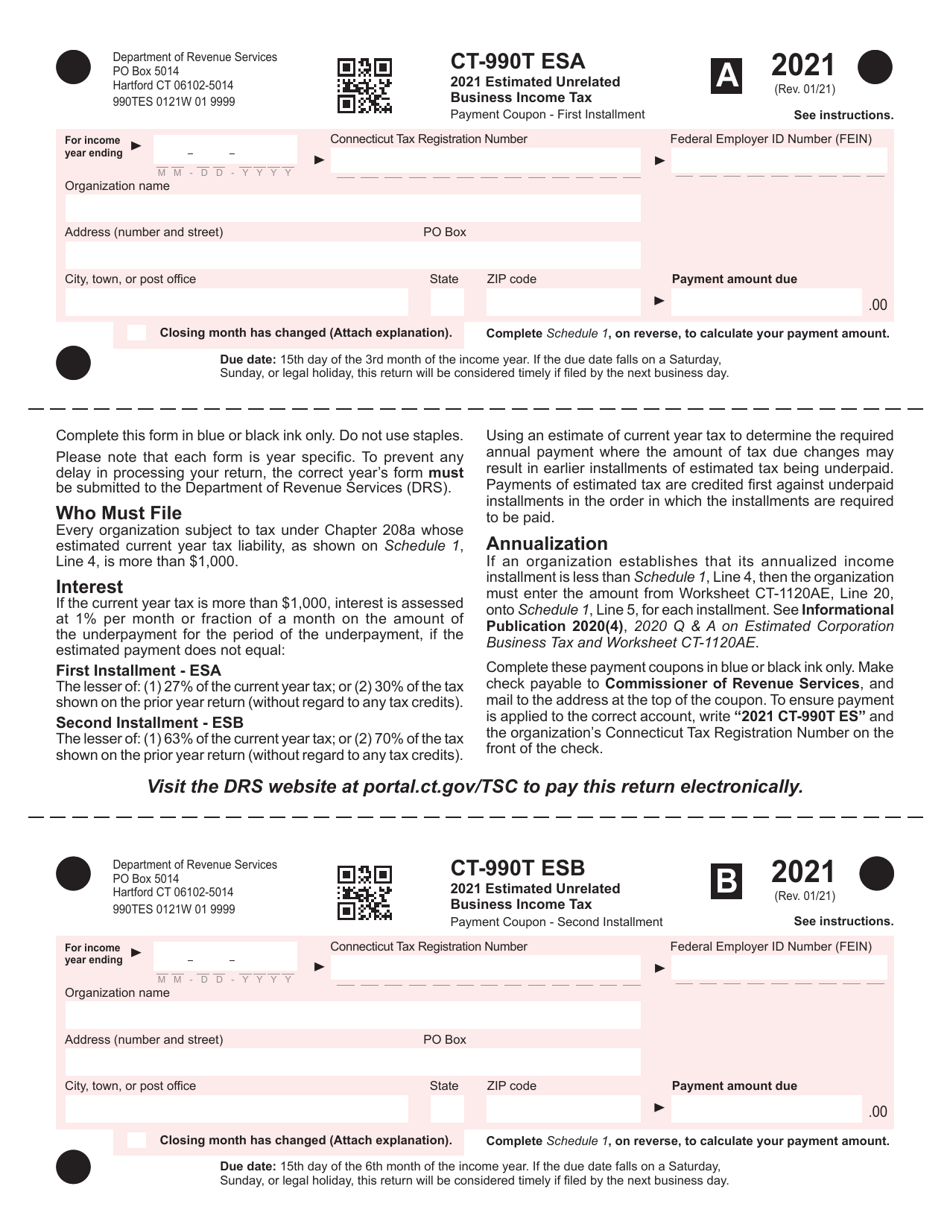

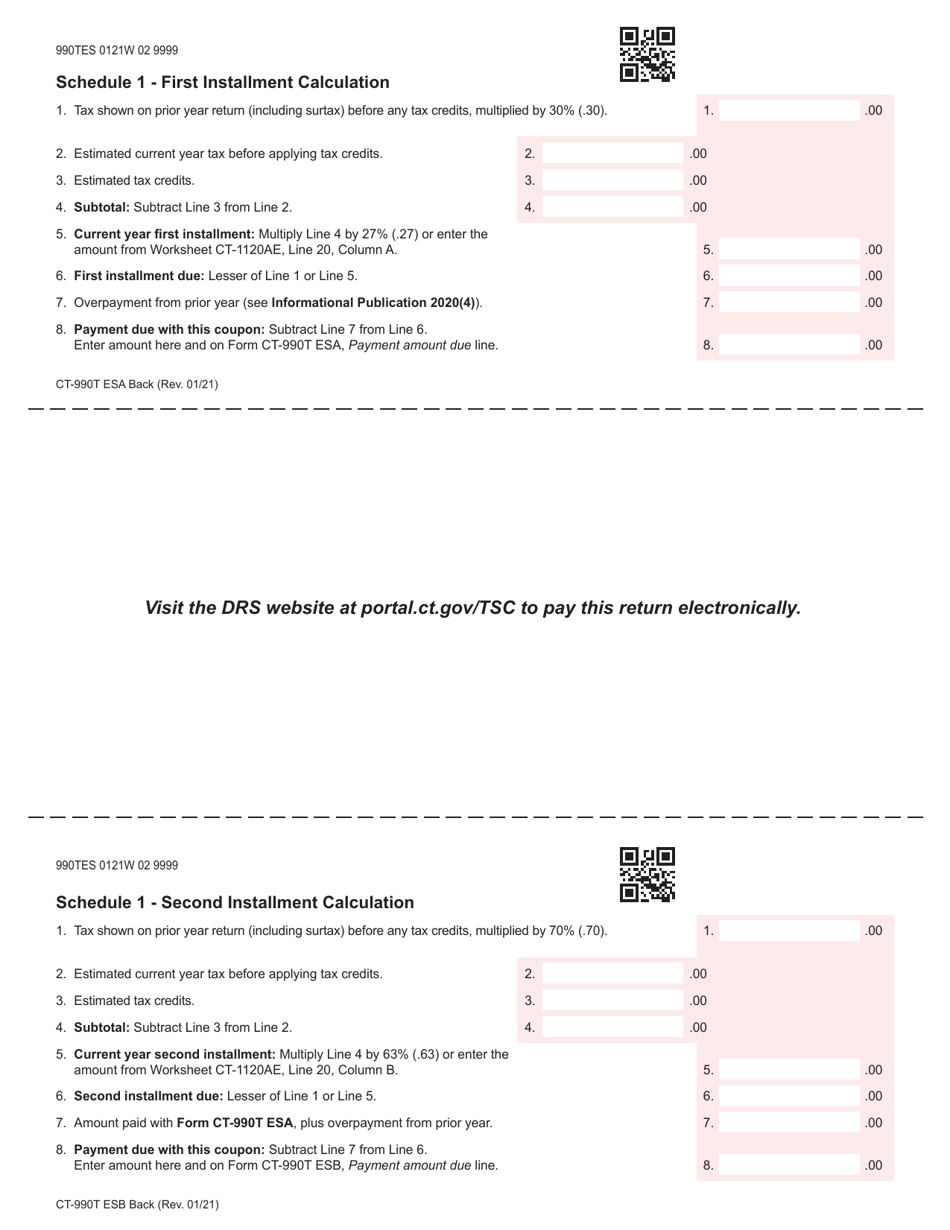

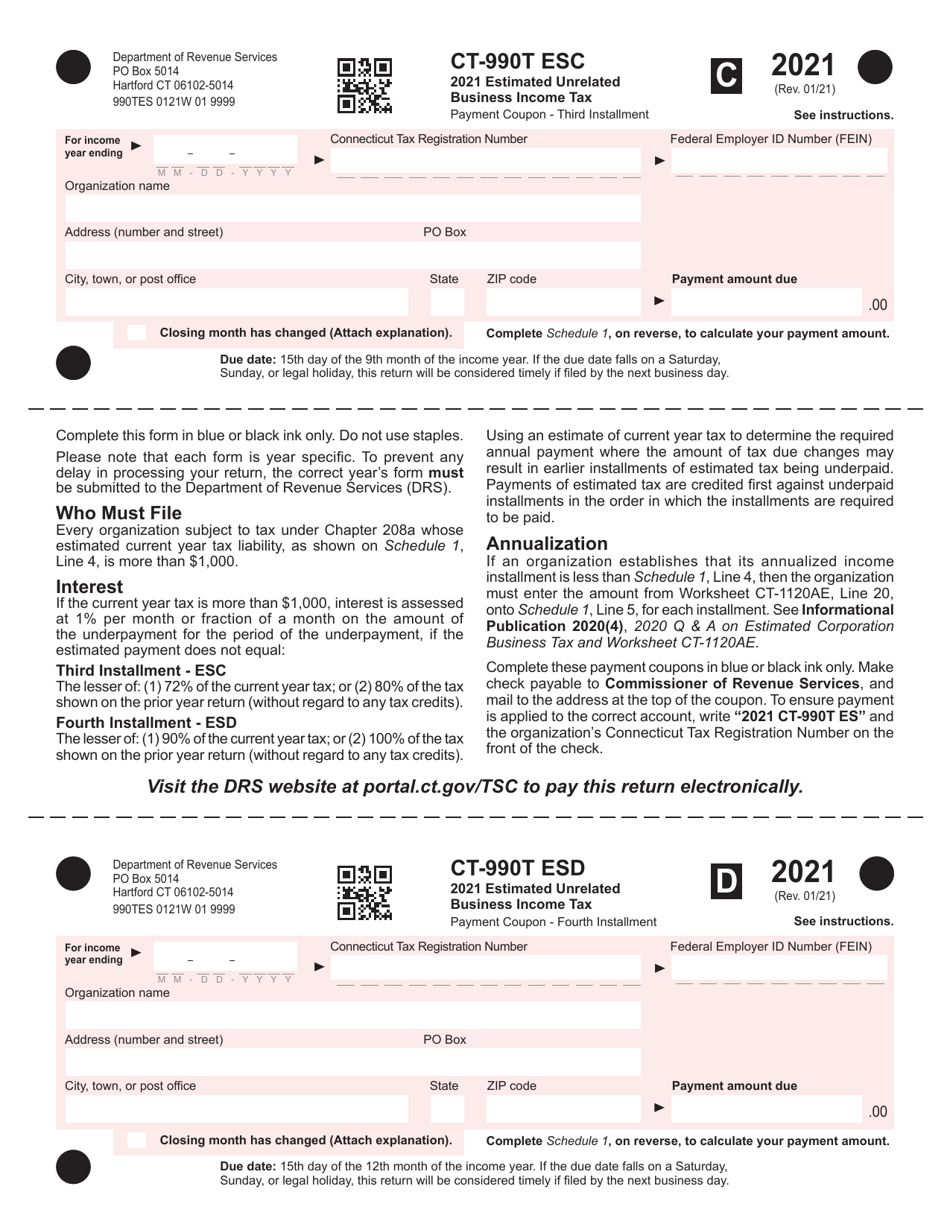

Q: How often do I need to file Form CT-990 ES?

A: Form CT-990 ES needs to be filed on a quarterly basis (four times a year) to make the estimated payments.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-990 ES by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.