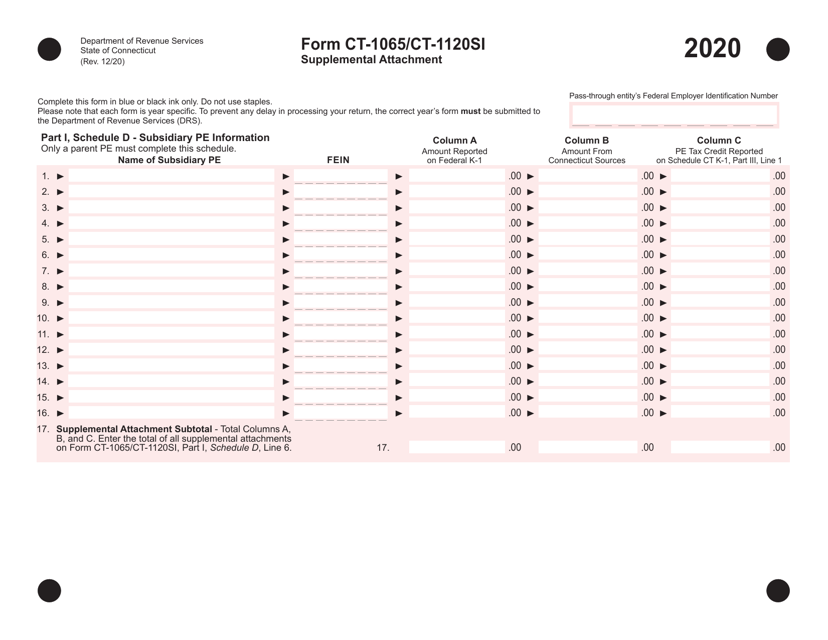

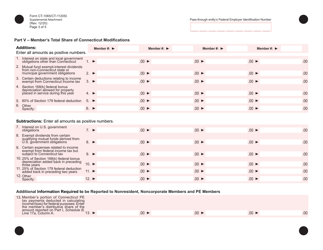

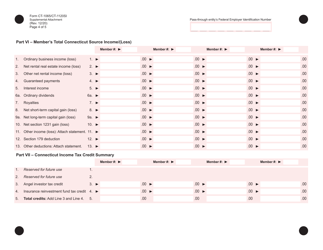

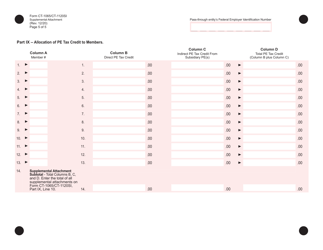

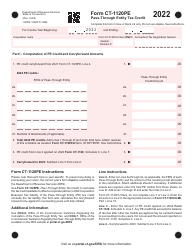

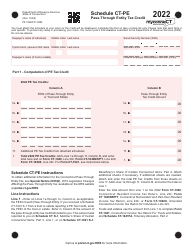

Form CT-1065 / CT-1120SI Connecticut Pass-Through Entity Tax Return - Supplemental Attachment - Connecticut

What Is Form CT-1065/CT-1120SI?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1065/CT-1120SI?

A: Form CT-1065/CT-1120SI is a tax return for pass-through entities in Connecticut.

Q: Who needs to file Form CT-1065/CT-1120SI?

A: Pass-through entities in Connecticut, such as partnerships and S corporations, need to file Form CT-1065/CT-1120SI.

Q: What is the purpose of Form CT-1065/CT-1120SI?

A: The purpose of Form CT-1065/CT-1120SI is to report and calculate the Connecticut pass-through entity tax.

Q: Is Form CT-1065/CT-1120SI required if there is no tax due?

A: Yes, Form CT-1065/CT-1120SI is required to be filed even if there is no tax due.

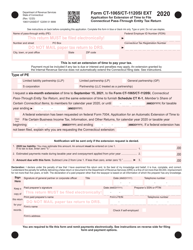

Q: When is the deadline to file Form CT-1065/CT-1120SI?

A: Form CT-1065/CT-1120SI is due on the same day as the federal tax return, which is typically April 15th.

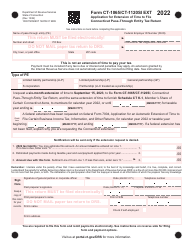

Q: Are there any extensions available for filing Form CT-1065/CT-1120SI?

A: Yes, you can request an extension to file Form CT-1065/CT-1120SI, but you must still pay any tax due by the original due date.

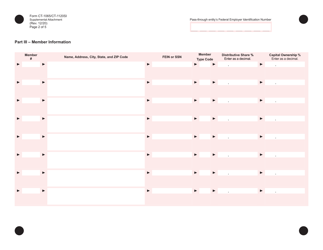

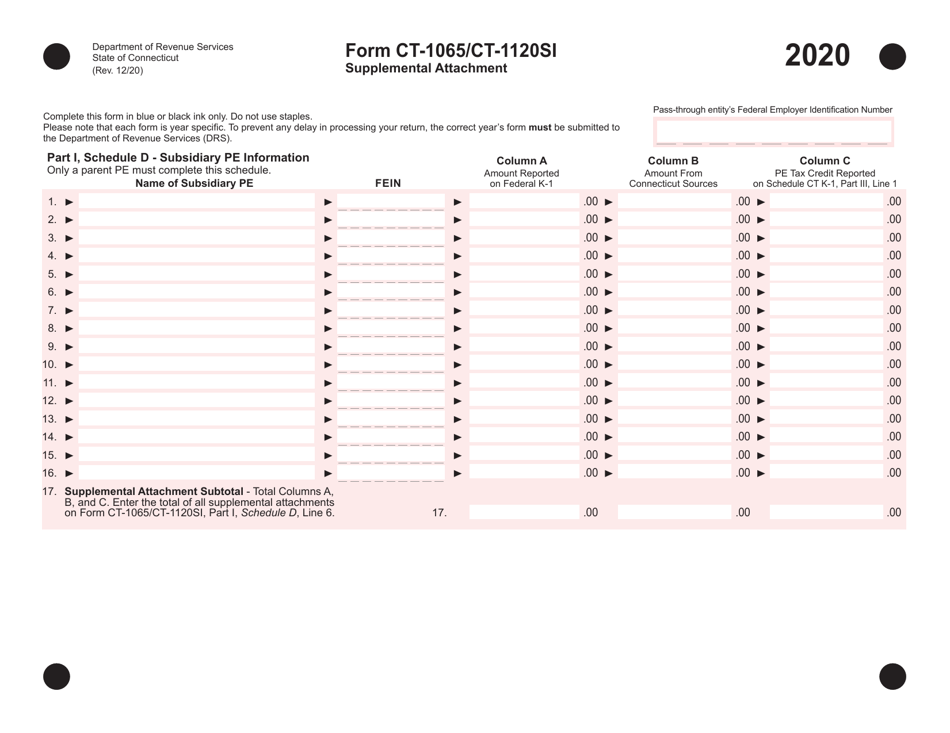

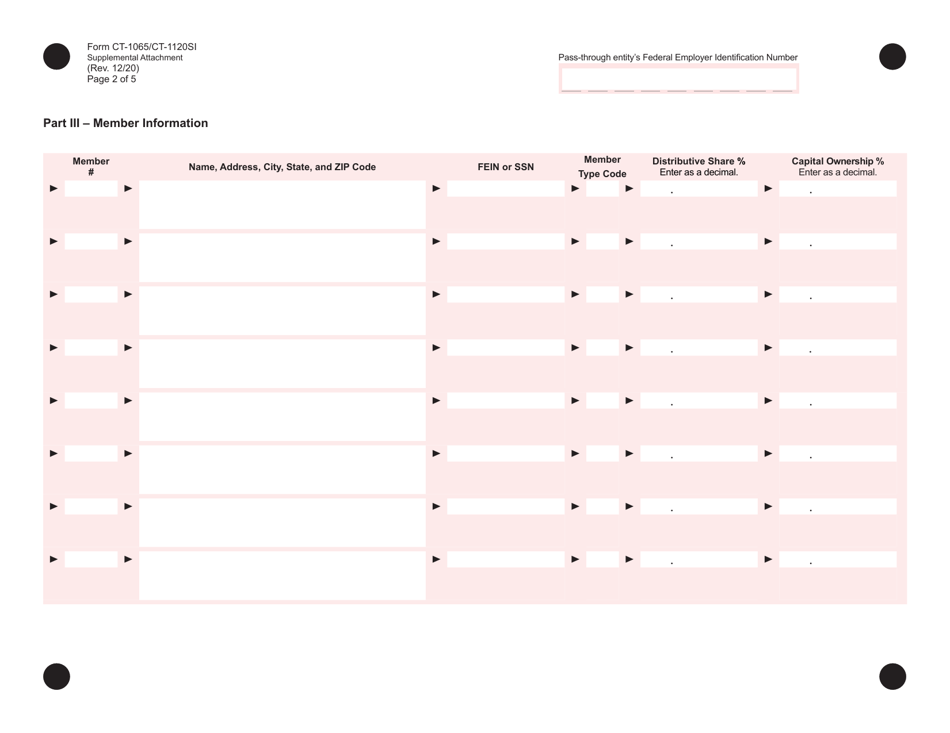

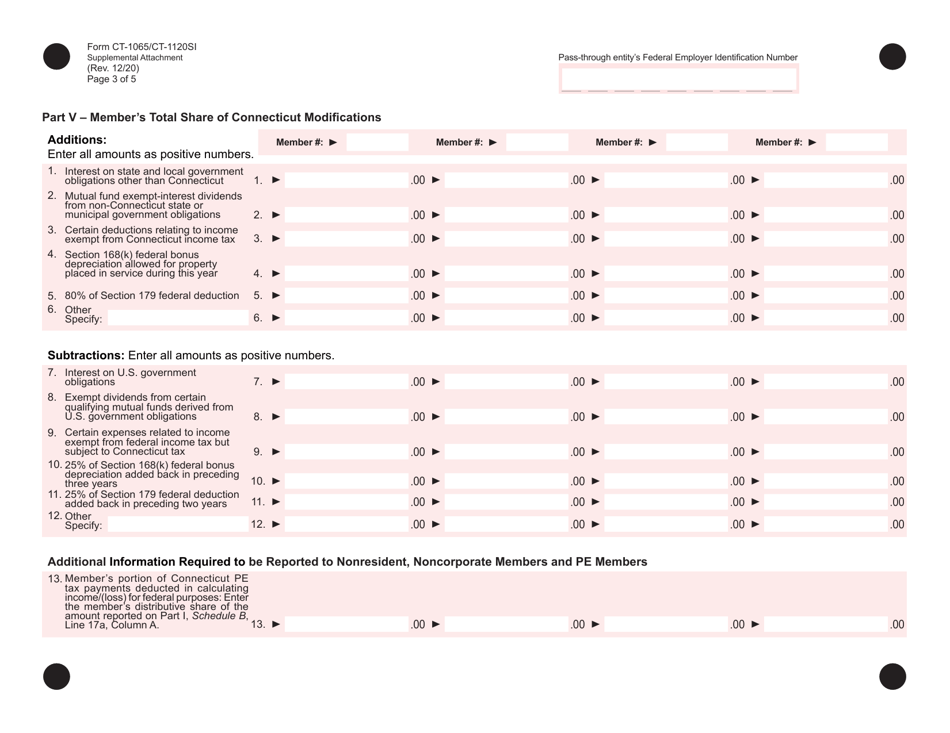

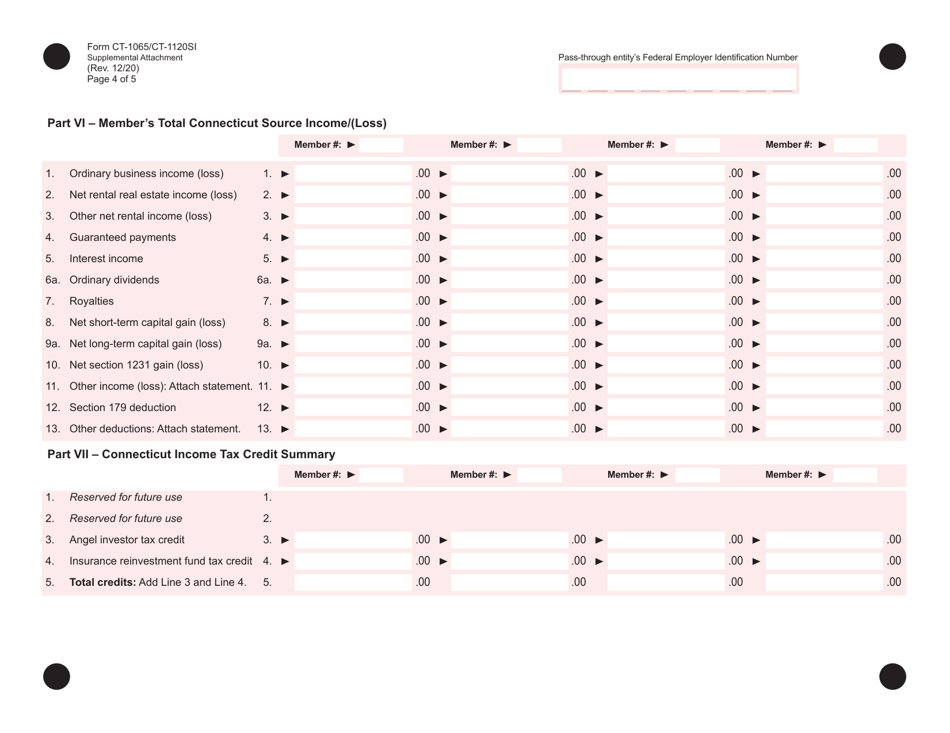

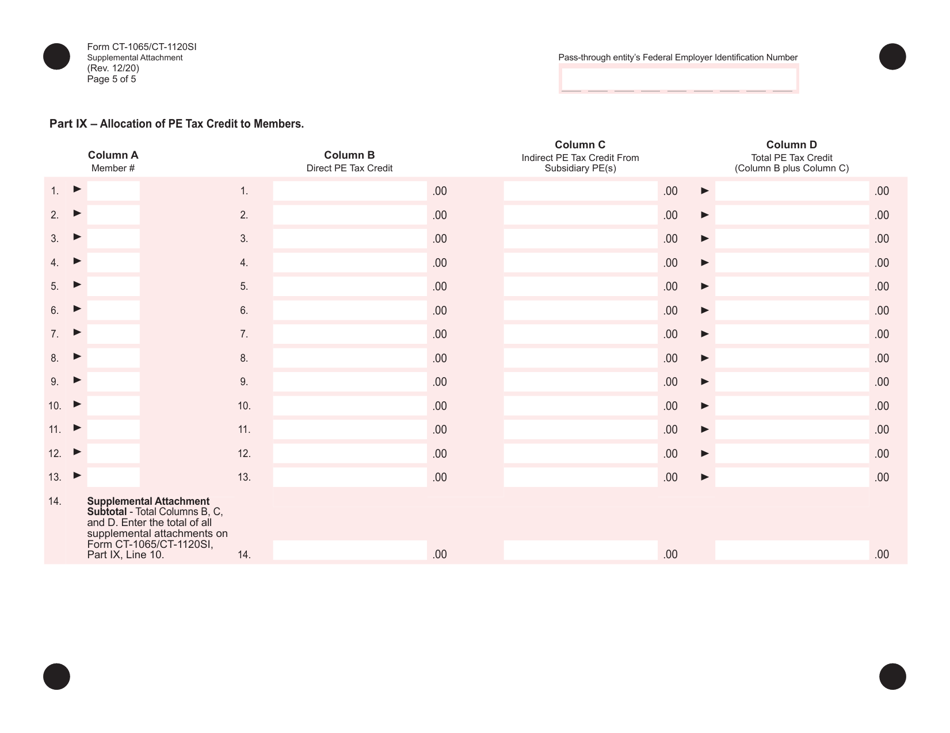

Q: Do I need to include any supplemental attachments with Form CT-1065/CT-1120SI?

A: Yes, you may need to include supplemental attachments depending on your specific situation. Refer to the instructions for Form CT-1065/CT-1120SI for more information.

Q: Can Form CT-1065/CT-1120SI be filed electronically?

A: Yes, you can file Form CT-1065/CT-1120SI electronically using approved tax software or through the Connecticut Taxpayer Service Center.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1065/CT-1120SI by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.