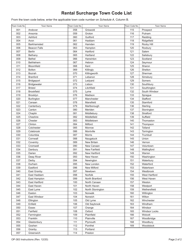

This version of the form is not currently in use and is provided for reference only. Download this version of

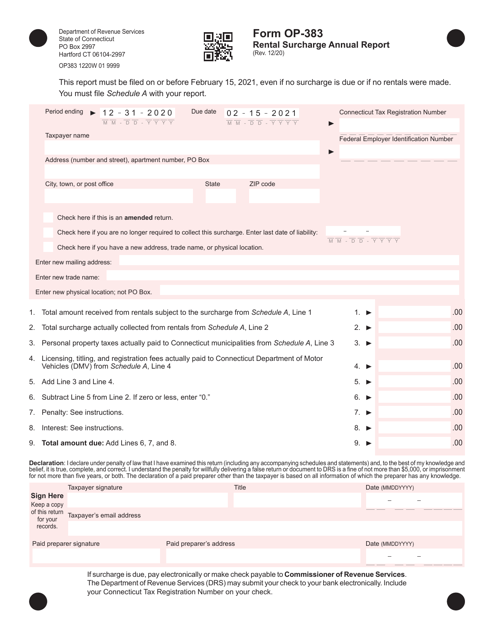

Form OP-383

for the current year.

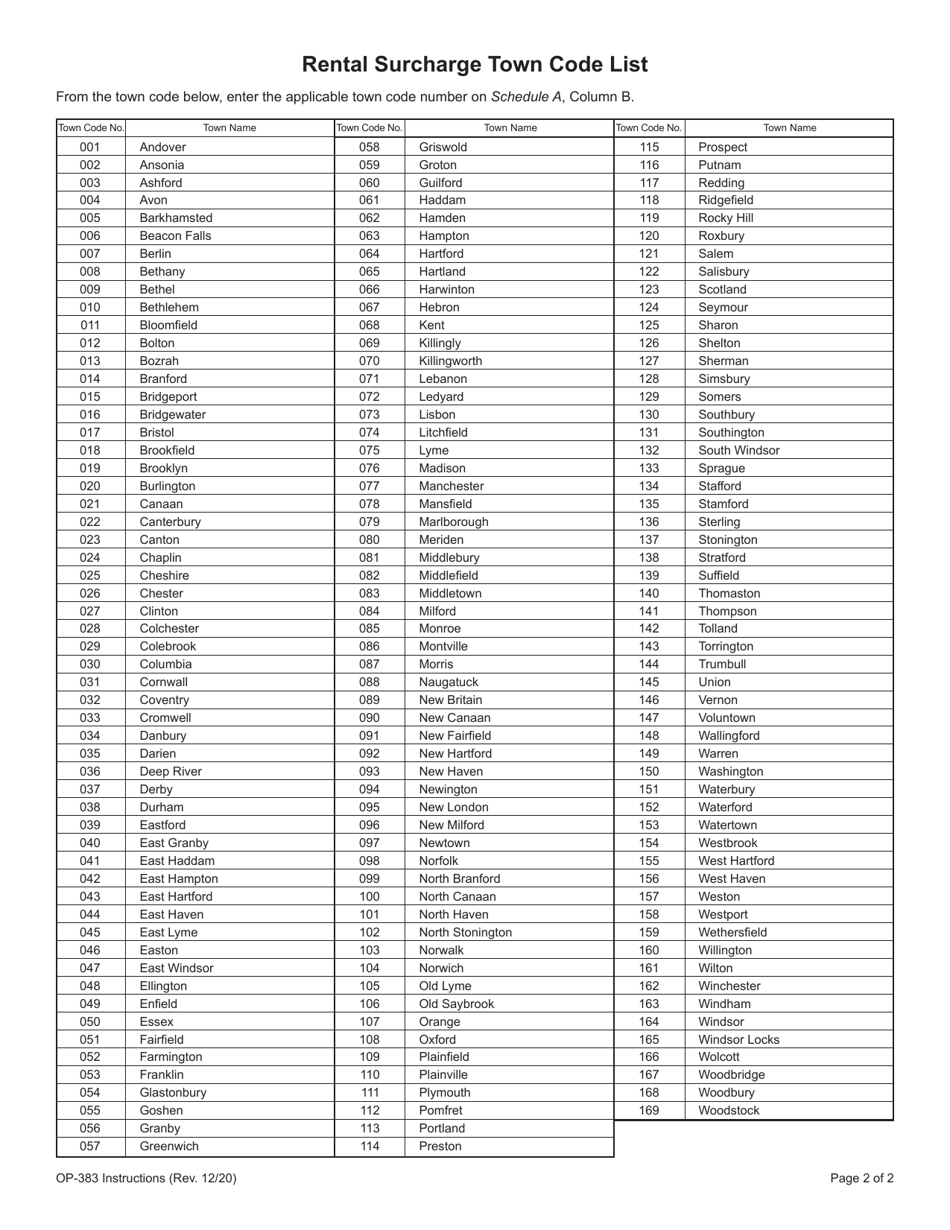

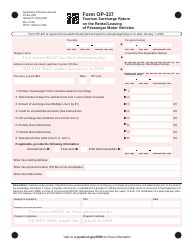

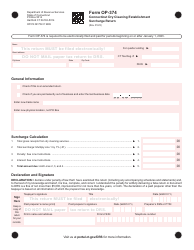

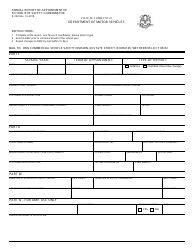

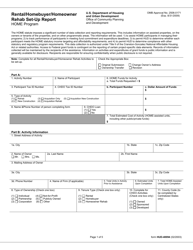

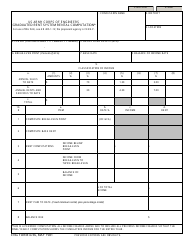

Form OP-383 Rental Surcharge Annual Report - Connecticut

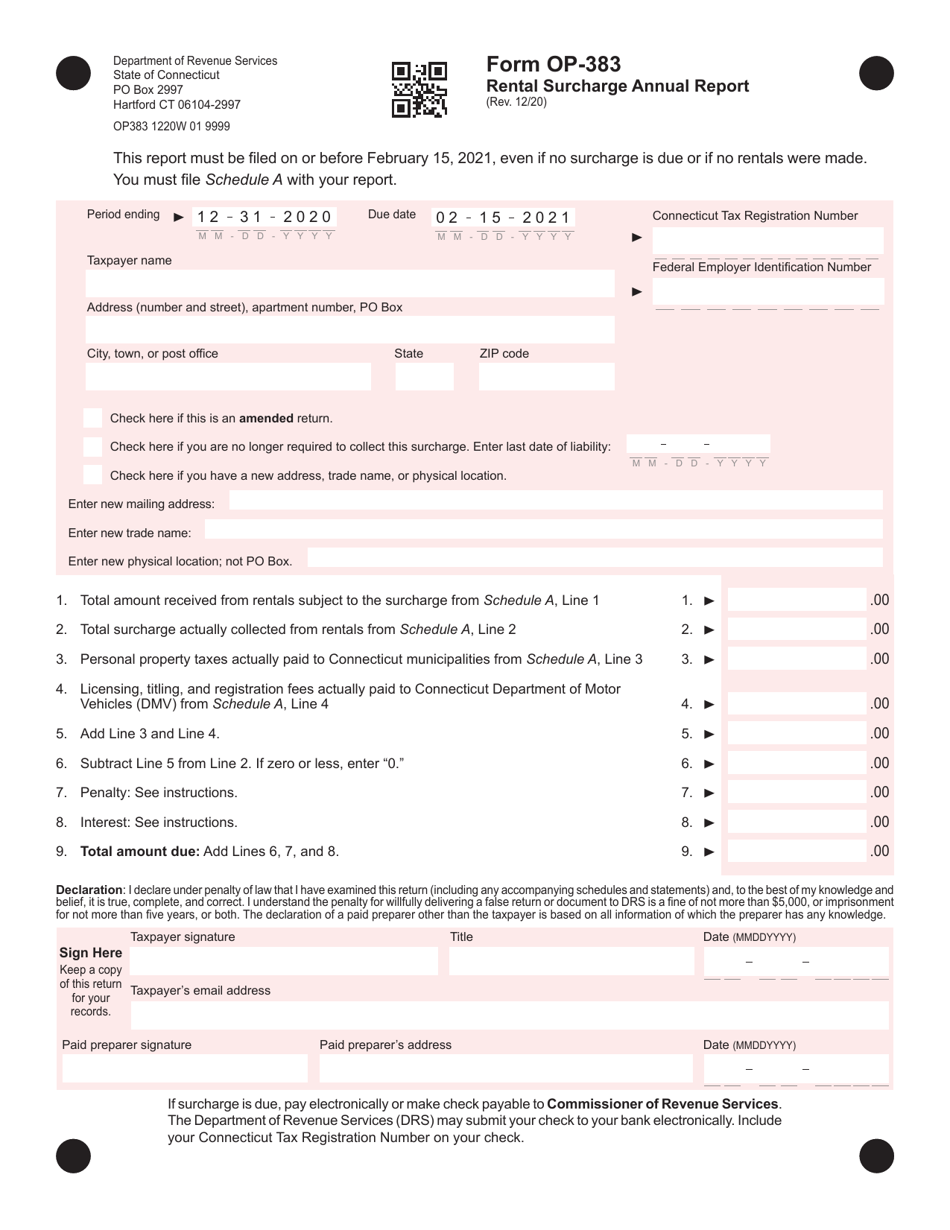

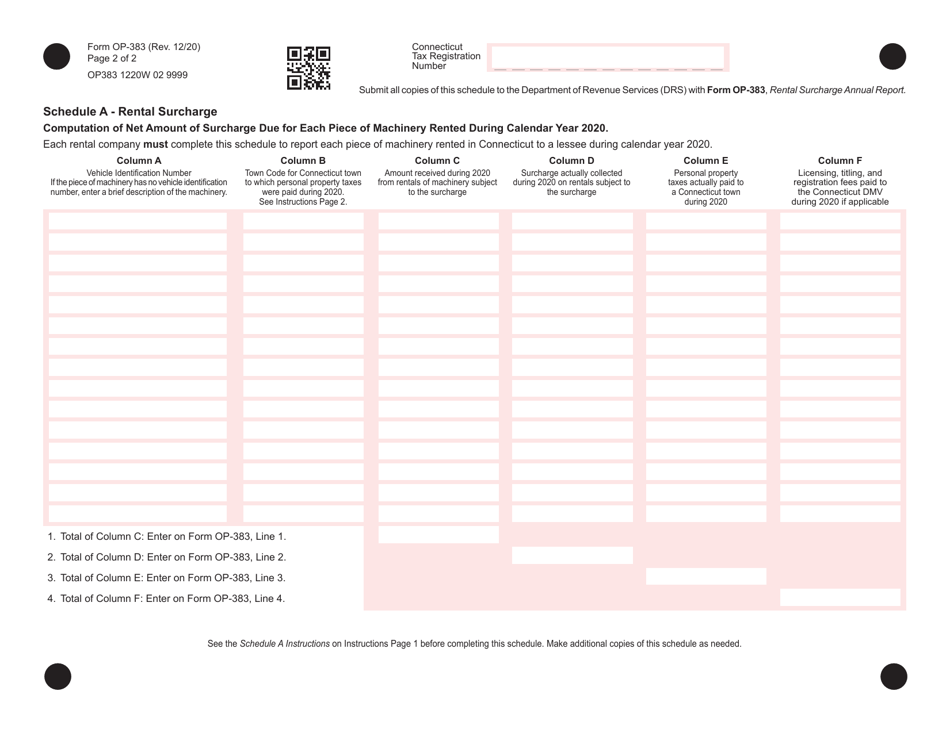

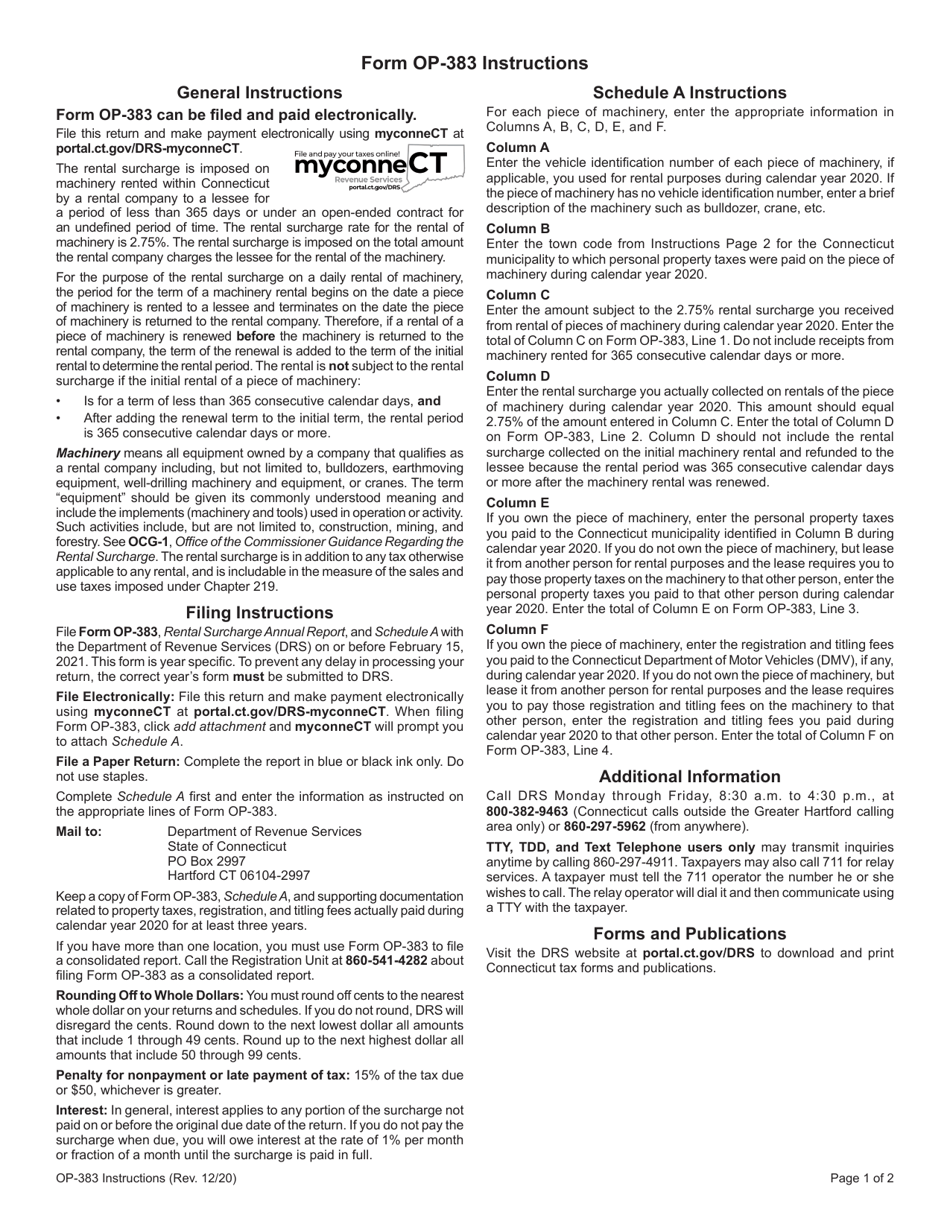

What Is Form OP-383?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-383?

A: Form OP-383 is the Rental Surcharge Annual Report in Connecticut.

Q: Who needs to file Form OP-383?

A: Landlords or property owners in Connecticut who collect rental surcharge need to file Form OP-383.

Q: What is the purpose of Form OP-383?

A: Form OP-383 is used to report rental surcharge collected by landlords or property owners in Connecticut.

Q: When is Form OP-383 due?

A: Form OP-383 is due on or before April 30th of each year.

Q: Is there a penalty for late filing?

A: Yes, there is a penalty for late filing. Failure to file or filing late may result in penalties and interest.

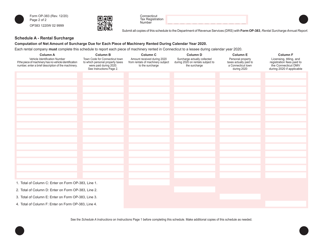

Q: Are there any exemptions to filing Form OP-383?

A: Yes, there are exemptions. Certain municipalities may be exempt from the rental surcharge requirement. Check the instructions of Form OP-383 for more information.

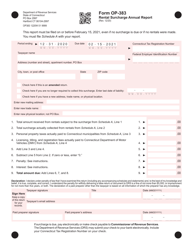

Q: What information do I need to complete Form OP-383?

A: You will need information on the rental units you own, the rental surcharge collected, and any exemptions or credits applied.

Q: Can I file Form OP-383 electronically?

A: Yes, you can file Form OP-383 electronically through the Connecticut Taxpayer Service Center.

Q: What should I do if I no longer collect rental surcharge?

A: If you no longer collect rental surcharge, you should notify the Connecticut Department of Revenue Services and indicate that you are no longer required to file Form OP-383.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-383 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.