This version of the form is not currently in use and is provided for reference only. Download this version of

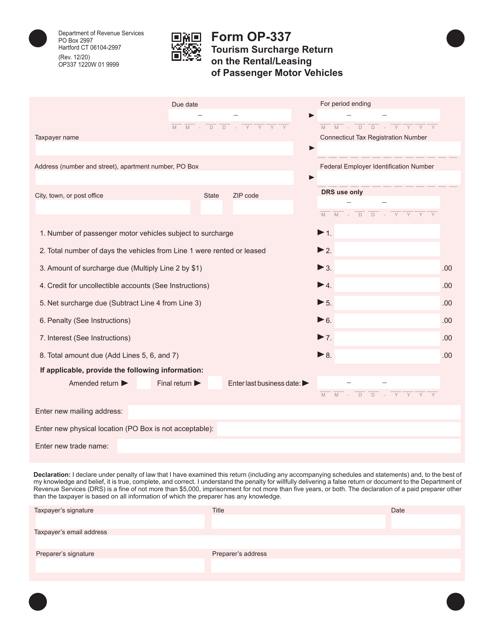

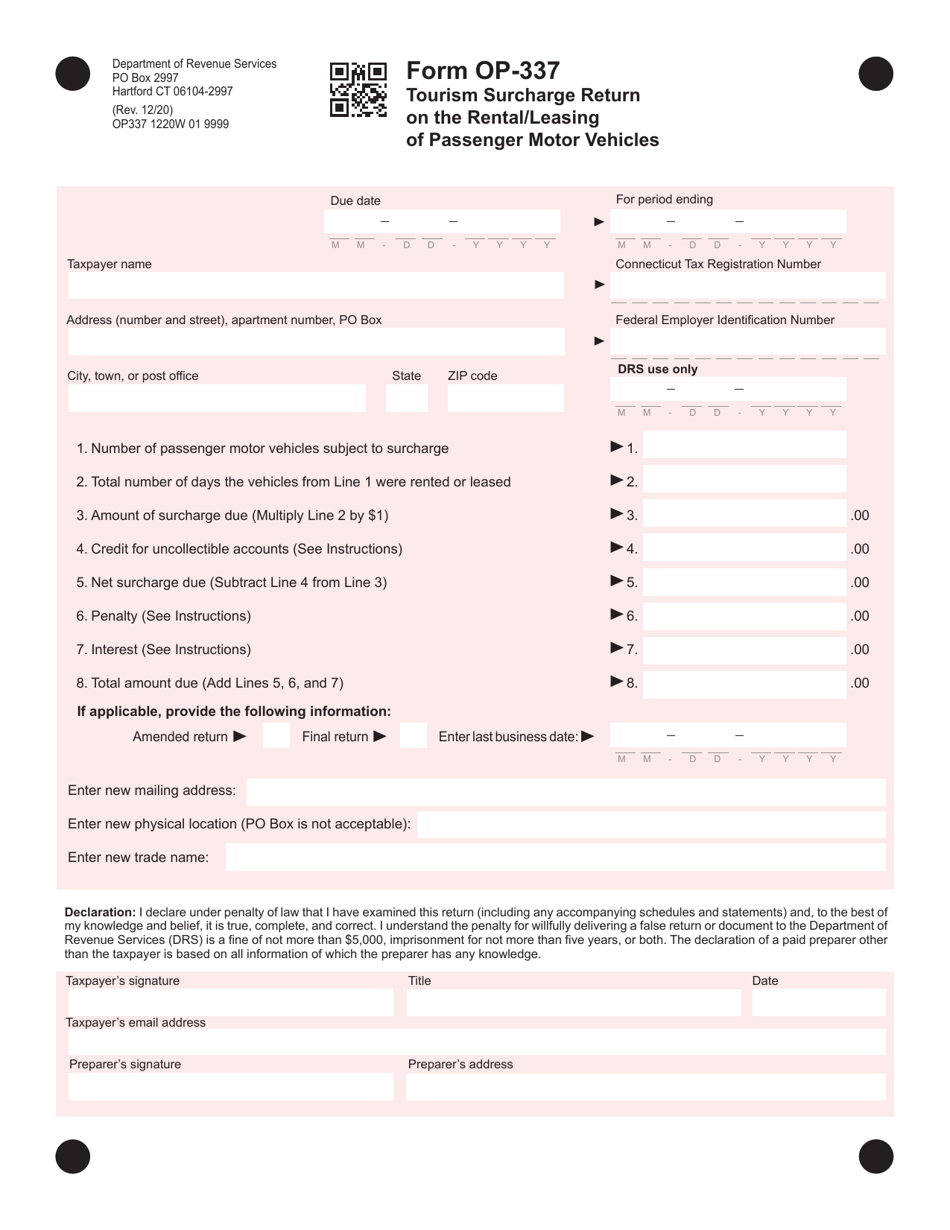

Form OP-337

for the current year.

Form OP-337 Tourism Surcharge Return on the Rental / Leasing of Passenger Motor Vehicles - Connecticut

What Is Form OP-337?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form OP-337?

A: Form OP-337 is used to report and pay the tourism surcharge on the rental or leasing of passenger motor vehicles in Connecticut.

Q: Who needs to file Form OP-337?

A: Any individual or business that rents or leases passenger motor vehicles in Connecticut and is subject to the tourism surcharge needs to file Form OP-337.

Q: What is the tourism surcharge?

A: The tourism surcharge is a tax imposed on the rental or leasing of passenger motor vehicles in Connecticut to support tourism initiatives in the state.

Q: How often do I need to file Form OP-337?

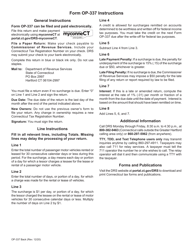

A: Form OP-337 must be filed on a quarterly basis. The due dates for each quarter are specified on the form.

Q: What information do I need to provide on Form OP-337?

A: You will need to provide details about your rental or leasing activity, including the number of passenger motor vehicles rented or leased and the amount of surcharge owed.

Q: Are there any exemptions from the tourism surcharge?

A: Yes, certain entities, such as government agencies and certain non-profit organizations, may be exempt from the tourism surcharge. The specific exemptions are described in the instructions accompanying Form OP-337.

Q: What are the consequences of not filing or paying the tourism surcharge?

A: Failure to file or pay the tourism surcharge can result in penalties and interest charges imposed by the Connecticut Department of Revenue Services.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-337 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.