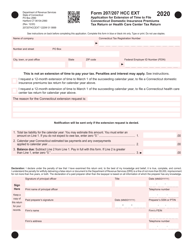

This version of the form is not currently in use and is provided for reference only. Download this version of

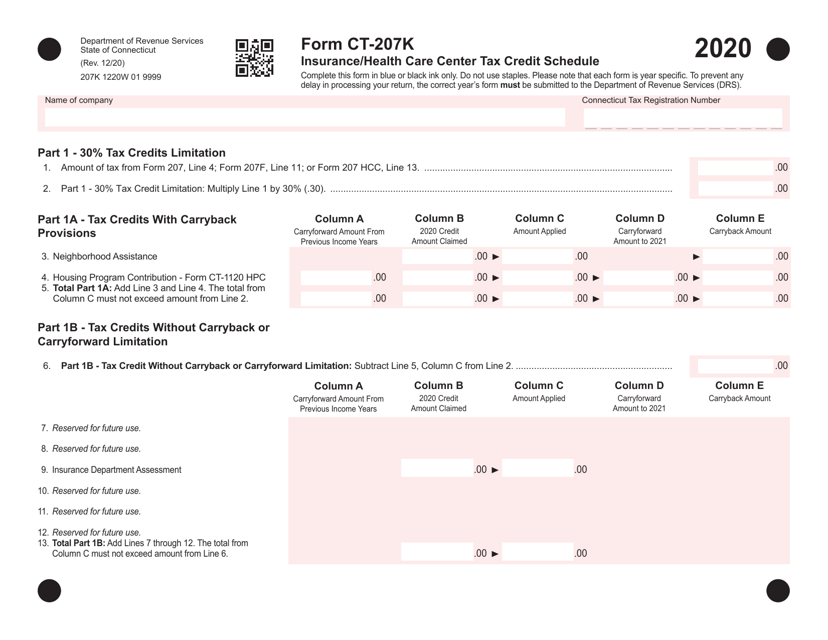

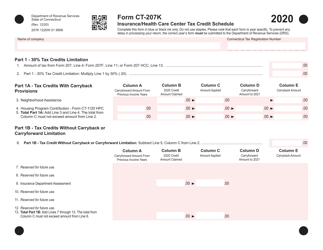

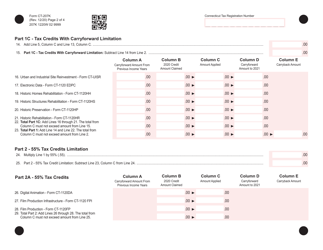

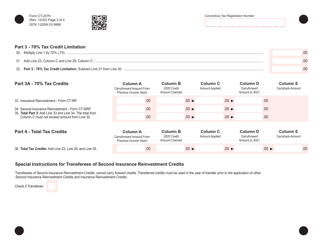

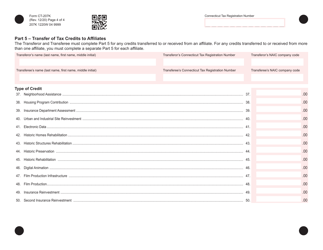

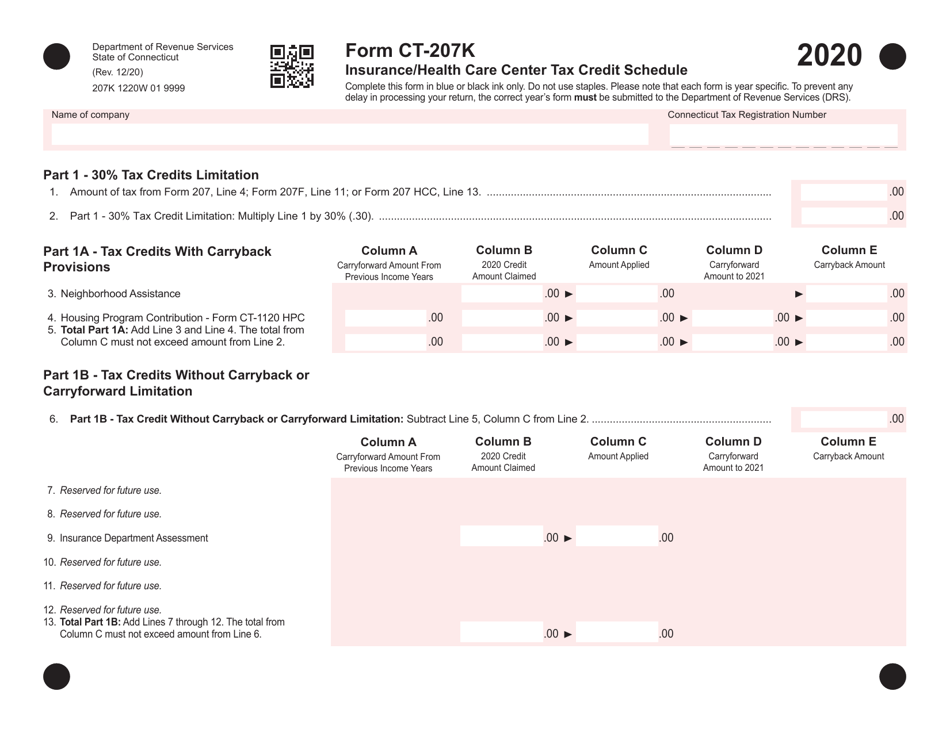

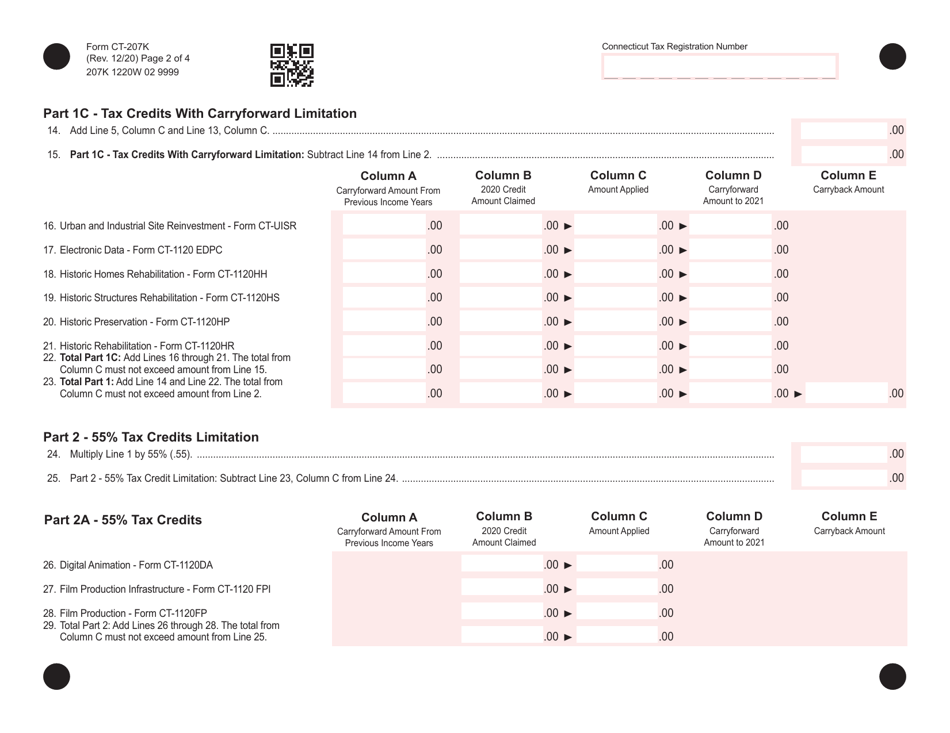

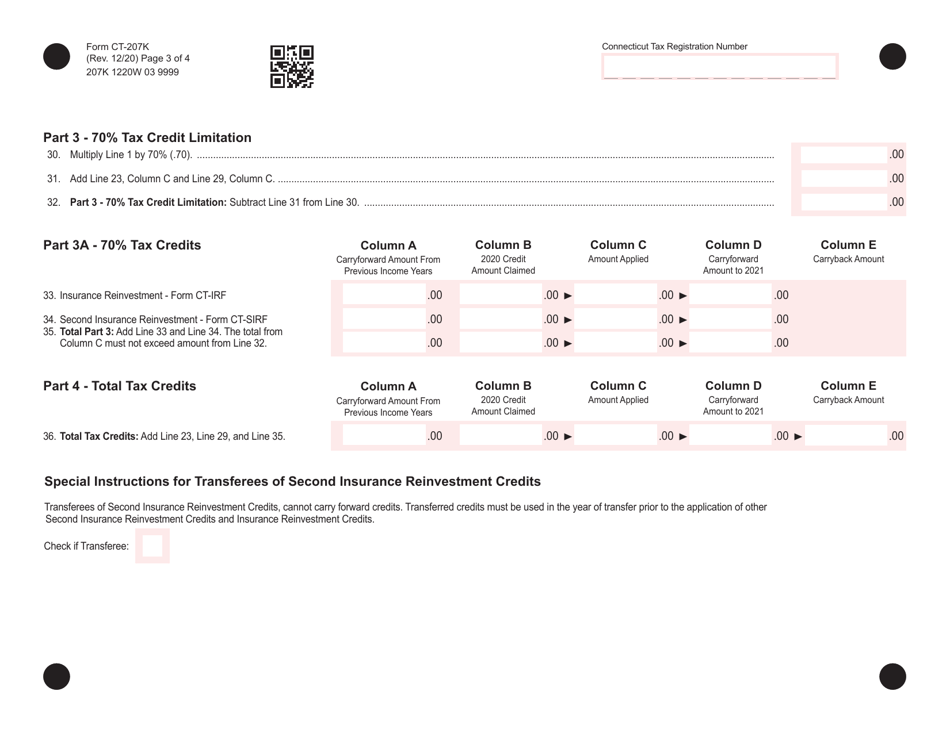

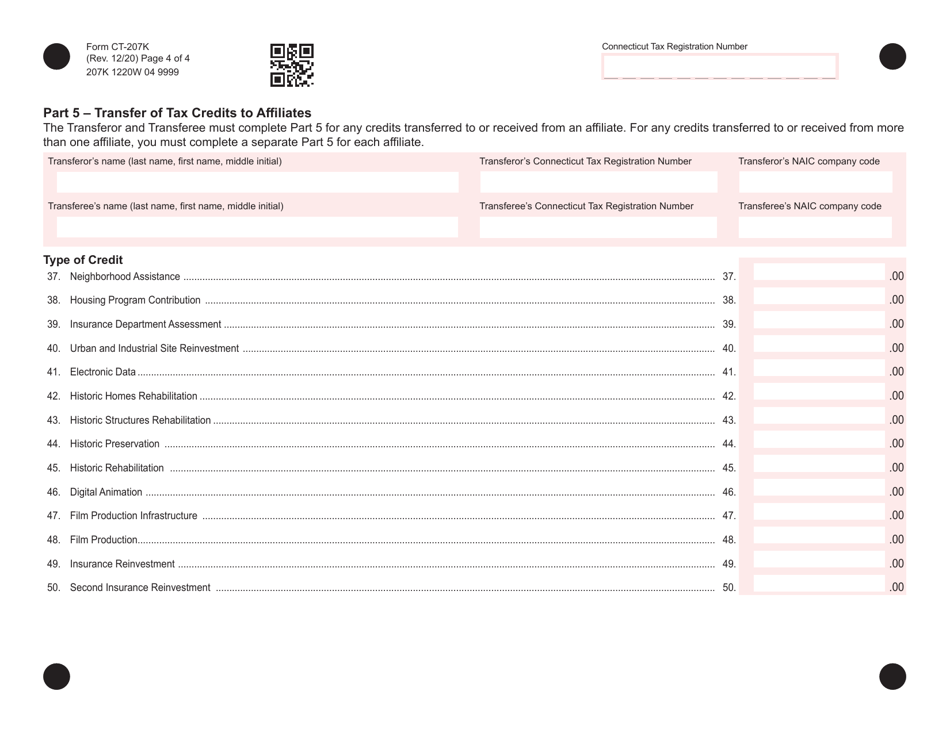

Form CT-207K

for the current year.

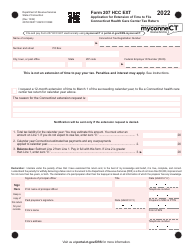

Form CT-207K Insurance / Health Care Center Tax Credit Schedule - Connecticut

What Is Form CT-207K?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-207K?

A: Form CT-207K is the Insurance/Health Care Center Tax Credit Schedule in Connecticut.

Q: What is the purpose of Form CT-207K?

A: The purpose of Form CT-207K is to calculate the insurance and health care center tax credit.

Q: Who needs to file Form CT-207K?

A: Individuals and businesses in Connecticut that are eligible for the insurance and health care center tax credit need to file this form.

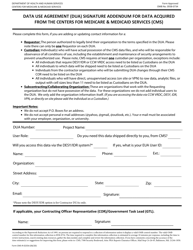

Q: What information do I need to complete Form CT-207K?

A: You will need detailed information about the insurance and health care center tax credit, including the amount of eligible expenses and documentation to support the credit.

Q: When is the deadline to file Form CT-207K?

A: The deadline to file Form CT-207K is usually April 15th of the year following the tax year.

Q: Are there any additional forms or schedules that need to be attached to Form CT-207K?

A: It may be necessary to attach supporting documentation and other schedules to Form CT-207K, depending on your specific tax situation.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-207K by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.