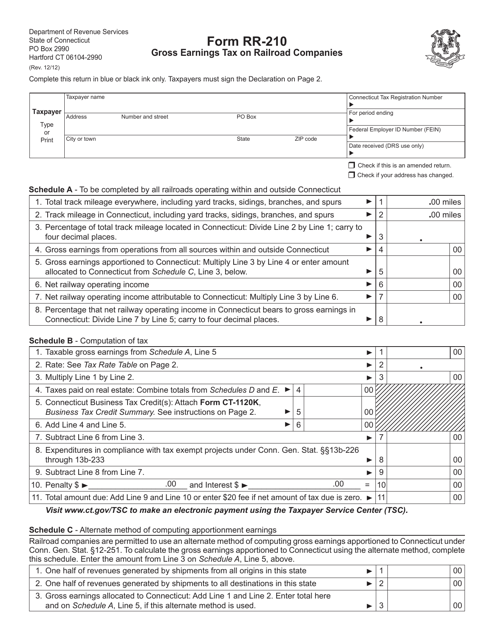

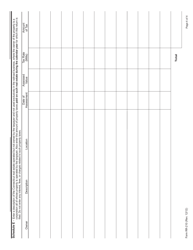

Form RR-210 Gross Earnings Tax on Railroad Companies - Connecticut

What Is Form RR-210?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RR-210 form?

A: The RR-210 form is the Gross Earnings Tax form specific to railroad companies in Connecticut.

Q: Who needs to file the RR-210 form?

A: Railroad companies operating in Connecticut need to file the RR-210 form.

Q: What is the purpose of the Gross Earnings Tax?

A: The Gross Earnings Tax is levied on railroad companies to generate revenue for the state of Connecticut.

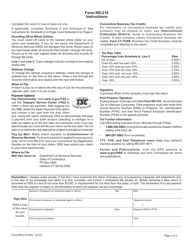

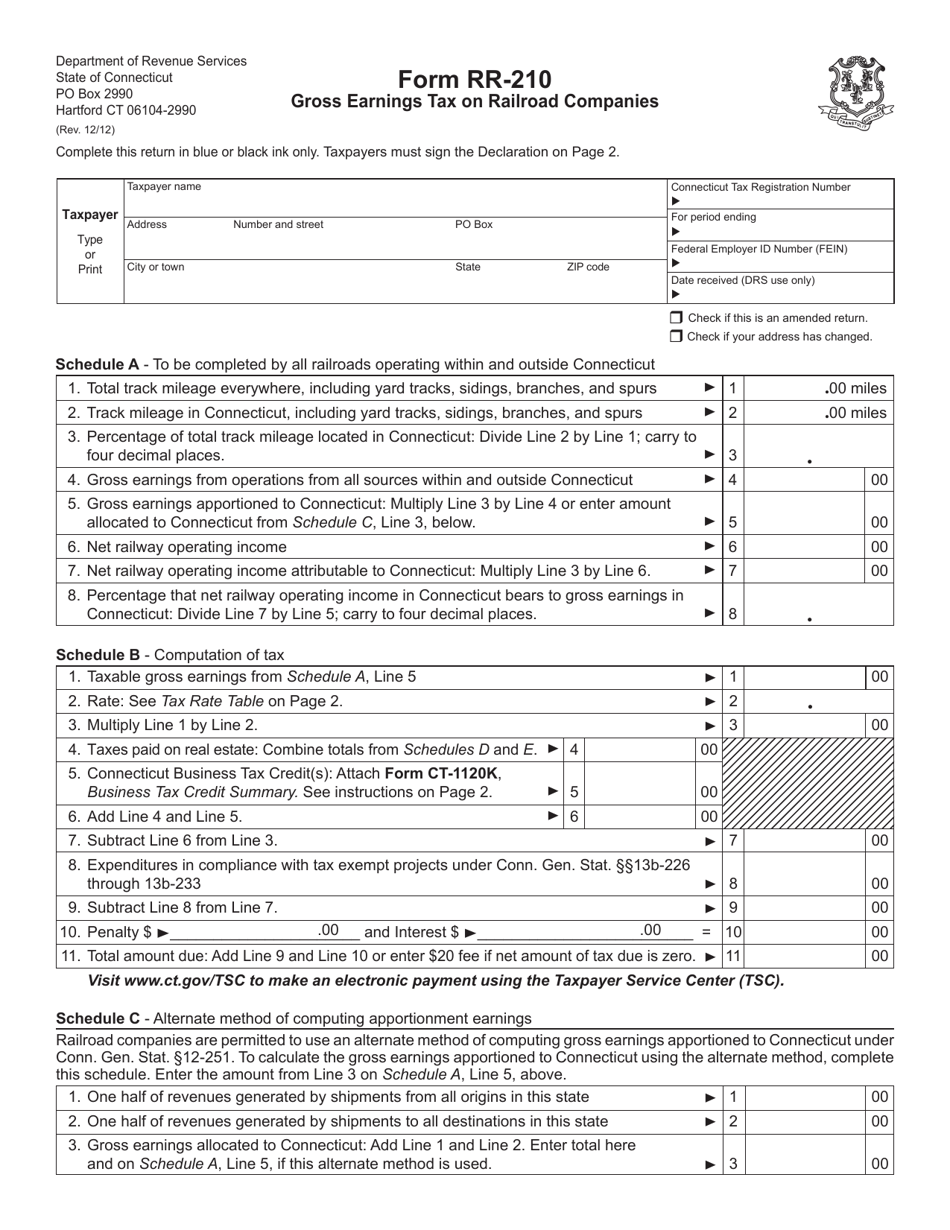

Q: When is the RR-210 form due?

A: The RR-210 form is due annually on March 31st.

Q: Are there any penalties for late filing of the RR-210 form?

A: Yes, there may be penalties for late filing of the RR-210 form. It is important to file on time to avoid penalties.

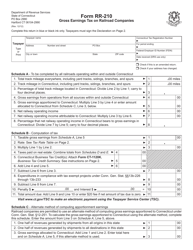

Q: How is the Gross Earnings Tax calculated?

A: The Gross Earnings Tax is calculated based on a percentage of the railroad company's gross receipts from operations in Connecticut.

Q: Are there any exemptions to the Gross Earnings Tax for railroad companies?

A: There may be exemptions available for certain railroad companies. It is best to consult the Connecticut Department of Revenue Services for specific details.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RR-210 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.