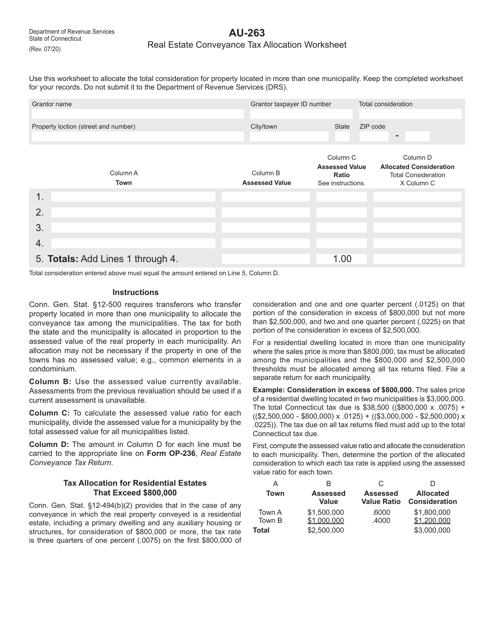

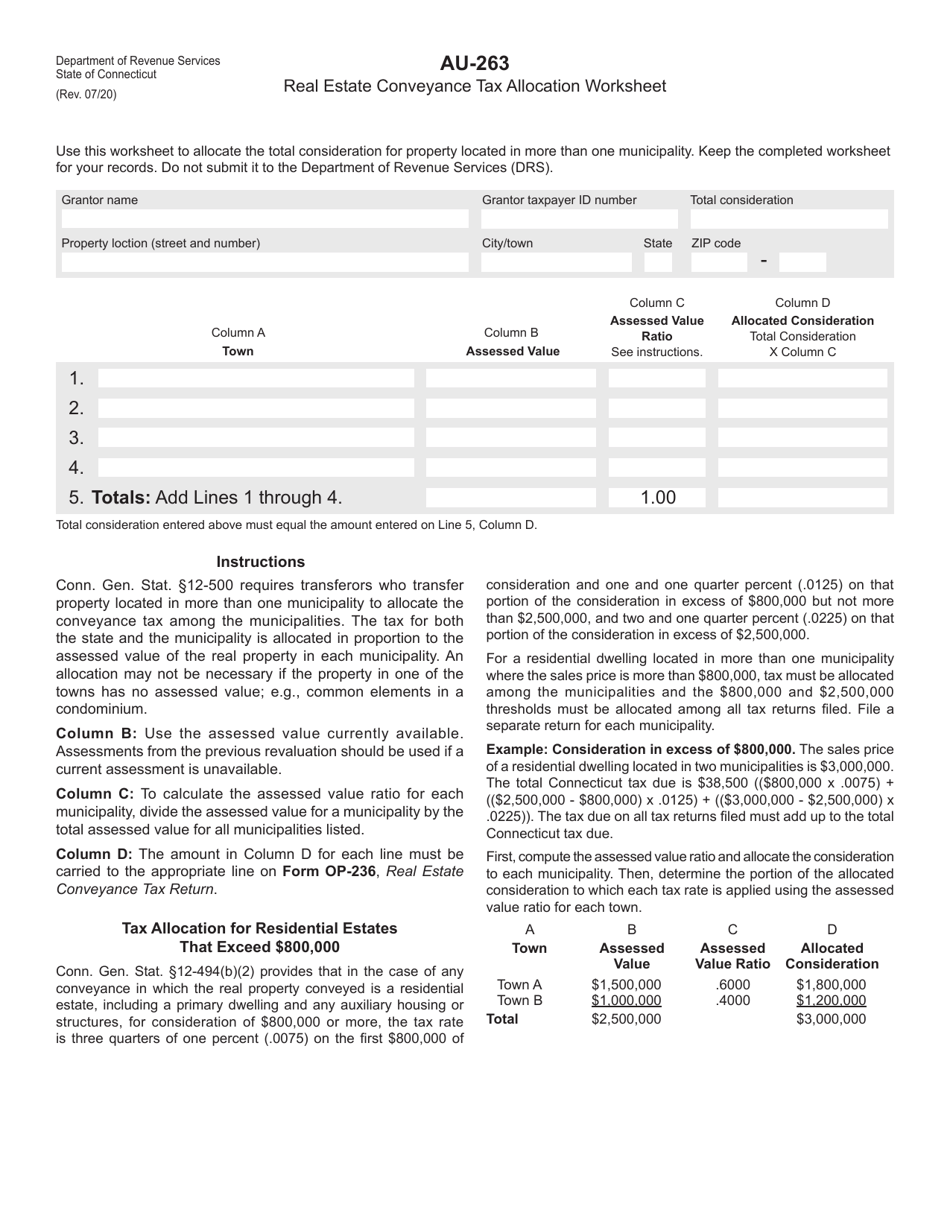

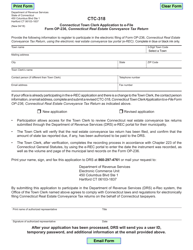

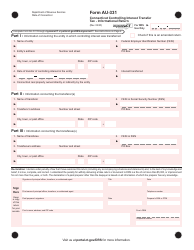

Form AU-263 Real Estate Conveyance Tax Allocation Worksheet - Connecticut

What Is Form AU-263?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

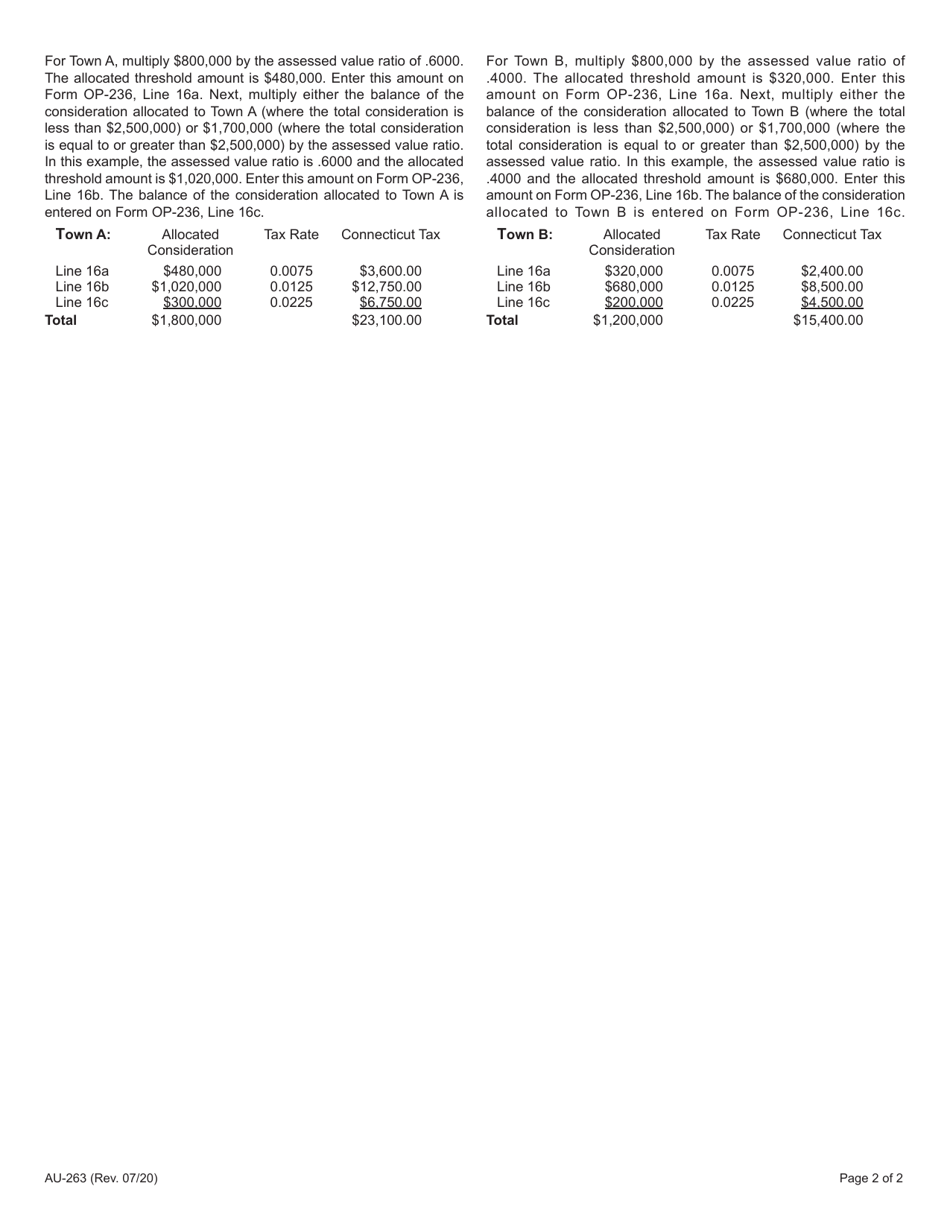

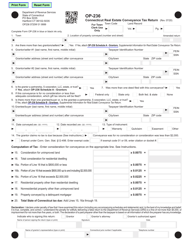

Q: What is AU-263 Real Estate Conveyance Tax Allocation Worksheet?

A: AU-263 is a form used in Connecticut for allocating real estate conveyance tax.

Q: What is real estate conveyance tax?

A: Real estate conveyance tax is a tax imposed on the transfer of real property ownership.

Q: Who uses AU-263 Real Estate Conveyance Tax Allocation Worksheet?

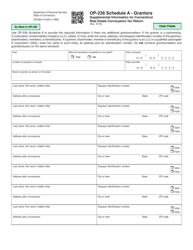

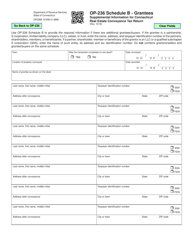

A: This form is used by individuals or entities involved in real estate transactions in Connecticut.

Q: What is the purpose of AU-263 Real Estate Conveyance Tax Allocation Worksheet?

A: The purpose of this form is to determine the allocation of the real estate conveyance tax among the parties involved in the real estate transaction.

Q: How tofill out AU-263 Real Estate Conveyance Tax Allocation Worksheet?

A: The form requires information related to the real estate transaction, including the names of the parties, the property details, and the allocation of the conveyance tax.

Q: Are there any filing fees associated with AU-263 Real Estate Conveyance Tax Allocation Worksheet?

A: There are no filing fees associated with this form.

Q: When should I file AU-263 Real Estate Conveyance Tax Allocation Worksheet?

A: The form should be filed within 30 days of the real estate transaction.

Q: Can I e-file AU-263 Real Estate Conveyance Tax Allocation Worksheet?

A: Yes, you can e-file the AU-263 form if you prefer.

Q: What happens if I don't file AU-263 Real Estate Conveyance Tax Allocation Worksheet?

A: Failure to file the form or provide accurate information may result in penalties or delays in the real estate transaction process.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-263 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.