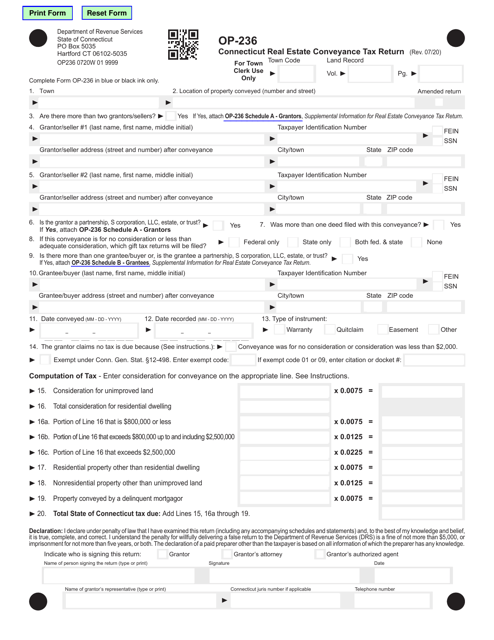

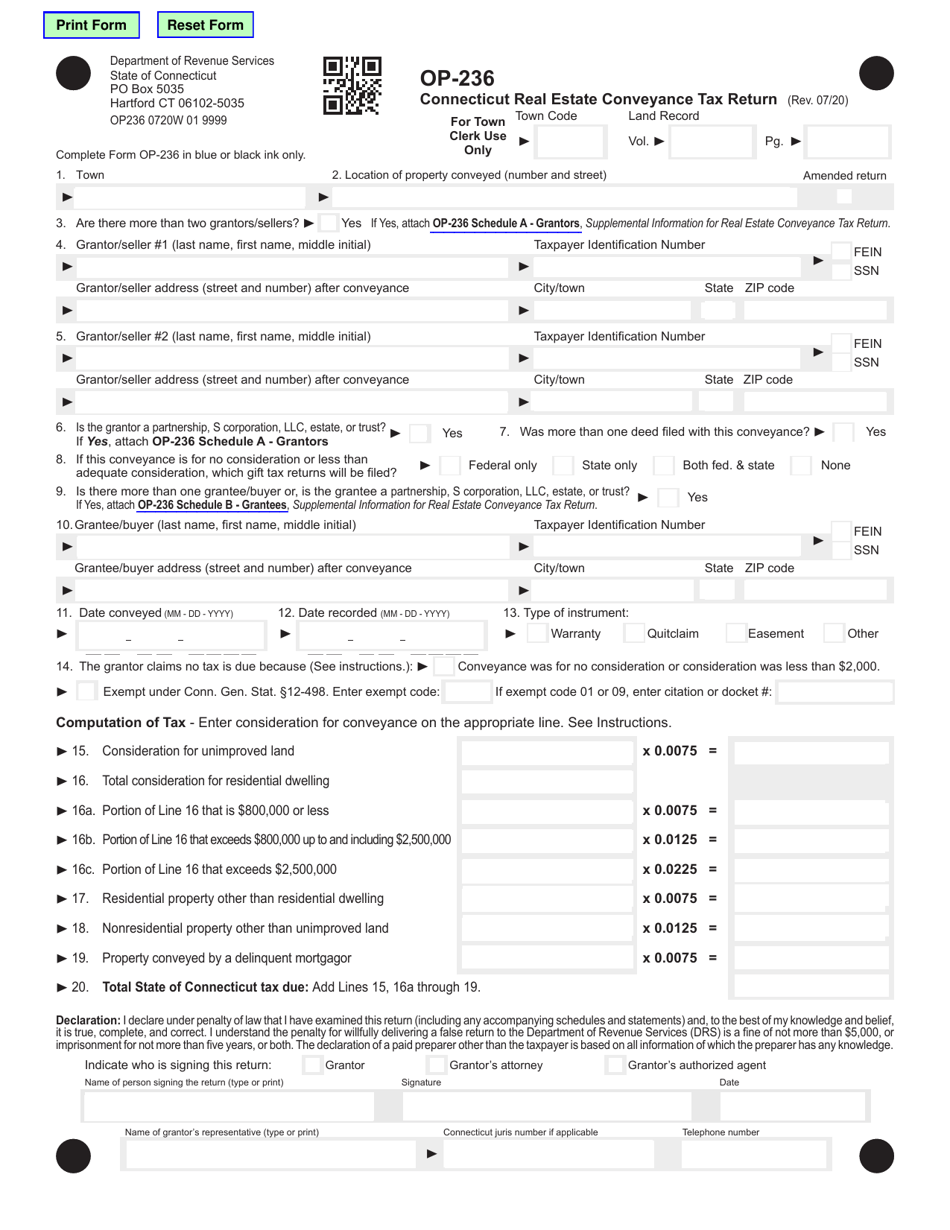

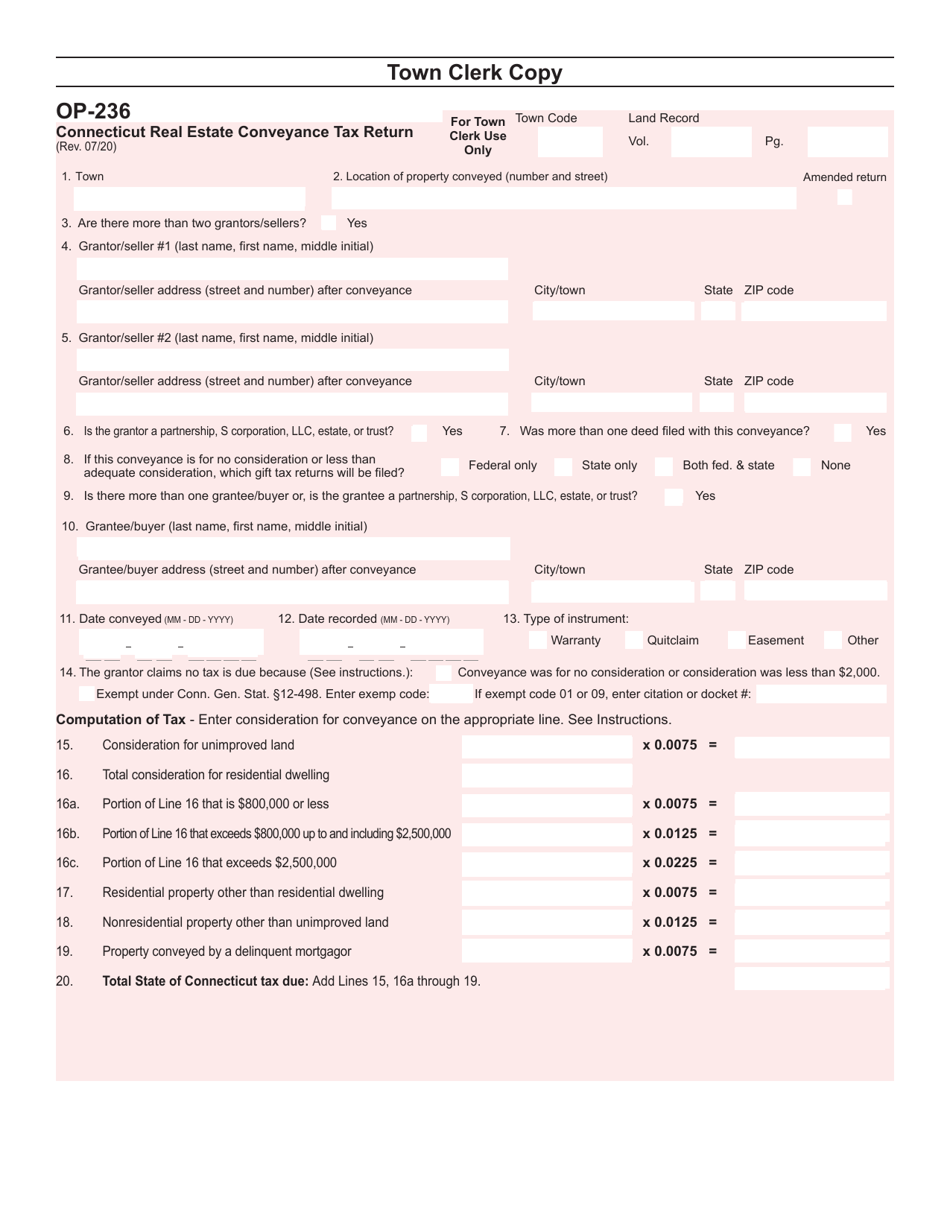

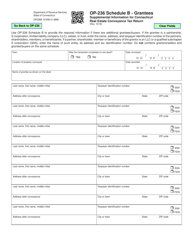

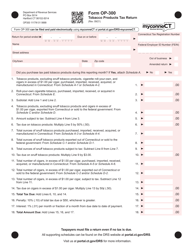

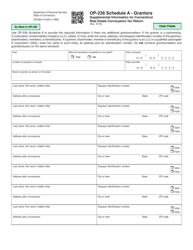

Form OP-236 Connecticut Real Estate Conveyance Tax Return - Connecticut

What Is Form OP-236?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the OP-236 Connecticut Real Estate Conveyance Tax Return?

A: The OP-236 is a tax form used in Connecticut to report and pay the real estate conveyance tax.

Q: Who needs to file the OP-236 Connecticut Real Estate Conveyance Tax Return?

A: Anyone who is involved in a real estate transaction in Connecticut may need to file this form, including buyers, sellers, and their attorneys or agents.

Q: When is the OP-236 Connecticut Real Estate Conveyance Tax Return due?

A: The form must generally be filed and the tax paid within 30 days from the date of the sale or transfer of the property.

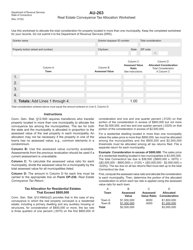

Q: How is the real estate conveyance tax calculated?

A: The tax is calculated based on the sale or transfer price of the property. The rates vary depending on the value of the property.

Q: Are there any exemptions to the real estate conveyance tax in Connecticut?

A: Yes, there are certain exemptions and deductions available, such as transfers between spouses, transfers to a non-profit organization, and transfers of affordable housing units.

Q: What happens if I don't file the OP-236 Connecticut Real Estate Conveyance Tax Return?

A: Failure to file the form and pay the tax on time may result in penalties and interest being assessed.

Q: Who should I contact for more information about the OP-236 Connecticut Real Estate Conveyance Tax Return?

A: For more information, you can contact the Connecticut Department of Revenue Services or consult with a tax professional.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OP-236 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.