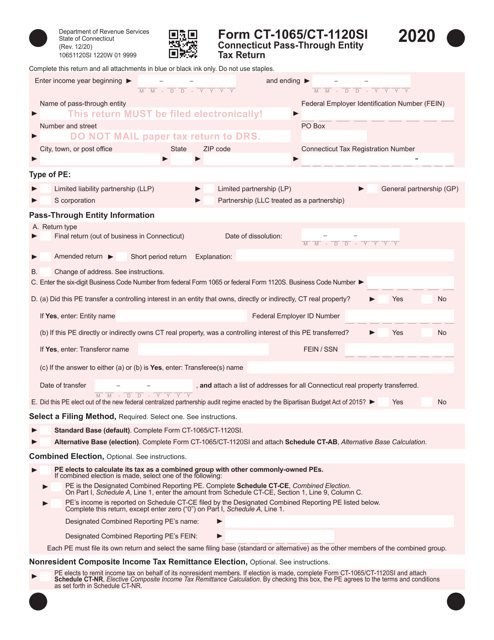

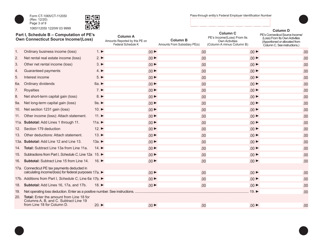

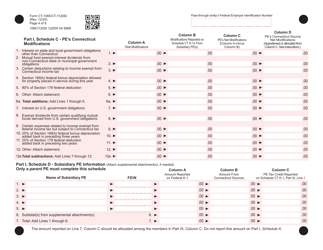

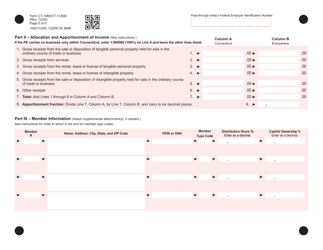

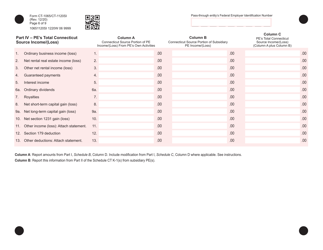

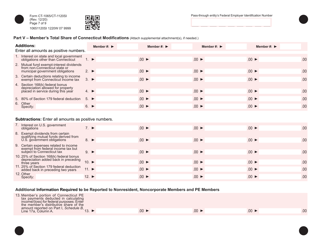

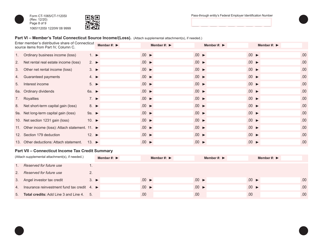

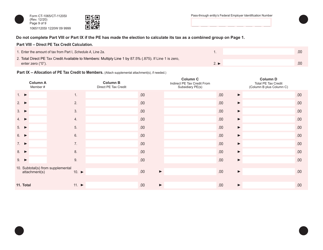

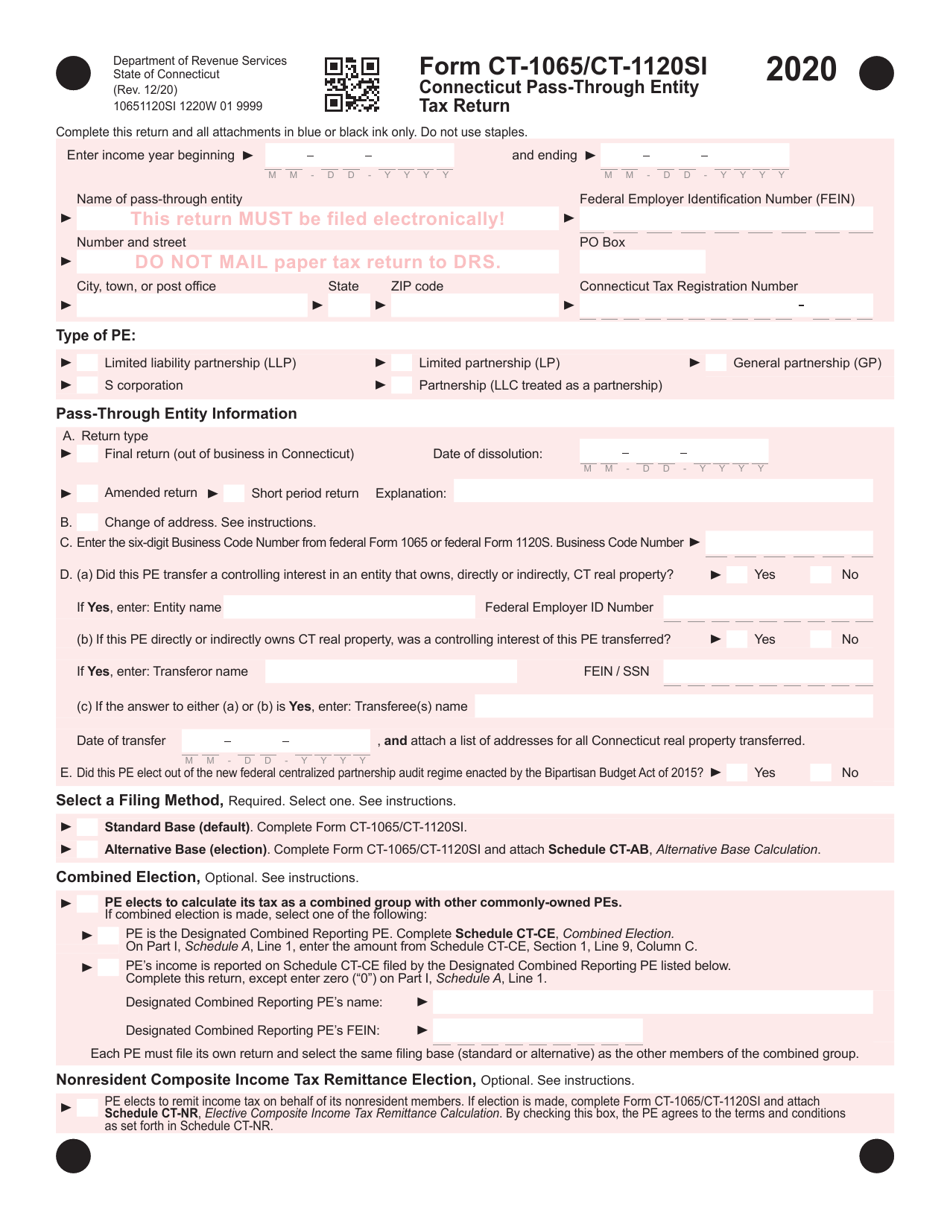

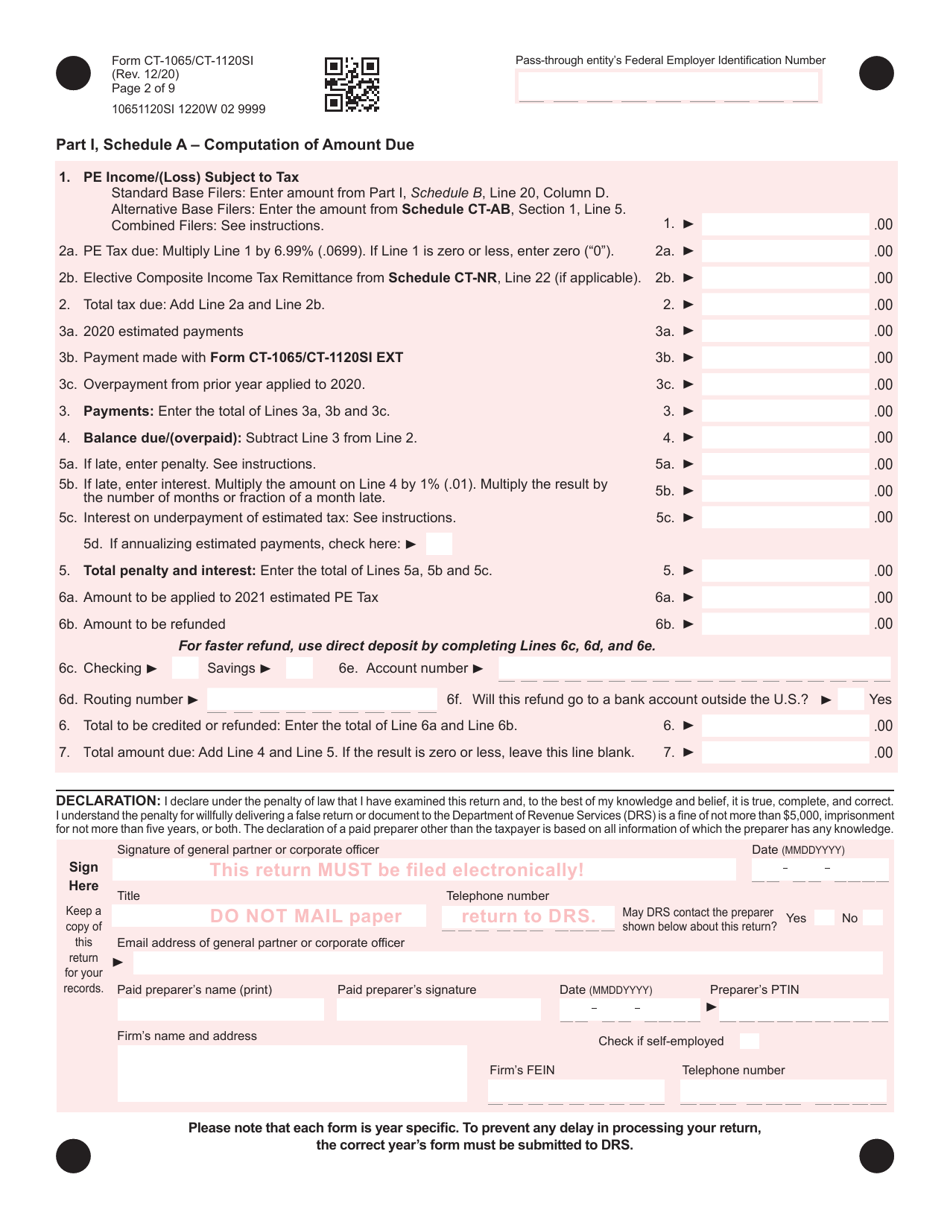

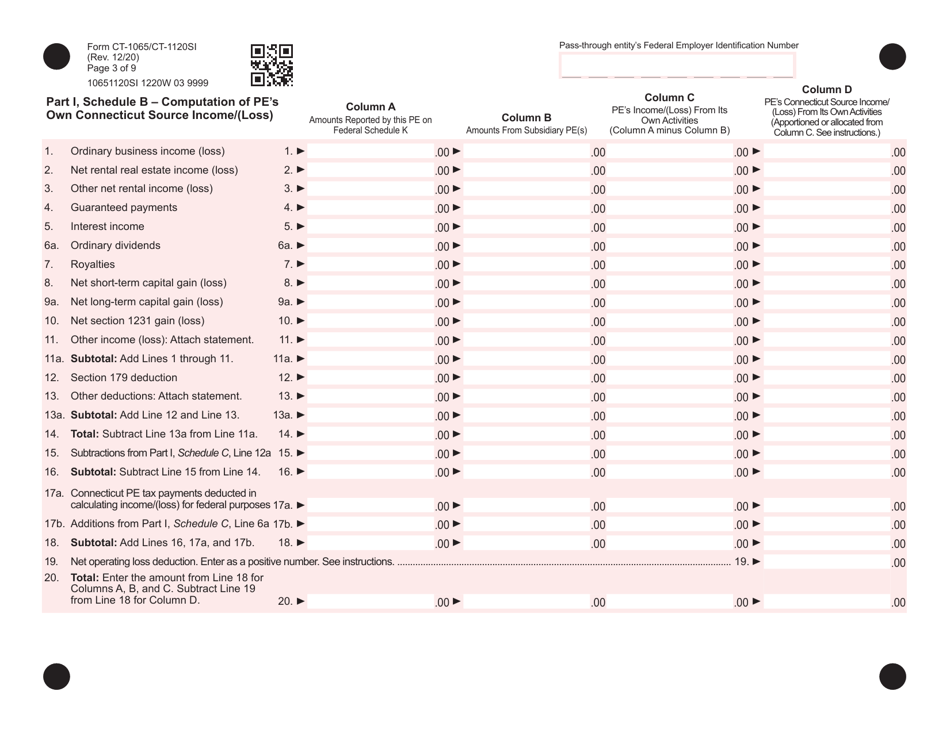

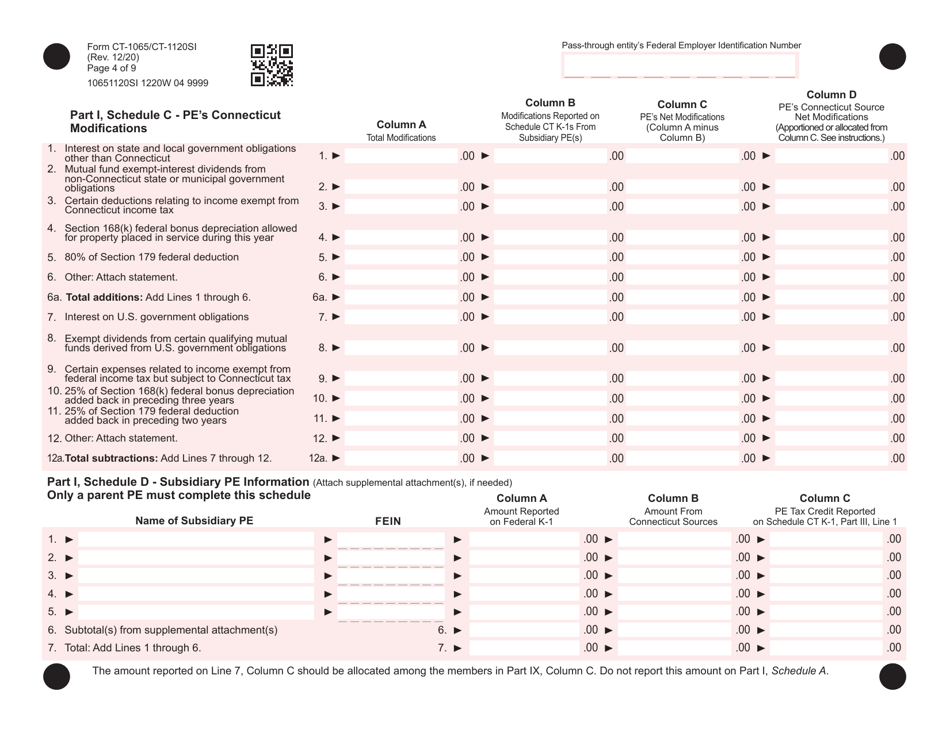

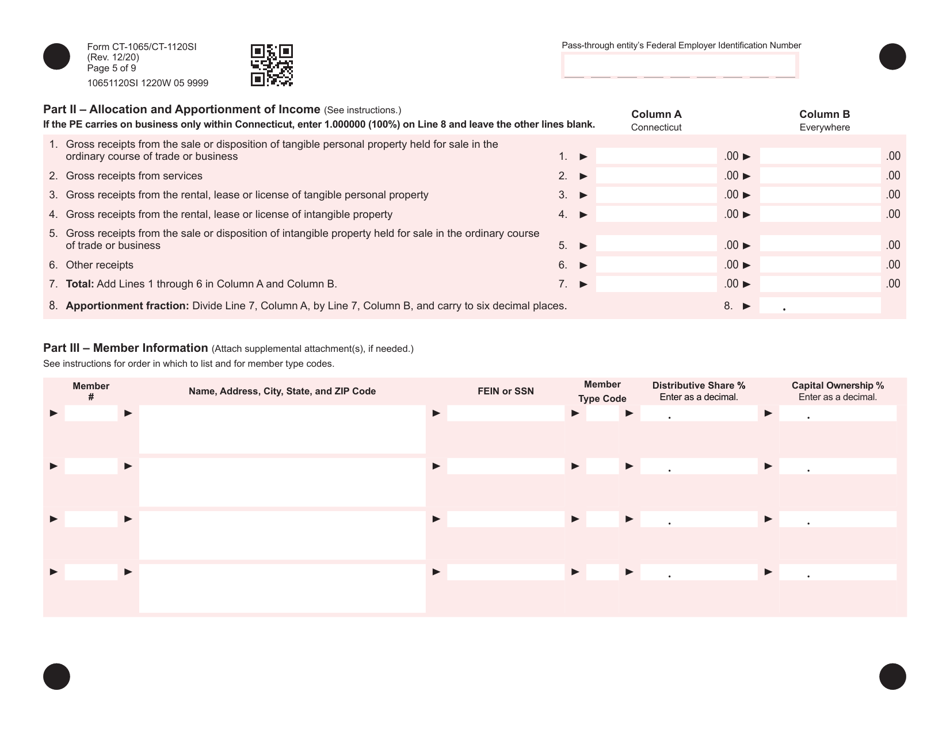

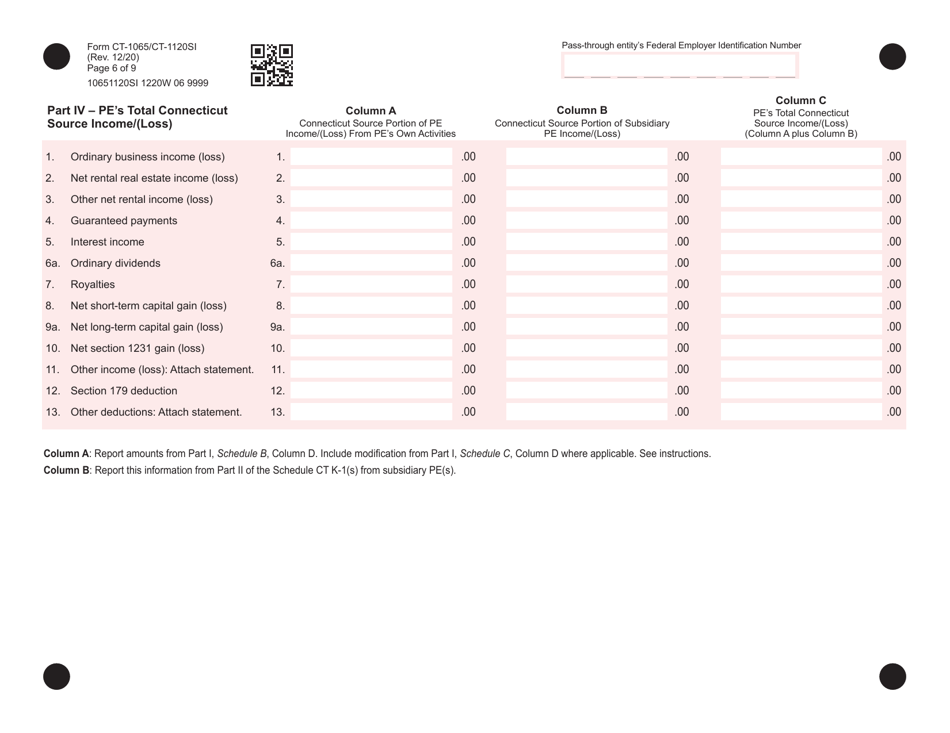

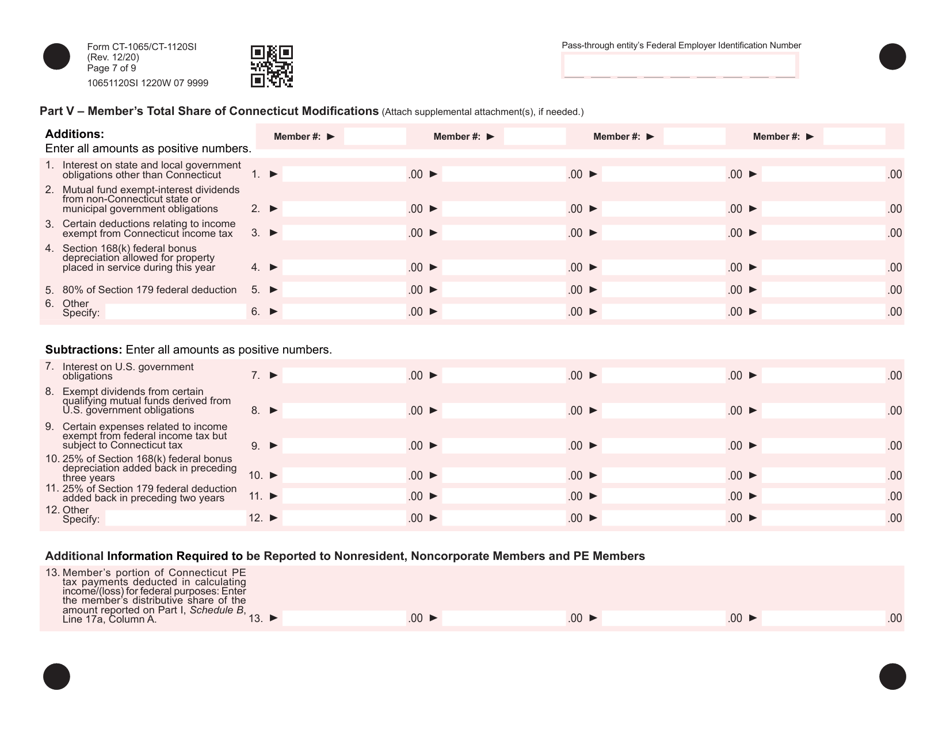

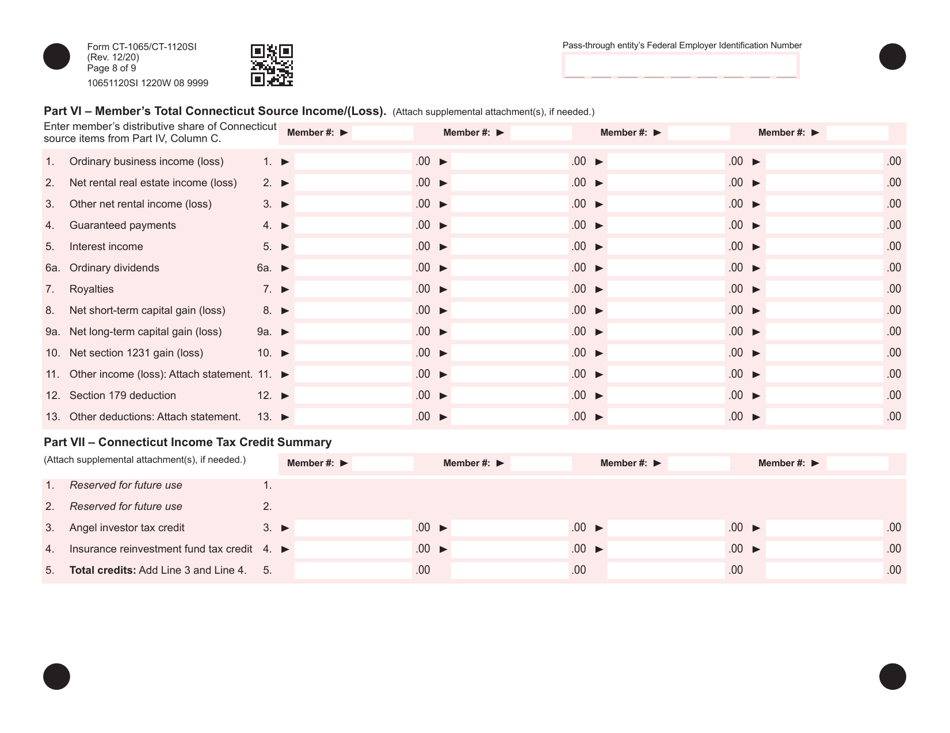

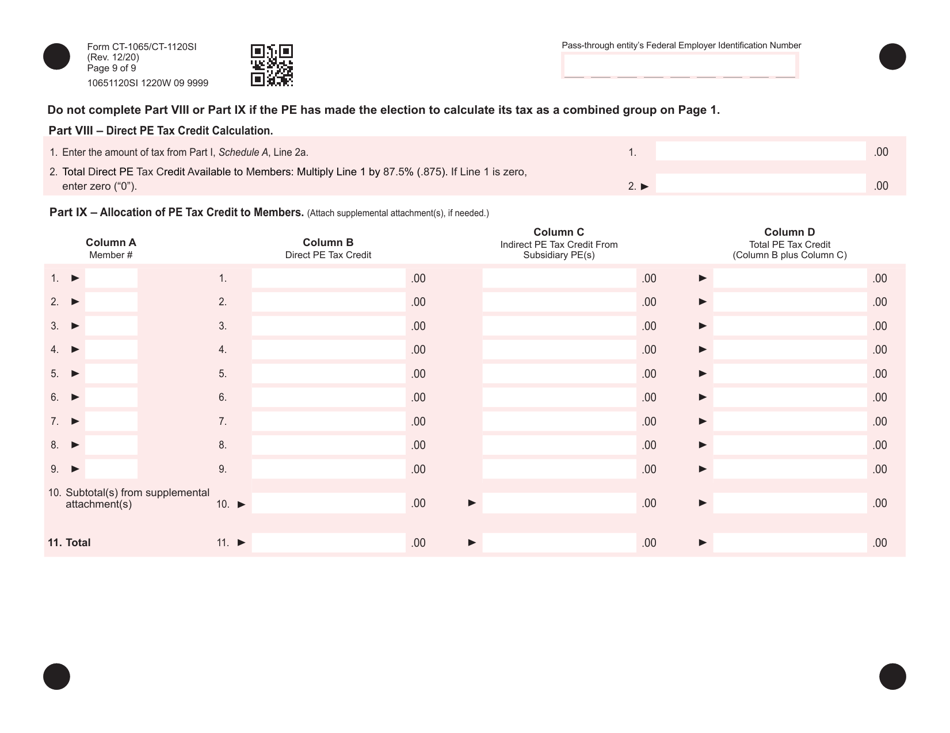

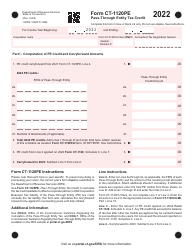

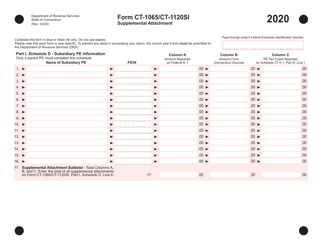

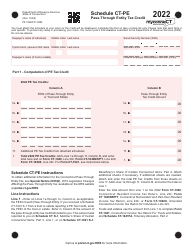

Form CT-1065 / CT-1120SI Connecticut Pass-Through Entity Tax Return - Connecticut

What Is Form CT-1065/CT-1120SI?

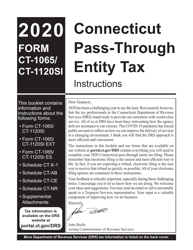

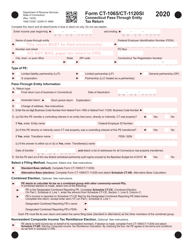

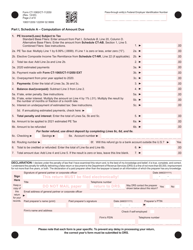

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1065/CT-1120SI?

A: Form CT-1065/CT-1120SI is the Connecticut Pass-Through Entity Tax Return.

Q: Who needs to file Form CT-1065/CT-1120SI?

A: Any pass-through entity doing business in Connecticut needs to file this form, including partnerships and S corporations.

Q: When is the due date for Form CT-1065/CT-1120SI?

A: The due date for this form is the fifteenth day of the fourth month following the close of the tax year.

Q: Can Form CT-1065/CT-1120SI be filed electronically?

A: Yes, it is possible to file this form electronically.

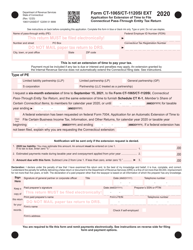

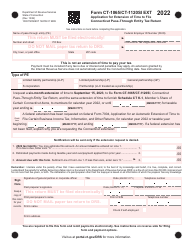

Q: What if I need an extension to file Form CT-1065/CT-1120SI?

A: You can request an extension by filing Form CT-1065/CT-1120SI EXT.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1065/CT-1120SI by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.