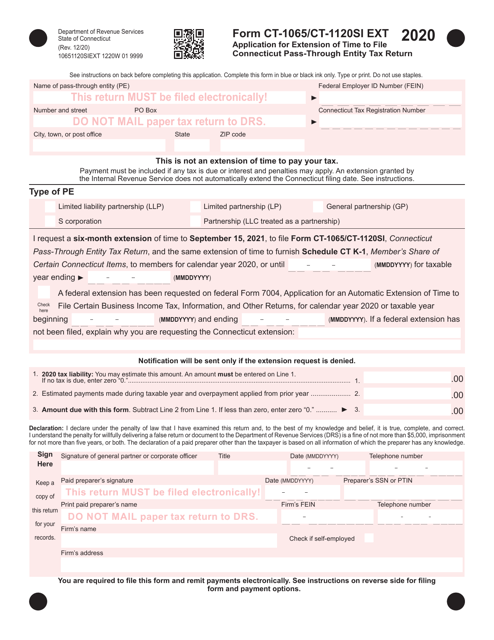

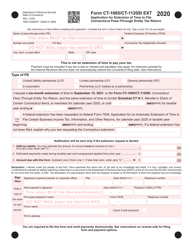

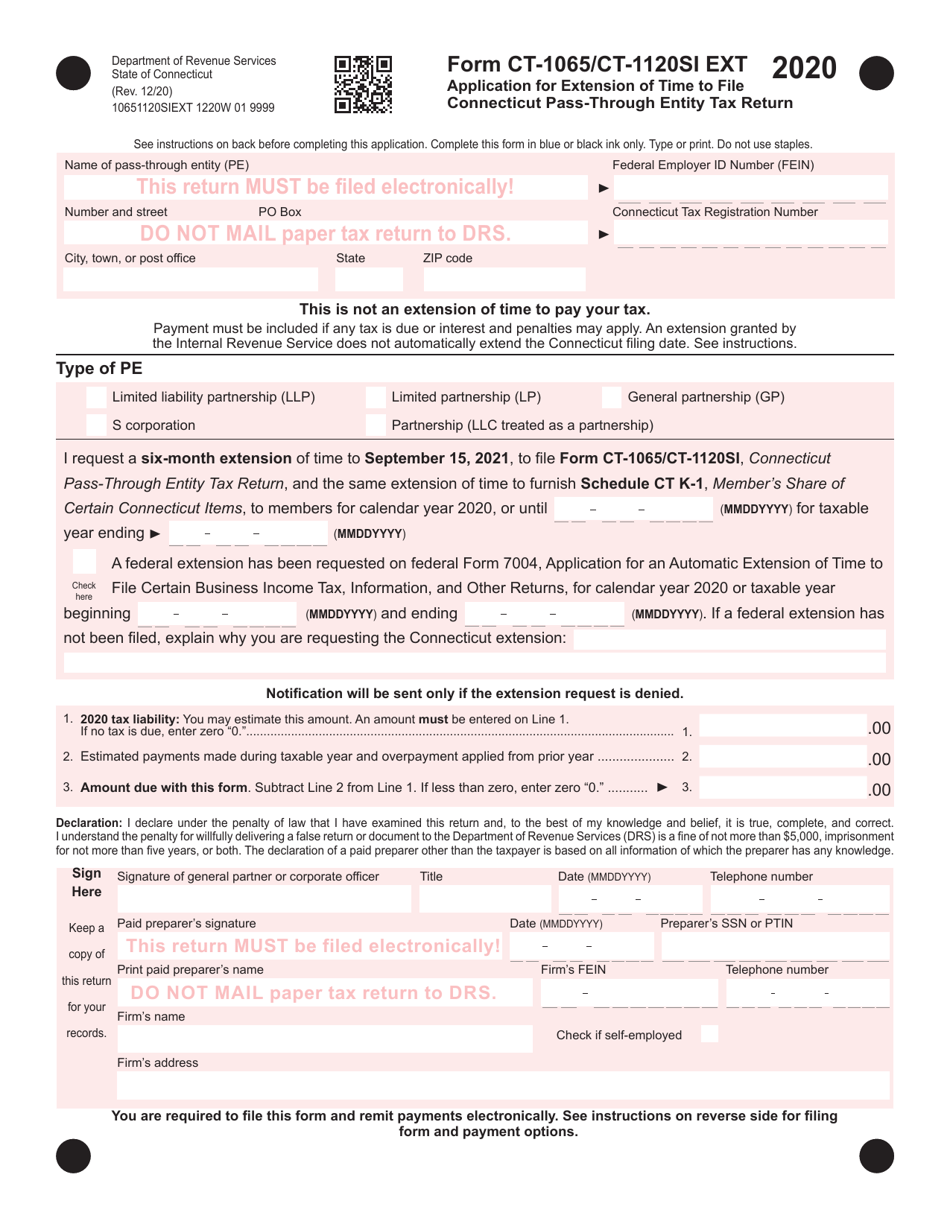

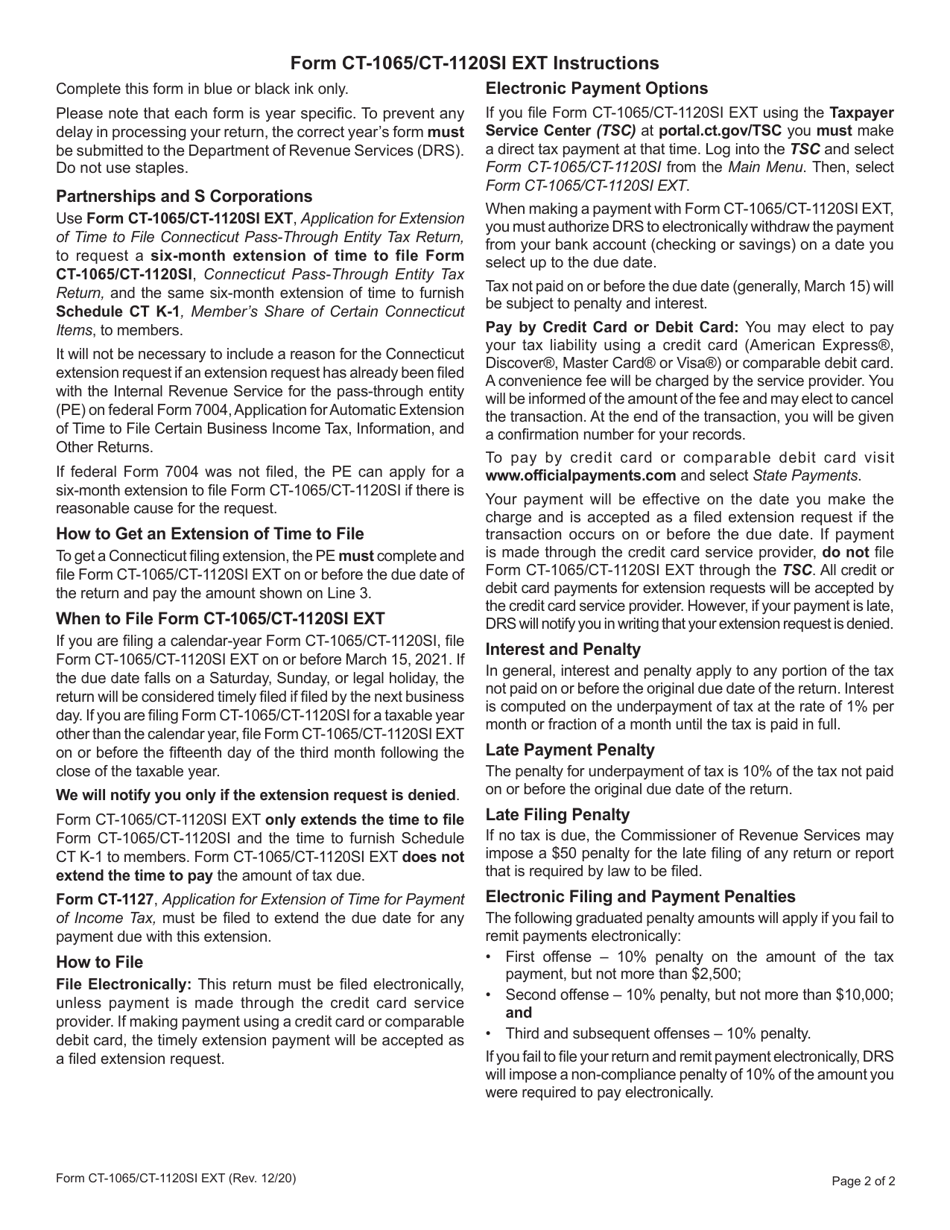

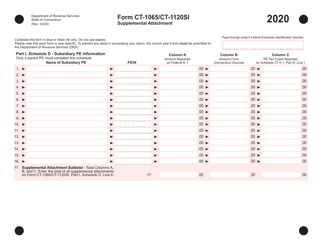

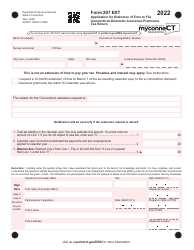

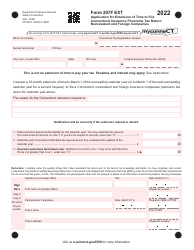

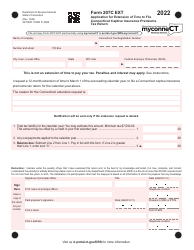

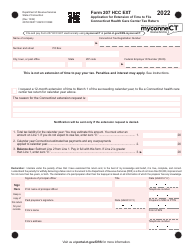

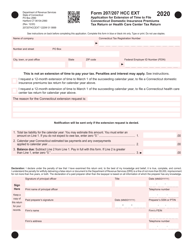

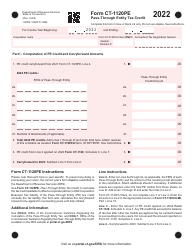

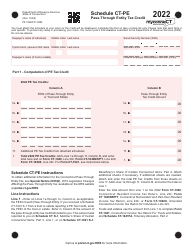

Form CT-1065 / CT-1120SI EXT Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return - Connecticut

What Is Form CT-1065/CT-1120SI EXT?

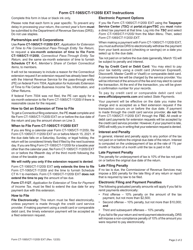

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

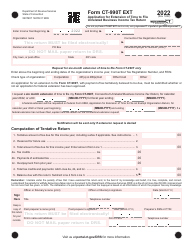

Q: What is Form CT-1065/CT-1120SI EXT?

A: Form CT-1065/CT-1120SI EXT is an application for extension of time to file Connecticut pass-through entity tax return in Connecticut.

Q: What is the purpose of Form CT-1065/CT-1120SI EXT?

A: The purpose of Form CT-1065/CT-1120SI EXT is to request an extension of time to file the Connecticut pass-through entity tax return.

Q: Who needs to file Form CT-1065/CT-1120SI EXT?

A: Pass-through entities in Connecticut who are unable to file their tax return by the deadline need to file Form CT-1065/CT-1120SI EXT to request an extension.

Q: What is the deadline for filing Form CT-1065/CT-1120SI EXT?

A: Form CT-1065/CT-1120SI EXT must be filed by the original due date of the Connecticut pass-through entity tax return, which is the same as the federal due date.

Q: Is there a fee for filing Form CT-1065/CT-1120SI EXT?

A: No, there is no fee for filing Form CT-1065/CT-1120SI EXT.

Q: How long is the extension granted by filing Form CT-1065/CT-1120SI EXT?

A: Filing Form CT-1065/CT-1120SI EXT grants a six-month extension, which moves the filing deadline for the Connecticut pass-through entity tax return to October 15th.

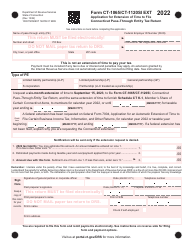

Q: Can I file Form CT-1065/CT-1120SI EXT after the original deadline?

A: Yes, Form CT-1065/CT-1120SI EXT can be filed after the original deadline, but it must be filed before the new extended deadline to avoid any penalties or fees.

Q: What if I filed Form CT-1065/CT-1120SI EXT but still can't file my tax return by the extended deadline?

A: If you are unable to file your tax return by the extended deadline, you may request an additional extension by filing Form CT-1065/CT-1120SI EXT again.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1065/CT-1120SI EXT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.