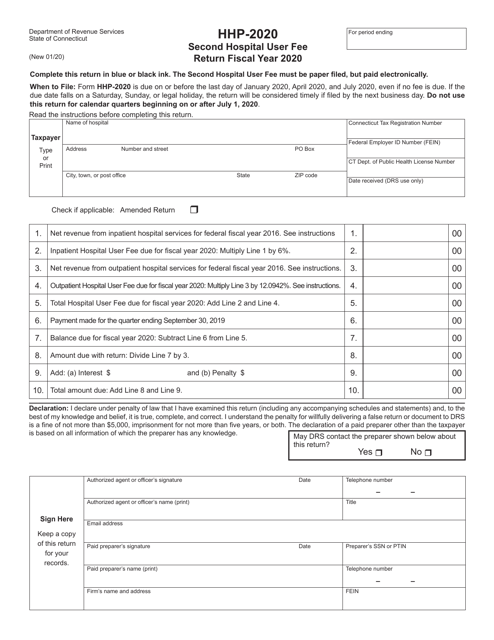

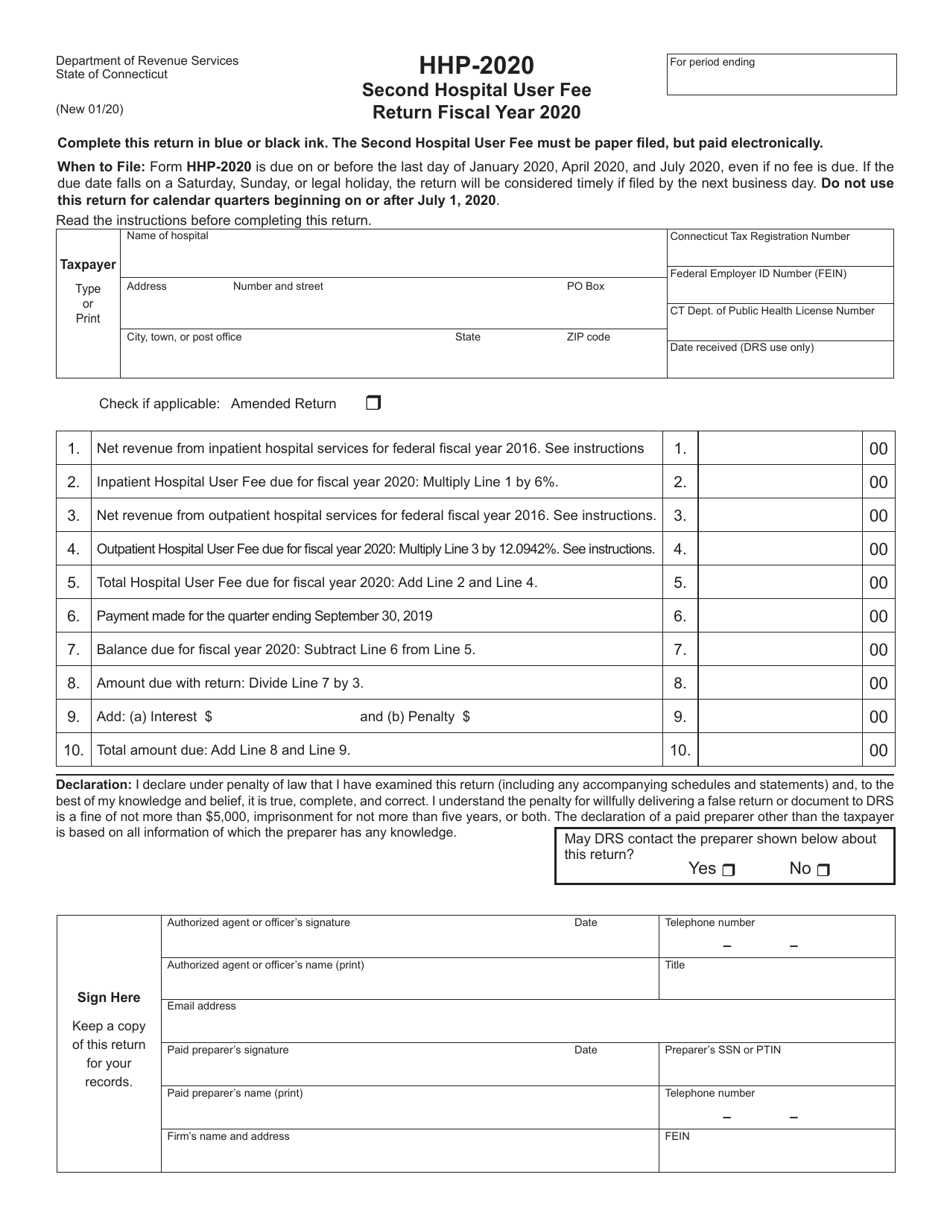

Form HHP-2020 Second Hospital User Fee Return - Connecticut

What Is Form HHP-2020?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HHP-2020?

A: Form HHP-2020 is the Second Hospital User Fee Return form.

Q: Who needs to file Form HHP-2020?

A: Hospitals in Connecticut need to file Form HHP-2020.

Q: What is the purpose of Form HHP-2020?

A: Form HHP-2020 is used to report and pay the Second Hospital User Fee in Connecticut.

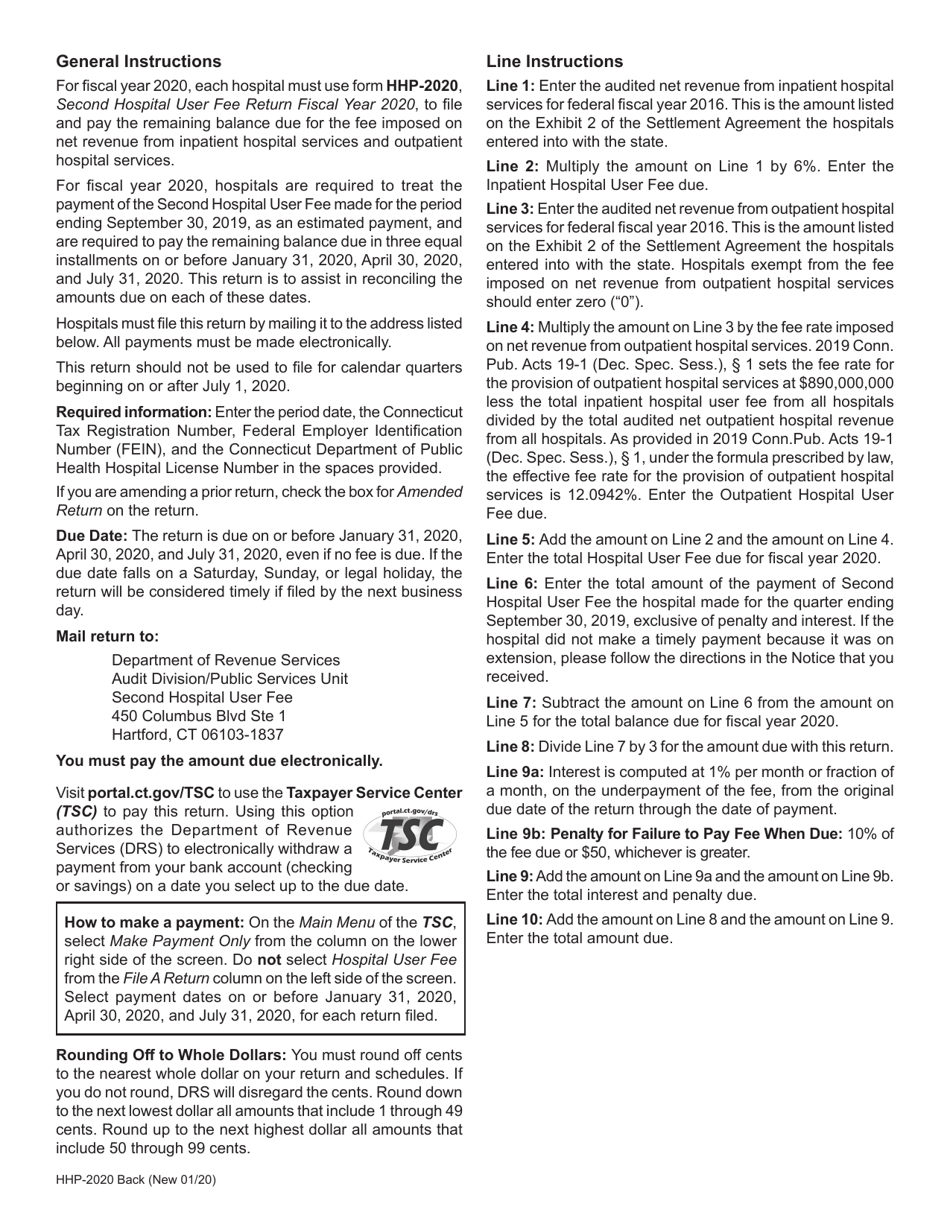

Q: When is Form HHP-2020 due?

A: Form HHP-2020 is typically due on a quarterly basis, but specific due dates may vary.

Q: What information is required on Form HHP-2020?

A: Form HHP-2020 requires hospitals to provide details such as patient days, charges, and payments for the reporting period.

Q: What happens if Form HHP-2020 is not filed or paid on time?

A: Failure to file or pay Form HHP-2020 on time may result in penalties and interest charges.

Q: Are there any exemptions or deductions available on Form HHP-2020?

A: Specific exemptions or deductions may be available for certain hospitals, but it is advisable to consult the instructions or a tax professional for detailed information.

Q: Can Form HHP-2020 be filed electronically?

A: Yes, Form HHP-2020 can be filed electronically using the Connecticut Taxpayer Service Center.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HHP-2020 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.