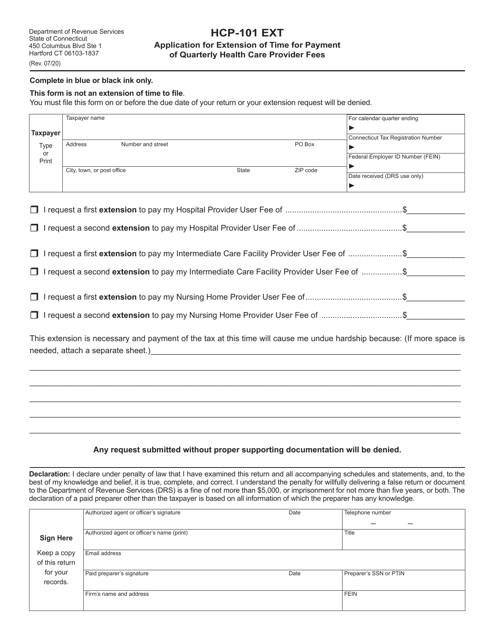

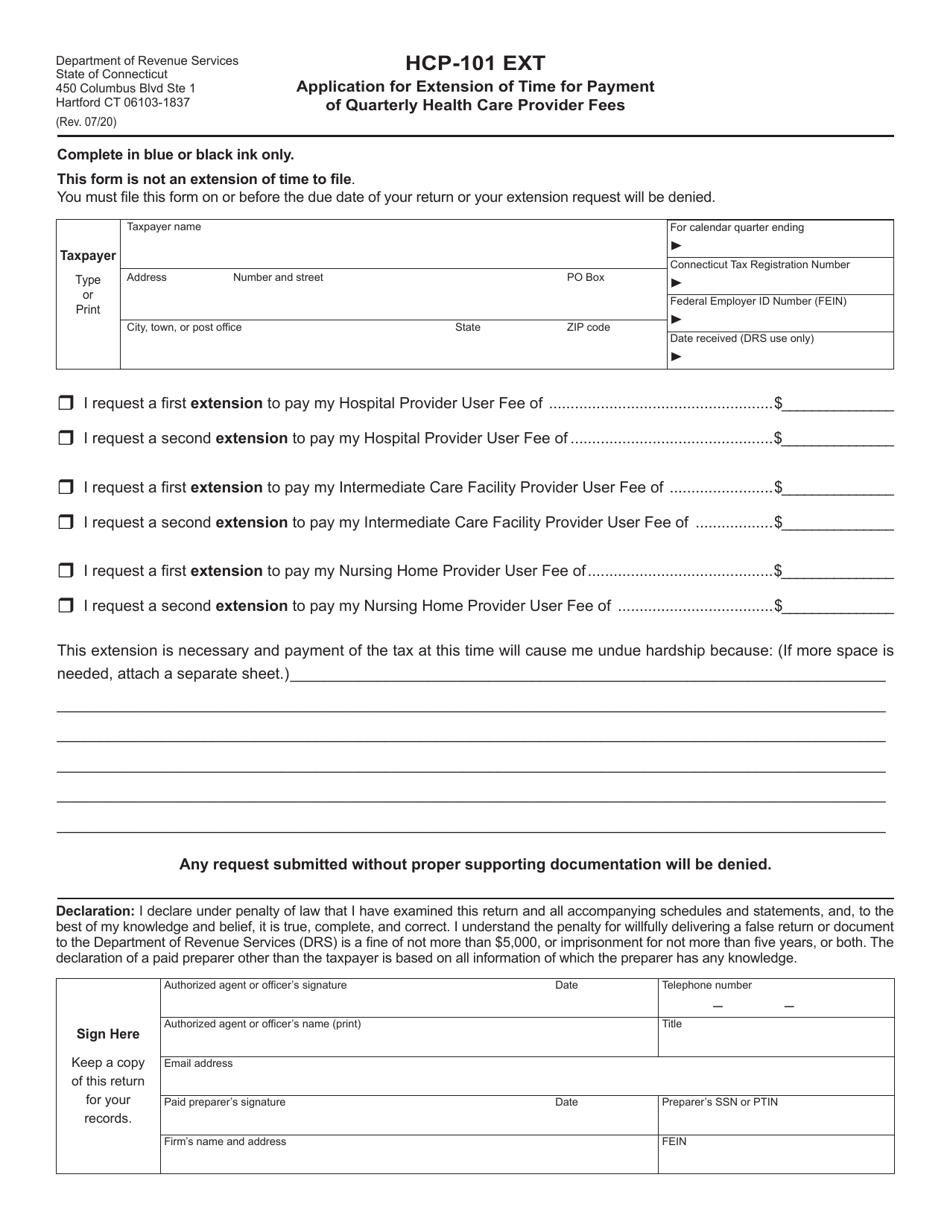

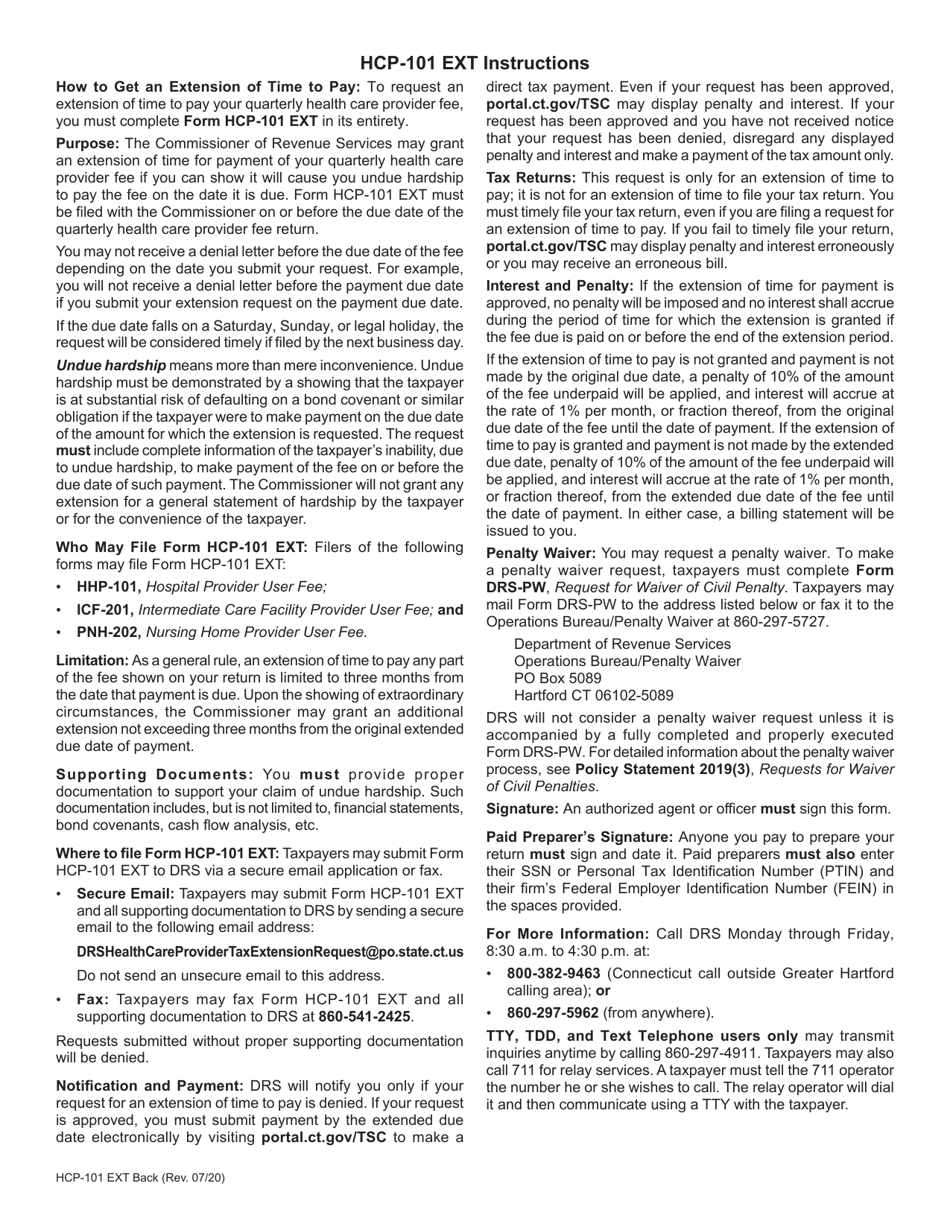

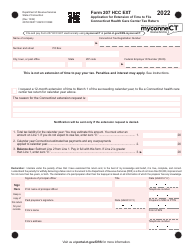

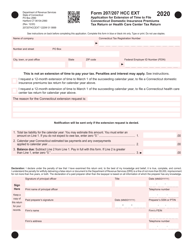

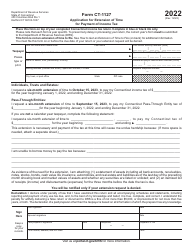

Form HCP-101 EXT Application for Extension of Time for Payment of Quarterly Health Care Provider Fees - Connecticut

What Is Form HCP-101 EXT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCP-101 EXT?

A: Form HCP-101 EXT is an application for extension of time for payment of quarterly health care provider fees in Connecticut.

Q: Who needs to file Form HCP-101 EXT?

A: Health care providers in Connecticut who require additional time to pay their quarterly fees need to file Form HCP-101 EXT.

Q: What is the purpose of Form HCP-101 EXT?

A: The purpose of Form HCP-101 EXT is to request an extension of time to pay quarterly health care provider fees.

Q: What information is required on Form HCP-101 EXT?

A: Form HCP-101 EXT requires information such as the healthcare provider's name, address, contact information, and the reason for requesting the extension.

Q: Is there a deadline for filing Form HCP-101 EXT?

A: Yes, Form HCP-101 EXT must be filed before the original due date of the quarterly health care provider fees.

Q: Will there be any penalties for filing Form HCP-101 EXT?

A: Penalties may still apply if the extension request is not granted or if the quarterly fees are not paid within the extended time period.

Q: How long is the extension period granted by Form HCP-101 EXT?

A: The extension period granted by Form HCP-101 EXT varies based on the circumstances and is determined by the Connecticut Department of Revenue Services.

Q: Is there a fee for filing Form HCP-101 EXT?

A: No, there is no fee for filing Form HCP-101 EXT.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HCP-101 EXT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.