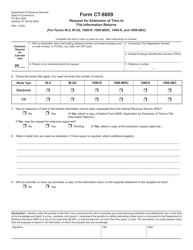

This version of the form is not currently in use and is provided for reference only. Download this version of

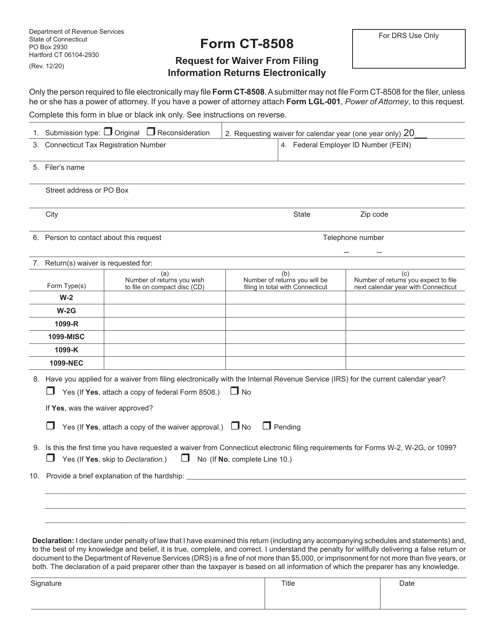

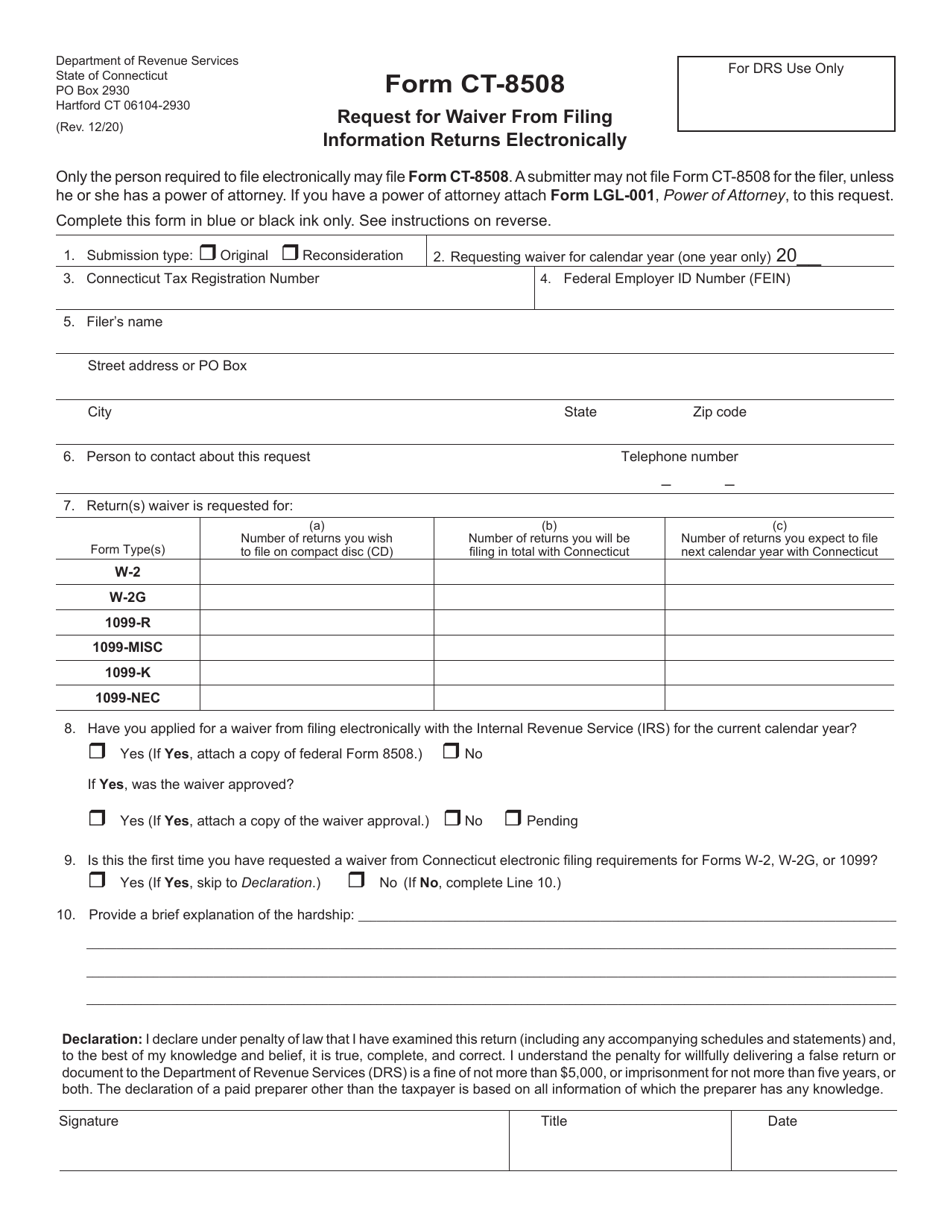

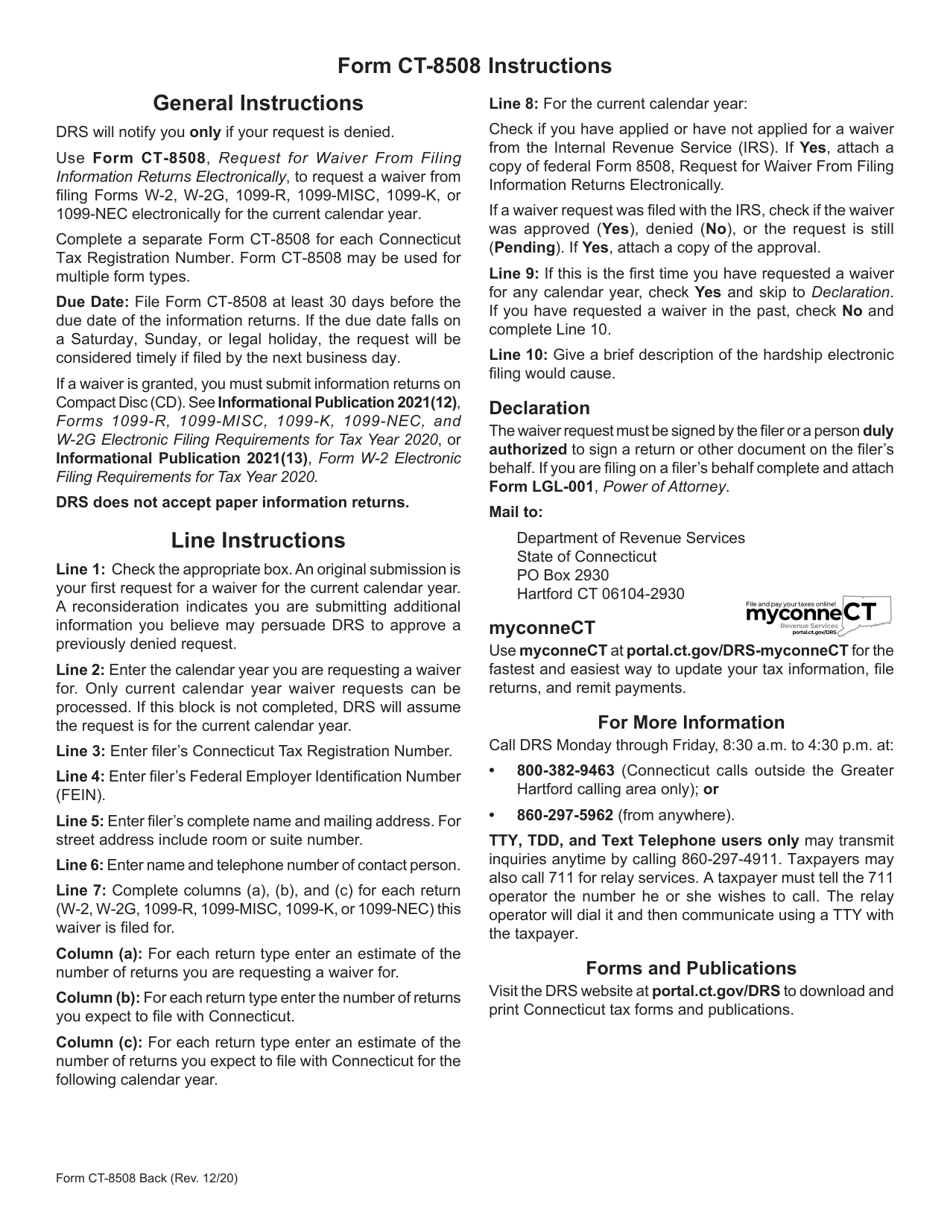

Form CT-8508

for the current year.

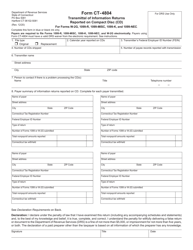

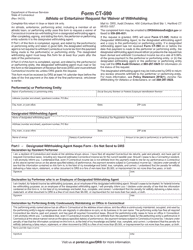

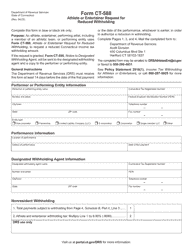

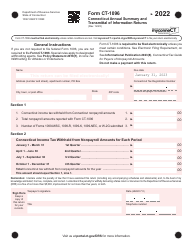

Form CT-8508 Request for Waiver From Filing Information Returns Electronically - Connecticut

What Is Form CT-8508?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-8508?

A: Form CT-8508 is a request for waiver from filing information returns electronically in Connecticut.

Q: Why would someone use Form CT-8508?

A: Someone would use Form CT-8508 to request a waiver from the requirement to file information returns electronically in Connecticut.

Q: What is an information return?

A: An information return is a tax form used to report certain types of income, payments, or transactions to the government.

Q: Who needs to file information returns in Connecticut?

A: Anyone who is required to file certain types of information returns, such as Forms W-2 or 1099, with the Connecticut Department of Revenue Services.

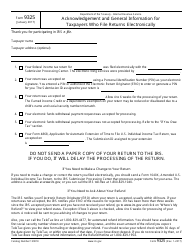

Q: What is the electronic filing requirement in Connecticut?

A: Connecticut requires certain taxpayers to file information returns electronically, rather than on paper.

Q: Can someone be exempt from the electronic filing requirement?

A: Yes, someone can request a waiver from the electronic filing requirement using Form CT-8508.

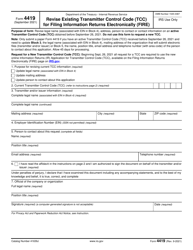

Q: How can someone request a waiver using Form CT-8508?

A: To request a waiver, taxpayers must complete Form CT-8508 and provide a valid reason for why they are unable to file electronically.

Q: Is there a deadline for submitting Form CT-8508?

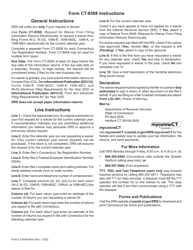

A: Yes, taxpayers must submit Form CT-8508 at least 45 days before the due date of the information returns they are requesting a waiver for.

Q: What happens after someone submits Form CT-8508?

A: The Connecticut Department of Revenue Services will review the request and notify the taxpayer of their decision.

Q: Is there a fee for requesting a waiver using Form CT-8508?

A: No, there is no fee for requesting a waiver using Form CT-8508.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8508 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.