This version of the form is not currently in use and is provided for reference only. Download this version of

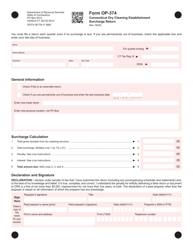

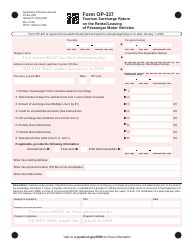

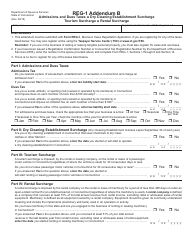

Form OP-374

for the current year.

Form OP-374 Connecticut Dry Cleaning Establishment Surcharge Return - Connecticut

What Is Form OP-374?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OP-374?

A: OP-374 is the form number for the Connecticut Dry Cleaning Establishment Surcharge Return.

Q: What is the purpose of OP-374?

A: The purpose of OP-374 is to report and pay the surcharge for dry cleaning establishments in Connecticut.

Q: Who needs to file OP-374?

A: Dry cleaning establishments in Connecticut need to file OP-374.

Q: When is OP-374 due?

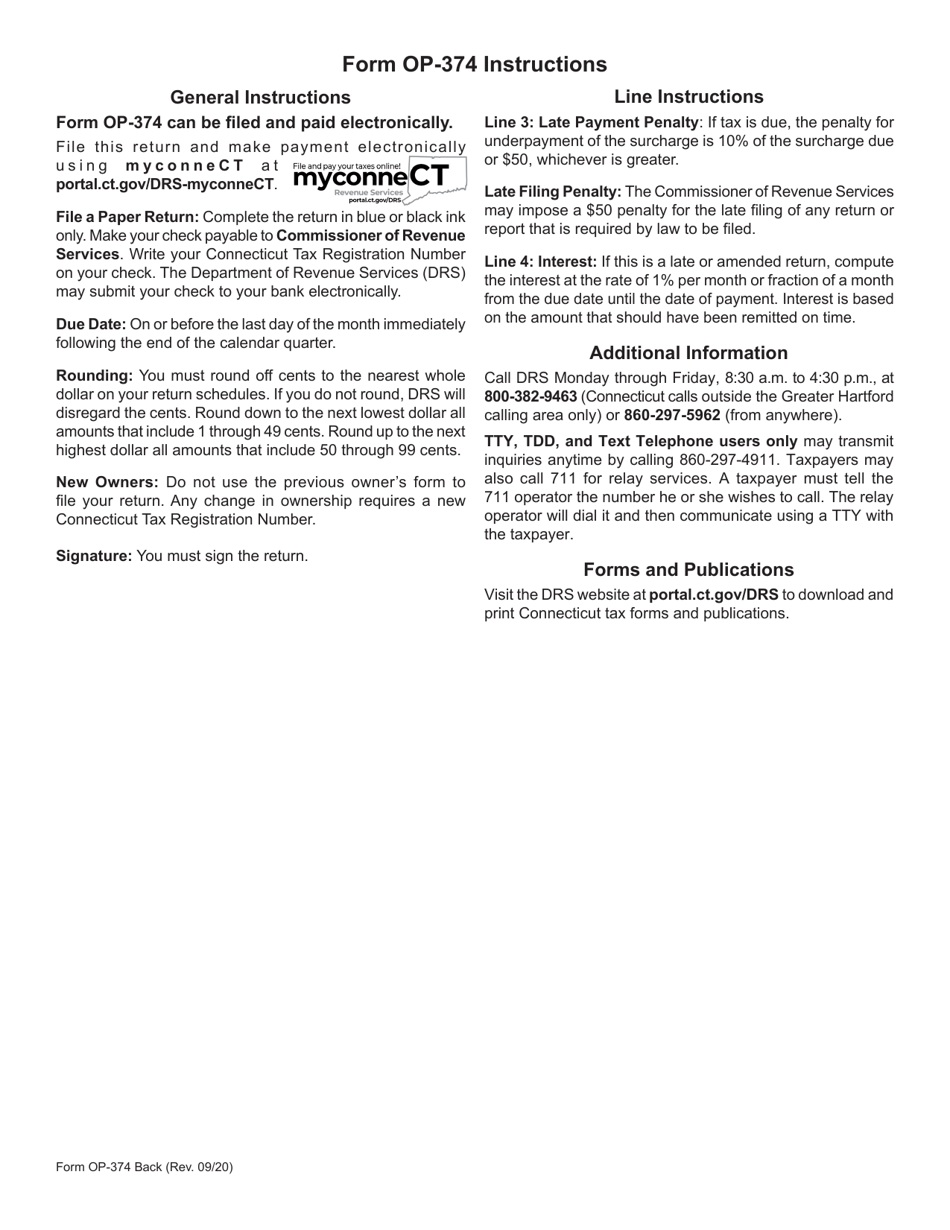

A: OP-374 is due on a quarterly basis, with the due dates falling on April 30, July 31, October 31, and January 31.

Q: Are there any penalties for late filing of OP-374?

A: Yes, there are penalties for late filing of OP-374. It is important to file and pay on time to avoid penalties and interest charges.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-374 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.