This version of the form is not currently in use and is provided for reference only. Download this version of

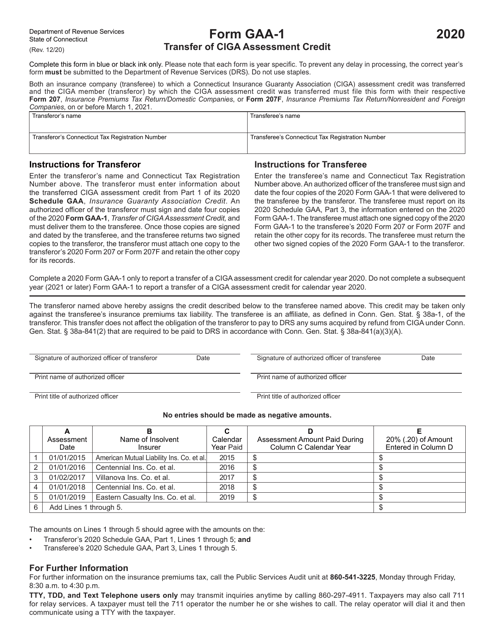

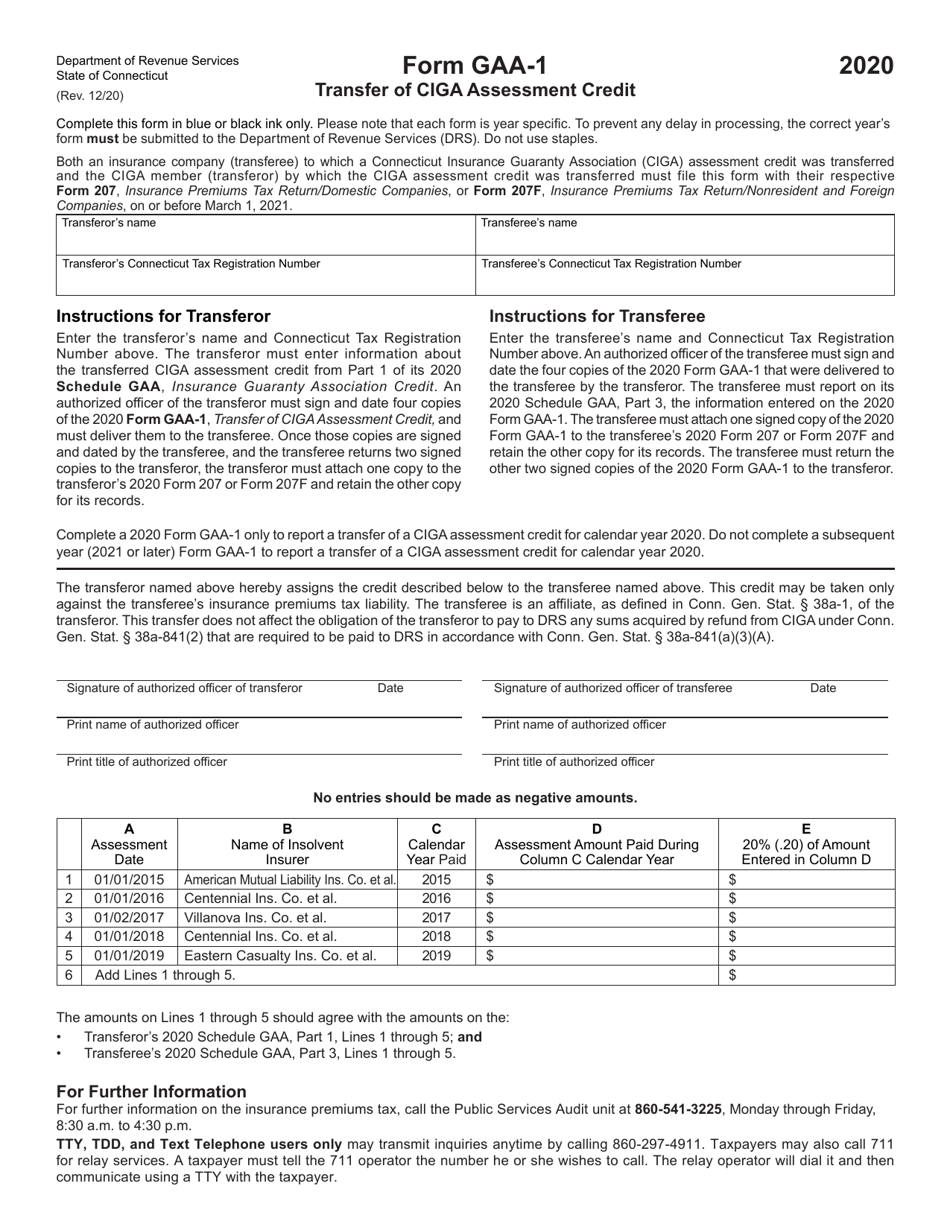

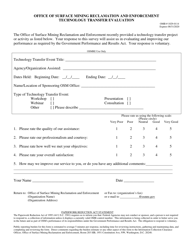

Form GAA-1

for the current year.

Form GAA-1 Transfer of Ciga Assessment Credit - Connecticut

What Is Form GAA-1?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

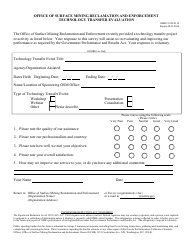

Q: What is Form GAA-1?

A: Form GAA-1 is a form used for transferring Ciga Assessment Credit in Connecticut.

Q: What is a Ciga Assessment Credit?

A: A Ciga Assessment Credit is a credit received by a taxpayer to offset the cost of the Ciga assessment, which is a surcharge on certain insurance policies in Connecticut.

Q: Who can use Form GAA-1?

A: Any taxpayer who has received a Ciga Assessment Credit and wishes to transfer it to another taxpayer can use Form GAA-1.

Q: Do I need to include any supporting documents with Form GAA-1?

A: Yes, you need to include a copy of the notice or certificate that shows the original amount of the Ciga Assessment Credit.

Q: Can I e-file Form GAA-1?

A: No, Form GAA-1 cannot be e-filed. It must be submitted by mail or in person to the Connecticut Department of Revenue Services.

Q: Is there a deadline for filing Form GAA-1?

A: Yes, Form GAA-1 must be filed within three years of the date the original Ciga Assessment Credit was received.

Q: Are there any fees associated with filing Form GAA-1?

A: No, there are no fees associated with filing Form GAA-1.

Q: What happens after I submit Form GAA-1?

A: Once the Connecticut Department of Revenue Services receives Form GAA-1, they will review the form and process the transfer of the Ciga Assessment Credit.

Q: Can I track the status of my Form GAA-1?

A: Yes, you can track the status of your Form GAA-1 by contacting the Connecticut Department of Revenue Services.

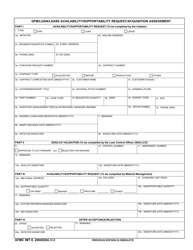

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAA-1 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.