This version of the form is not currently in use and is provided for reference only. Download this version of

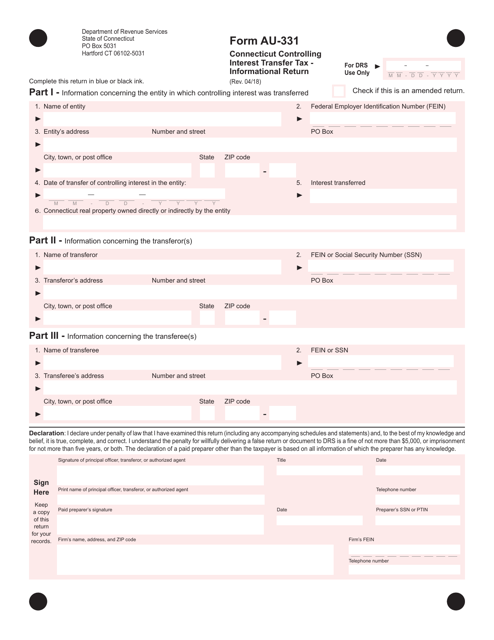

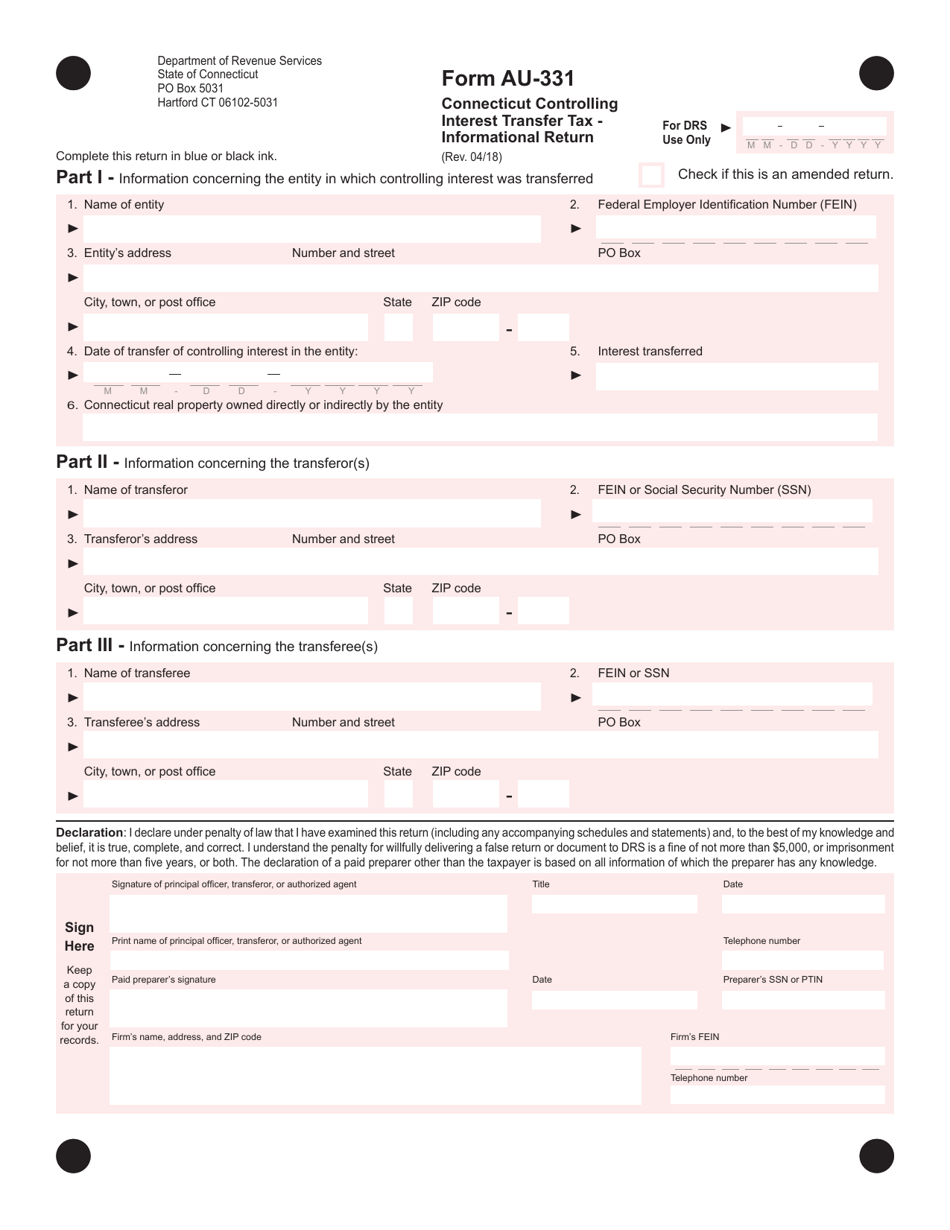

Form AU-331

for the current year.

Form AU-331 Connecticut Controlling Interest Transfer Tax - Informational Return - Connecticut

What Is Form AU-331?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-331?

A: Form AU-331 is an informational return for the Connecticut Controlling Interest Transfer Tax.

Q: What is the Connecticut Controlling Interest Transfer Tax?

A: The Connecticut Controlling Interest Transfer Tax is a tax on transfers of controlling interests in entities that own real property in Connecticut.

Q: Who needs to file Form AU-331?

A: Anyone who transfers a controlling interest in an entity that owns real property in Connecticut needs to file Form AU-331.

Q: What is a controlling interest?

A: A controlling interest is the ownership interest that allows the owner to control the management and decision-making of the entity.

Q: What is the purpose of Form AU-331?

A: Form AU-331 is used to collect information about transfers of controlling interests for the purpose of enforcing the Connecticut Controlling Interest Transfer Tax.

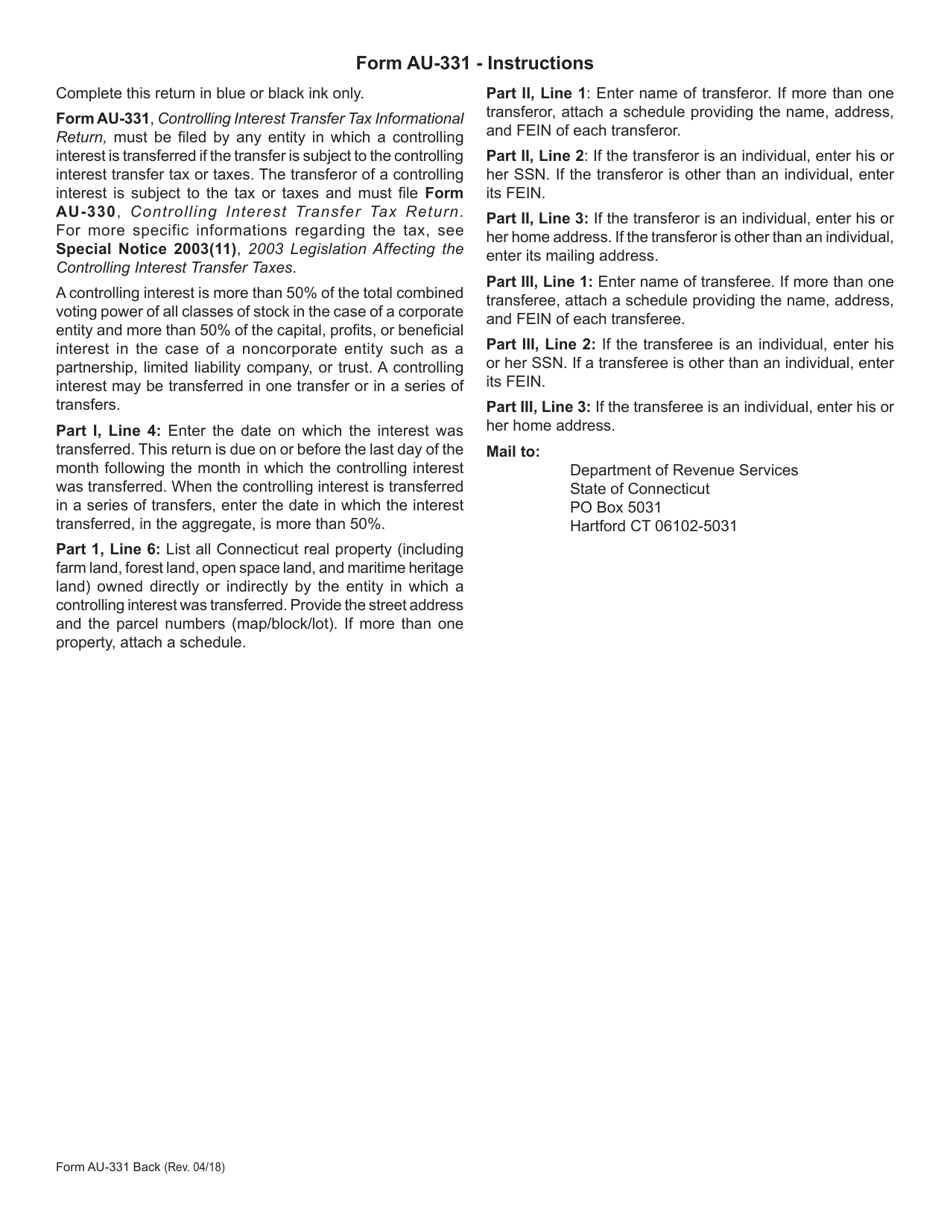

Q: What information is required on Form AU-331?

A: Form AU-331 requires information about the transferor, transferee, entities involved, and details of the transfer.

Q: When is Form AU-331 due?

A: Form AU-331 is due within 30 days of the transfer of the controlling interest.

Q: Is there a fee for filing Form AU-331?

A: No, there is no fee for filing Form AU-331.

Q: What happens if I don't file Form AU-331?

A: Failure to file Form AU-331 may result in penalties and interest being assessed.

Q: Are there any exceptions to the Connecticut Controlling Interest Transfer Tax?

A: Yes, certain transfers are exempt from the tax, such as transfers between family members or transfers made through a bankruptcy proceeding.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-331 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.