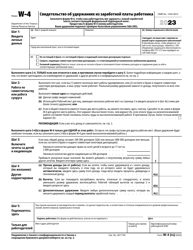

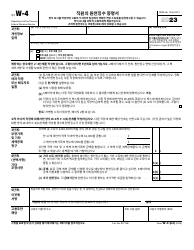

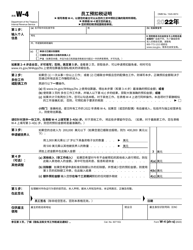

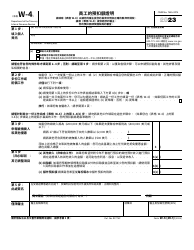

This version of the form is not currently in use and is provided for reference only. Download this version of

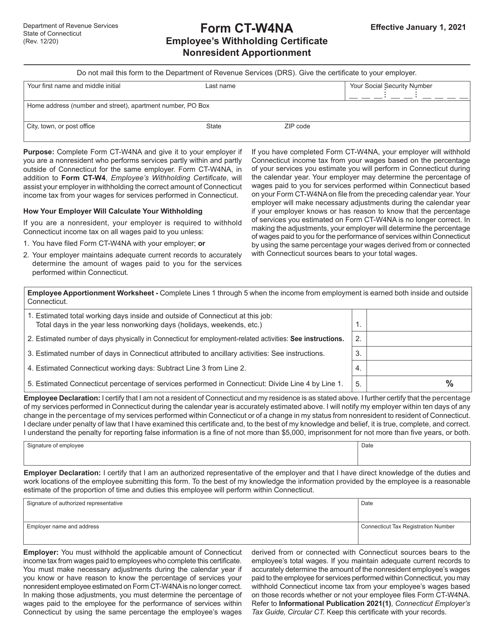

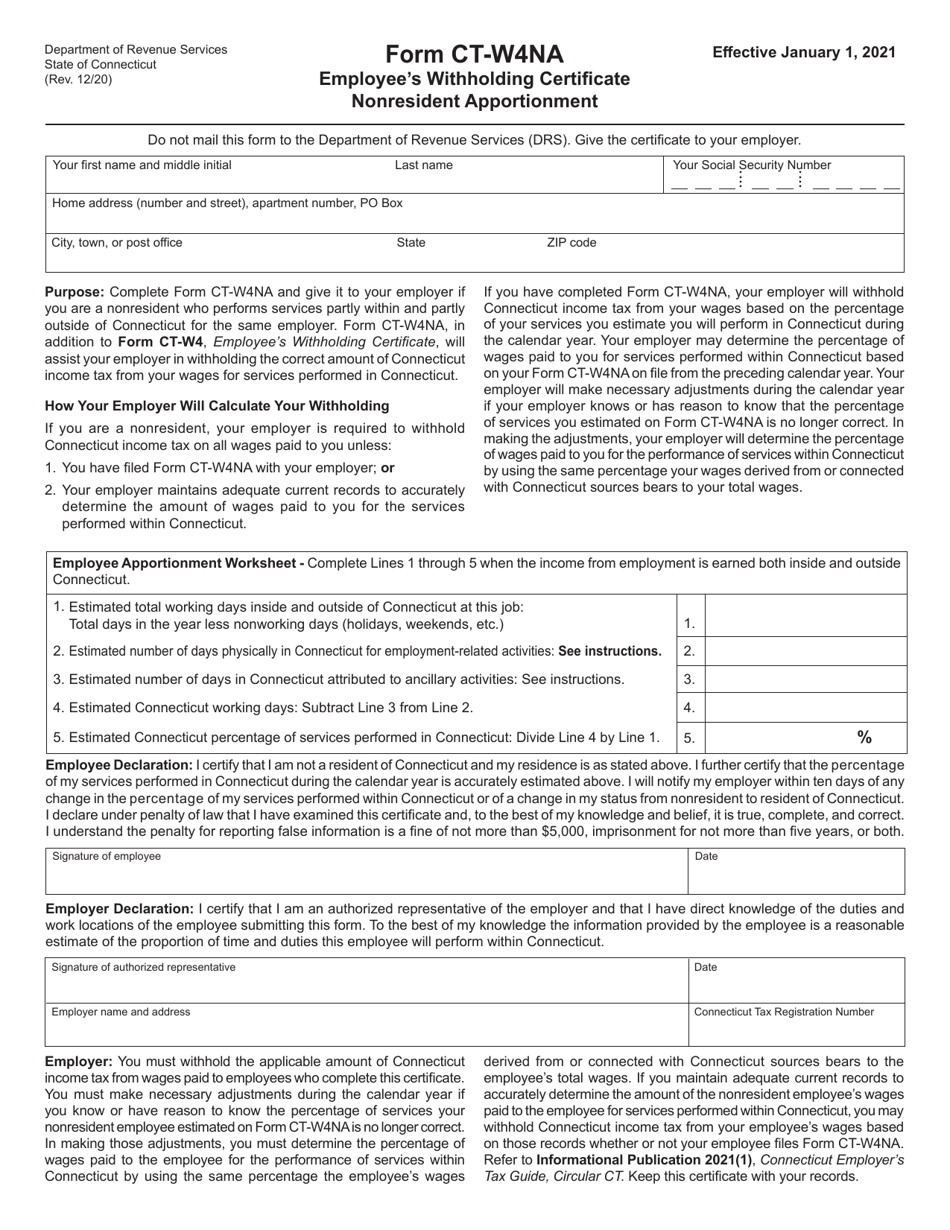

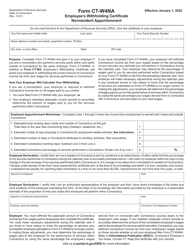

Form CT-W4NA

for the current year.

Form CT-W4NA Employees Withholding Certificate - Nonresident Apportionment - Connecticut

What Is Form CT-W4NA?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-W4NA?

A: Form CT-W4NA is the Employees Withholding Certificate for nonresident individuals to apportion their income tax withholding in Connecticut.

Q: Who should use Form CT-W4NA?

A: Form CT-W4NA should be used by nonresident individuals who receive Connecticut-source income and want to apportion their income tax withholding.

Q: What is the purpose of Form CT-W4NA?

A: The purpose of Form CT-W4NA is to allow nonresidents to allocate their income tax withholding based on the percentage of income derived from Connecticut sources.

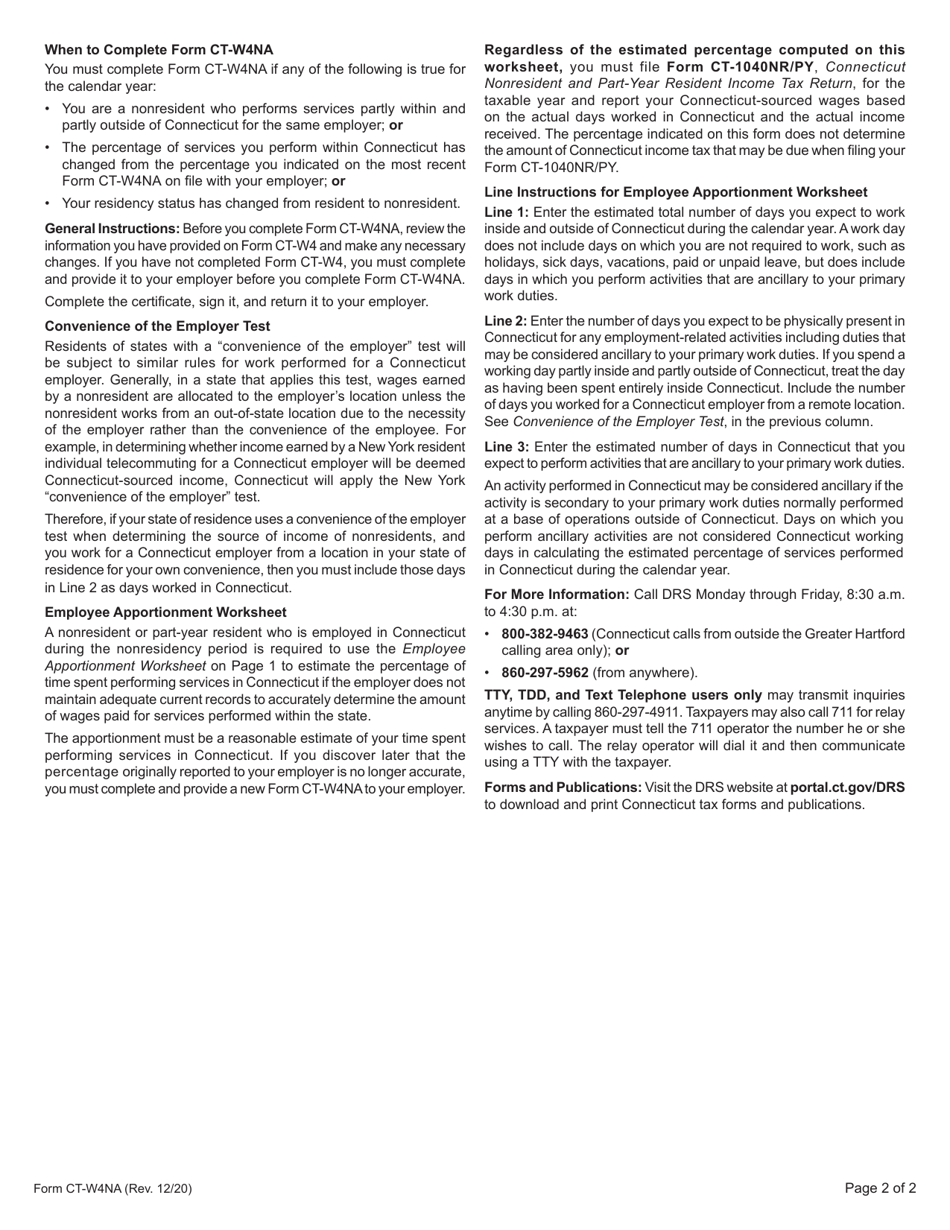

Q: How do I fill out Form CT-W4NA?

A: To fill out Form CT-W4NA, you need to provide your personal information, including your name, Social Security number, and address, as well as information about your sources of income and the percentage derived from Connecticut sources.

Q: When should I submit Form CT-W4NA?

A: You should submit Form CT-W4NA to your employer as soon as you begin working in Connecticut.

Q: Can I change my withholding allocation after submitting Form CT-W4NA?

A: Yes, you can change your withholding allocation by submitting a new Form CT-W4NA to your employer.

Q: Do I need to file Form CT-W4NA every year?

A: No, you only need to file Form CT-W4NA once, unless there are changes to your residency or income sources.

Q: What if I am a resident of Connecticut?

A: If you are a resident of Connecticut, you should use Form CT-W4, the Employees Withholding Certificate for residents.

Q: Is Form CT-W4NA applicable for Canadian residents?

A: Form CT-W4NA is applicable for nonresident individuals, including Canadian residents, who earn income from Connecticut sources.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-W4NA by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.