This version of the form is not currently in use and is provided for reference only. Download this version of

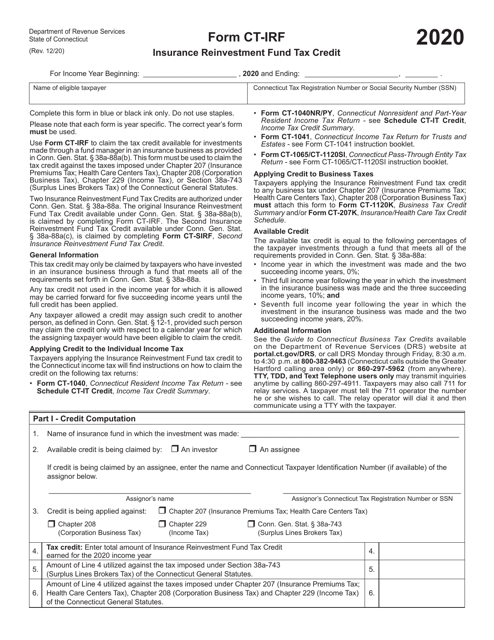

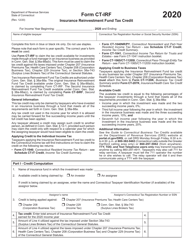

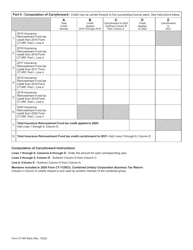

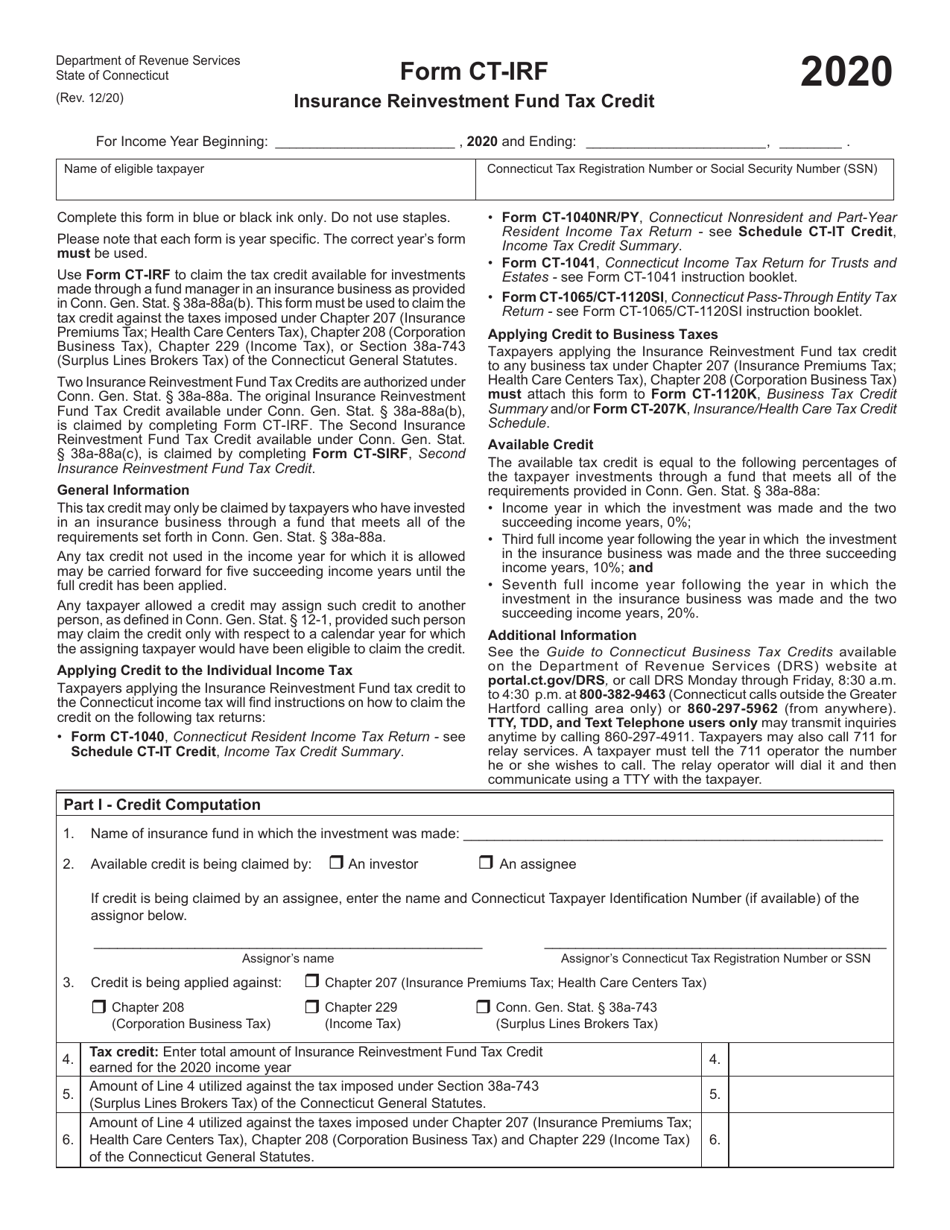

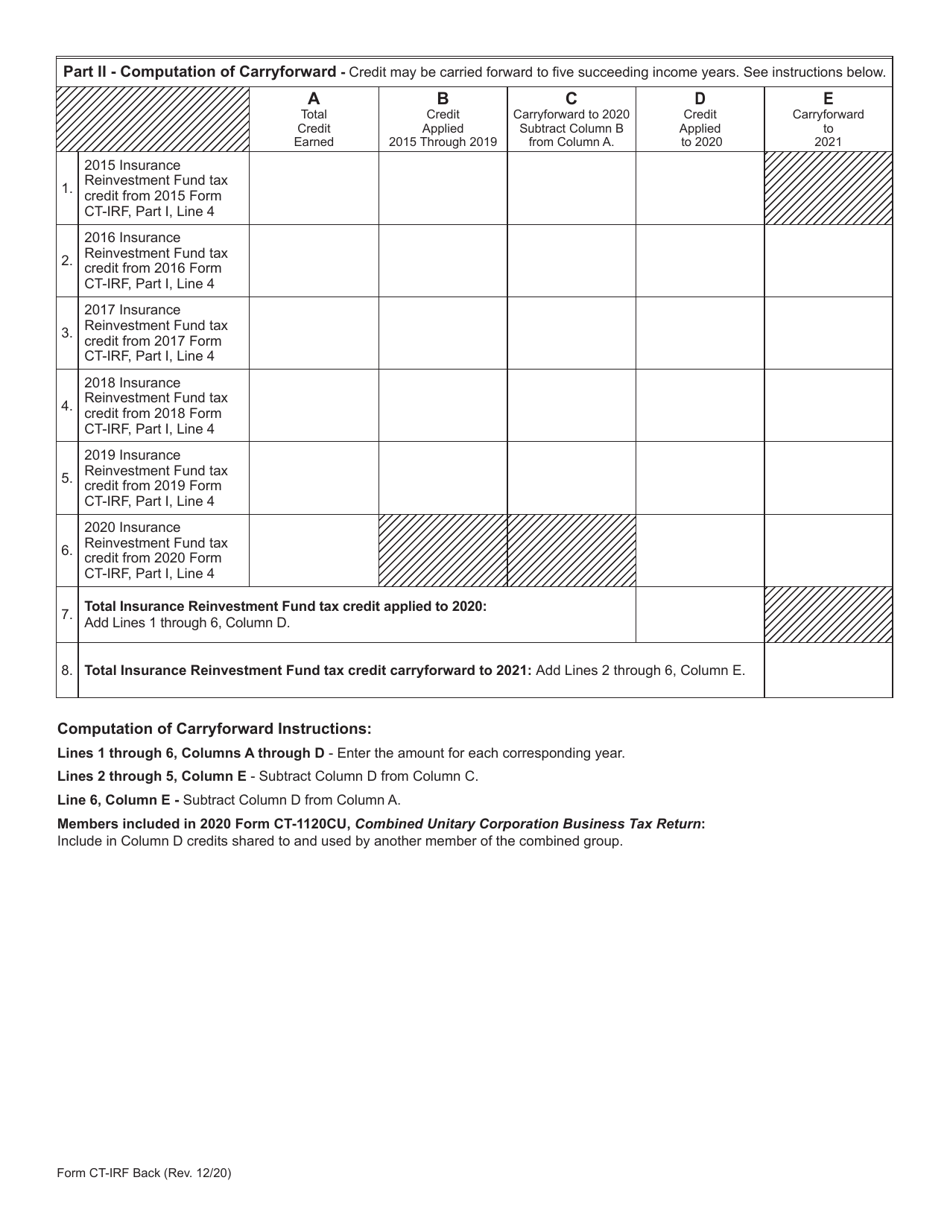

Form CT-IRF

for the current year.

Form CT-IRF Insurance Reinvestment Fund Tax Credit - Connecticut

What Is Form CT-IRF?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-IRF?

A: Form CT-IRF is a tax form in Connecticut.

Q: What does CT-IRF stand for?

A: CT-IRF stands for Connecticut Insurance Reinvestment Fund.

Q: What is the purpose of Form CT-IRF?

A: Form CT-IRF is used to claim a tax credit for contributions made to the Connecticut Insurance Reinvestment Fund.

Q: Who is eligible to file Form CT-IRF?

A: Any taxpayer who makes a qualifying contribution to the Connecticut Insurance Reinvestment Fund is eligible to file Form CT-IRF.

Q: What is the Connecticut Insurance Reinvestment Fund?

A: The Connecticut Insurance Reinvestment Fund is a fund that supports investments in smaller insurance companies and related businesses in Connecticut.

Q: How much is the tax credit?

A: The tax credit is equal to 100% of the qualifying contribution made to the Connecticut Insurance Reinvestment Fund.

Q: Are there any limitations on the tax credit?

A: Yes, the maximum allowable credit in any one income year is $25,000.

Q: What supporting documents are required to be attached with Form CT-IRF?

A: Taxpayers are required to attach the written certification of the eligible investment made by the Connecticut Insurance Department with Form CT-IRF.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-IRF by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.