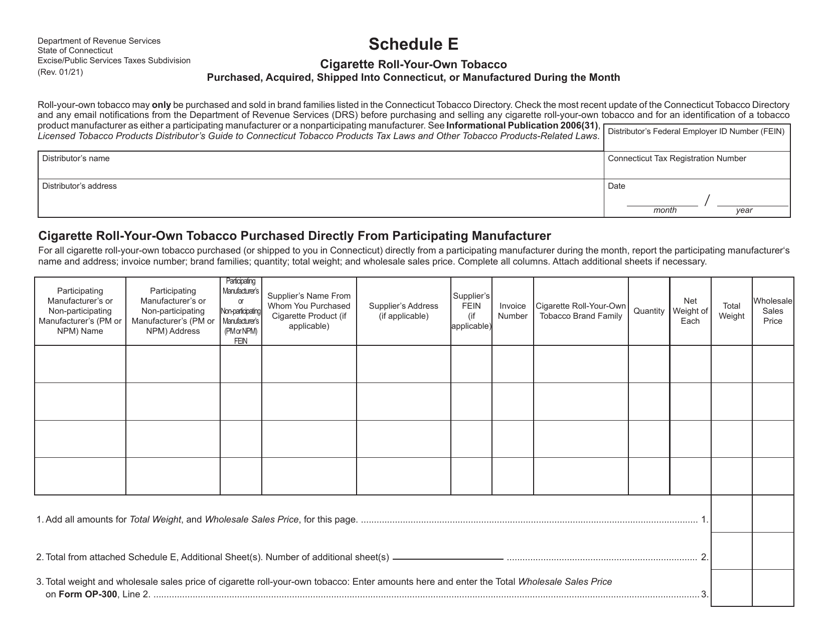

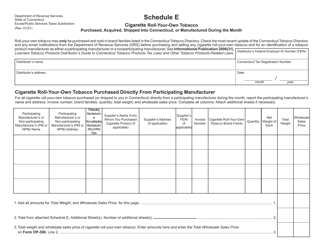

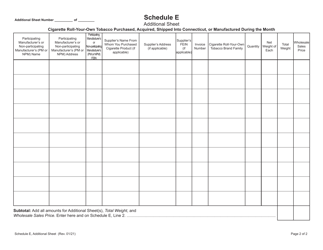

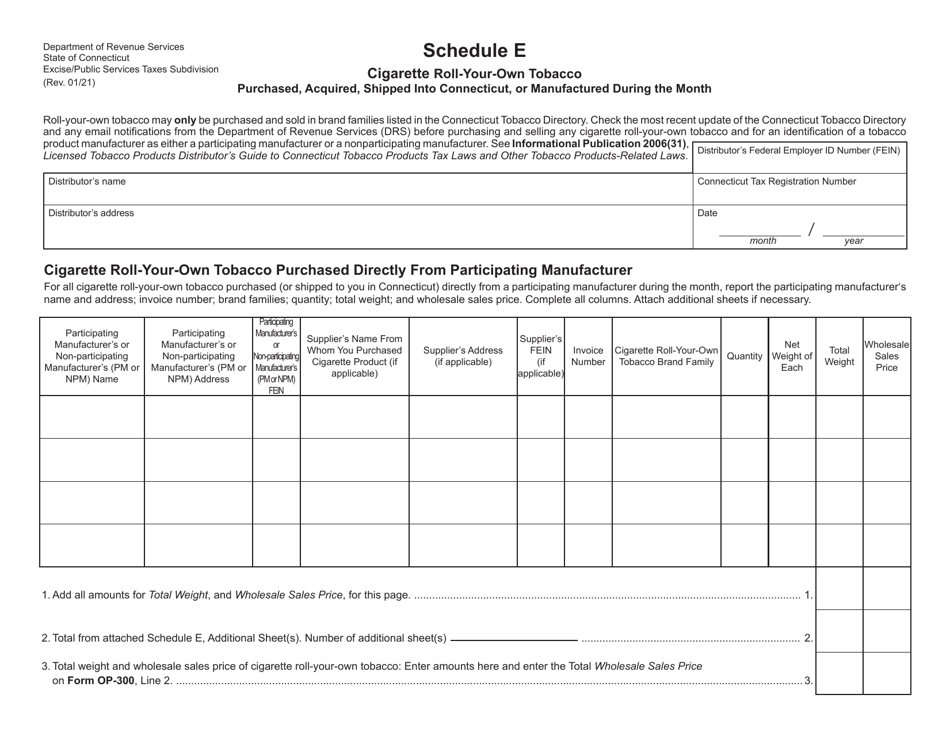

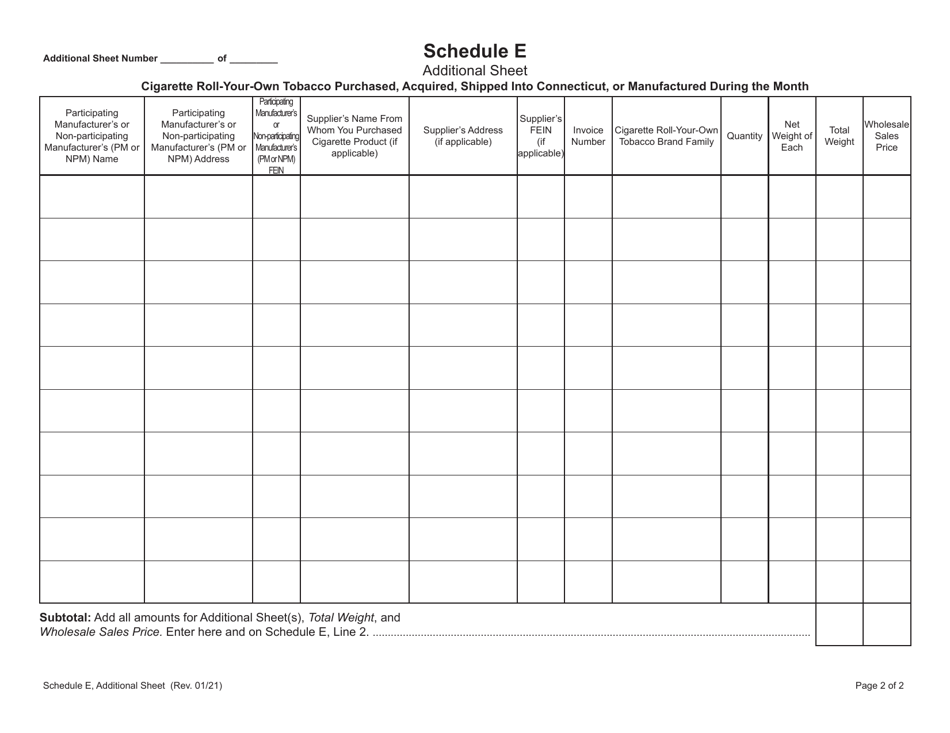

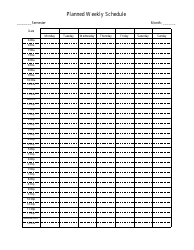

Schedule E Cigarette Roll-Your-Own Tobacco - Purchased, Acquired, Shipped Into Connecticut, or Manufactured During the Month - Connecticut

What Is Schedule E?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule E?

A: Schedule E is a form that reports the purchase, acquisition, shipment, or manufacture of roll-your-own tobacco in Connecticut.

Q: What is roll-your-own tobacco?

A: Roll-your-own tobacco is loose tobacco that individuals use to make their own cigarettes.

Q: Why is Schedule E important?

A: Schedule E helps the state of Connecticut track the sale and use of roll-your-own tobacco products.

Q: Who needs to file Schedule E?

A: Any individual or business that purchases, acquires, ships into Connecticut, or manufactures roll-your-own tobacco needs to file Schedule E.

Q: When is Schedule E due?

A: Schedule E is generally due at the end of each month for the previous month's purchases, acquisitions, shipments, or manufacturing of roll-your-own tobacco.

Q: What information do I need to fill out Schedule E?

A: You will need to provide details such as the quantity of roll-your-own tobacco purchased, acquired, shipped into Connecticut, or manufactured during the month.

Q: Are there any penalties for not filing Schedule E?

A: Failure to file Schedule E or filing false information can result in penalties and potential legal consequences.

Q: Can I amend Schedule E if I made a mistake?

A: Yes, you can file an amended Schedule E if you need to correct any errors or omissions in your original filing.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule E by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.