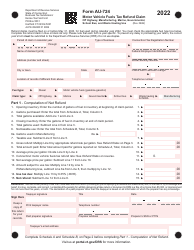

This version of the form is not currently in use and is provided for reference only. Download this version of

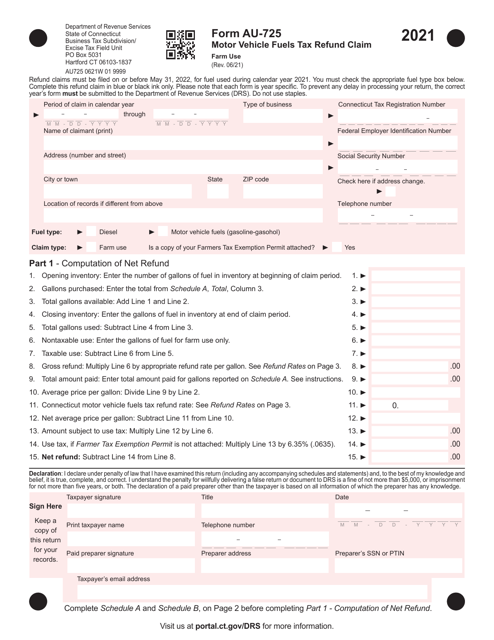

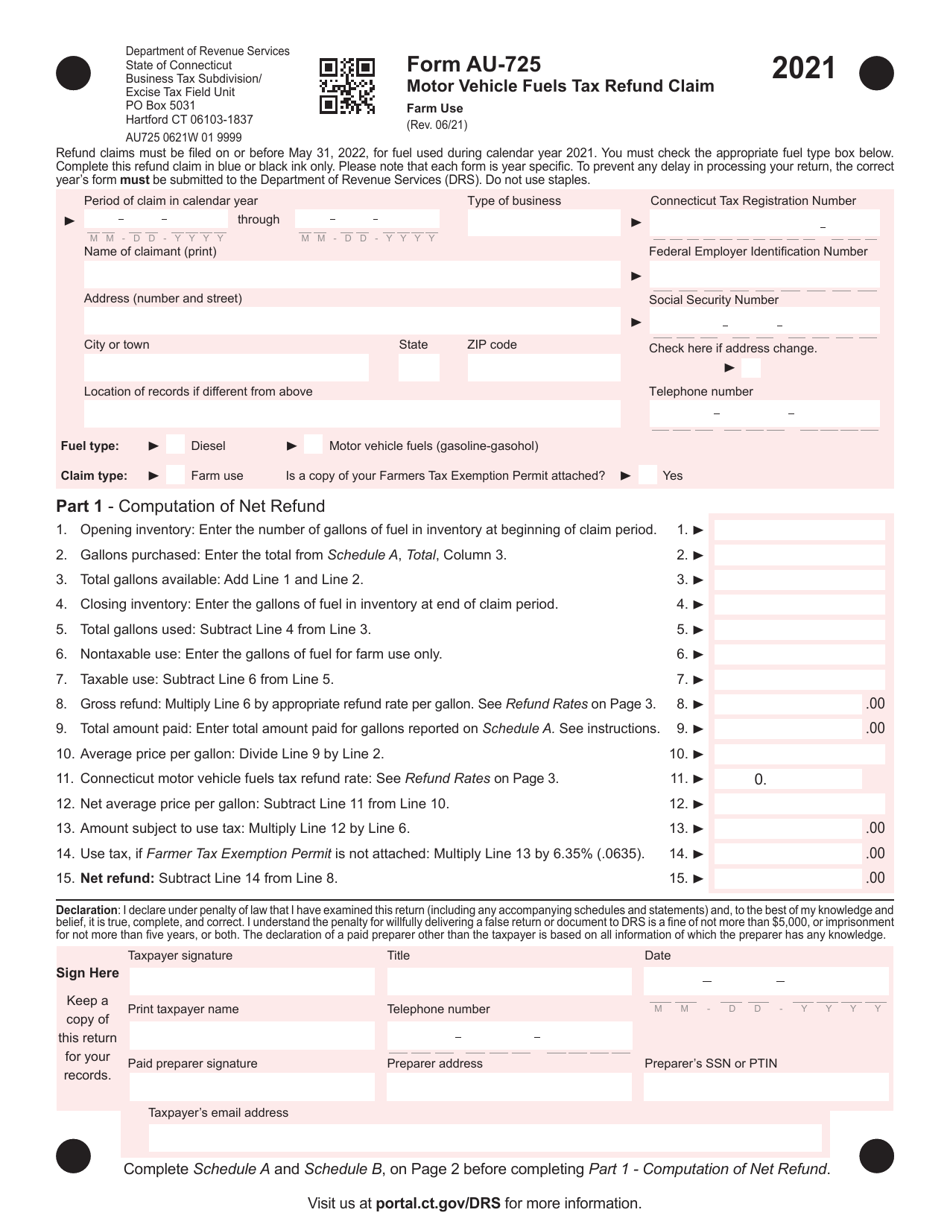

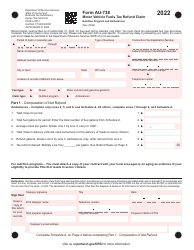

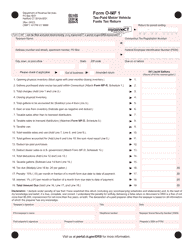

Form AU-725

for the current year.

Form AU-725 Motor Vehicle Fuels Tax Refund Claim - Farm Use - Connecticut

What Is Form AU-725?

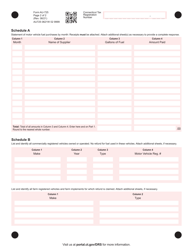

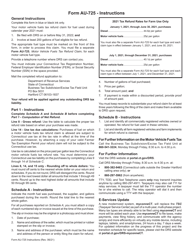

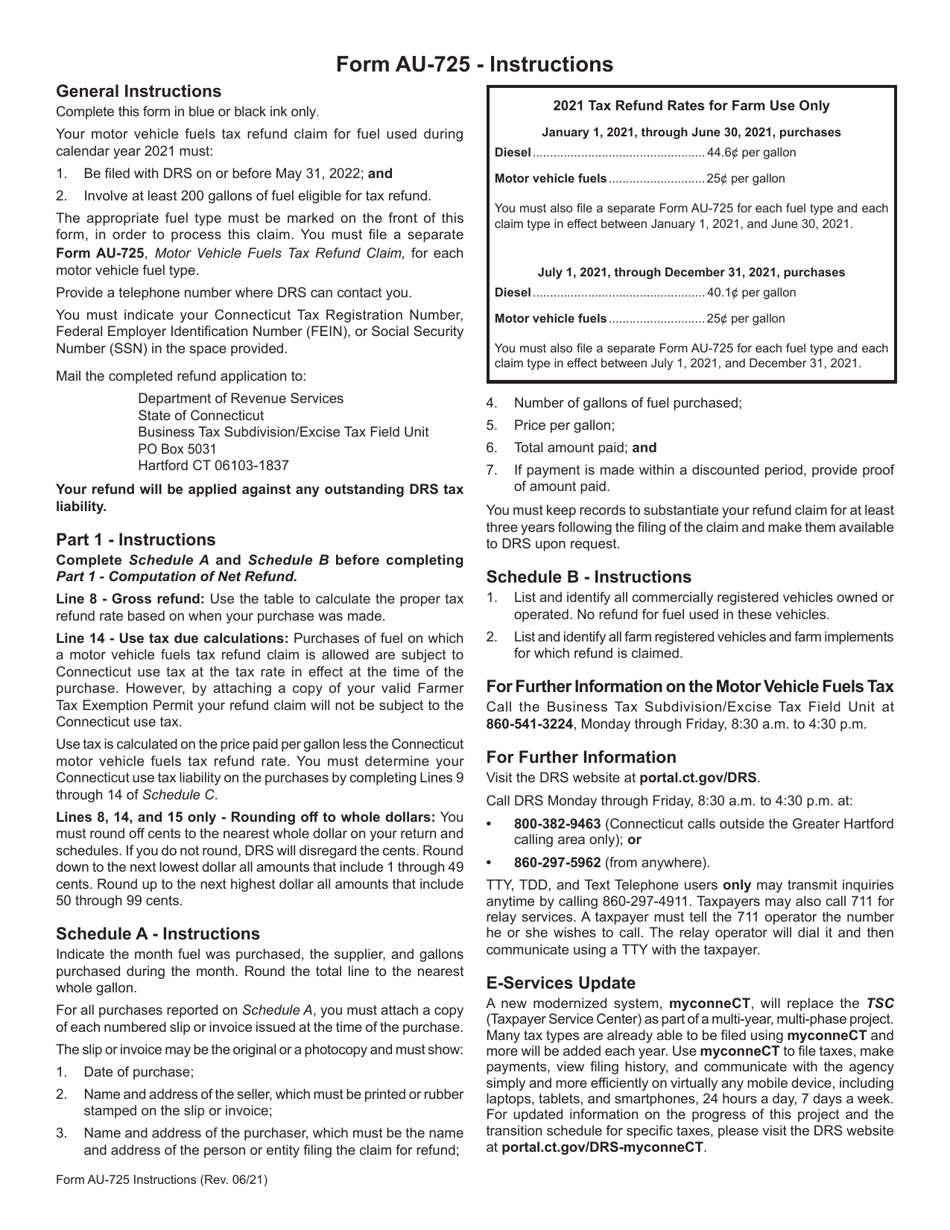

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AU-725?

A: Form AU-725 is the Motor VehicleFuels Tax Refund Claim specifically for Farm Use in Connecticut.

Q: Who can use form AU-725?

A: Farmers in Connecticut who use motor vehicle fuels for agricultural purposes are eligible to use form AU-725.

Q: What is the purpose of form AU-725?

A: The purpose of form AU-725 is to claim a refund on motor vehicle fuels tax paid by farmers for farm use in Connecticut.

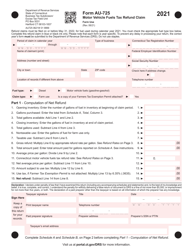

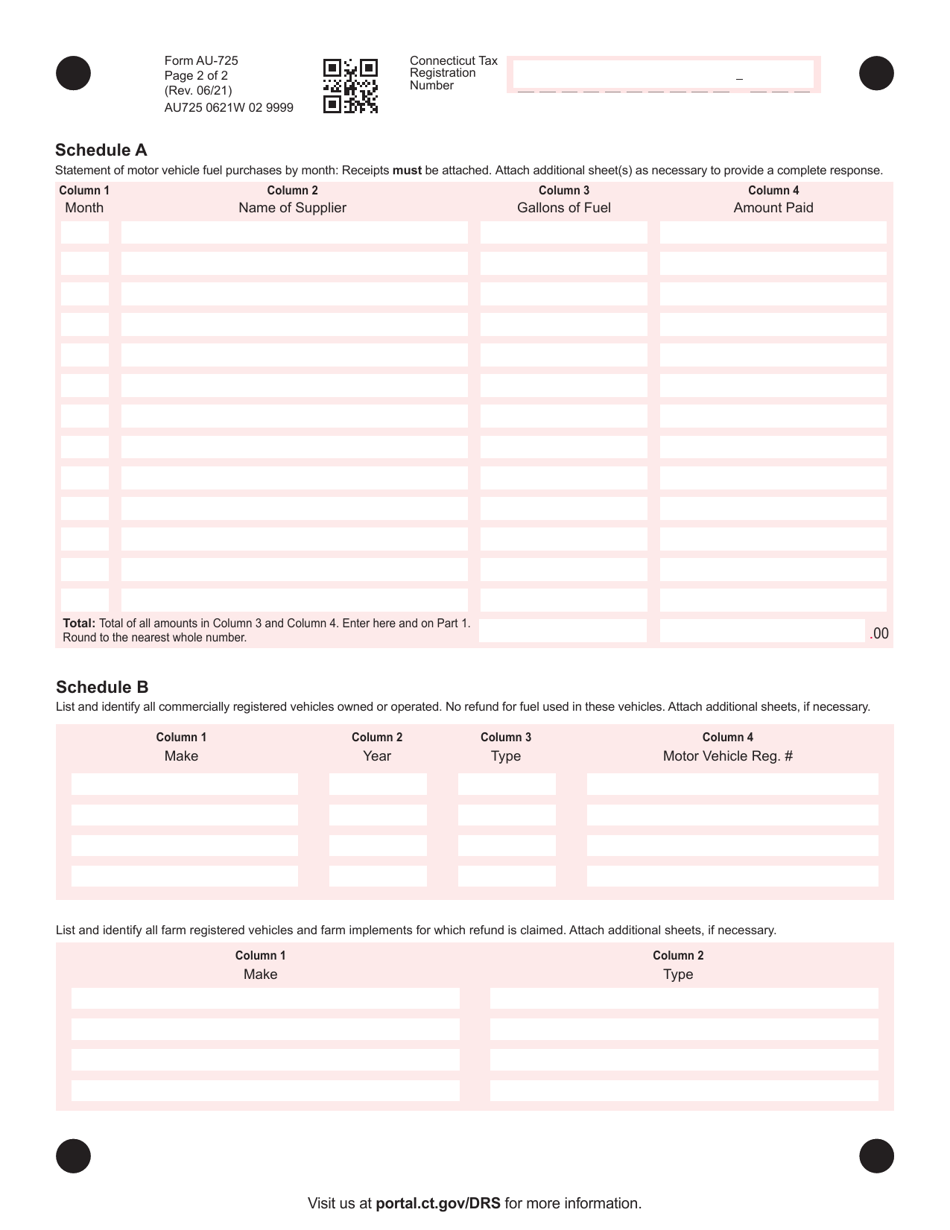

Q: What information is required on form AU-725?

A: Form AU-725 requires information such as the farmer's name, address, fuel purchase details, and the amount of motor vehicle fuels tax paid.

Q: When should I file form AU-725?

A: Form AU-725 should be filed quarterly with the Connecticut Department of Revenue Services.

Q: Are there any special conditions or restrictions for claiming a refund with form AU-725?

A: Yes, there are specific requirements and restrictions outlined in the instructions for form AU-725. It is important to review these guidelines before filing.

Q: What is the deadline for filing form AU-725?

A: Form AU-725 must be filed within three years from the due date of the motor vehicle fuels tax return being claimed.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-725 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.