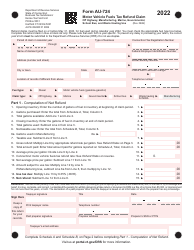

This version of the form is not currently in use and is provided for reference only. Download this version of

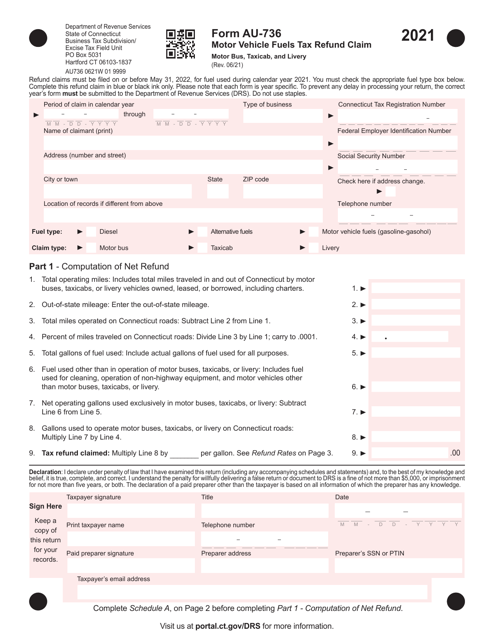

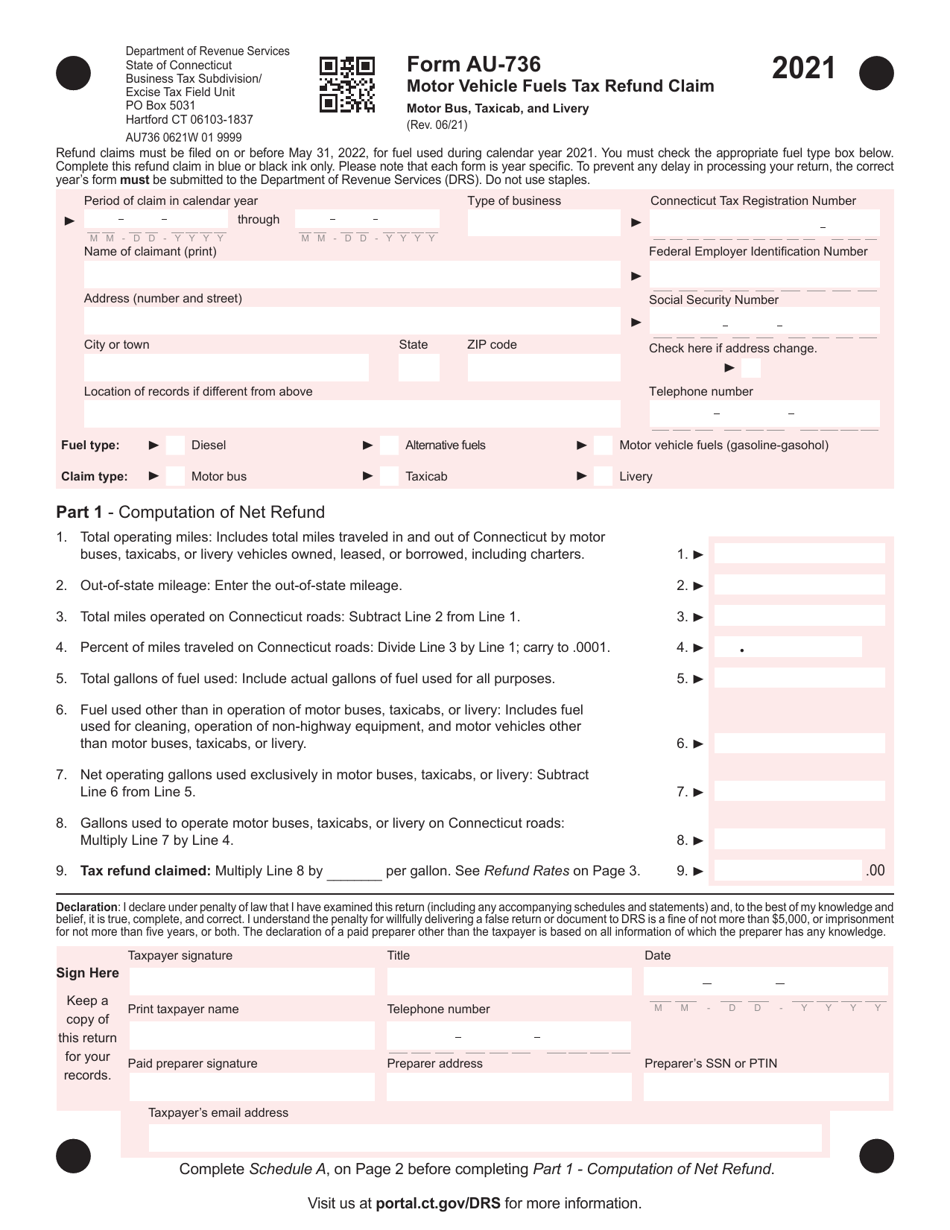

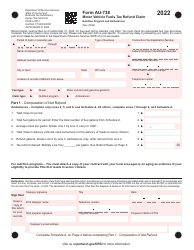

Form AU-736

for the current year.

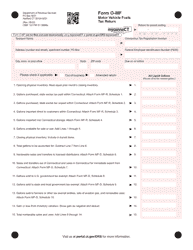

Form AU-736 Motor Vehicle Fuels Tax Refund Claim - Motor Bus, Taxicab and Livery - Connecticut

What Is Form AU-736?

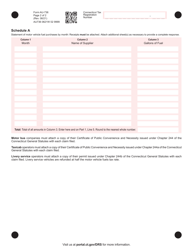

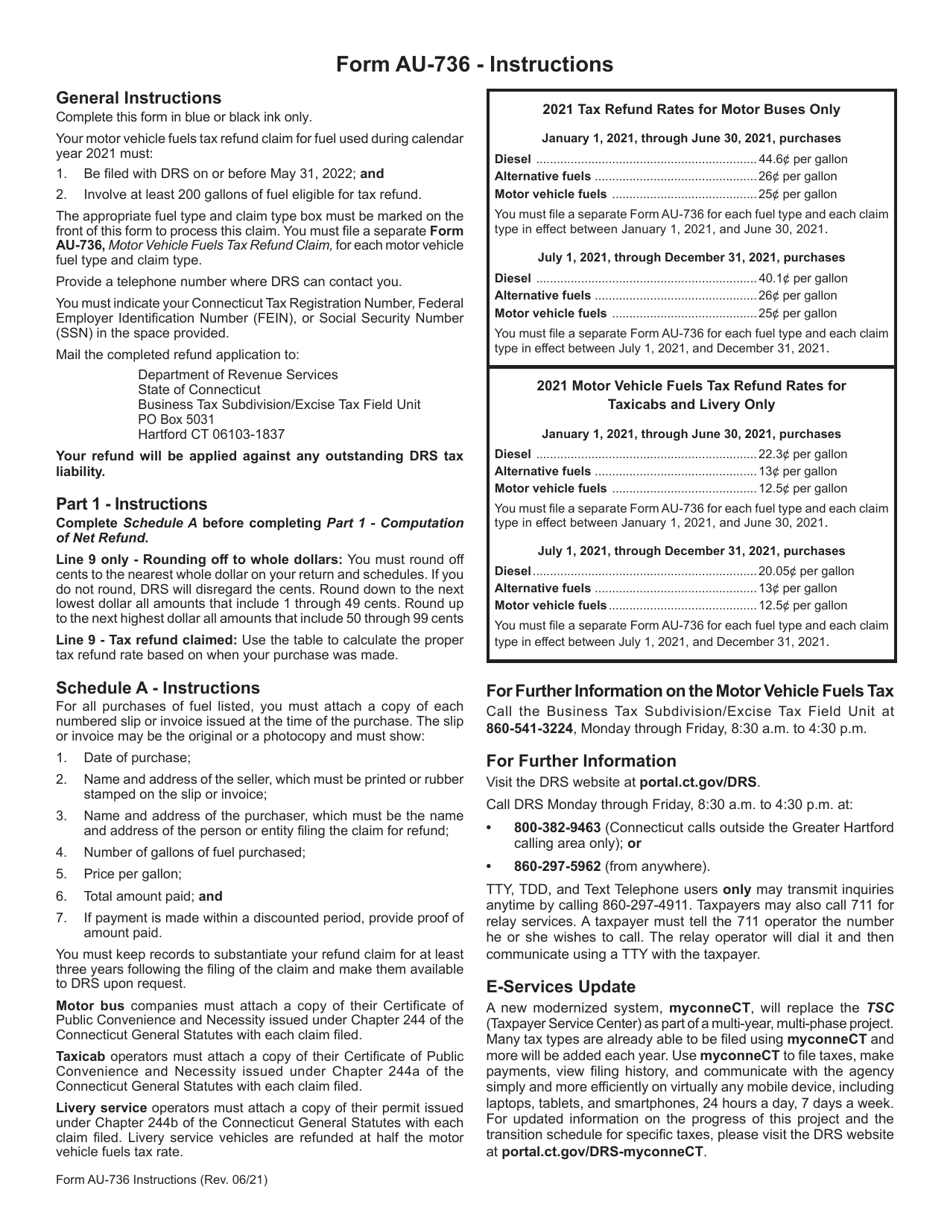

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AU-736?

A: Form AU-736 is a Motor VehicleFuels Tax Refund Claim specifically for Motor Bus, Taxicab, and Livery in Connecticut.

Q: Who can use form AU-736?

A: This form is for individuals or businesses that operate motor buses, taxicabs, or livery vehicles in Connecticut and want to claim a refund on motor vehicle fuels tax.

Q: What is the purpose of form AU-736?

A: The purpose of form AU-736 is to allow eligible individuals or businesses to claim a refund on the motor vehicle fuels tax they paid for operating motor buses, taxicabs, or livery vehicles.

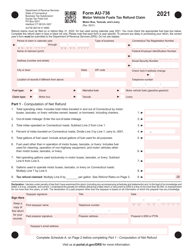

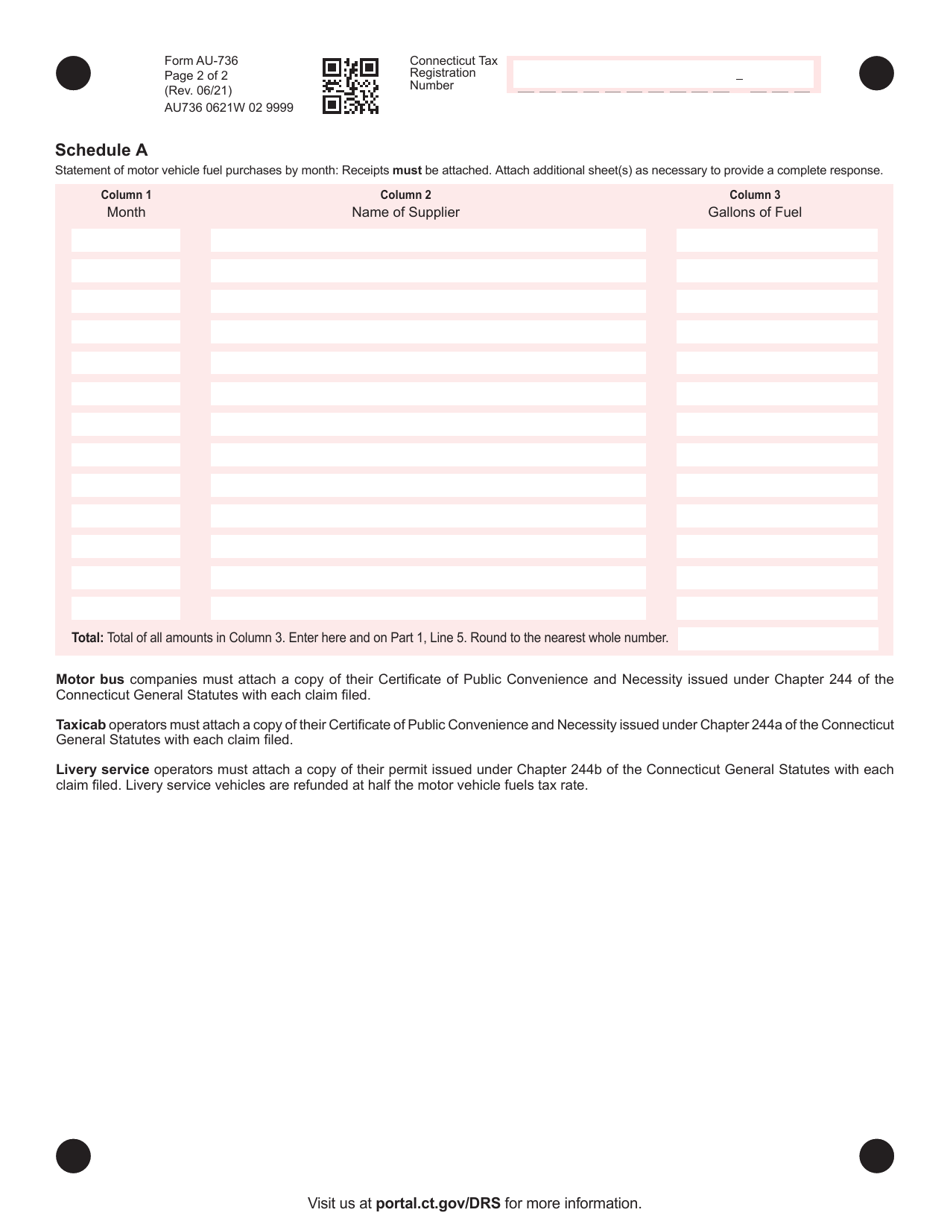

Q: What information is required on form AU-736?

A: Form AU-736 requires information such as the name and address of the claimant, vehicle information, and detailed fuel purchase and usage data.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-736 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.