This version of the form is not currently in use and is provided for reference only. Download this version of

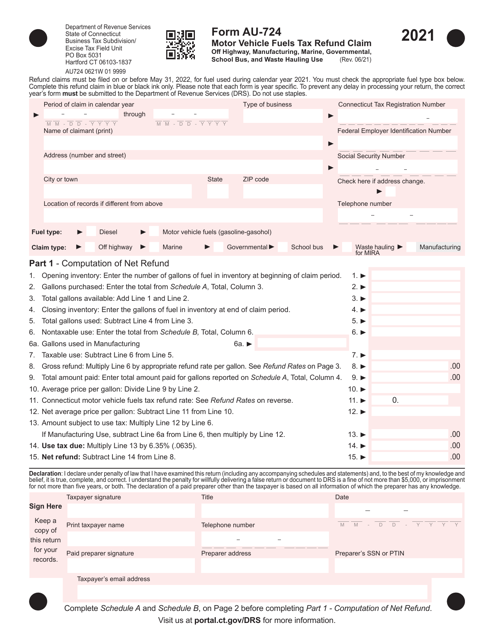

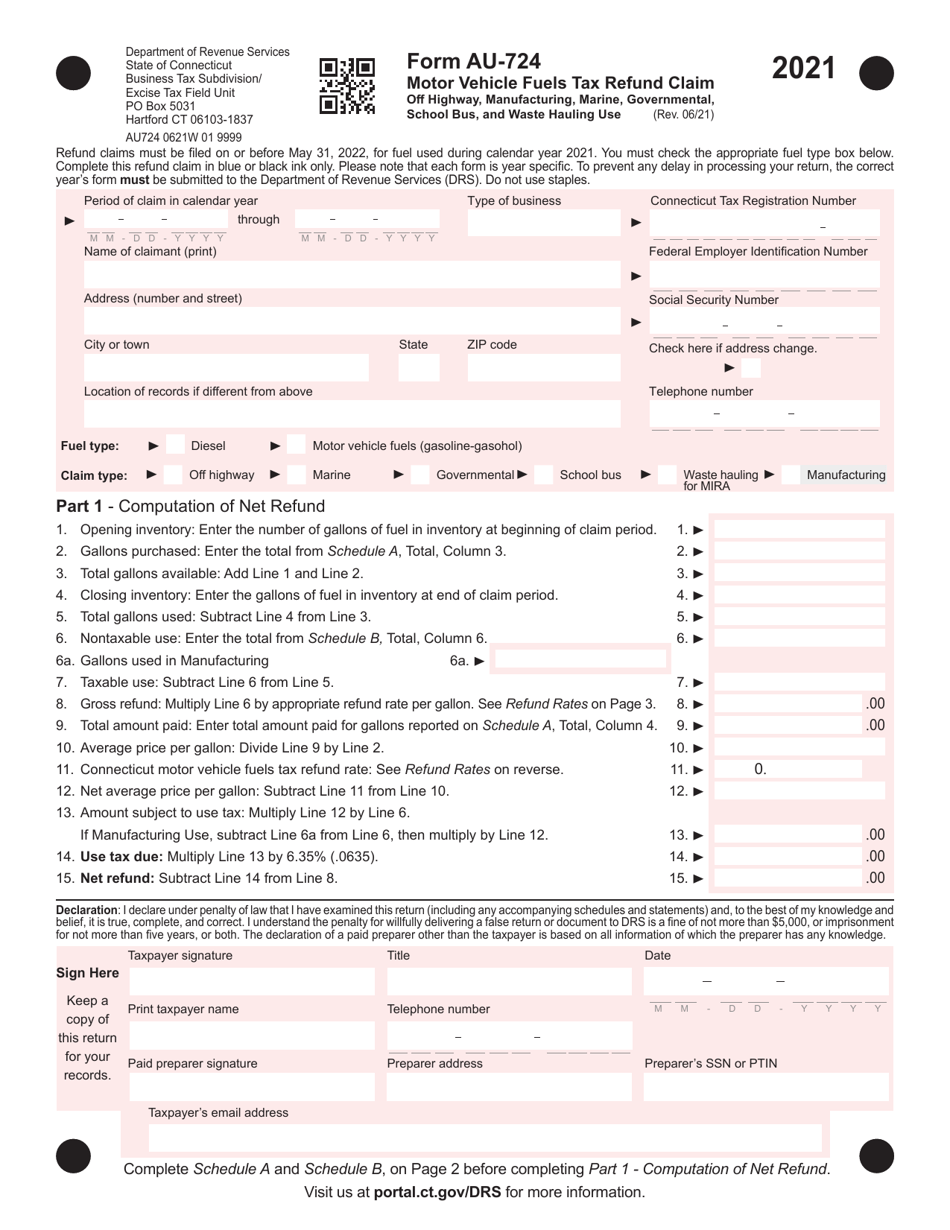

Form AU-724

for the current year.

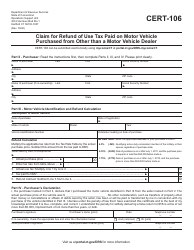

Form AU-724 Motor Vehicle Fuels Tax Refund Claim - off Highway, Manufacturing, Marine, Governmental, School Bus, and Waste Hauling Use - Connecticut

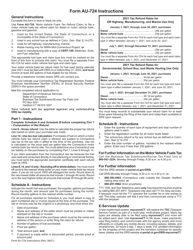

What Is Form AU-724?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-724?

A: Form AU-724 is a Motor VehicleFuels Tax Refund Claim specifically designed for off Highway, Manufacturing, Marine, Governmental, School Bus, and Waste Hauling Use in Connecticut.

Q: Who can use Form AU-724?

A: Individuals or companies that engage in off Highway, Manufacturing, Marine, Governmental, School Bus, or Waste Hauling activities in Connecticut can use Form AU-724 to claim a motor vehicle fuels tax refund.

Q: What is the purpose of Form AU-724?

A: The purpose of Form AU-724 is to apply for a refund of the motor vehicle fuels tax paid on fuel purchases that were used for off Highway, Manufacturing, Marine, Governmental, School Bus, or Waste Hauling purposes in Connecticut.

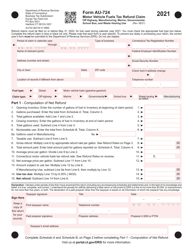

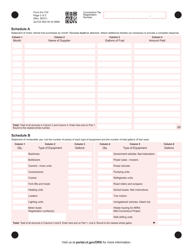

Q: What information do I need to provide on Form AU-724?

A: On Form AU-724, you will need to provide information such as your name, address, fuel usage details, and supporting documentation to substantiate your claim.

Q: Are there any deadlines for filing Form AU-724?

A: Yes, Form AU-724 must be filed within three years from the end of the month in which the fuel was purchased or used.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-724 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.