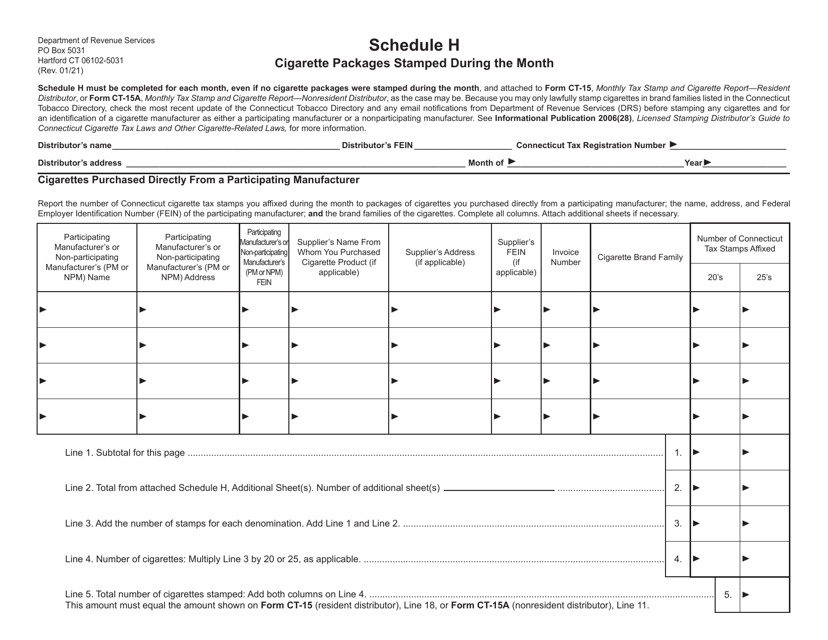

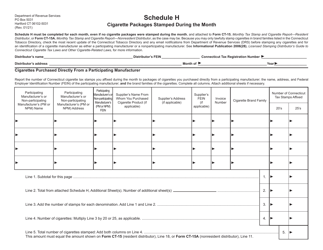

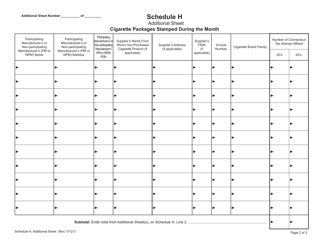

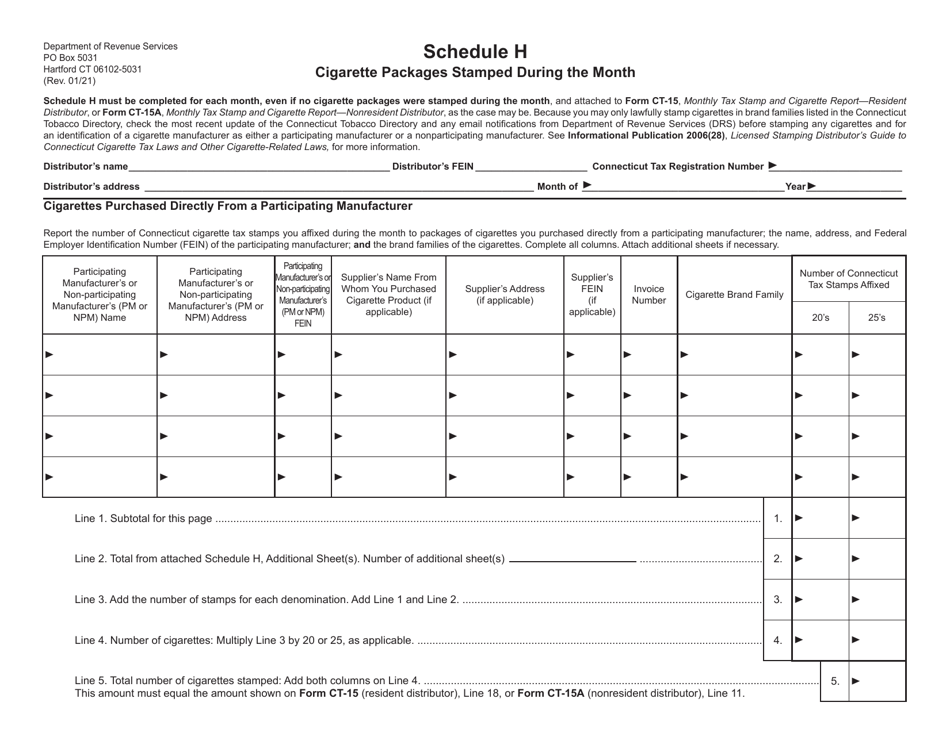

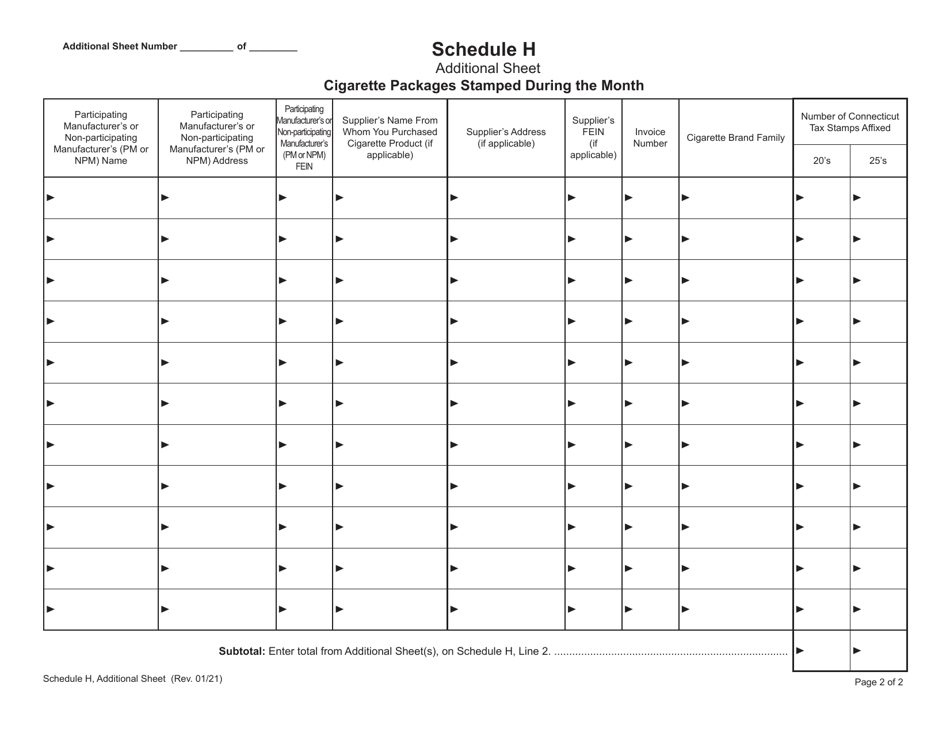

Schedule H Cigarette Packages Stamped During the Month - Connecticut

What Is Schedule H?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule H?

A: Schedule H refers to the monthly report of cigarette packages that were stamped in Connecticut.

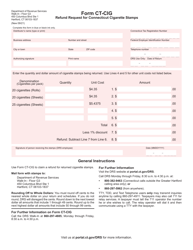

Q: What does 'stamped' mean in this context?

A: In this context, 'stamped' refers to cigarette packages that have a physical stamp or mark indicating that the appropriate taxes have been paid.

Q: Why does Connecticut track cigarette packages that are stamped?

A: Connecticut tracks stamped cigarette packages to ensure that the correct amount of taxes are being paid on each pack.

Q: Who is responsible for stamping cigarette packages?

A: Cigarette manufacturers or distributors are responsible for stamping packages before they are sold.

Q: What is the purpose of the monthly report for stamped cigarette packages?

A: The monthly report provides a record of the number of cigarette packages that have been stamped in Connecticut during a specific month.

Q: What information is included in the Schedule H report?

A: The report includes details such as the number of stamped cigarette packages, the brands, and the quantities.

Q: Is it mandatory to submit a Schedule H report?

A: Yes, it is mandatory for cigarette manufacturers or distributors to submit the Schedule H report to the appropriate authorities in Connecticut.

Q: Are there any penalties for not submitting the Schedule H report?

A: Yes, there may be penalties for non-compliance, including fines or other consequences as determined by Connecticut law.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule H by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.