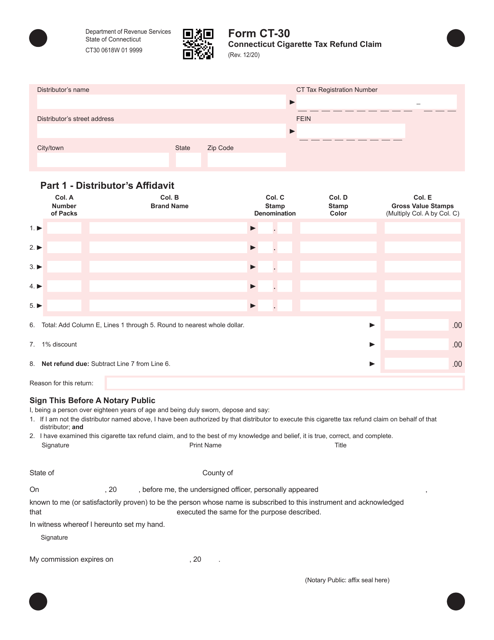

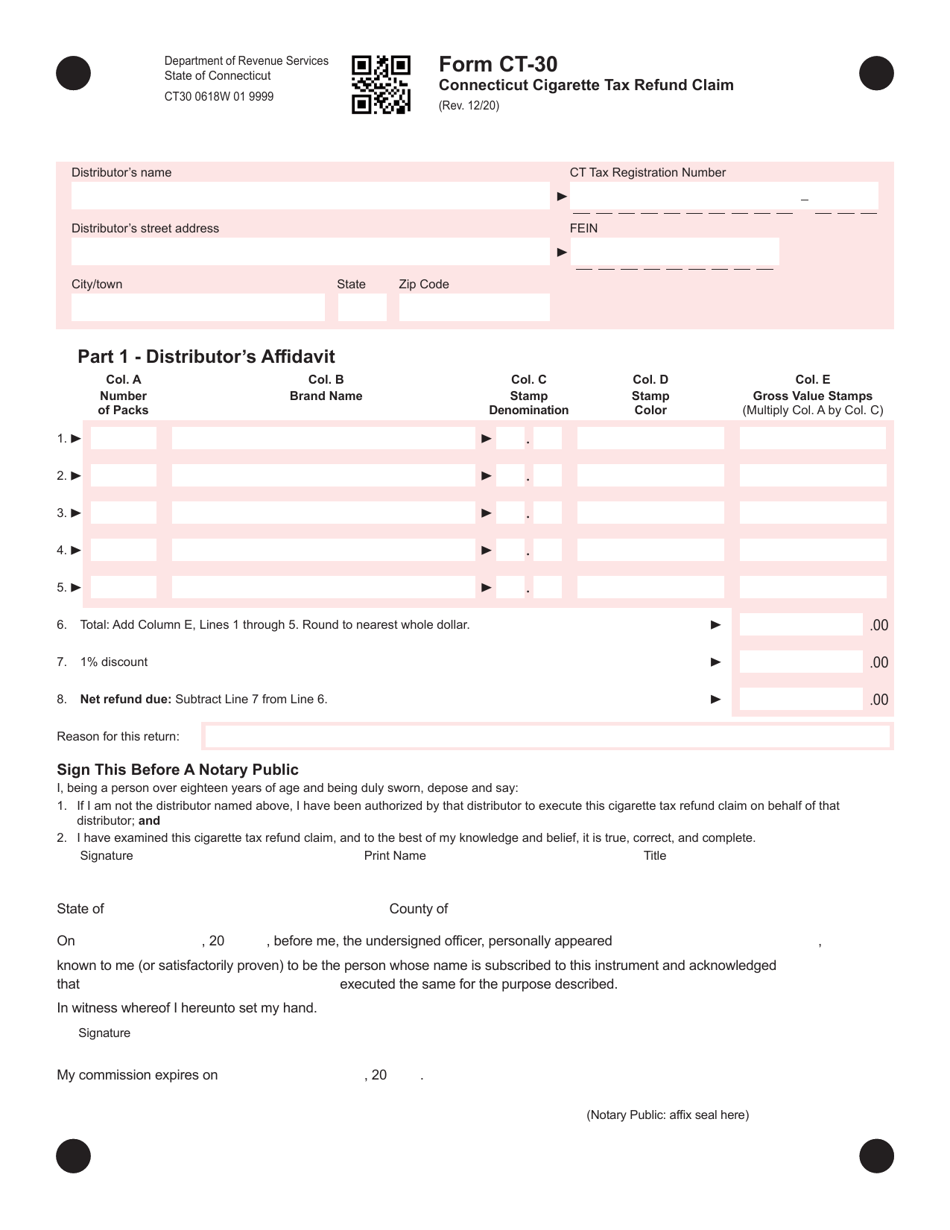

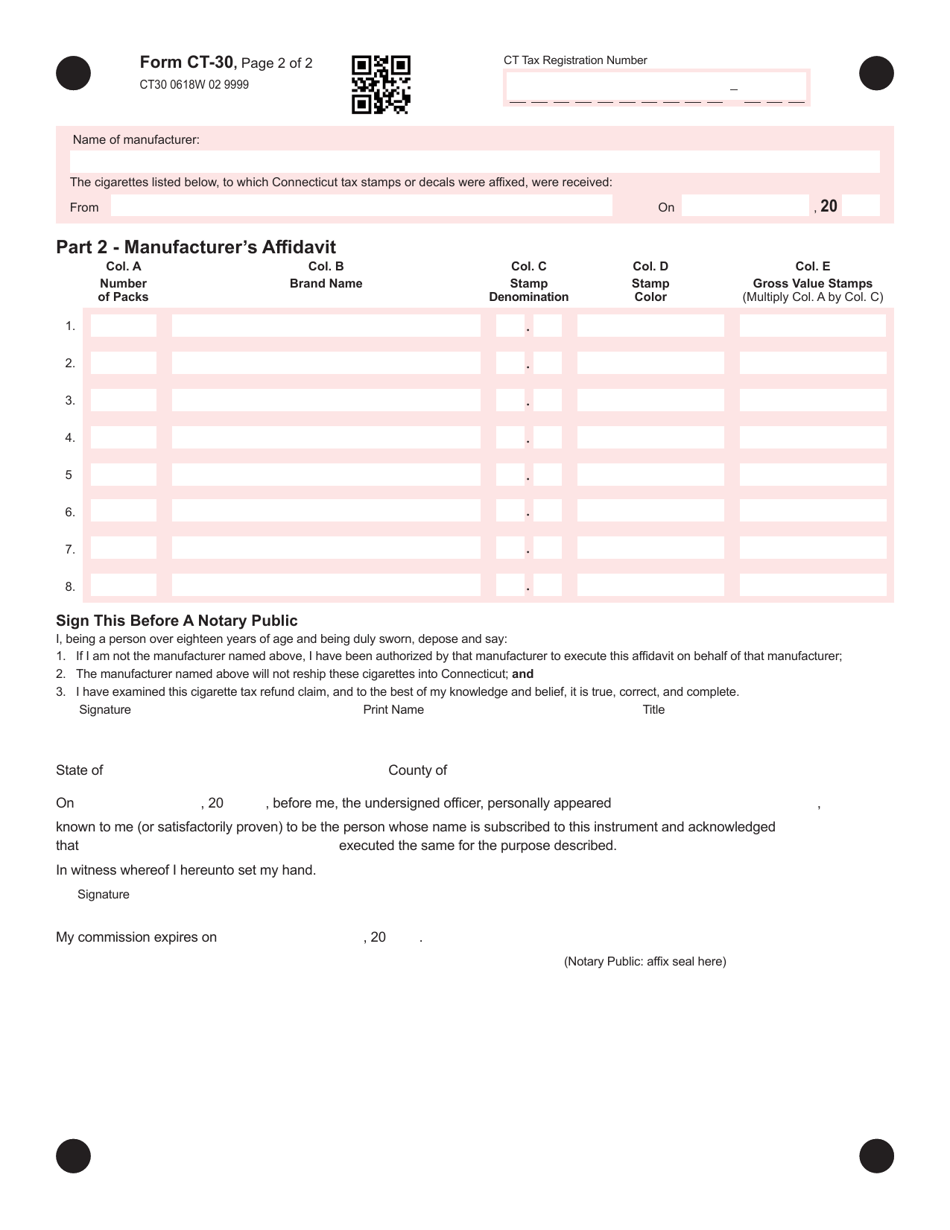

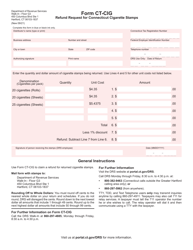

Form CT-30 Connecticut Cigarette Tax Refund Claim - Connecticut

What Is Form CT-30?

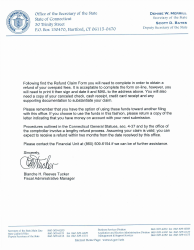

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-30?

A: Form CT-30 is the Connecticut Cigarette Tax Refund Claim.

Q: What is the purpose of Form CT-30?

A: The purpose of Form CT-30 is to claim a refund for the cigarette tax paid in Connecticut.

Q: Who should file Form CT-30?

A: Cigarette distributors, wholesalers, or retailers who have overpaid the cigarette tax in Connecticut should file Form CT-30.

Q: When should I file Form CT-30?

A: Form CT-30 must be filed within three years from the due date of the original tax return or within three years from the date the tax was paid, whichever is later.

Q: What documents should I attach to Form CT-30?

A: You should attach copies of invoices, bills of lading, or purchase receipts that support the claim for refund.

Q: Is there a deadline to file Form CT-30?

A: Yes, Form CT-30 must be filed within the specified deadline to be eligible for a refund.

Q: Can I file Form CT-30 electronically?

A: Currently, Form CT-30 cannot be filed electronically. It must be filed by mail.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-30 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.