This version of the form is not currently in use and is provided for reference only. Download this version of

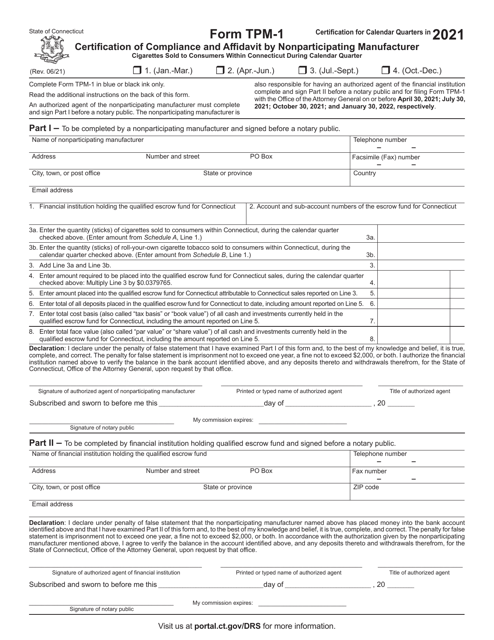

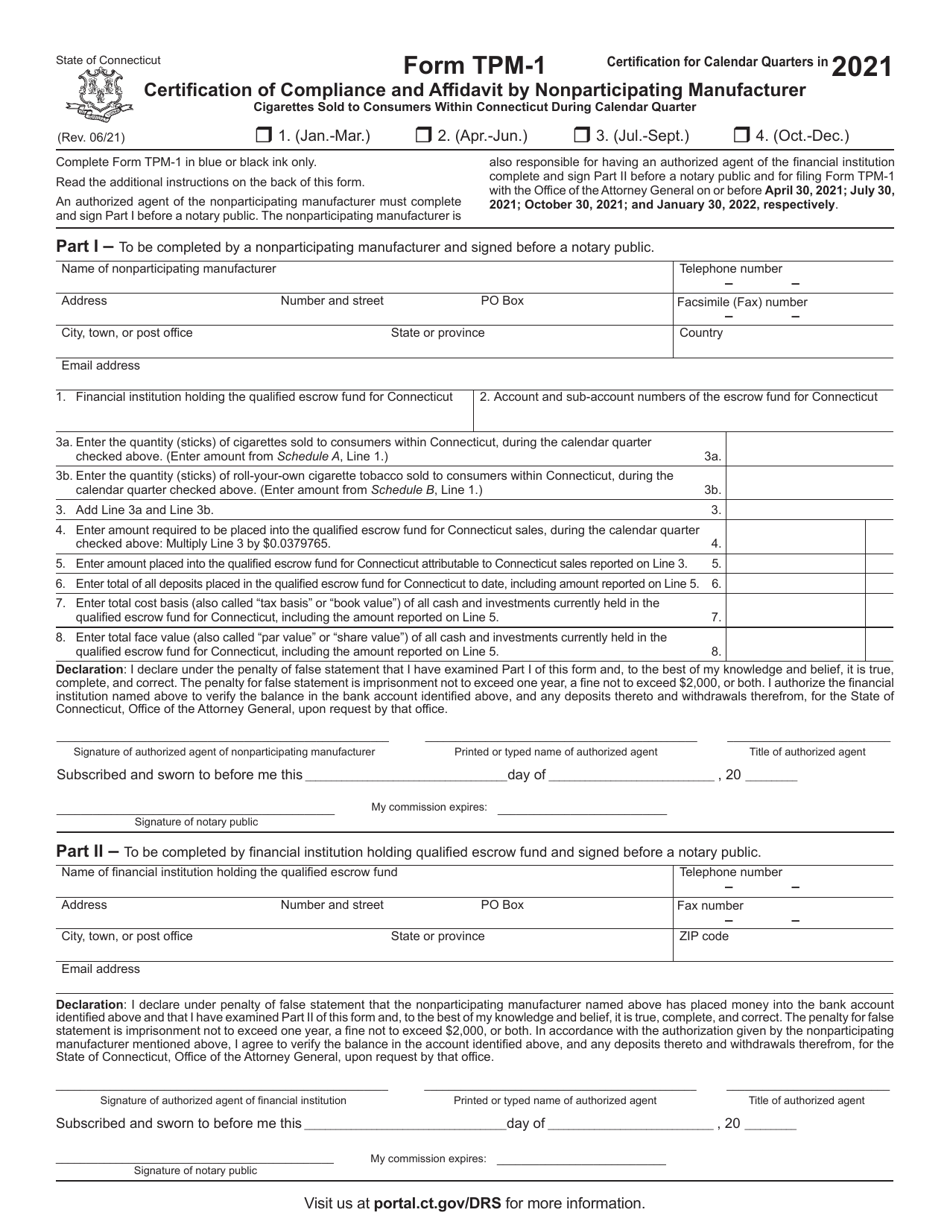

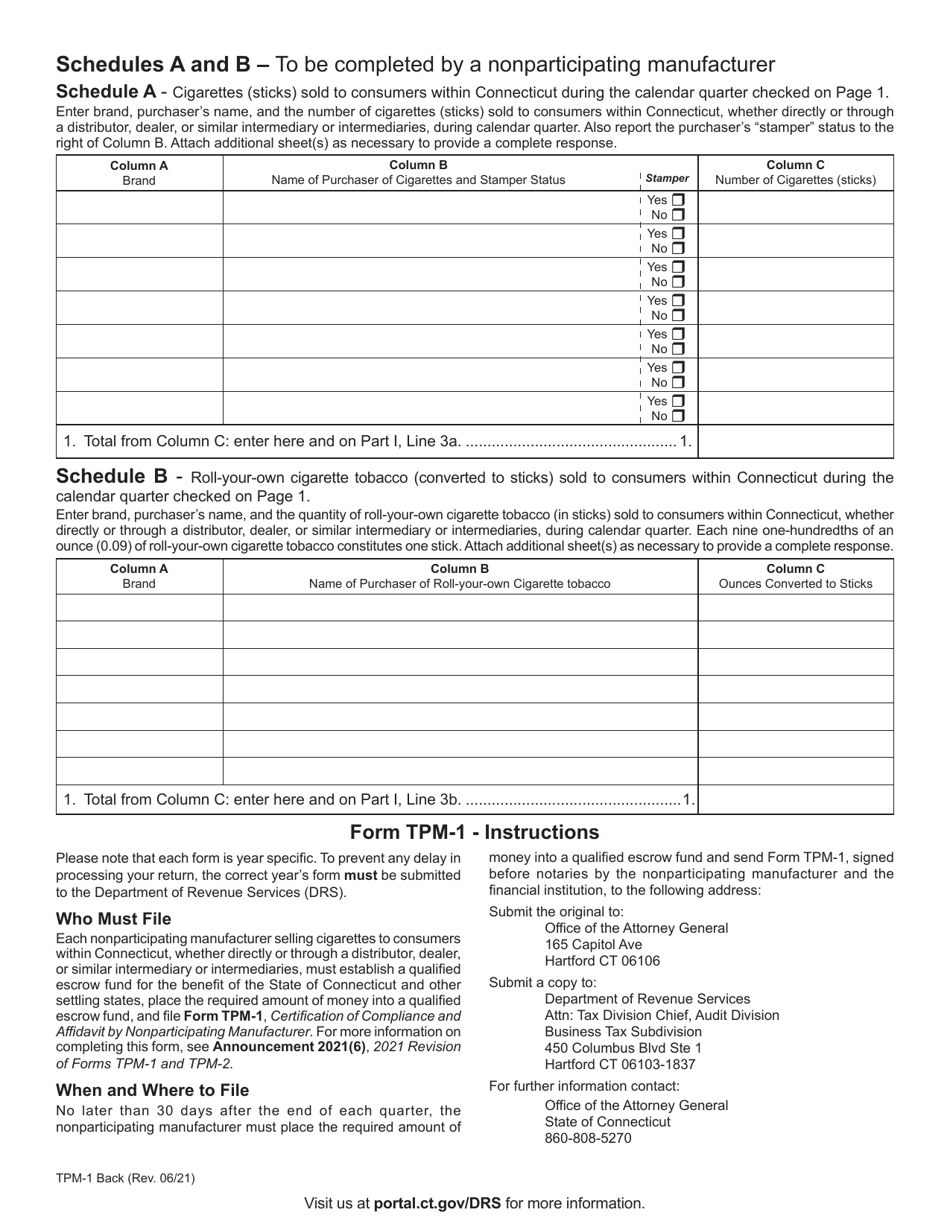

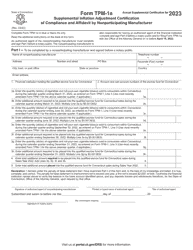

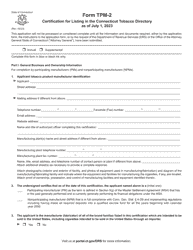

Form TPM-1

for the current year.

Form TPM-1 Certification of Compliance and Affidavit by Nonparticipating Manufacturer - Connecticut

What Is Form TPM-1?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a TPM-1 Certification of Compliance and Affidavit by Nonparticipating Manufacturer?

A: TPM-1 Certification of Compliance is a document that nonparticipating manufacturers in the state of Connecticut must submit to certify their compliance with the Tobacco Products Master Settlement Agreement (MSA) and related statutes.

Q: Who needs to file a TPM-1 Compliance Certification in Connecticut?

A: Nonparticipating manufacturers who sell or distribute tobacco products in Connecticut are required to file a TPM-1 Compliance Certification.

Q: What is the purpose of filing a TPM-1 Compliance Certification?

A: The purpose of filing a TPM-1 Compliance Certification is to ensure that nonparticipating manufacturers comply with the provisions of the Tobacco Products Master Settlement Agreement, including payment obligations and reporting requirements.

Q: How often should a TPM-1 Compliance Certification be filed?

A: Nonparticipating manufacturers must file a TPM-1 Compliance Certification annually, on or before April 15th, for the previous calendar year.

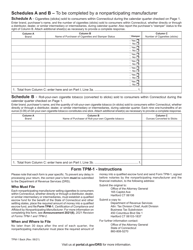

Q: What information is required in a TPM-1 Compliance Certification?

A: The TPM-1 Compliance Certification requires information such as manufacturer details, sales and distribution data, payment information, and any other relevant information required by the Connecticut Department of Revenue Services.

Q: What happens if a nonparticipating manufacturer fails to file a TPM-1 Compliance Certification?

A: Failure to file a TPM-1 Compliance Certification can result in penalties and enforcement actions by the Connecticut Department of Revenue Services, including but not limited to fines and potential legal consequences.

Q: Can a nonparticipating manufacturer be exempted from filing a TPM-1 Compliance Certification?

A: Nonparticipating manufacturers may request an exemption from filing a TPM-1 Compliance Certification if they meet certain criteria specified by the Connecticut Department of Revenue Services.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TPM-1 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.