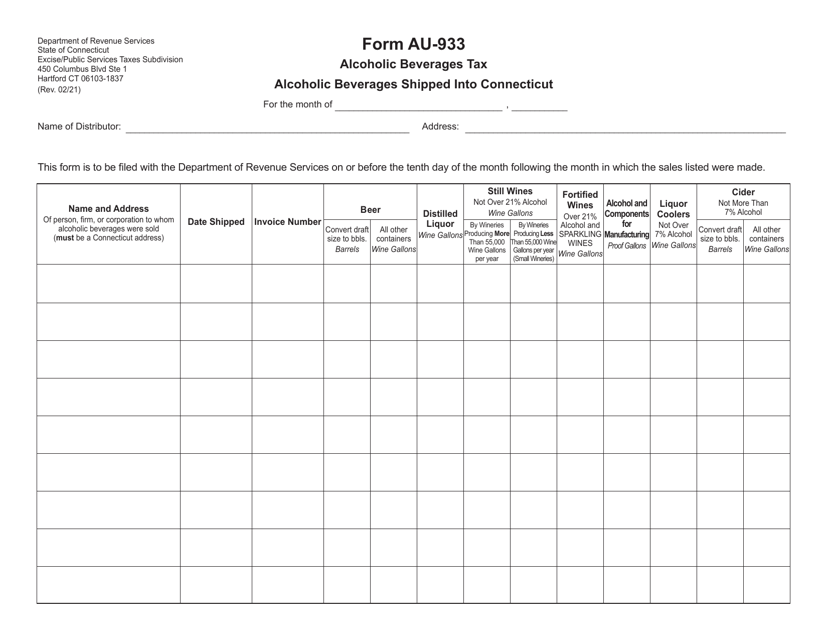

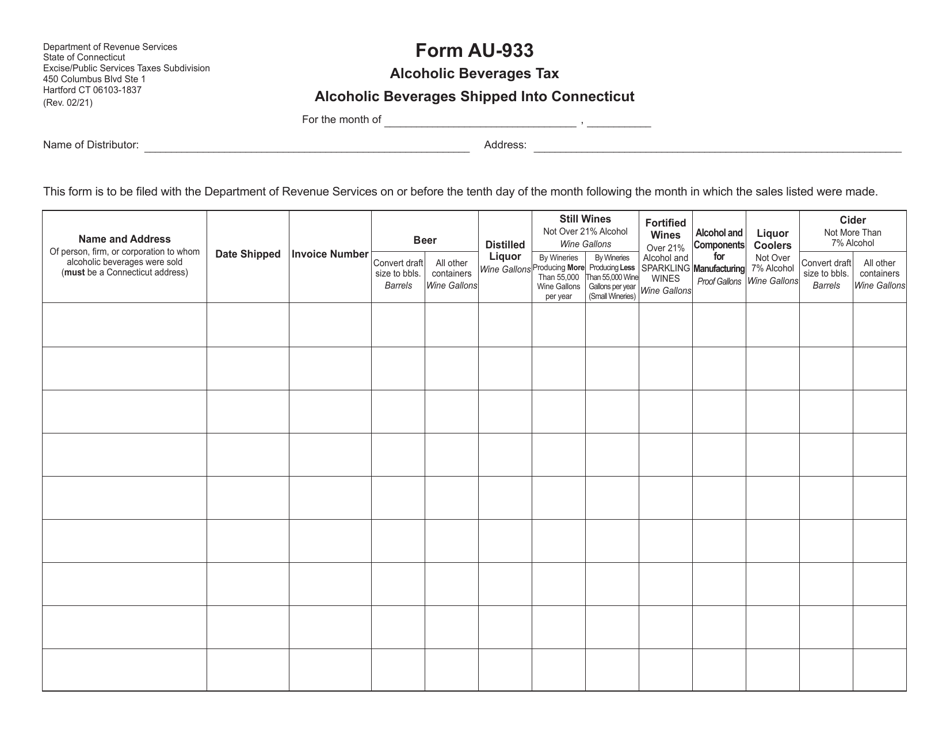

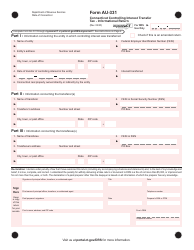

Form AU-933 Alcoholic Beverages Tax, Alcoholic Beverages Shipped Into Connecticut - Connecticut

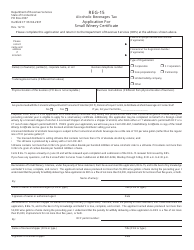

What Is Form AU-933?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-933?

A: Form AU-933 is the Alcoholic Beverages Tax form for alcoholic beverages shipped into Connecticut.

Q: Who needs to file Form AU-933?

A: Any individual or entity that ships alcoholic beverages into Connecticut needs to file Form AU-933.

Q: What is the purpose of Form AU-933?

A: Form AU-933 is used to report and pay the Alcoholic Beverages Tax for alcoholic beverages shipped into Connecticut.

Q: How often do I need to file Form AU-933?

A: Form AU-933 must be filed on a monthly basis.

Q: Is there a deadline for filing Form AU-933?

A: Yes, Form AU-933 must be filed and the tax payment must be made by the 20th day of the month following the month in which the alcoholic beverages were shipped into Connecticut.

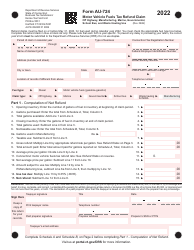

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the Alcoholic Beverages Tax laws in Connecticut. It is important to file and pay on time to avoid penalties and interest charges.

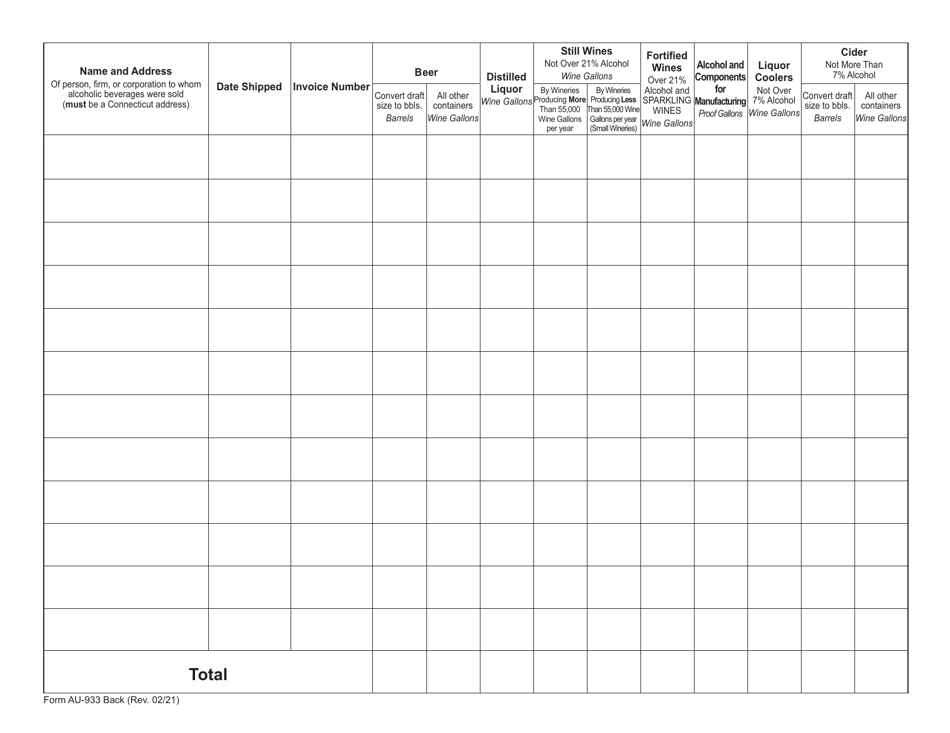

Q: What information do I need to complete Form AU-933?

A: To complete Form AU-933, you will need information such as the quantity and value of the alcoholic beverages shipped into Connecticut, the types and brands of the alcoholic beverages, and the tax due.

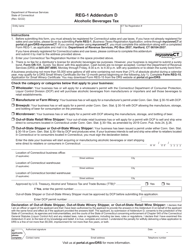

Q: Is there any exemption or credit available for the Alcoholic Beverages Tax?

A: There are certain exemptions and credits available for the Alcoholic Beverages Tax in Connecticut. You should consult the instructions for Form AU-933 or contact the Connecticut Department of Revenue Services for more information.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-933 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.