This version of the form is not currently in use and is provided for reference only. Download this version of

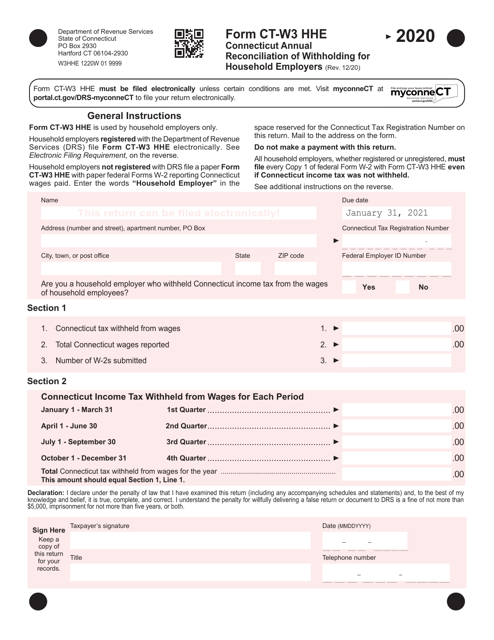

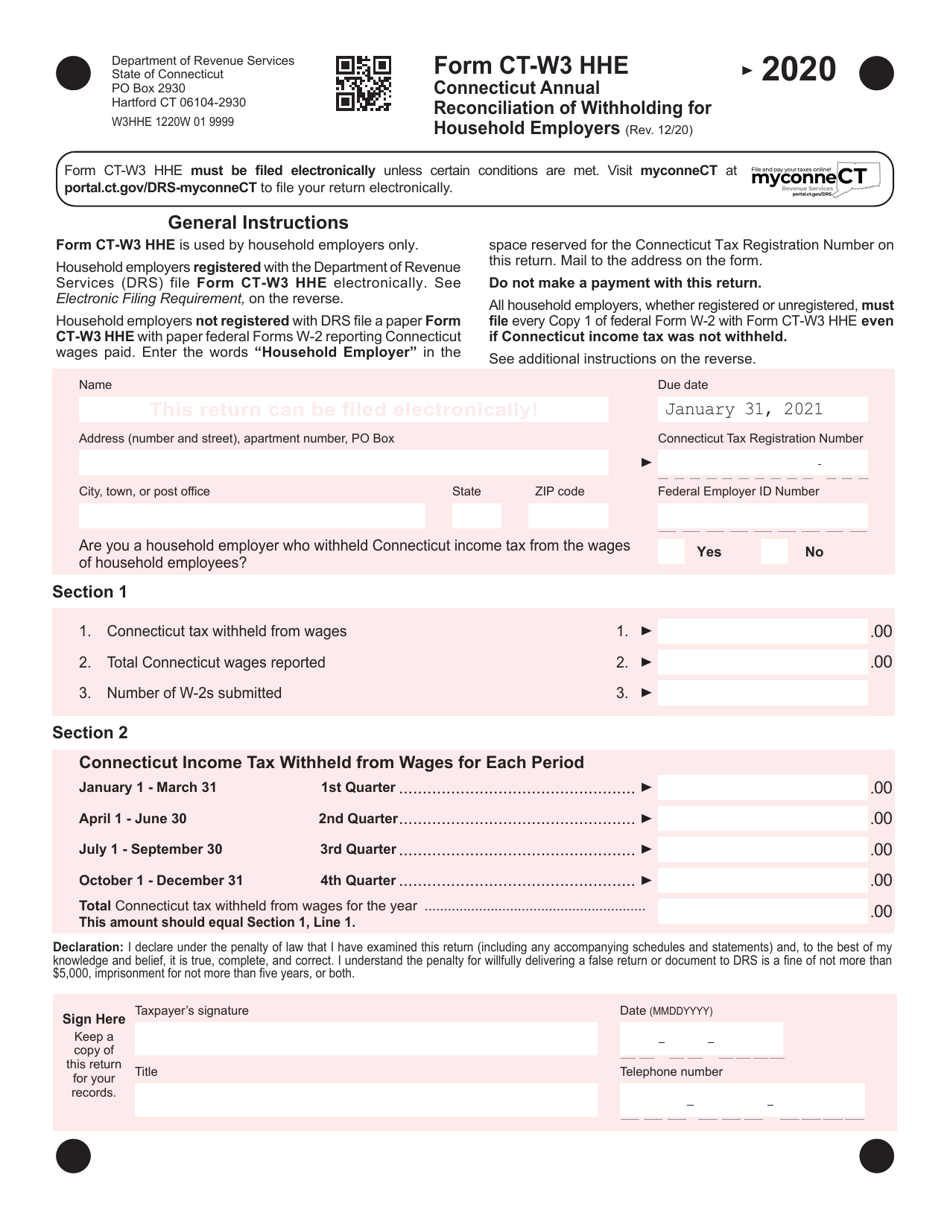

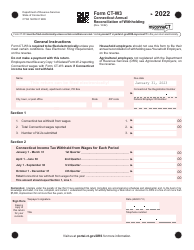

Form CT-W3 HHE

for the current year.

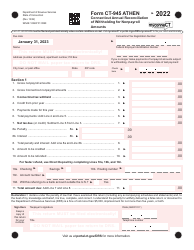

Form CT-W3 HHE Connecticut Annual Reconciliation of Withholding for Household Employers - Connecticut

What Is Form CT-W3 HHE?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-W3 HHE?

A: Form CT-W3 HHE is a Connecticut Annual Reconciliation of Withholding for Household Employers form.

Q: Who needs to file Form CT-W3 HHE?

A: Household employers in Connecticut need to file Form CT-W3 HHE.

Q: What is the purpose of Form CT-W3 HHE?

A: The purpose of Form CT-W3 HHE is to report and reconcile the withholding taxes paid by household employers in Connecticut.

Q: When is Form CT-W3 HHE due?

A: Form CT-W3 HHE is due on or before January 31st of each year.

Q: Are there any penalties for not filing Form CT-W3 HHE?

A: Yes, there can be penalties for not filing Form CT-W3 HHE or filing it late. It is important to file the form on time.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-W3 HHE by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.