This version of the form is not currently in use and is provided for reference only. Download this version of

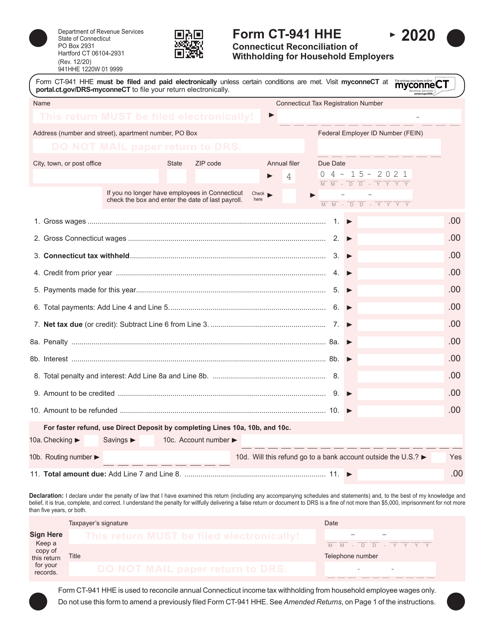

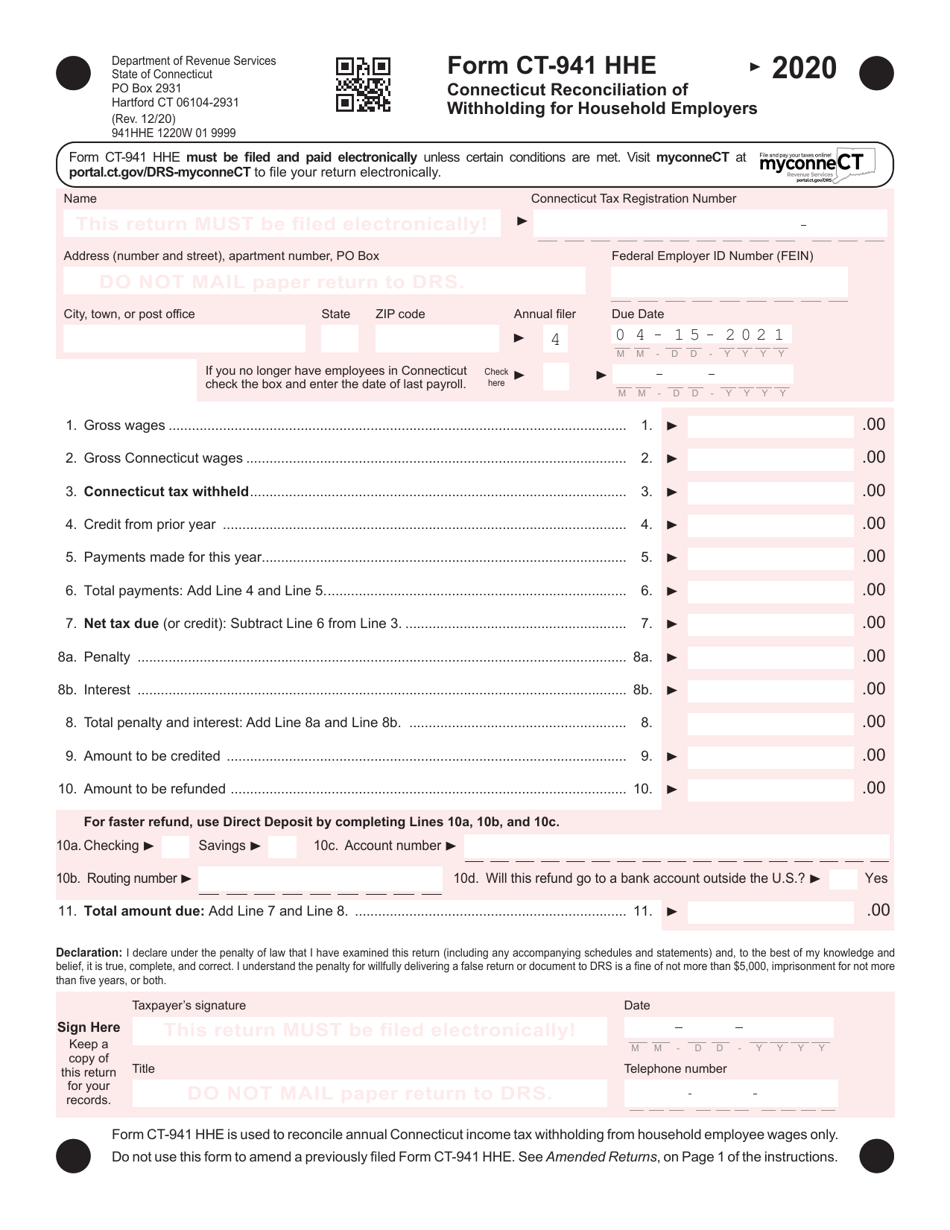

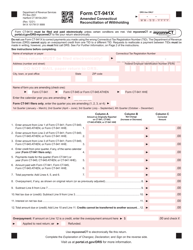

Form CT-941 HHE

for the current year.

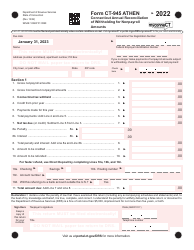

Form CT-941 HHE Connecticut Reconciliation of Withholding for Household Employers - Connecticut

What Is Form CT-941 HHE?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-941 HHE?

A: Form CT-941 HHE is the Connecticut Reconciliation of Withholding for Household Employers form.

Q: Who should use Form CT-941 HHE?

A: Form CT-941 HHE is used by household employers in Connecticut to reconcile their withholding taxes.

Q: What is the purpose of Form CT-941 HHE?

A: The purpose of Form CT-941 HHE is to report and reconcile the withholding taxes for household employers in Connecticut.

Q: When is Form CT-941 HHE due?

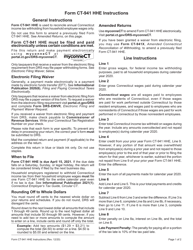

A: Form CT-941 HHE is generally due quarterly. The due dates are April 30, July 31, October 31, and January 31.

Q: Are there any penalties for not filing Form CT-941 HHE?

A: Yes, household employers who fail to file or pay the required withholding taxes may be subject to penalties and interest.

Q: What information do I need to complete Form CT-941 HHE?

A: To complete Form CT-941 HHE, you will need information such as the total wages paid to household employees, the amount of withholding taxes, and the total number of employees.

Q: Can I make changes to Form CT-941 HHE after filing?

A: Yes, you can file an amended Form CT-941 HHE if you need to make changes or corrections to the original form.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-941 HHE by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.