This version of the form is not currently in use and is provided for reference only. Download this version of

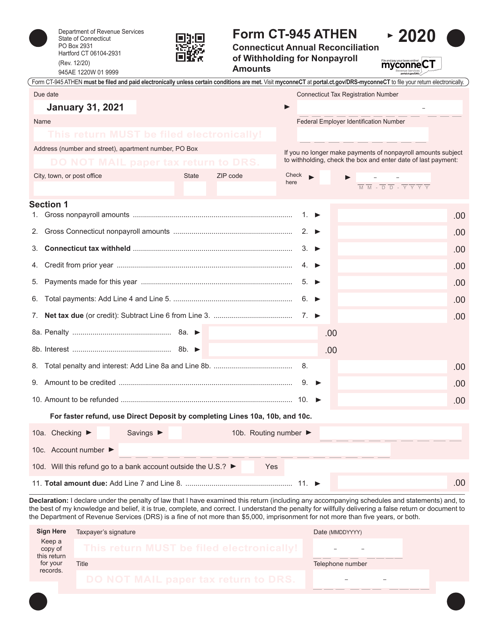

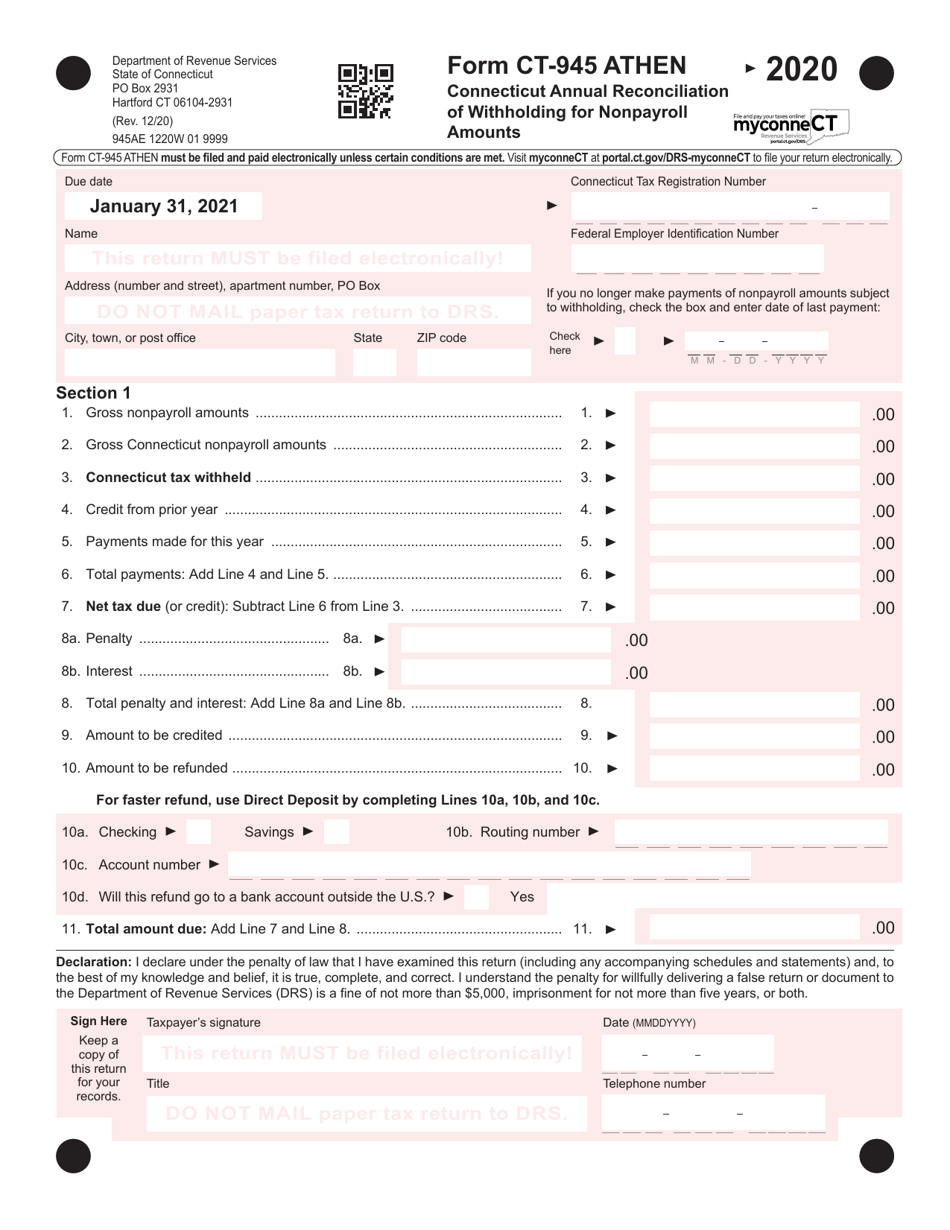

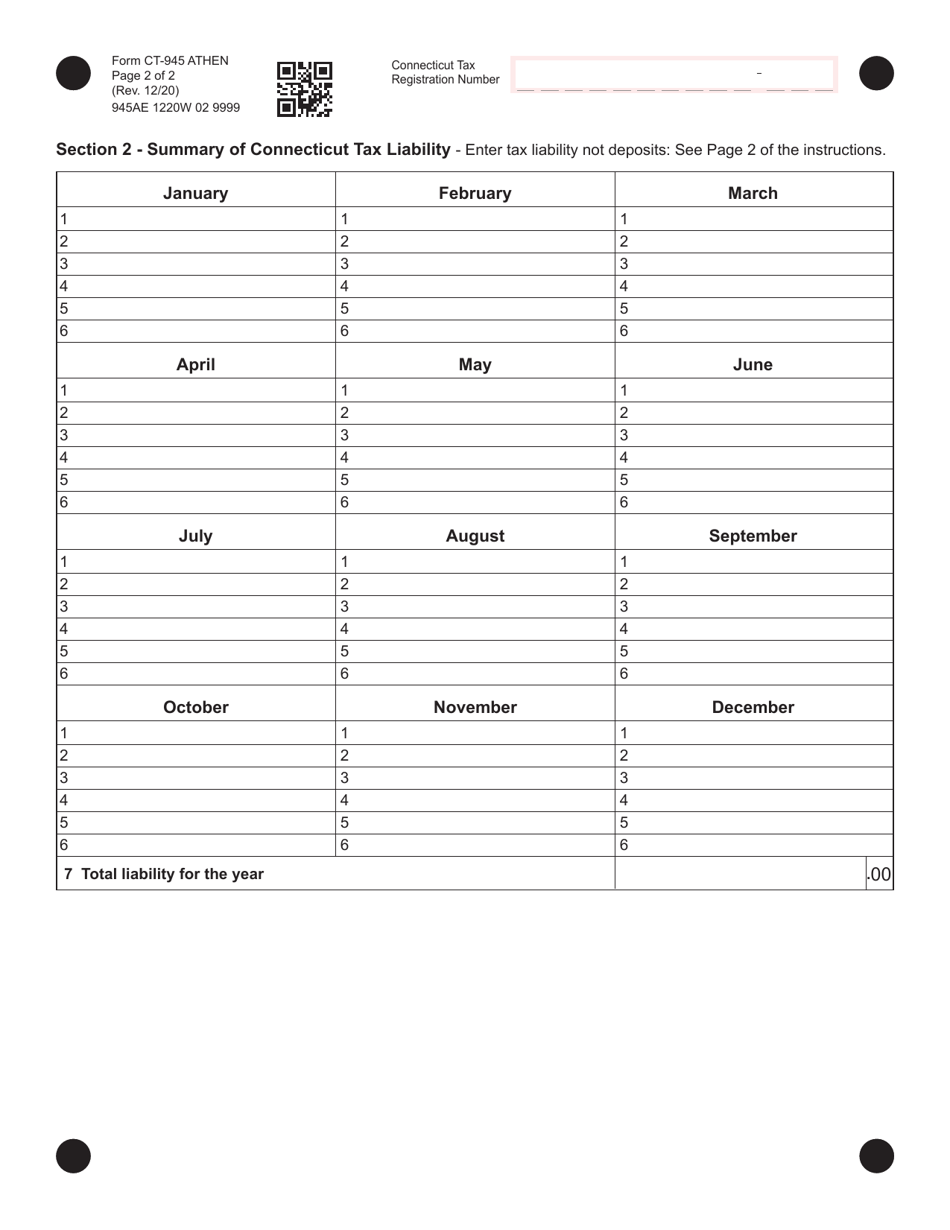

Form CT-945 ATHEN

for the current year.

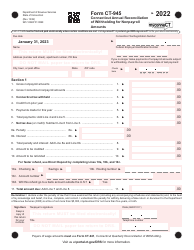

Form CT-945 ATHEN Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts - Connecticut

What Is Form CT-945 ATHEN?

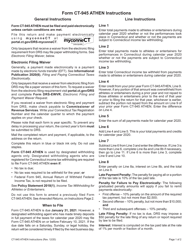

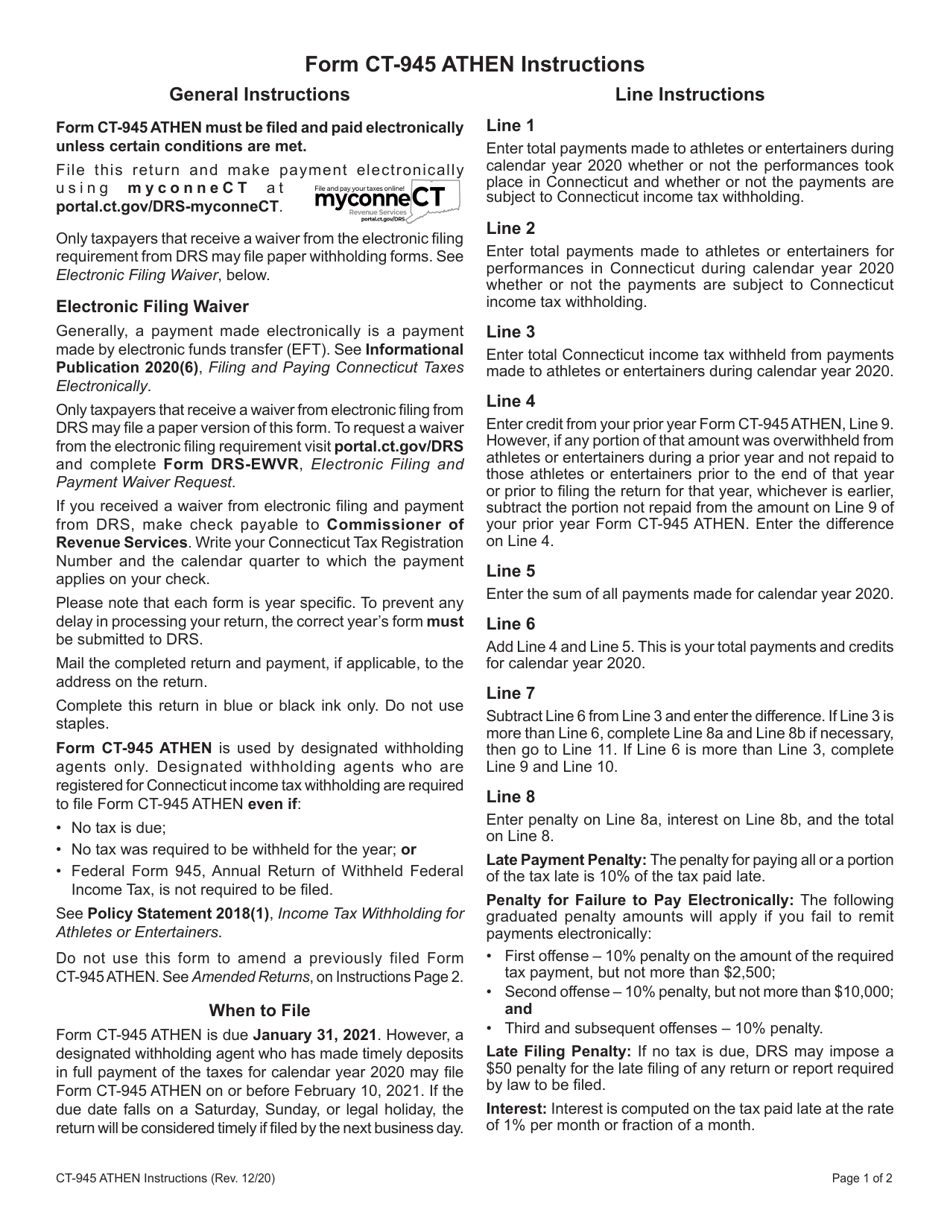

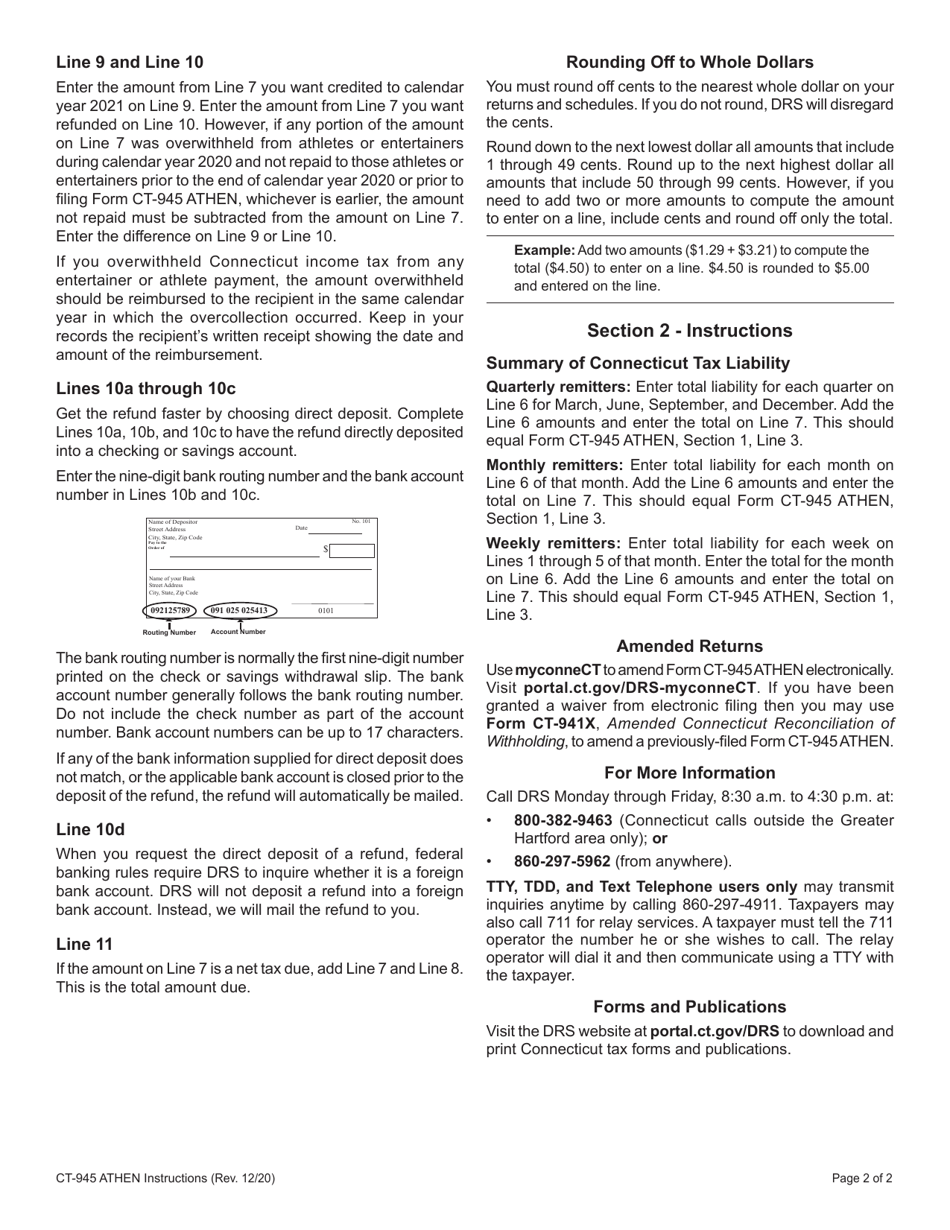

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-945 ATHEN?

A: Form CT-945 ATHEN is the Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts.

Q: Who needs to file Form CT-945 ATHEN?

A: Any taxpayer who withholds Connecticut income tax for nonpayroll amounts, such as pensions, annuities, and gambling winnings, must file Form CT-945 ATHEN.

Q: What is the purpose of Form CT-945 ATHEN?

A: The purpose of Form CT-945 ATHEN is to reconcile the amount of Connecticut income tax withheld for nonpayroll amounts and to remit any additional tax due or claim a refund of any overpayment.

Q: When is Form CT-945 ATHEN due?

A: Form CT-945 ATHEN is due by the last day of February following the close of the calendar year.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-945 ATHEN by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.