This version of the form is not currently in use and is provided for reference only. Download this version of

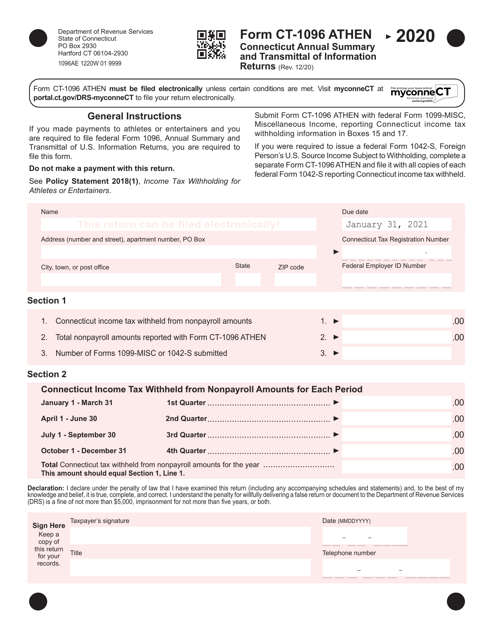

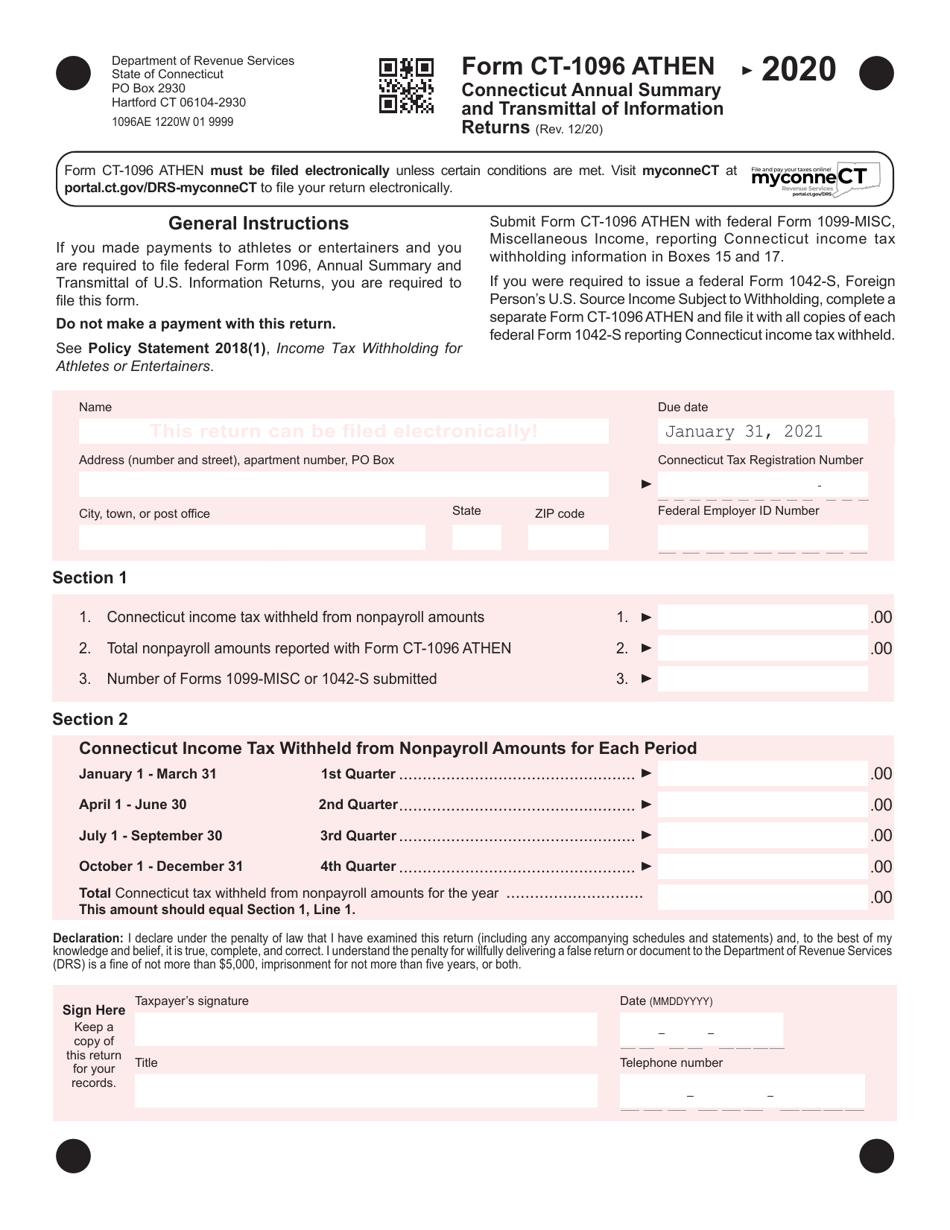

Form CT-1096 ATHEN

for the current year.

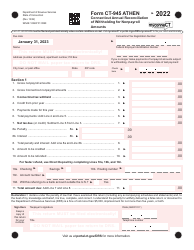

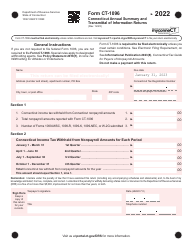

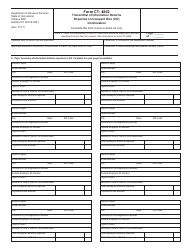

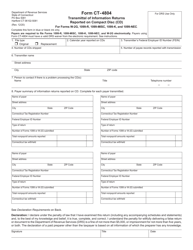

Form CT-1096 ATHEN Connecticut Annual Summary and Transmittal of Information Returns - Connecticut

What Is Form CT-1096 ATHEN?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1096?

A: Form CT-1096 is Connecticut Annual Summary and Transmittal of Information Returns.

Q: What is the purpose of Form CT-1096?

A: The purpose of Form CT-1096 is to summarize and transmit information returns to the Connecticut Department of Revenue Services.

Q: Who needs to file Form CT-1096?

A: Anyone who is required to file information returns with the Connecticut Department of Revenue Services needs to file Form CT-1096.

Q: What information returns are included in Form CT-1096?

A: Form CT-1096 includes a summary of various information returns, such as Forms W-2G, 1099-MISC, and 1099-R.

Q: When is Form CT-1096 due?

A: Form CT-1096 is generally due by the last day of February following the calendar year in which the information returns were required to be filed.

Q: Is Form CT-1096 the same as federal Form 1096?

A: No, Form CT-1096 is specific to Connecticut and is used to transmit information returns to the Connecticut Department of Revenue Services.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1096 ATHEN by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.