This version of the form is not currently in use and is provided for reference only. Download this version of

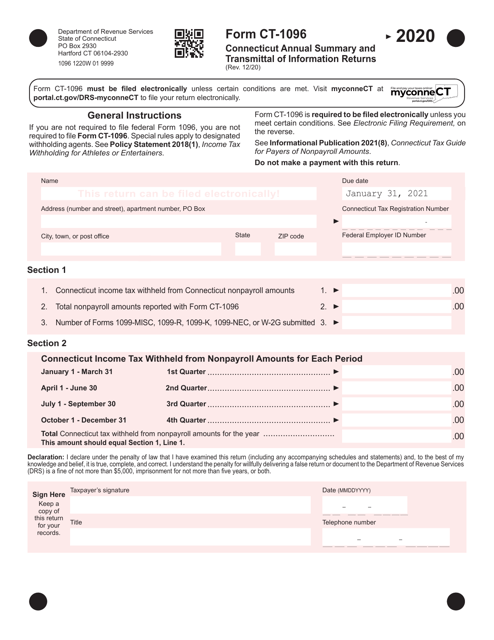

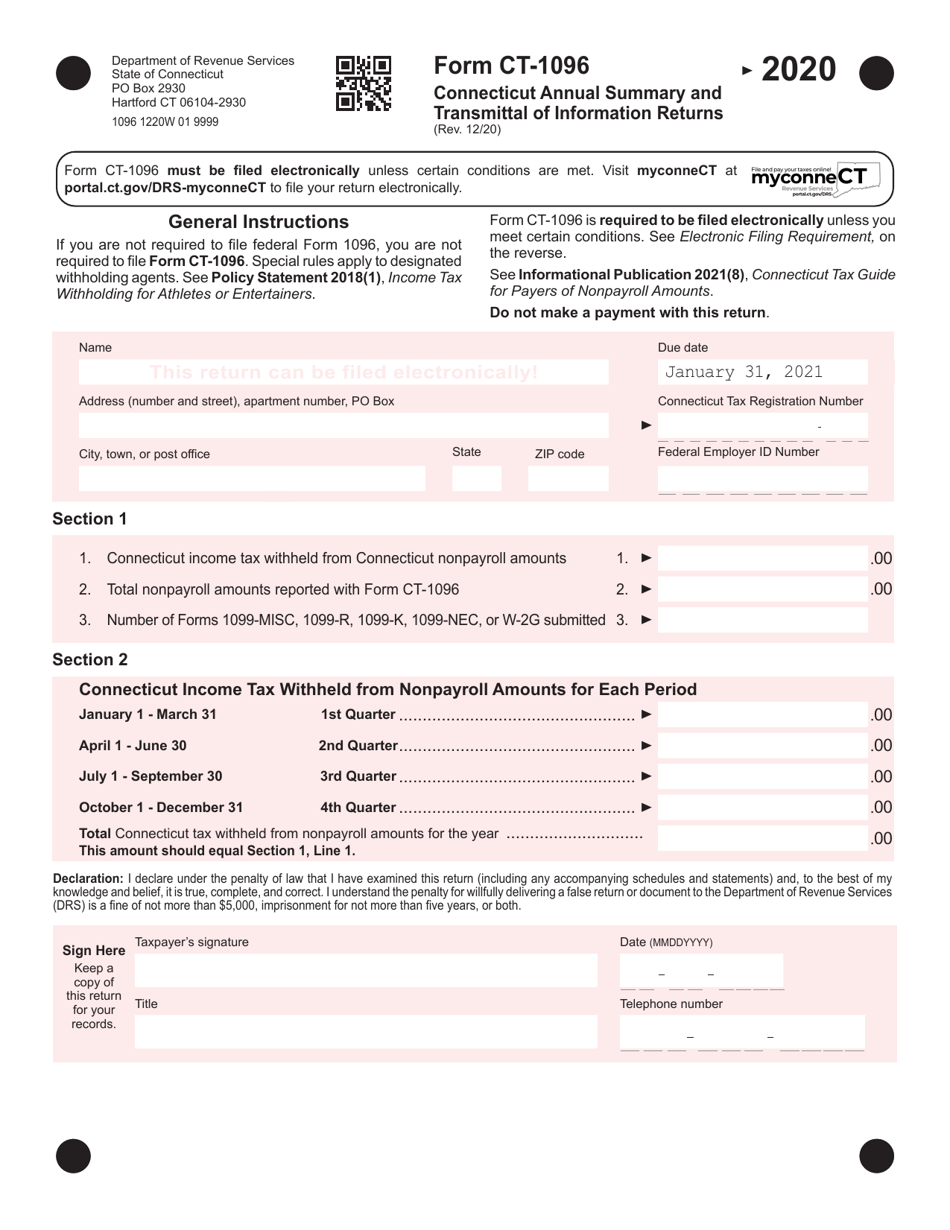

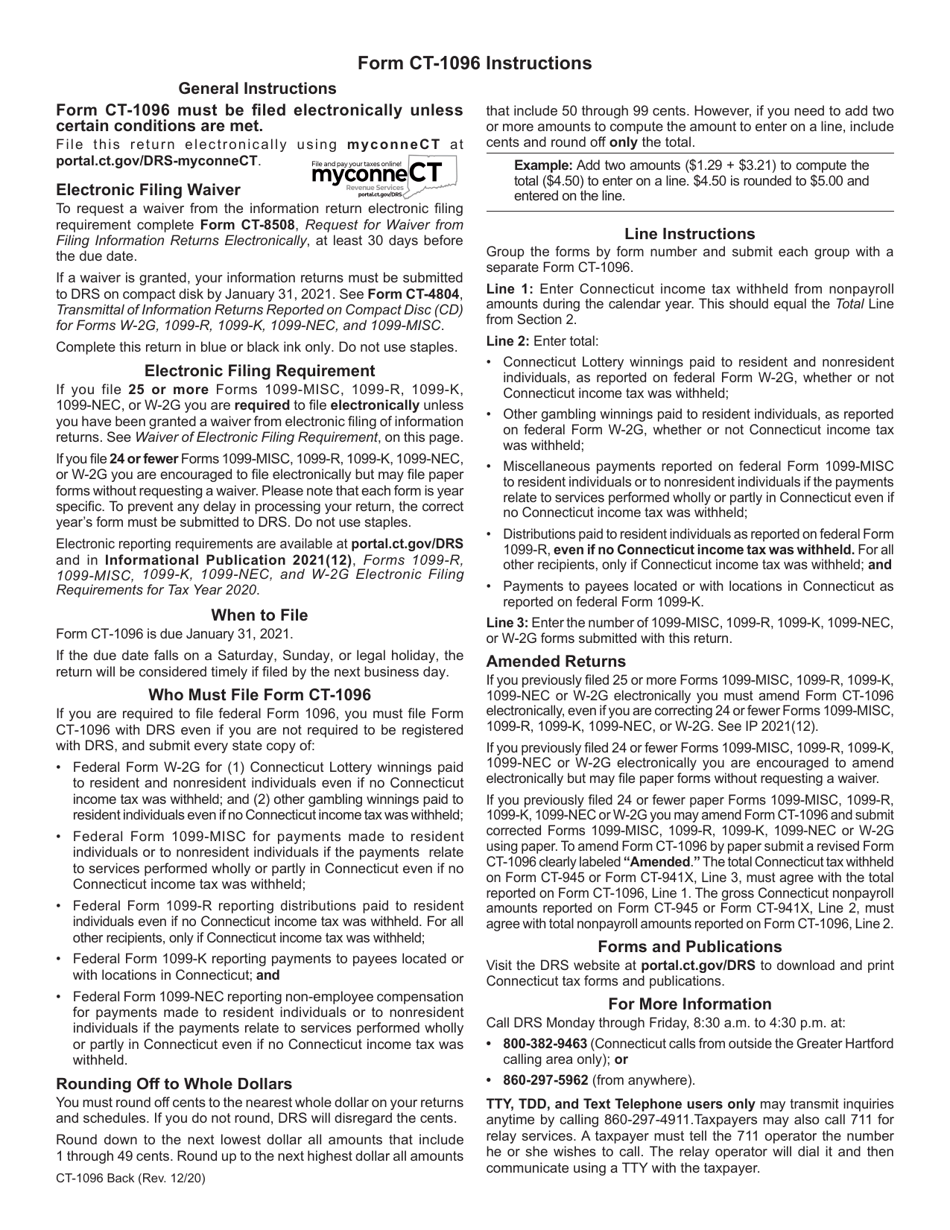

Form CT-1096

for the current year.

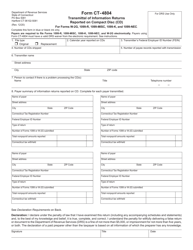

Form CT-1096 Connecticut Annual Summary and Transmittal of Information Returns - Connecticut

What Is Form CT-1096?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1096?

A: Form CT-1096 is a Connecticut Annual Summary and Transmittal of Information Returns.

Q: What is the purpose of Form CT-1096?

A: The purpose of Form CT-1096 is to summarize and transmit information returns, such as Form W-2 or 1099, to the state of Connecticut.

Q: Who needs to file Form CT-1096?

A: Anyone who is required to file information returns like Form W-2 or 1099 with the state of Connecticut needs to file Form CT-1096.

Q: When is Form CT-1096 due?

A: Form CT-1096 is due on or before the last day of February following the calendar year in which the information returns were made.

Q: How do I file Form CT-1096?

A: You can file Form CT-1096 electronically or by mail. The specific instructions for filing are provided on the form itself.

Q: Are there any penalties for late or incorrect filing of Form CT-1096?

A: Yes, there may be penalties for late or incorrect filing of Form CT-1096. It is important to file the form accurately and on time to avoid penalties.

Q: Can I use Form CT-1096 for federal tax purposes?

A: No, Form CT-1096 is specifically for reporting information returns to the state of Connecticut. For federal tax purposes, you would need to use the appropriate federal forms.

Q: Do I need to include any supporting documents with Form CT-1096?

A: Generally, you do not need to include any supporting documents with Form CT-1096. However, you should keep the supporting documents, such as copies of information returns, for your records.

Q: What if I have additional questions about Form CT-1096?

A: If you have additional questions about Form CT-1096, you can contact the Connecticut Department of Revenue Services for further assistance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1096 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.