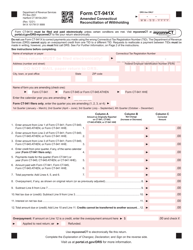

This version of the form is not currently in use and is provided for reference only. Download this version of

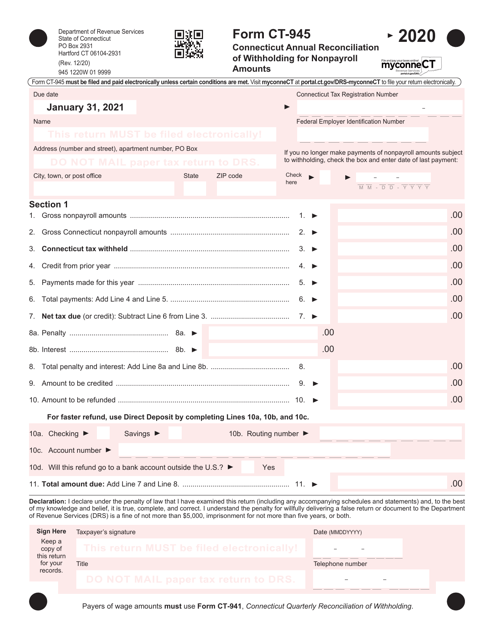

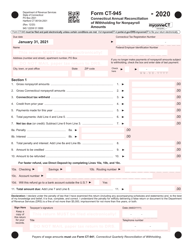

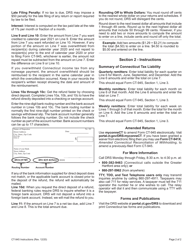

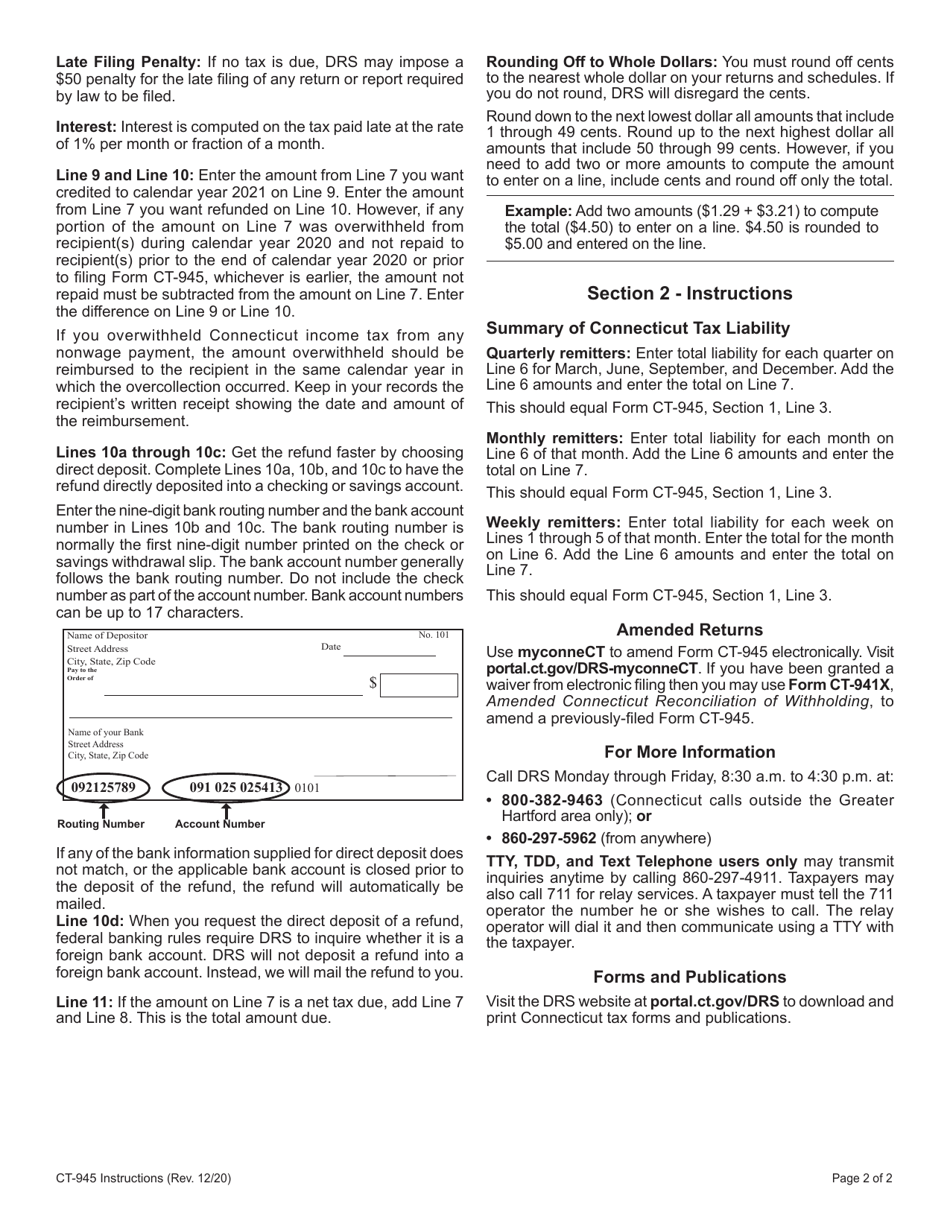

Form CT-945

for the current year.

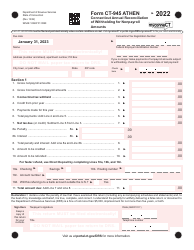

Form CT-945 Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts - Connecticut

What Is Form CT-945?

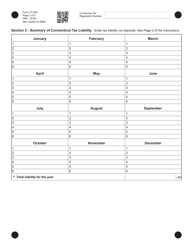

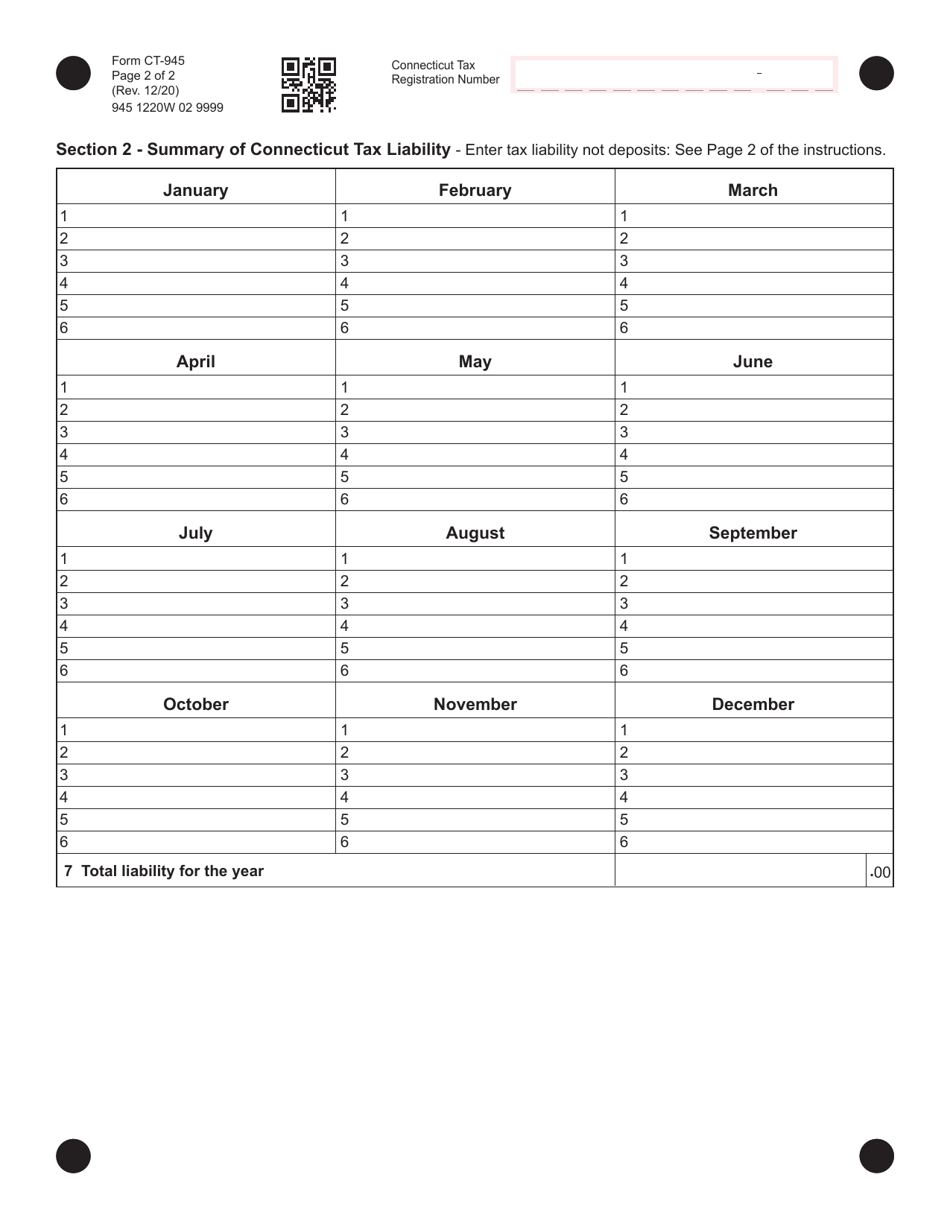

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-945?

A: Form CT-945 is the Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts.

Q: Who needs to file Form CT-945?

A: Employers who are required to withhold Connecticut income tax from nonpayroll income need to file Form CT-945.

Q: What is nonpayroll income?

A: Nonpayroll income includes payments such as pensions, annuities, gambling winnings, and certain other sources of income that are subject to Connecticut income tax withholding.

Q: When is Form CT-945 due?

A: Form CT-945 is due on or before January 31 of the following year.

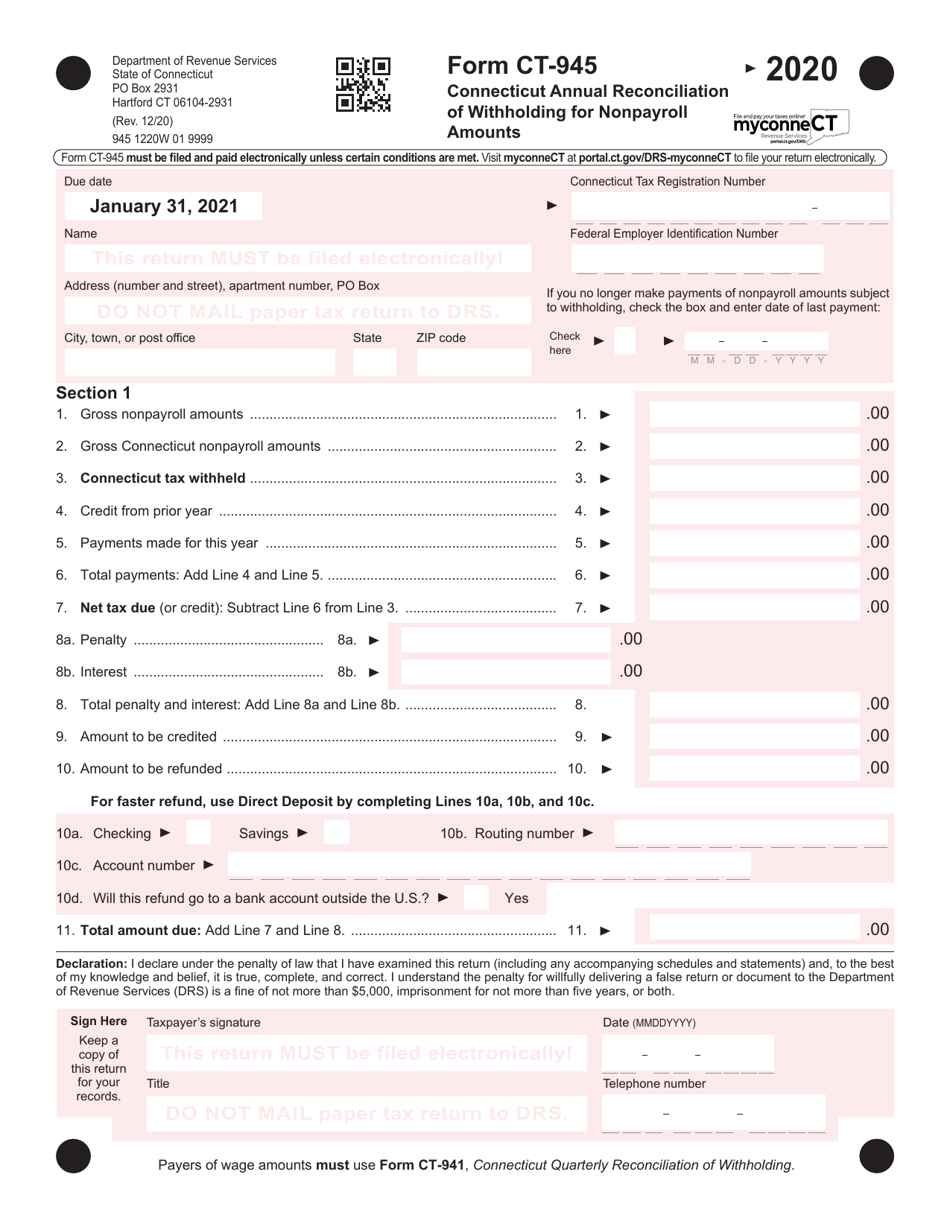

Q: What information do I need to complete Form CT-945?

A: You will need information about the nonpayroll income subject to Connecticut income tax withholding, including the amount withheld and the payee's information.

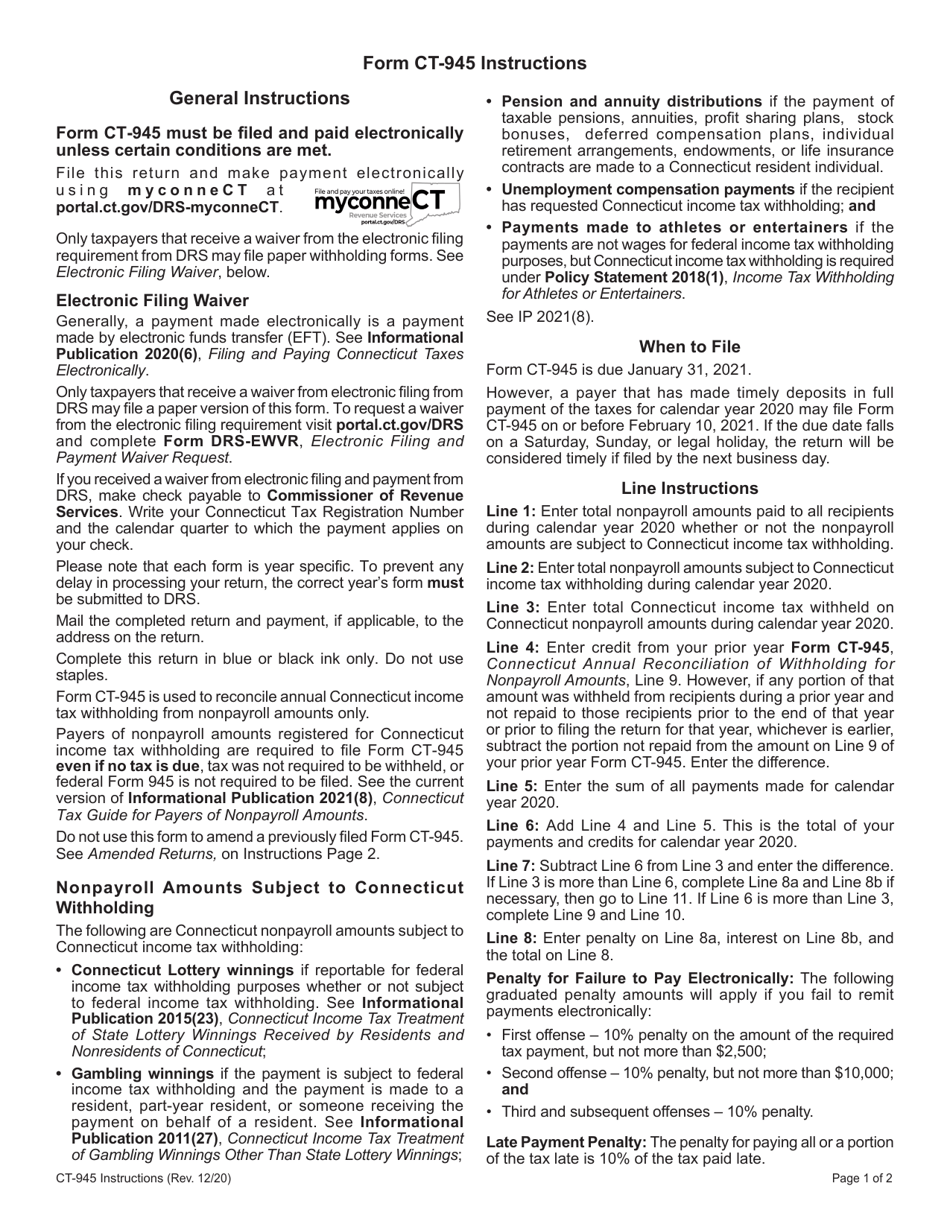

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with Connecticut income tax withholding requirements. It is important to file Form CT-945 on time and accurately.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-945 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.