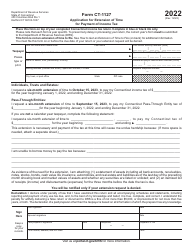

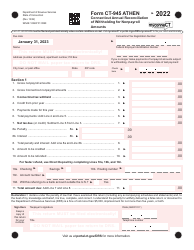

This version of the form is not currently in use and is provided for reference only. Download this version of

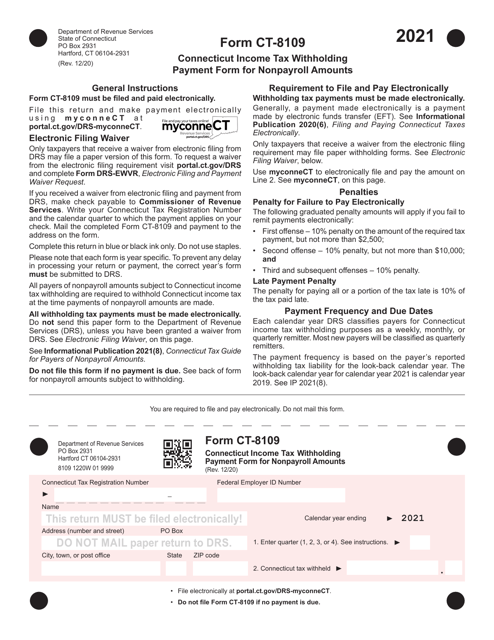

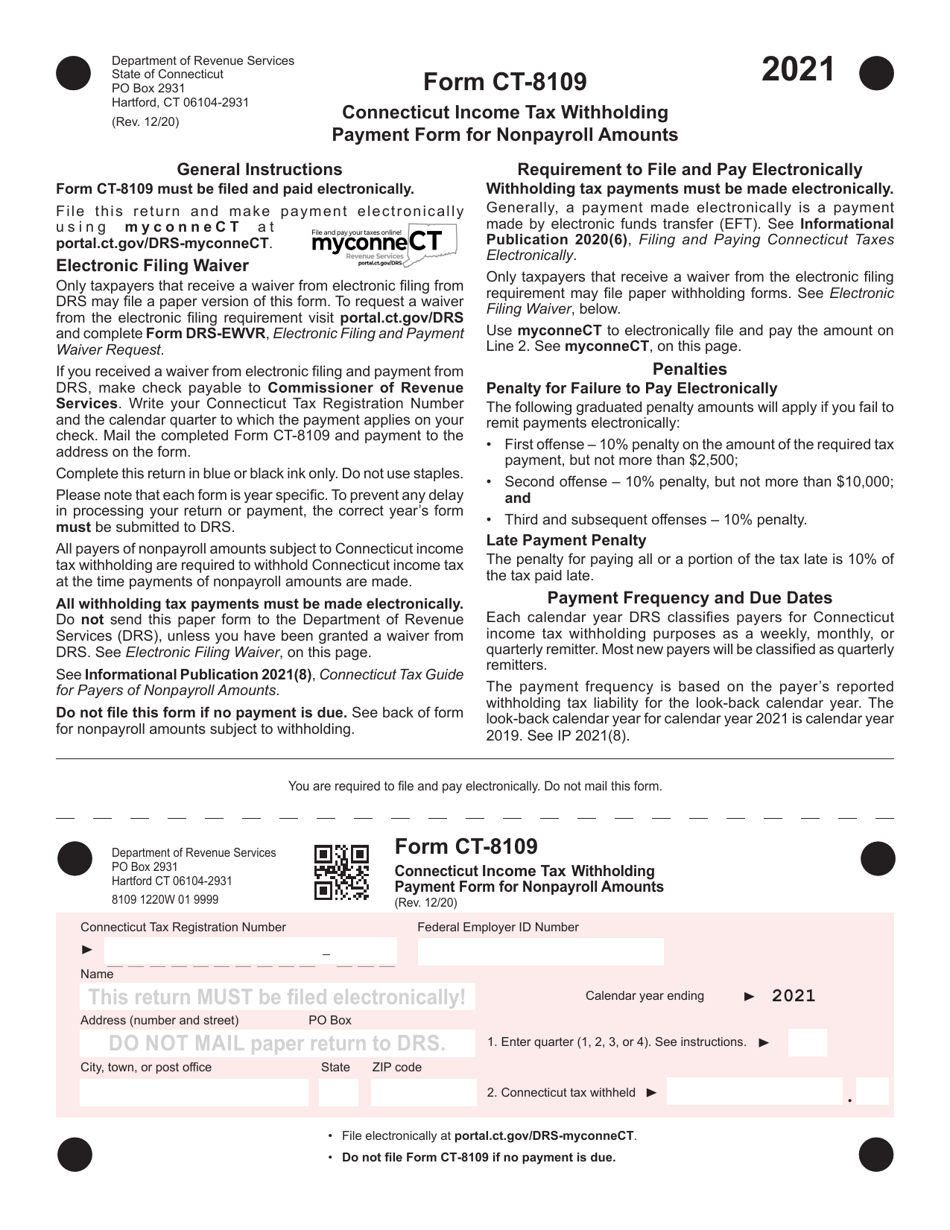

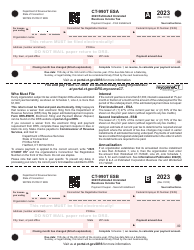

Form CT-8109

for the current year.

Form CT-8109 Connecticut Income Tax Withholding Payment Form for Nonpayroll Amounts - Connecticut

What Is Form CT-8109?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-8109?

A: Form CT-8109 is the Connecticut Income Tax Withholding Payment Form for Nonpayroll Amounts.

Q: What is the purpose of Form CT-8109?

A: The purpose of Form CT-8109 is to make income tax withholding payments for nonpayroll amounts to the State of Connecticut.

Q: Who needs to file Form CT-8109?

A: Anyone who is required to withhold Connecticut income tax from nonpayroll payments needs to file Form CT-8109.

Q: What are nonpayroll amounts?

A: Nonpayroll amounts refer to payments made to individuals or entities that are subject to Connecticut income tax withholding, but are not made in the course of an employer-employee relationship.

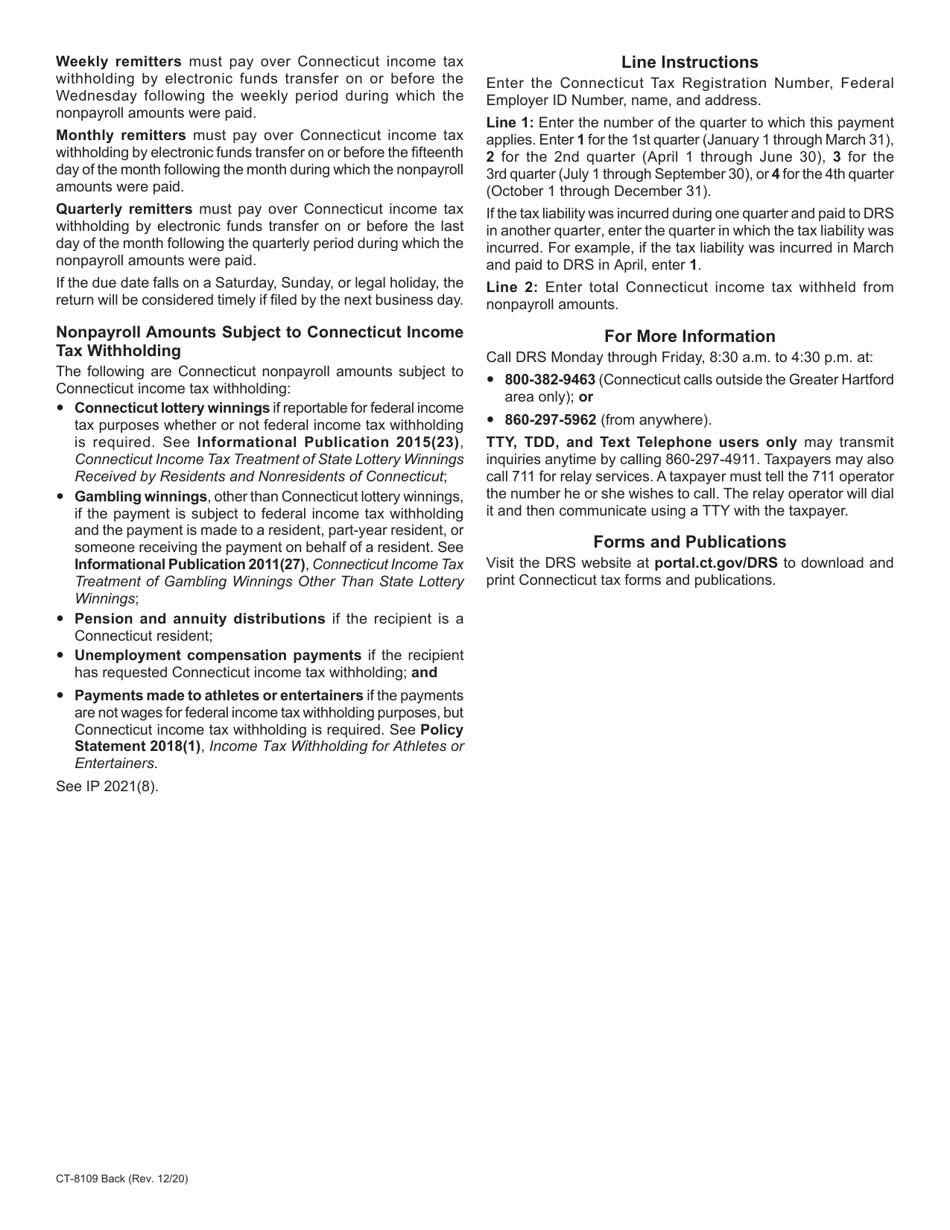

Q: When is Form CT-8109 due?

A: Form CT-8109 must be filed and payment must be made on or before the due date of the income tax return for the applicable period, which is generally the last day of the month following the end of the quarter in which the nonpayroll amounts were paid.

Q: What should I do if I made an error on Form CT-8109?

A: If you made an error on Form CT-8109, you should file an amended form as soon as possible to correct the error and make the appropriate payment.

Q: Is there a penalty for late filing of Form CT-8109?

A: Yes, if Form CT-8109 is filed late, a penalty may be assessed based on the amount of tax due.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8109 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.