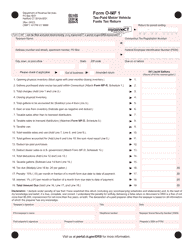

This version of the form is not currently in use and is provided for reference only. Download this version of

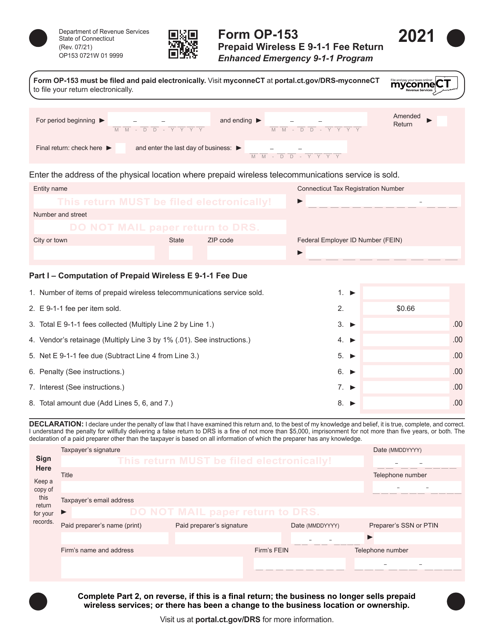

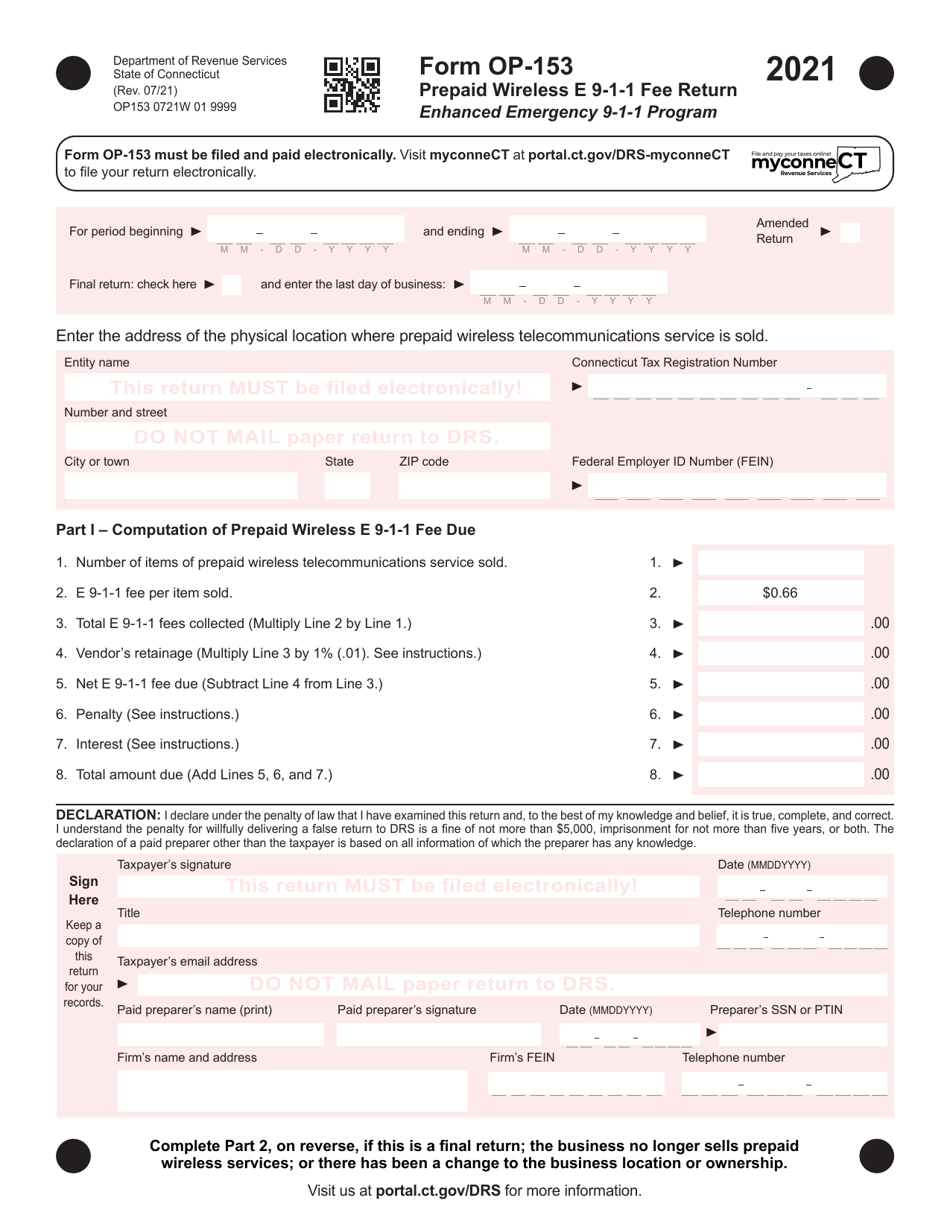

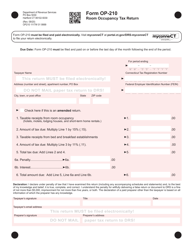

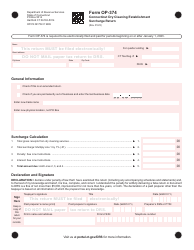

Form OP-153

for the current year.

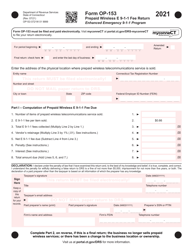

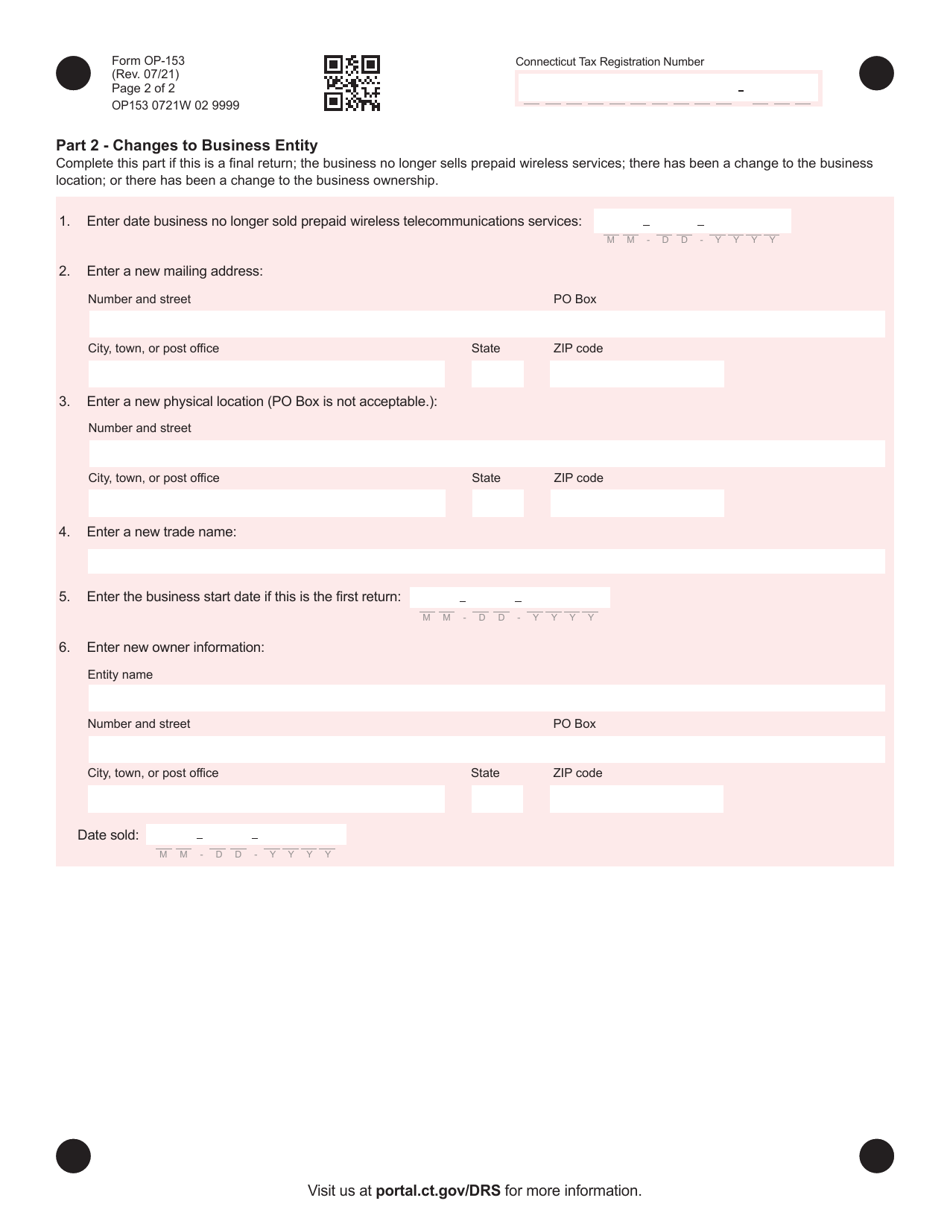

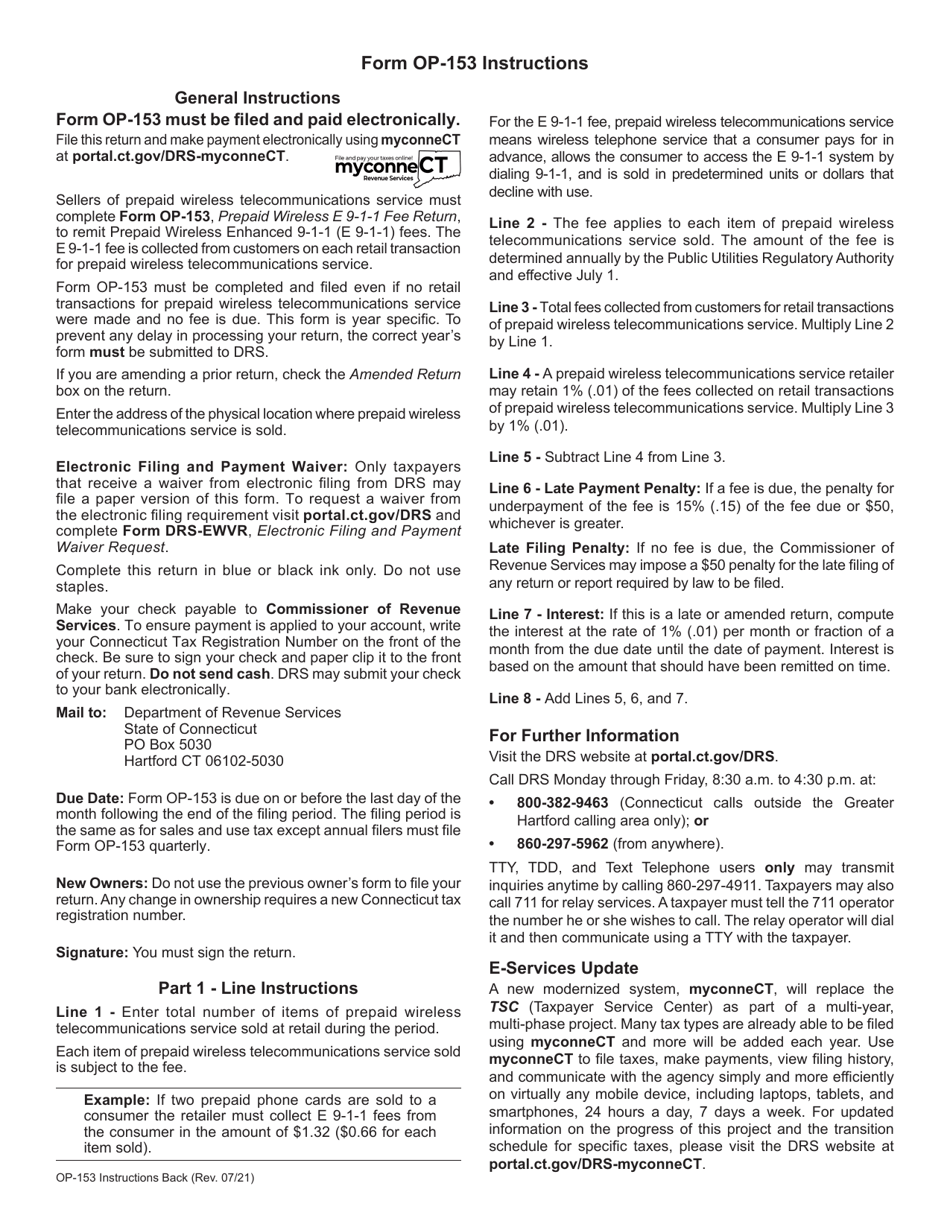

Form OP-153 Prepaid Wireless E 9-1-1 Fee Return - Connecticut

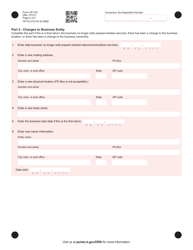

What Is Form OP-153?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-153?

A: Form OP-153 is the Prepaid Wireless E 9-1-1 Fee Return form in Connecticut.

Q: What is the purpose of Form OP-153?

A: The purpose of Form OP-153 is to report and remit the Prepaid Wireless E 9-1-1 fee in Connecticut.

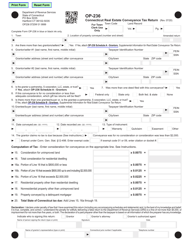

Q: Who needs to file Form OP-153?

A: Prepaid wireless service providers in Connecticut need to file Form OP-153.

Q: What is the Prepaid Wireless E 9-1-1 fee?

A: The Prepaid Wireless E 9-1-1 fee is a fee imposed on prepaid wireless service providers in Connecticut to support the funding of Enhanced 9-1-1 services.

Q: When is Form OP-153 due?

A: Form OP-153 is due on or before the last day of the month following the end of each calendar quarter.

Q: Is there a penalty for not filing Form OP-153?

A: Yes, failure to file Form OP-153 or late filing may result in penalties and interest.

Q: Are there any exemptions to the Prepaid Wireless E 9-1-1 fee?

A: Yes, there are specific exemptions and deductions available. You should consult the instructions for Form OP-153 or contact the Connecticut Department of Revenue Services for more information.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-153 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.