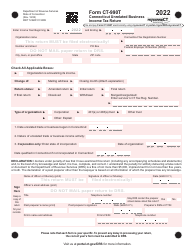

This version of the form is not currently in use and is provided for reference only. Download this version of

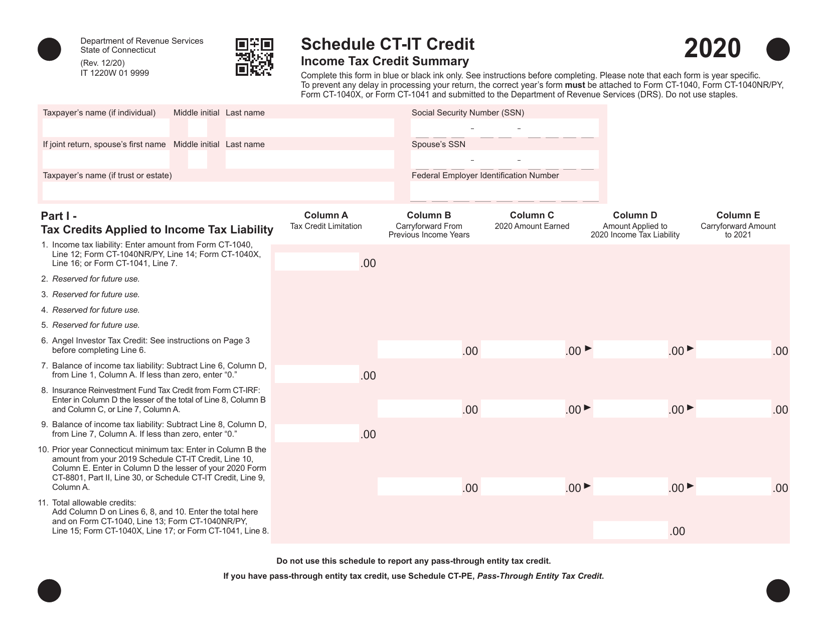

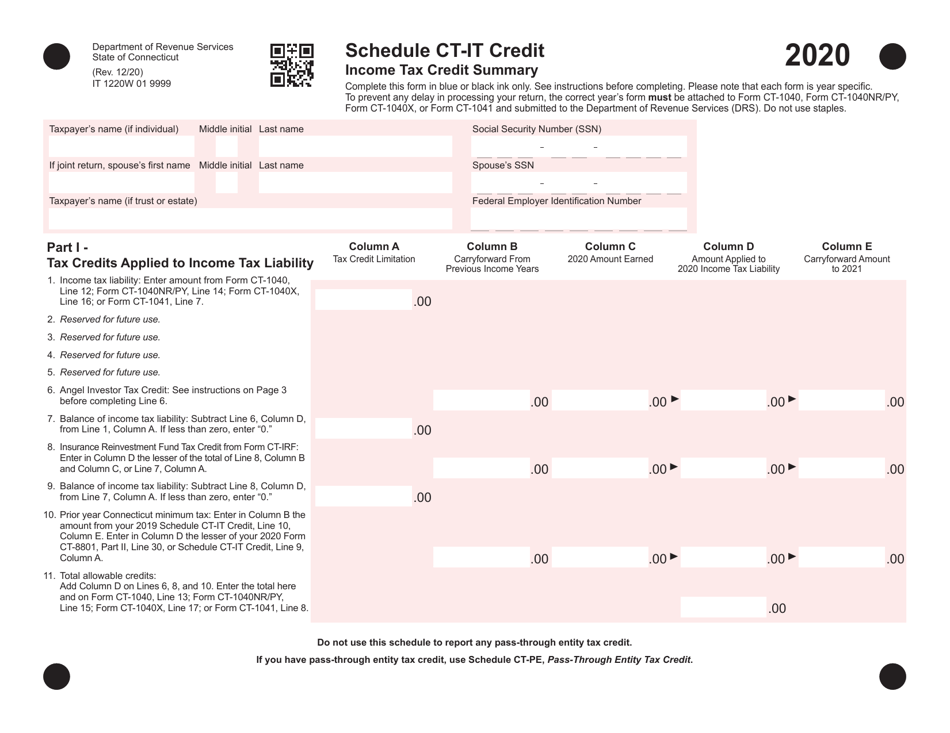

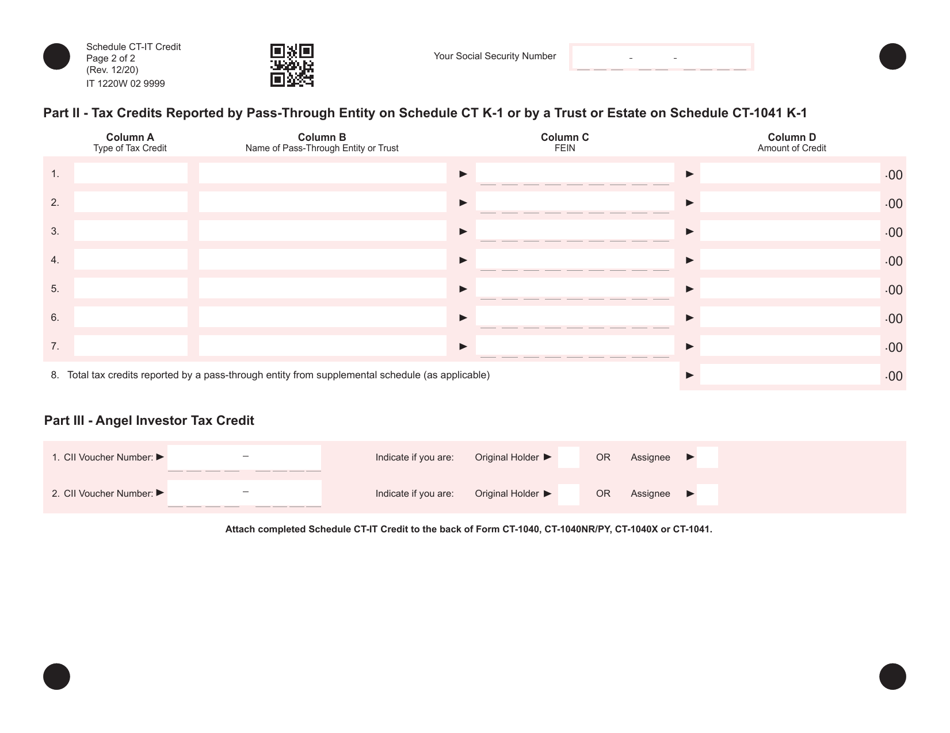

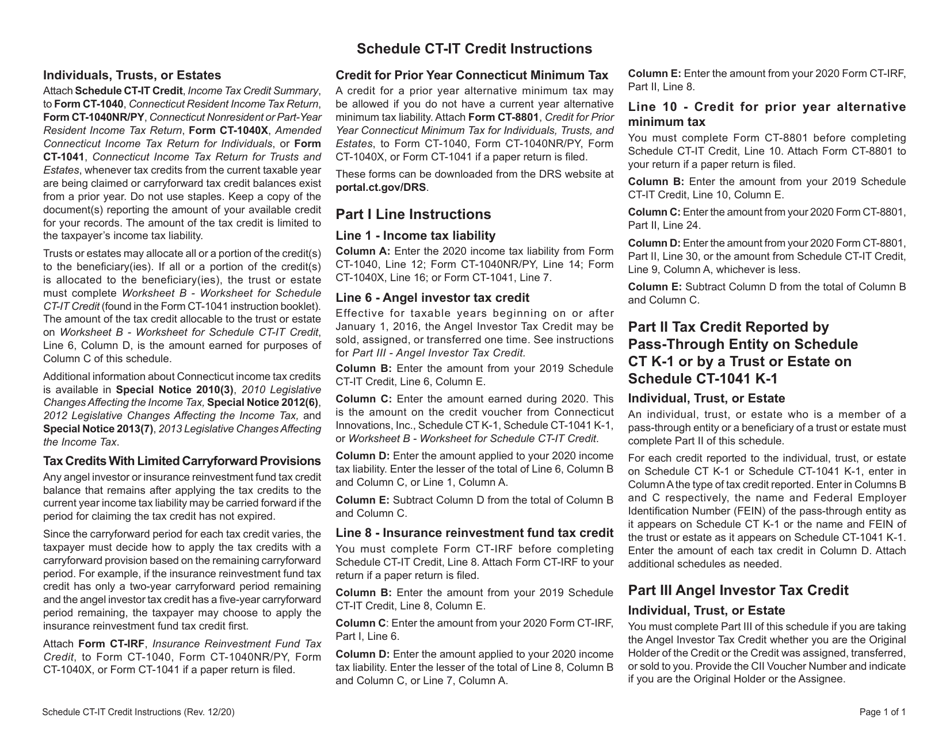

Schedule CT-IT CREDIT

for the current year.

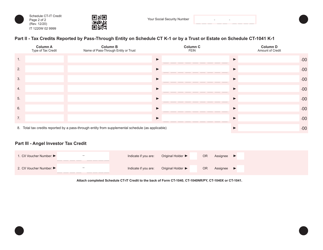

Schedule CT-IT CREDIT Income Tax Credit Summary - Connecticut

What Is Schedule CT-IT CREDIT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

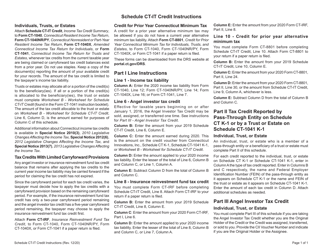

Q: What is the CT-IT CREDIT?

A: The CT-IT CREDIT is an income tax credit available in Connecticut.

Q: Who is eligible for the CT-IT CREDIT?

A: Eligibility for the CT-IT CREDIT depends on certain income and filing status requirements set by the state of Connecticut.

Q: How can I claim the CT-IT CREDIT?

A: To claim the CT-IT CREDIT, you need to include the necessary information and calculations on your Connecticut state income tax return.

Q: What is the purpose of the CT-IT CREDIT?

A: The purpose of the CT-IT CREDIT is to provide a tax relief or incentive for certain individuals or businesses in Connecticut.

Q: Are there any limitations or restrictions on the CT-IT CREDIT?

A: Yes, there may be limitations or restrictions on the CT-IT CREDIT depending on the specific provisions and rules set by the state of Connecticut.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-IT CREDIT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.