This version of the form is not currently in use and is provided for reference only. Download this version of

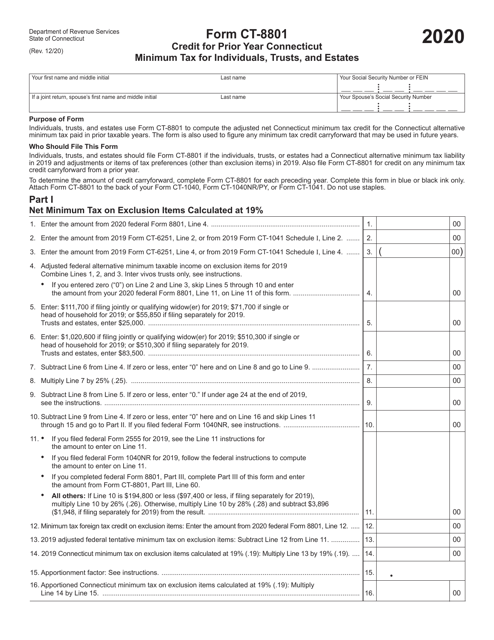

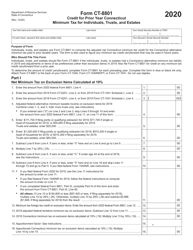

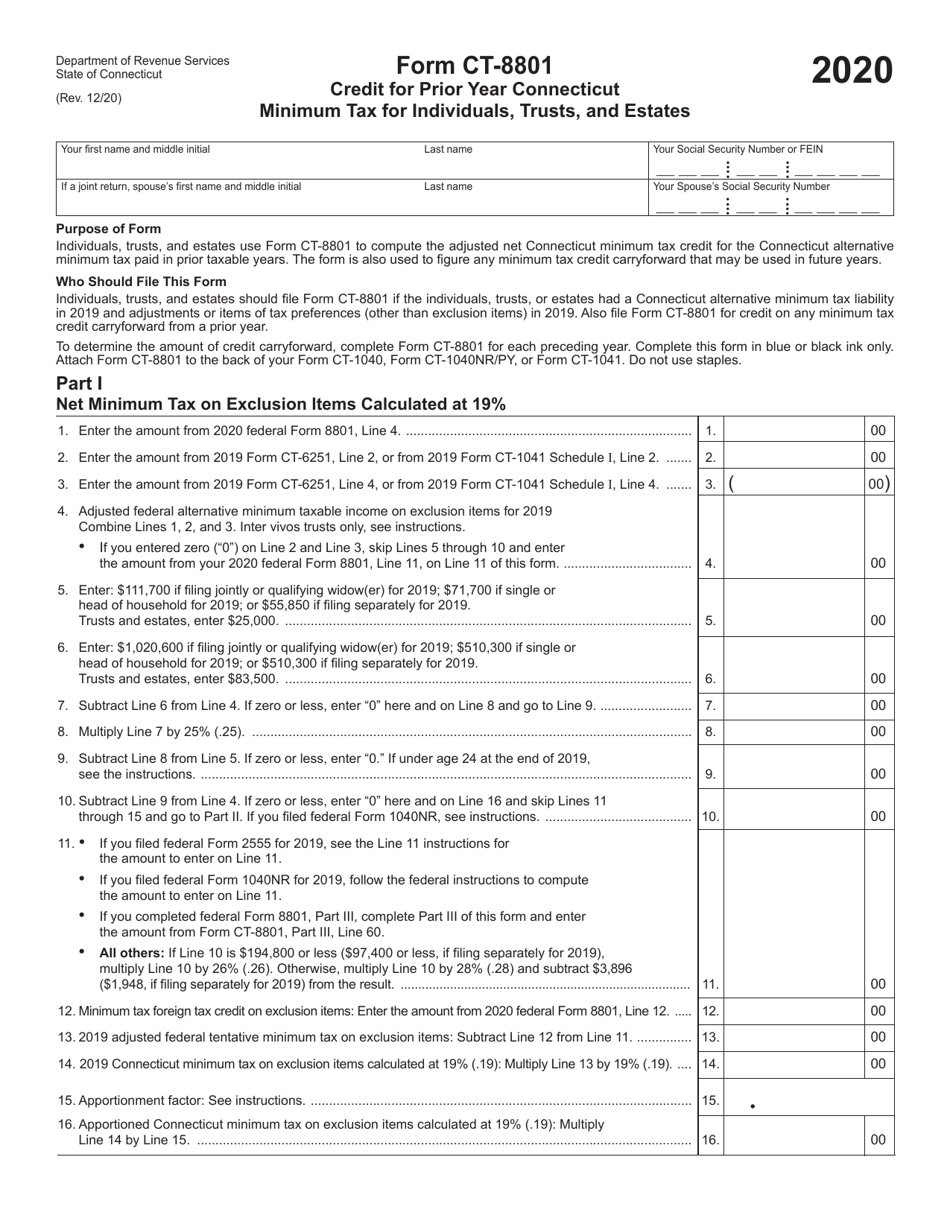

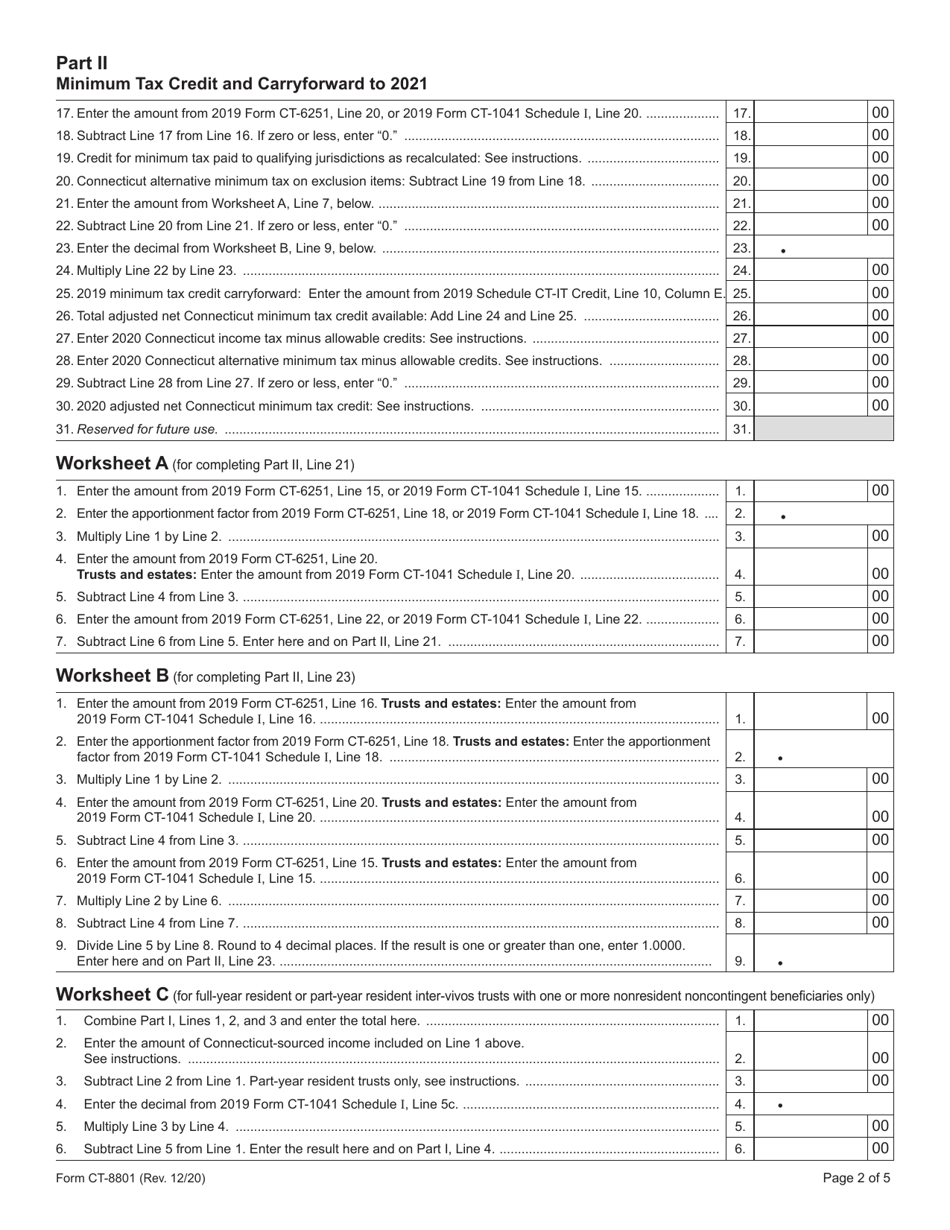

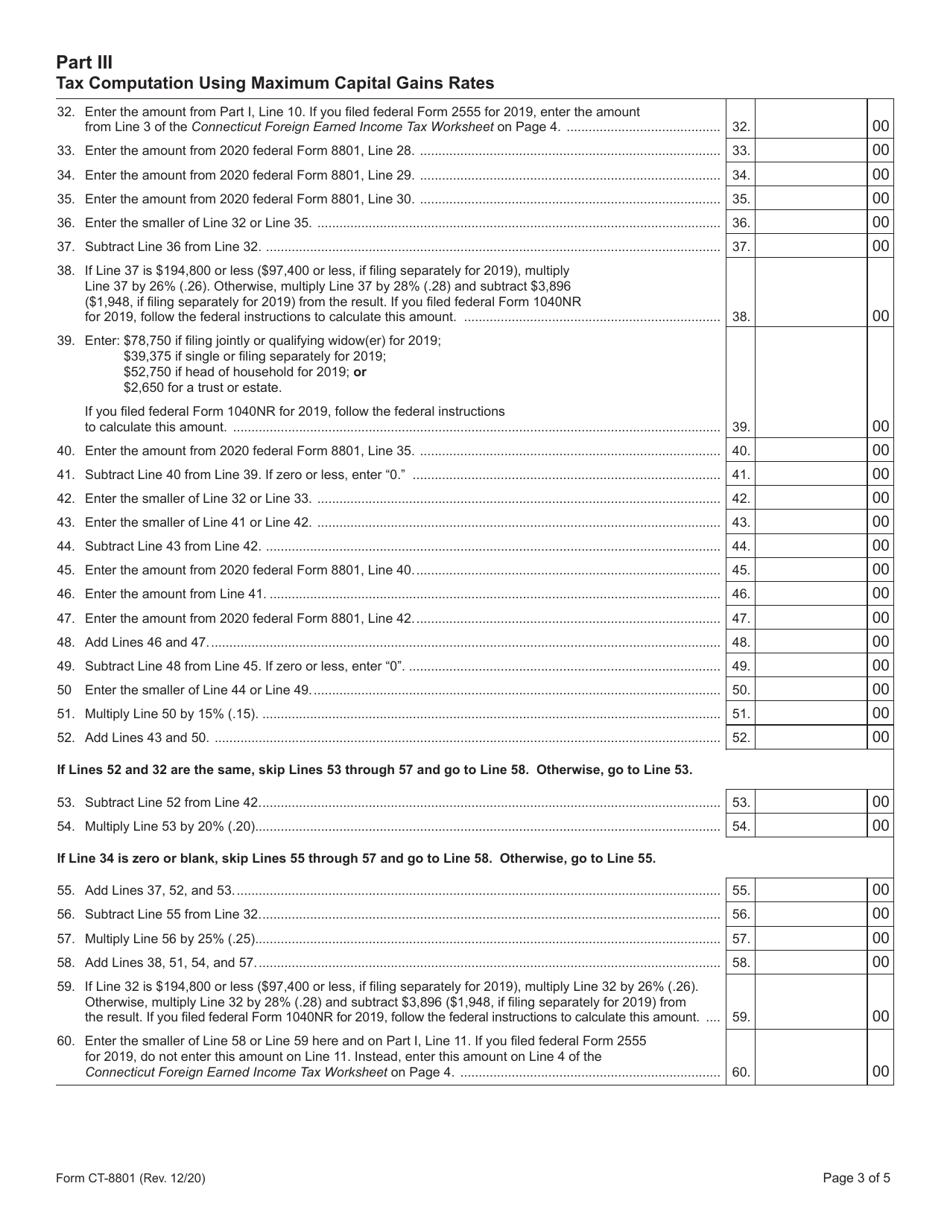

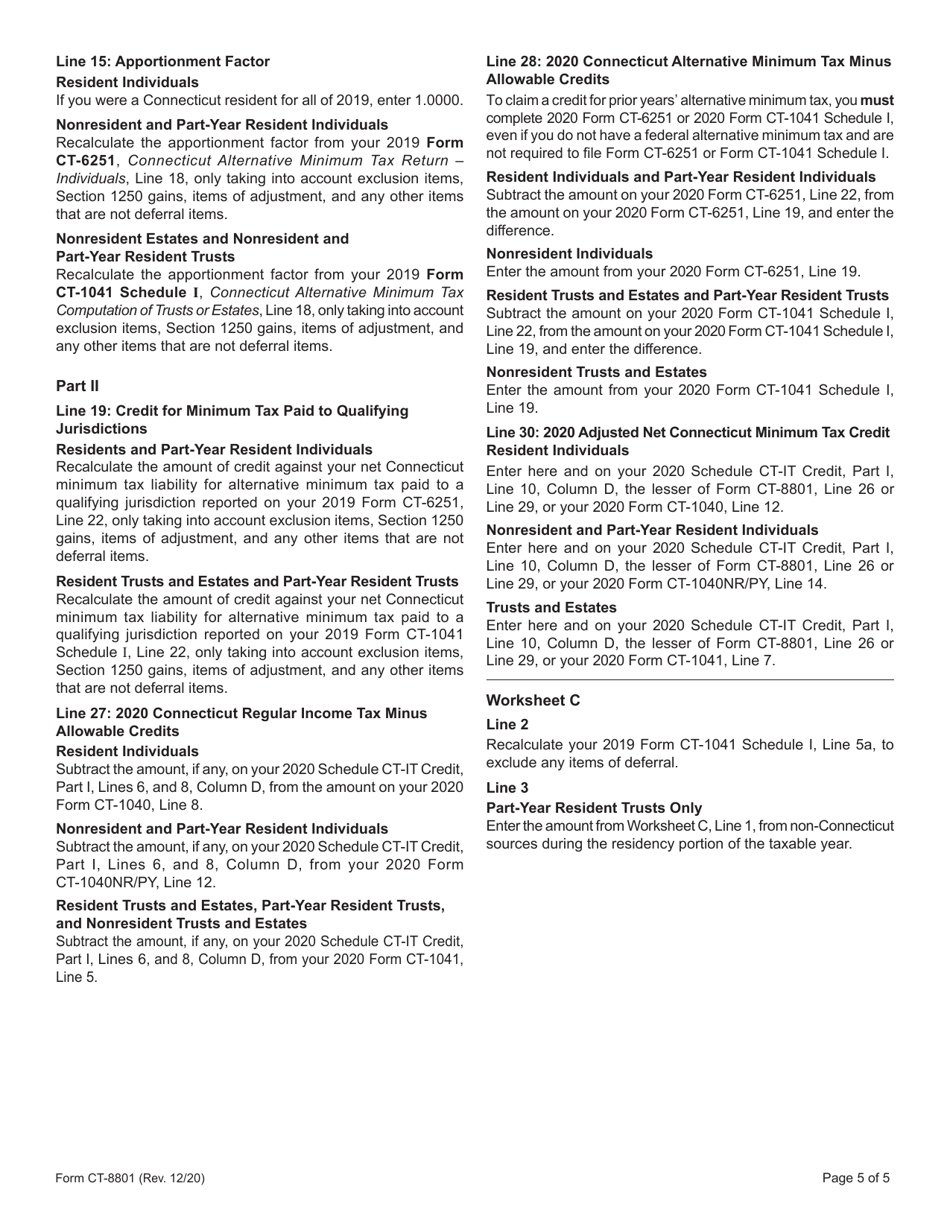

Form CT-8801

for the current year.

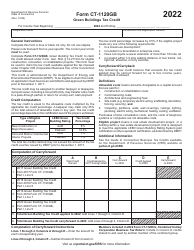

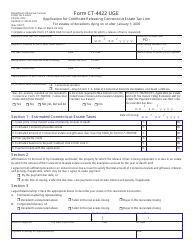

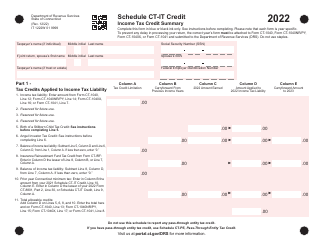

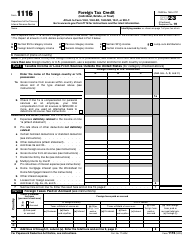

Form CT-8801 Credit for Prior Year Connecticut Minimum Tax for Individuals, Trusts, and Estates - Connecticut

What Is Form CT-8801?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-8801?

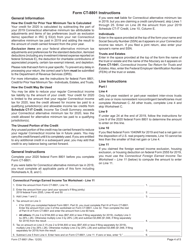

A: Form CT-8801 is used to calculate the credit for prior year Connecticut minimum tax for individuals, trusts, and estates.

Q: Who needs to file Form CT-8801?

A: Individuals, trusts, and estates that paid Connecticut minimum tax in a prior year may need to file Form CT-8801.

Q: What is the purpose of Form CT-8801?

A: The purpose of Form CT-8801 is to calculate the credit for prior year Connecticut minimum tax that can be used to reduce the current year's Connecticut income tax liability.

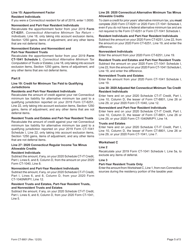

Q: How do I fill out Form CT-8801?

A: You will need to provide information about your Connecticut minimum tax liability from the prior year and calculate the credit using the instructions provided with the form.

Q: Is Form CT-8801 only for residents of Connecticut?

A: No, Form CT-8801 may also need to be filed by non-residents or part-year residents of Connecticut who paid Connecticut minimum tax in a prior year.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8801 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.