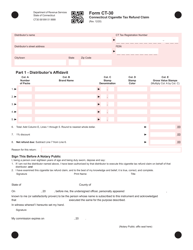

This version of the form is not currently in use and is provided for reference only. Download this version of

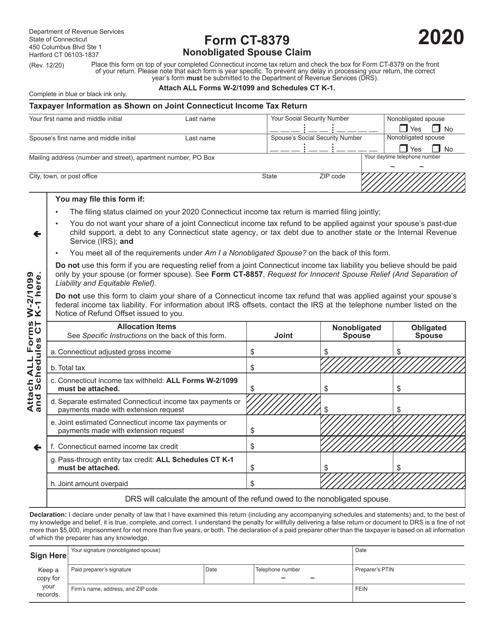

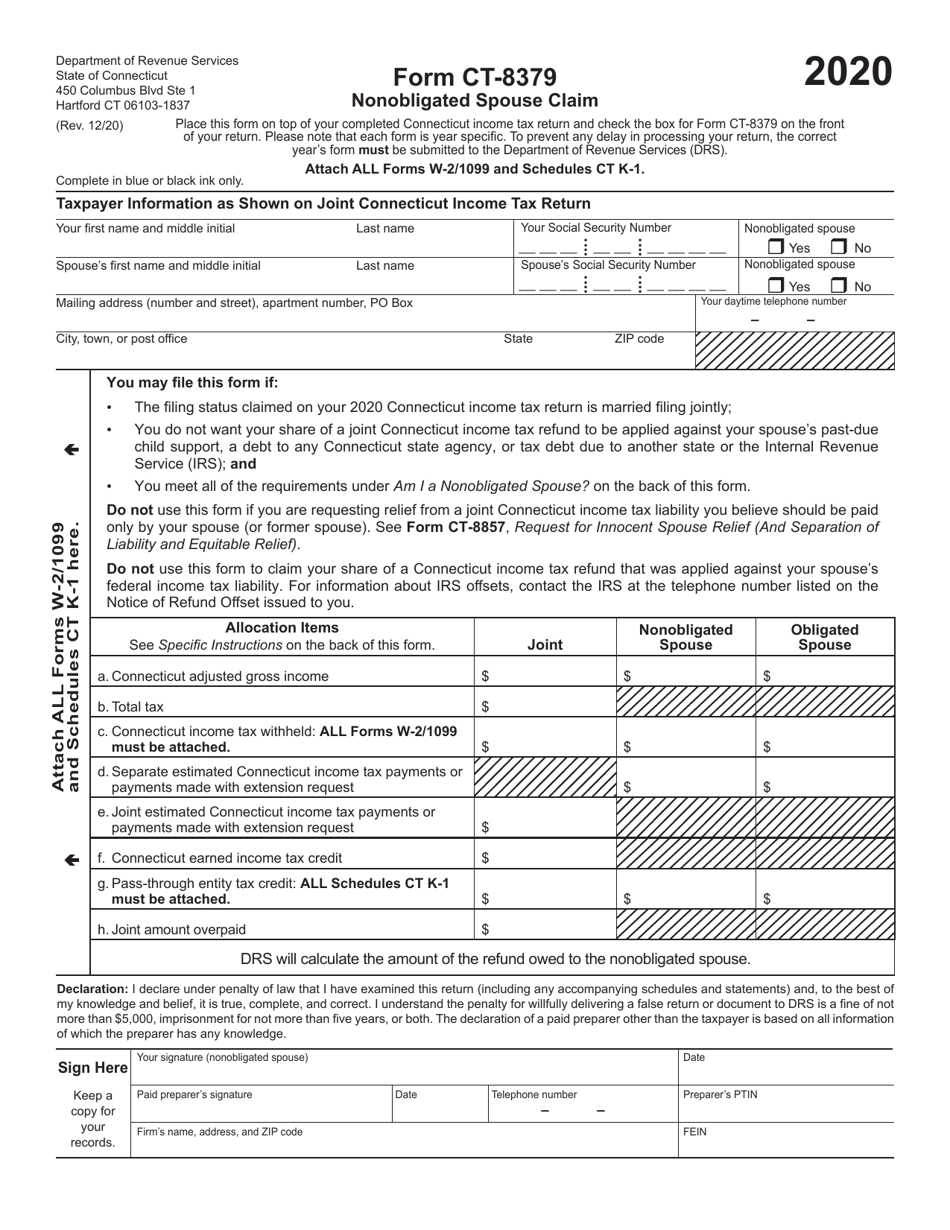

Form CT-8379

for the current year.

Form CT-8379 Nonobligated Spouse Claim - Connecticut

What Is Form CT-8379?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

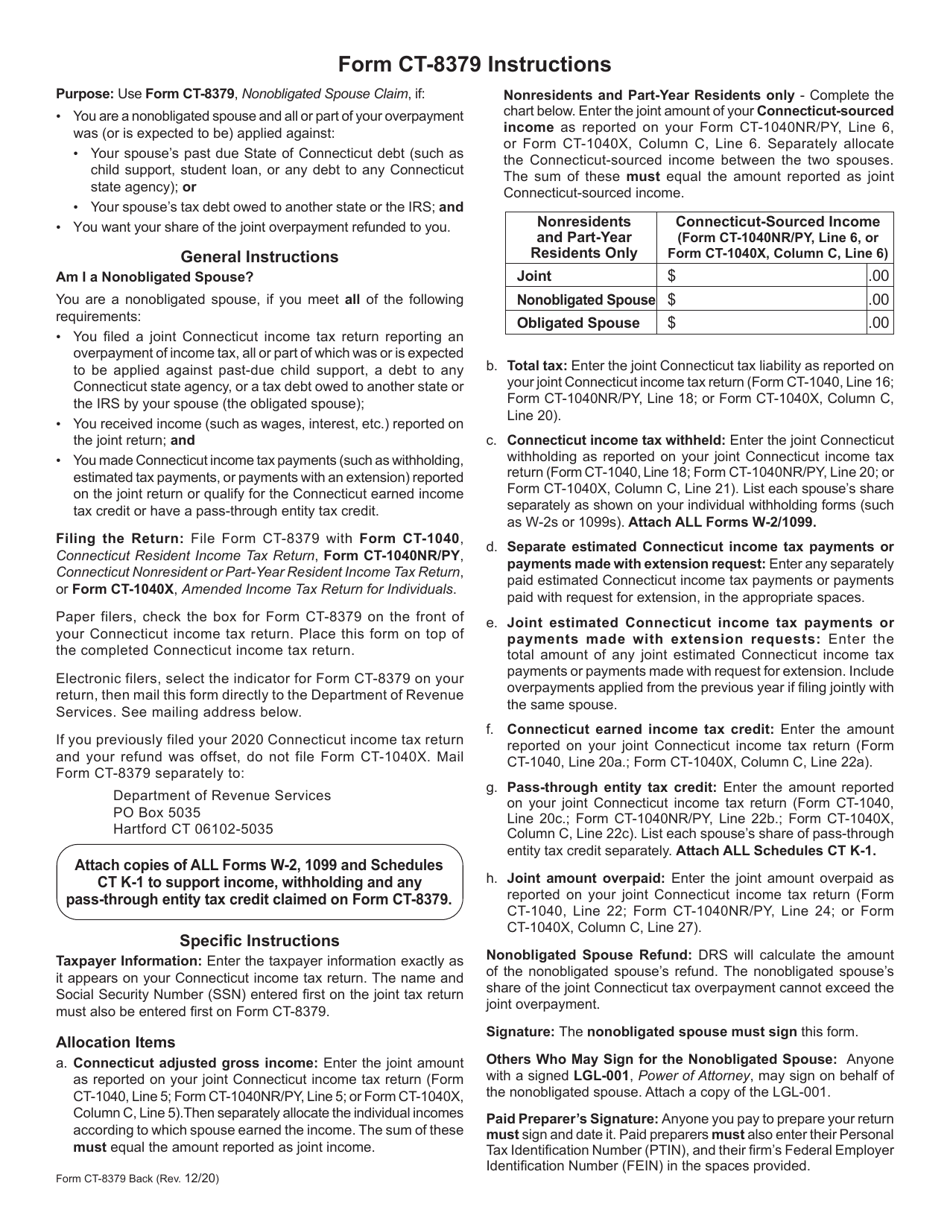

Q: What is Form CT-8379?

A: Form CT-8379 is a tax form used by nonobligated spouses in Connecticut to claim their share of a joint tax refund.

Q: Who can use Form CT-8379?

A: Nonobligated spouses in Connecticut who want to claim their portion of a joint tax refund can use Form CT-8379.

Q: What does 'nonobligated spouse' mean?

A: A nonobligated spouse is someone who is not responsible for the debt or liability that resulted in an offset of their joint tax refund.

Q: What information is needed to complete Form CT-8379?

A: To complete Form CT-8379, you will need your personal information, including your name, social security number, and address, as well as information about your spouse and details about the joint tax refund.

Q: Is there a deadline for filing Form CT-8379?

A: Yes, Form CT-8379 must be filed within 3 years from the due date of the original return or 2 years from the date the tax was paid, whichever is later.

Q: Can I claim a refund if my spouse has outstanding debts?

A: Yes, if you are a nonobligated spouse, you can claim your share of a joint tax refund even if your spouse has outstanding debts.

Q: Can I file Form CT-8379 if I am divorced or separated?

A: Yes, even if you are divorced or separated, you can file Form CT-8379 to claim your share of a joint tax refund if you meet the criteria of a nonobligated spouse.

Q: Is there a fee to file Form CT-8379?

A: No, there is no fee to file Form CT-8379.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8379 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.