This version of the form is not currently in use and is provided for reference only. Download this version of

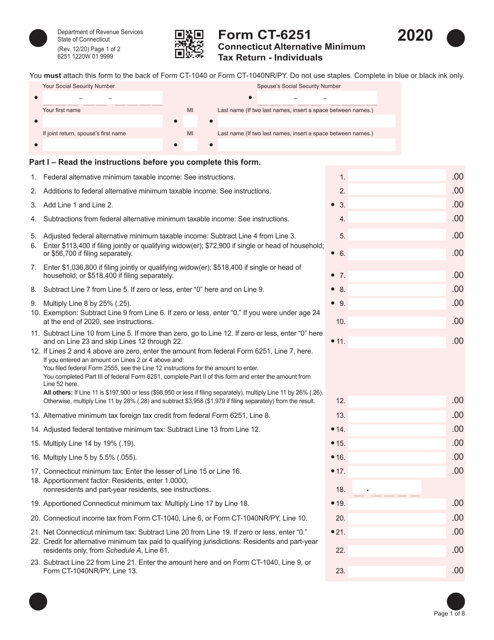

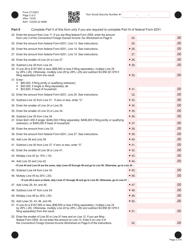

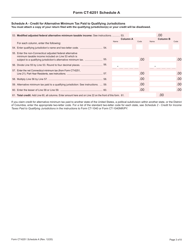

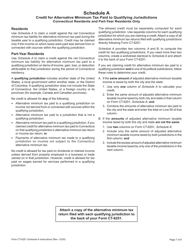

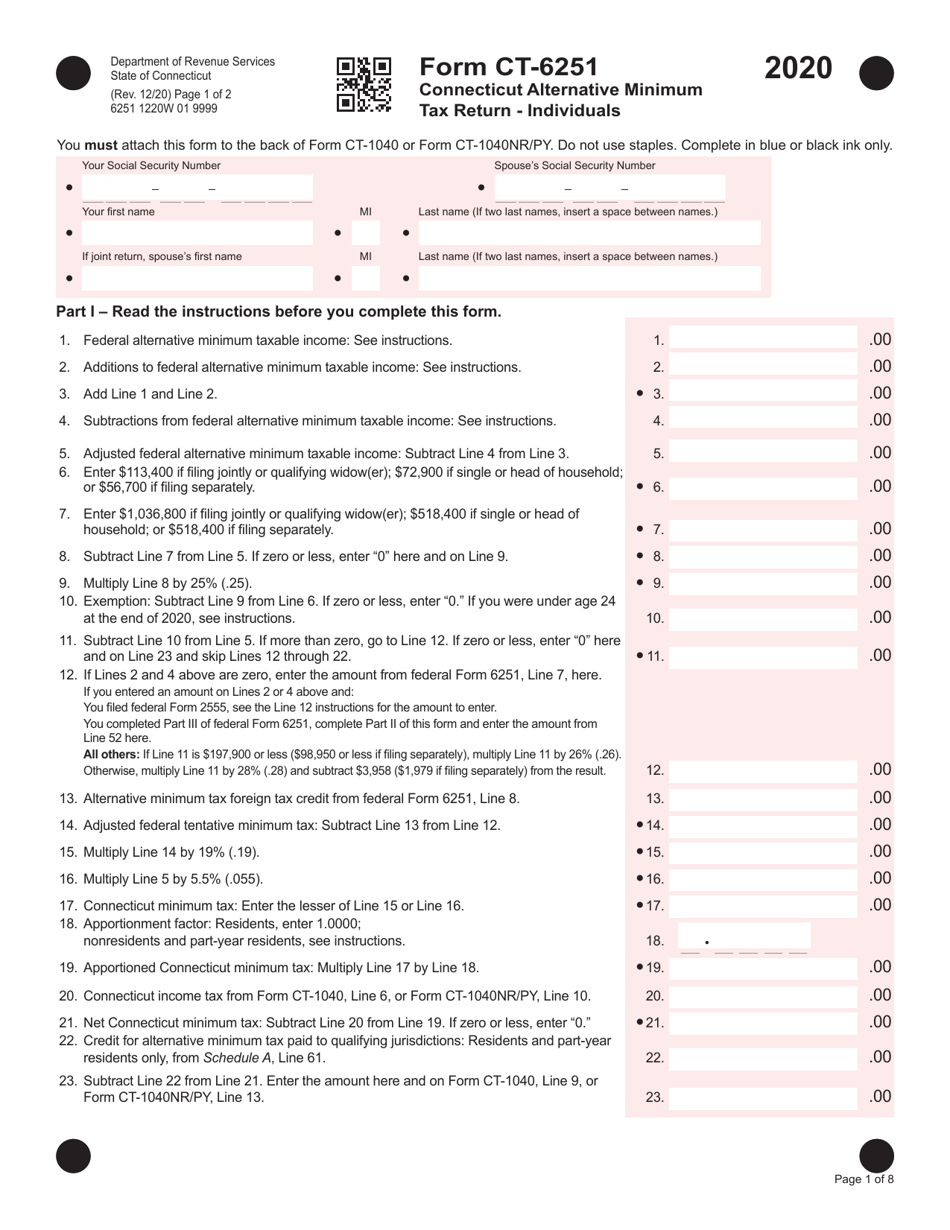

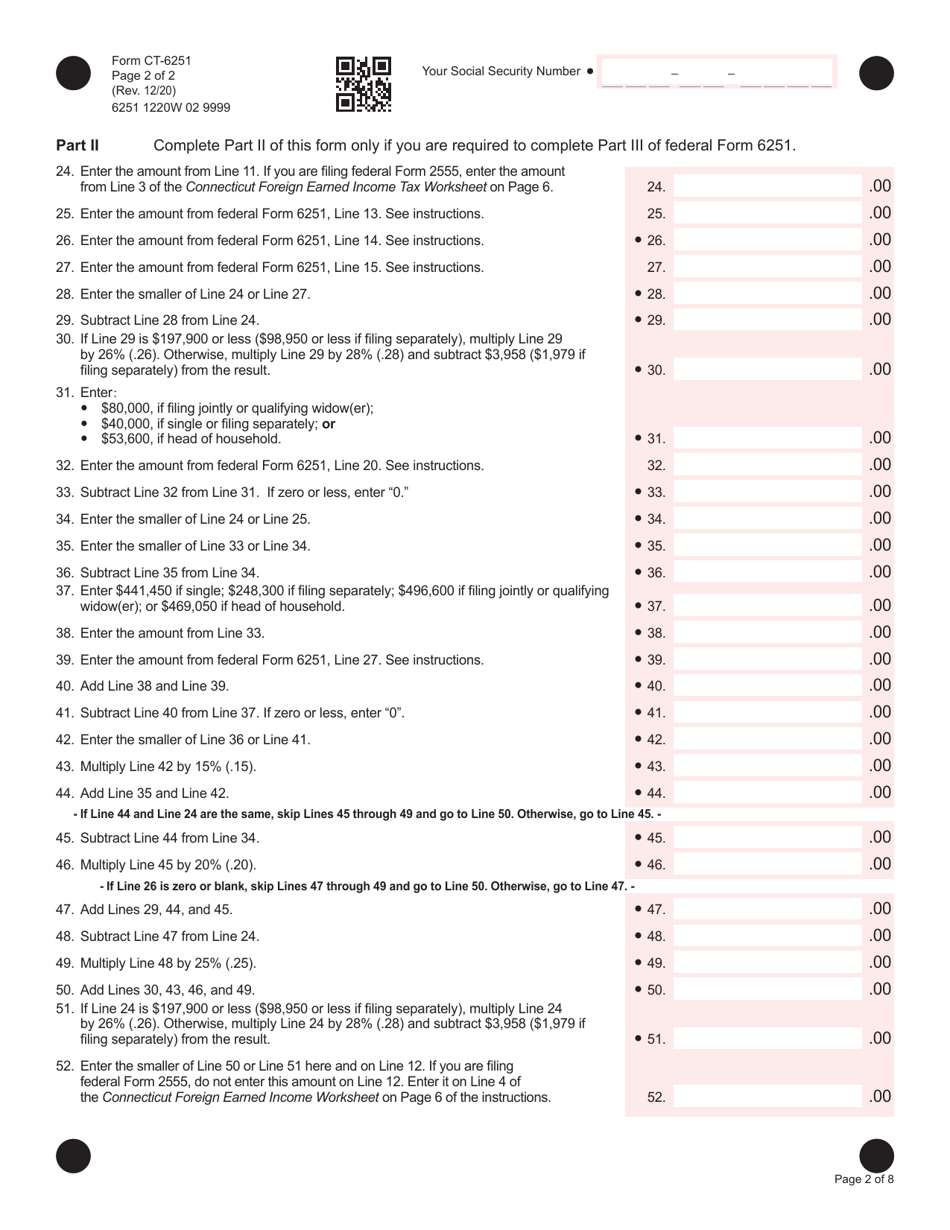

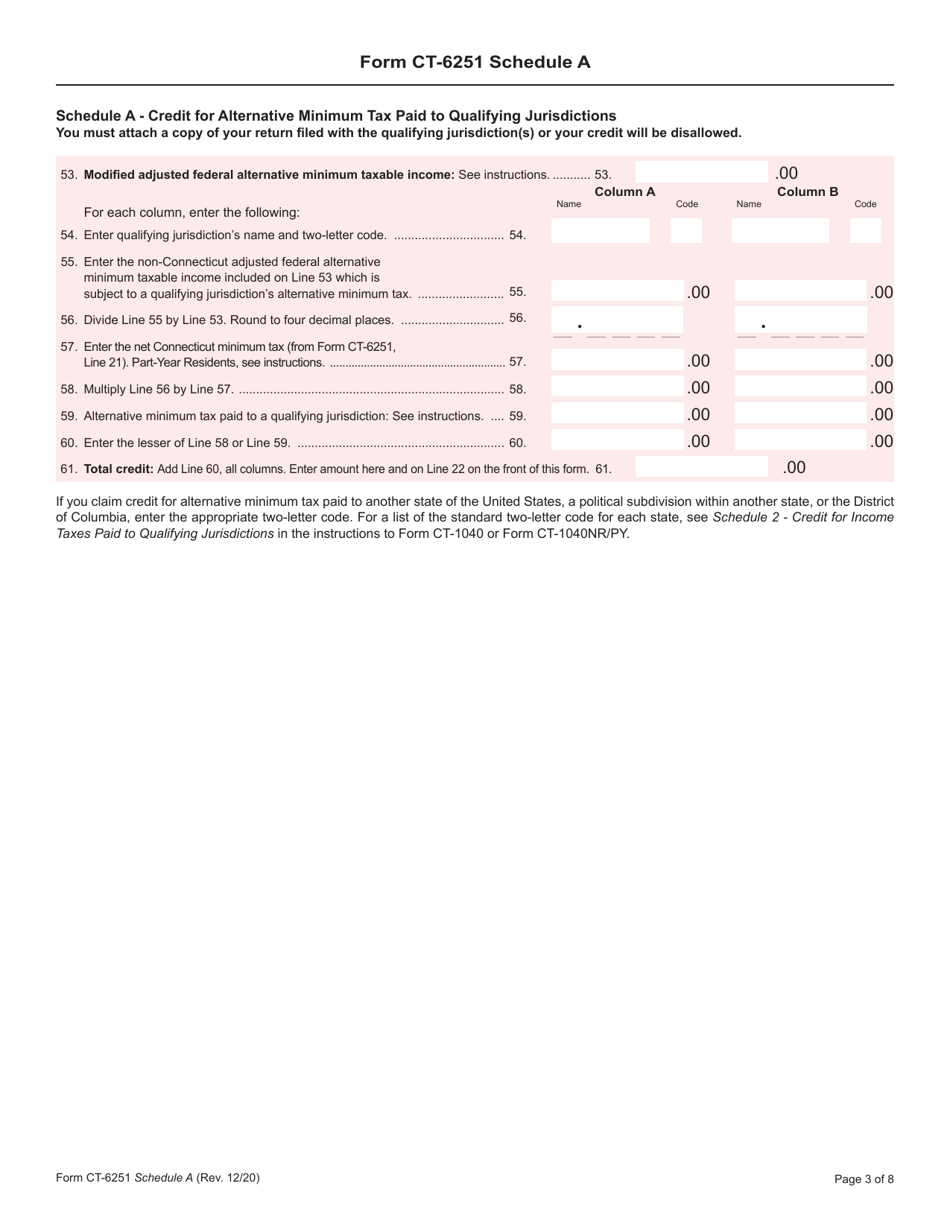

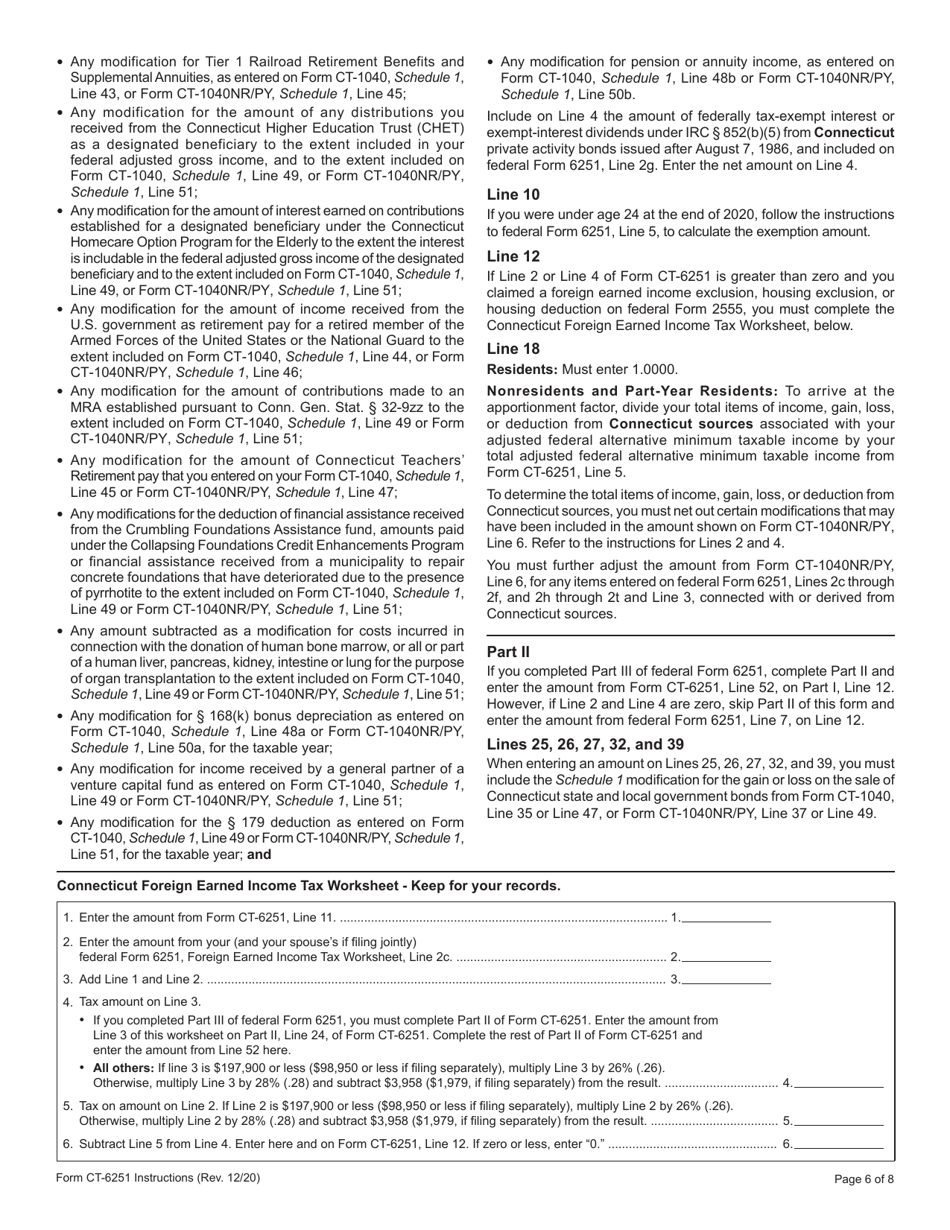

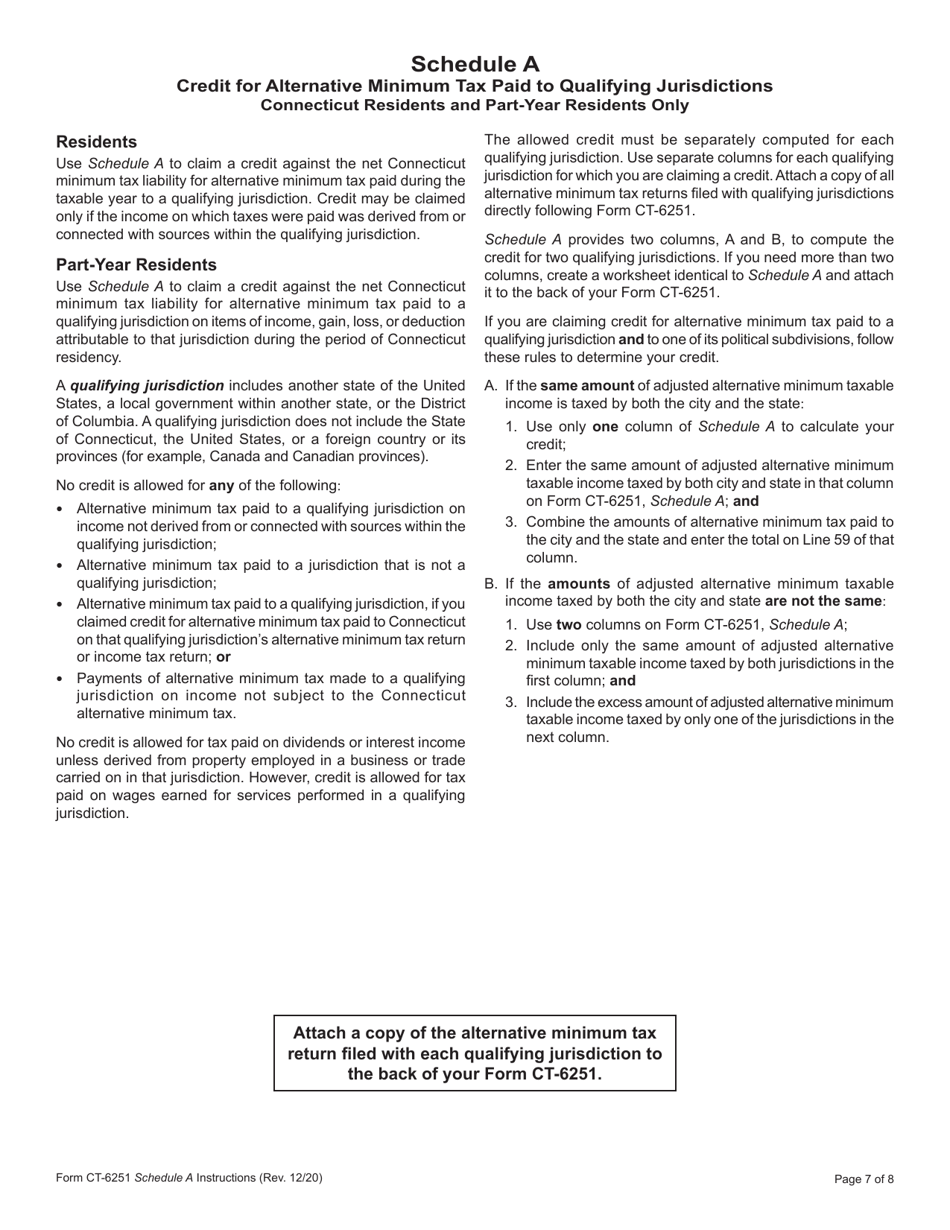

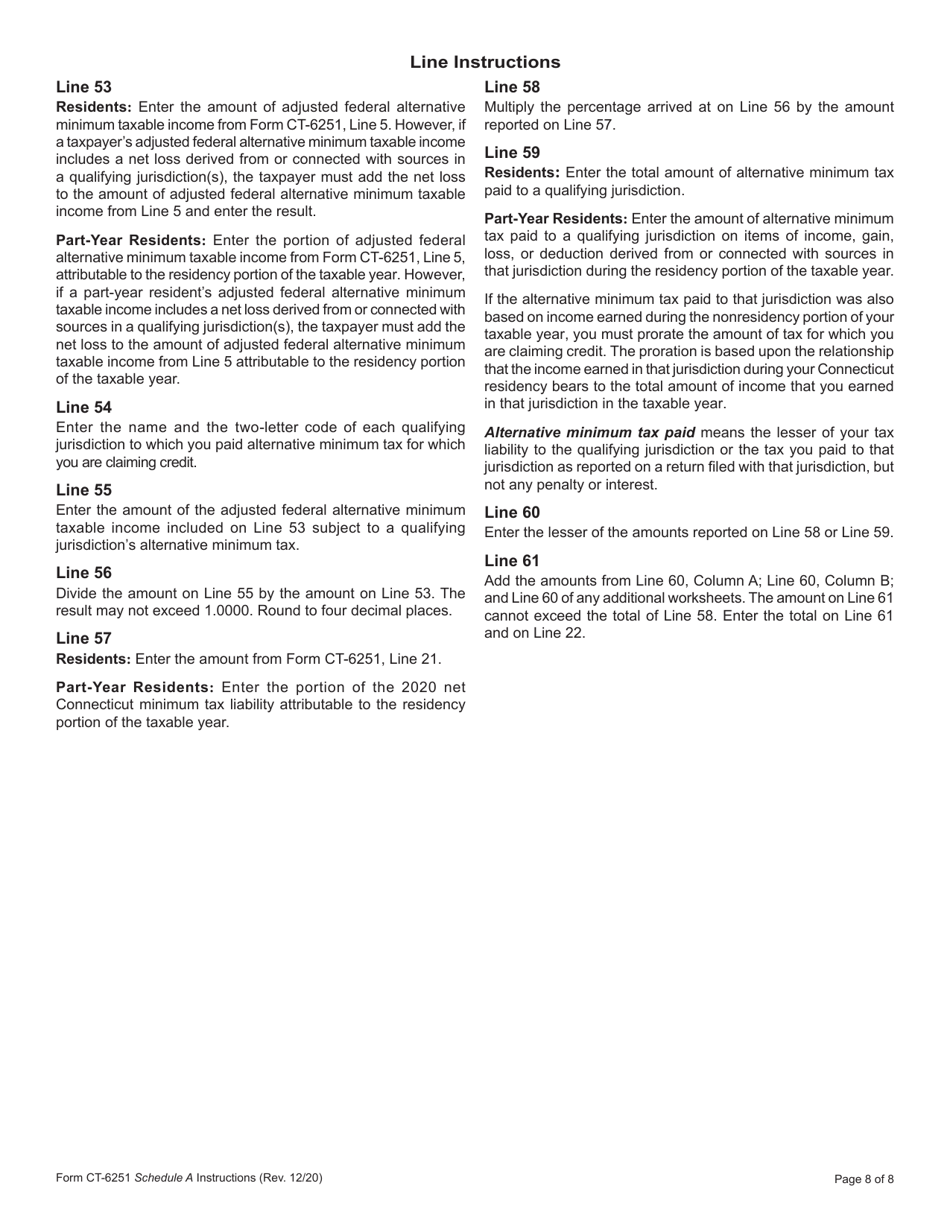

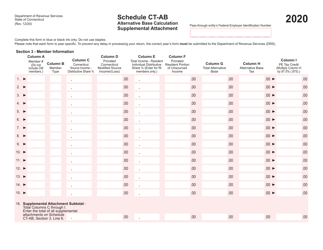

Form CT-6251

for the current year.

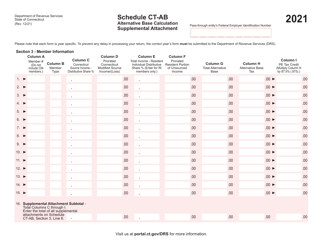

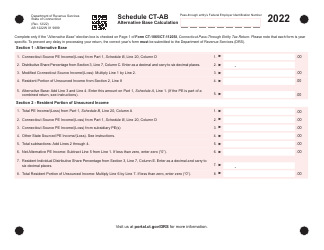

Form CT-6251 Connecticut Alternative Minimum Tax Return - Individuals - Connecticut

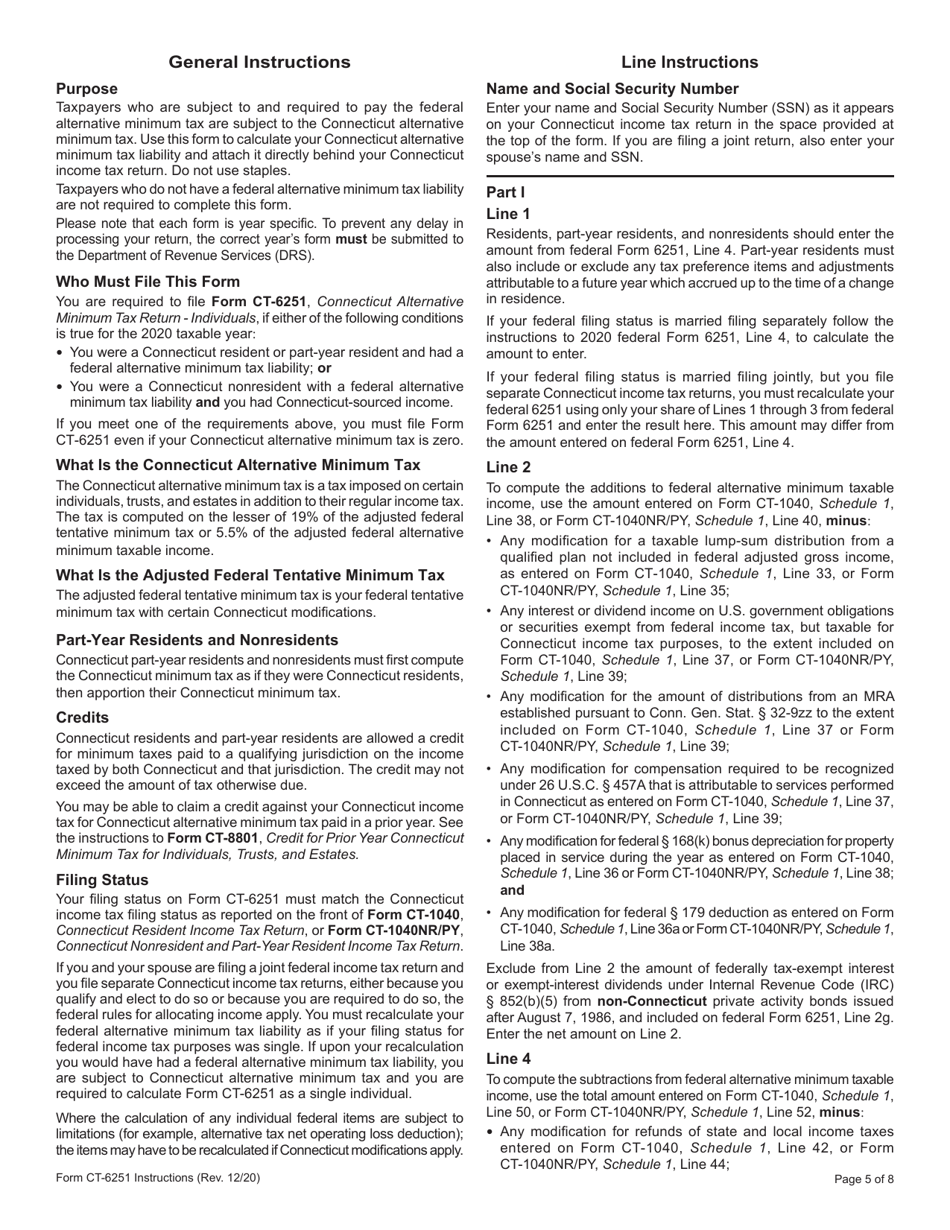

What Is Form CT-6251?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-6251?

A: Form CT-6251 is the Connecticut Alternative Minimum Tax Return for individuals.

Q: Who needs to file Form CT-6251?

A: Individuals who are subject to the Connecticut Alternative Minimum Tax (AMT) are required to file Form CT-6251.

Q: What is the Connecticut Alternative Minimum Tax?

A: The Connecticut Alternative Minimum Tax is a separate tax calculation that limits certain deductions and credits to ensure that taxpayers pay a minimum amount of tax.

Q: When is the deadline to file Form CT-6251?

A: The deadline to file Form CT-6251 is the same as the deadline for filing your Connecticut income tax return, which is usually April 15th.

Q: What should I do if I can't pay the Connecticut Alternative Minimum Tax?

A: If you are unable to pay the Connecticut Alternative Minimum Tax, you should contact the Connecticut Department of Revenue Services to discuss payment options and potential alternatives.

Q: Are there any exemptions or deductions available for the Connecticut Alternative Minimum Tax?

A: No, the Connecticut Alternative Minimum Tax does not offer any exemptions or deductions.

Q: Is Form CT-6251 the same as the federal Alternative Minimum Tax?

A: No, Form CT-6251 is specific to Connecticut and should not be confused with the federal Alternative Minimum Tax.

Q: Can I e-file Form CT-6251?

A: Yes, you can e-file Form CT-6251 using approved tax software or through a tax professional.

Q: What penalties may apply if I fail to file or pay the Connecticut Alternative Minimum Tax?

A: The Connecticut Department of Revenue Services may impose penalties for failure to file or pay the Connecticut Alternative Minimum Tax, including interest charges and potential legal action.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-6251 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.