This version of the form is not currently in use and is provided for reference only. Download this version of

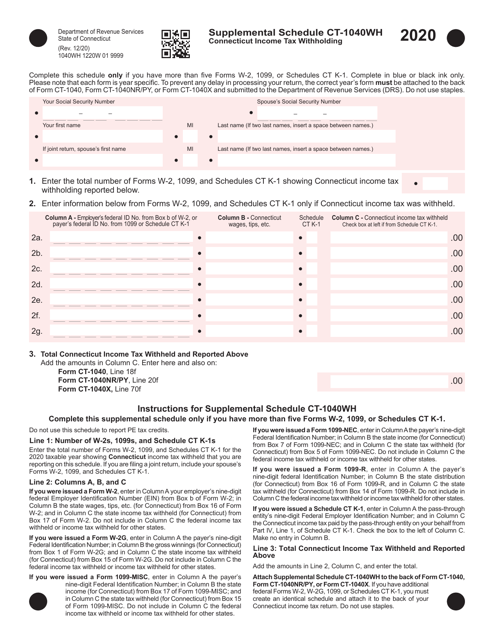

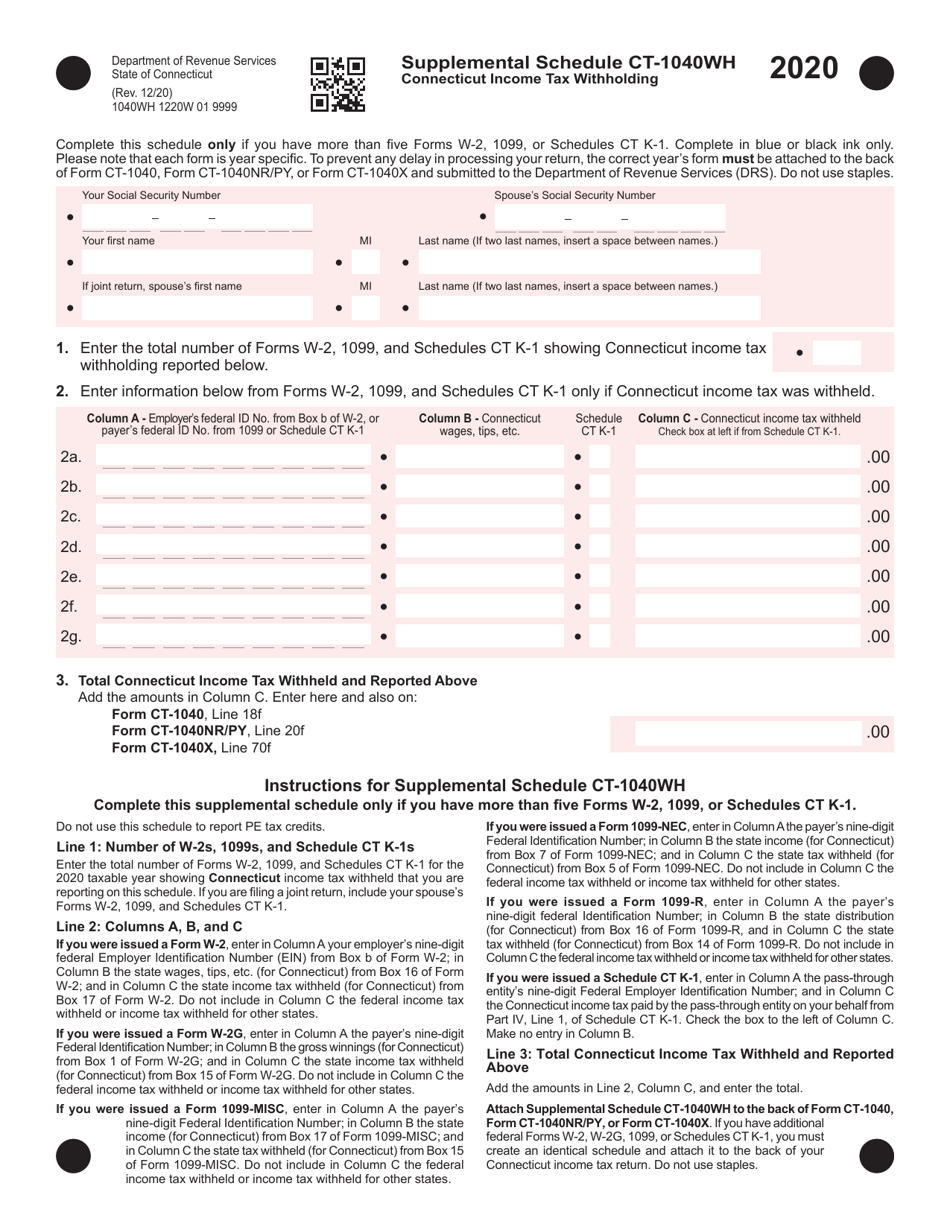

Schedule CT-1040WH

for the current year.

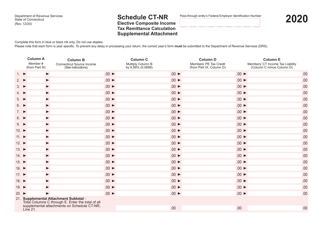

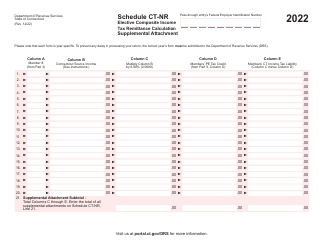

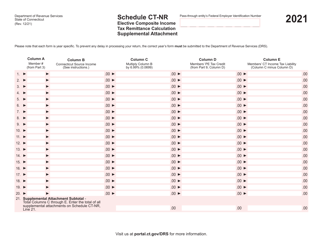

Schedule CT-1040WH Connecticut Income Tax Withholding Supplemental Schedule - Connecticut

What Is Schedule CT-1040WH?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule CT-1040WH?

A: Schedule CT-1040WH is the Connecticut Income Tax WithholdingSupplemental Schedule.

Q: What is the purpose of Schedule CT-1040WH?

A: The purpose of Schedule CT-1040WH is to calculate and report any additional income tax withholding that needs to be paid to the state of Connecticut.

Q: Who needs to fill out Schedule CT-1040WH?

A: Individuals who have additional income tax withholding to report in Connecticut may need to fill out Schedule CT-1040WH.

Q: How do I fill out Schedule CT-1040WH?

A: To fill out Schedule CT-1040WH, you'll need to calculate the additional income tax withholding based on your income and complete the necessary fields on the form.

Q: Is Schedule CT-1040WH required for all Connecticut residents?

A: No, Schedule CT-1040WH is only required for individuals who have additional income tax withholding to report in Connecticut.

Q: When is Schedule CT-1040WH due?

A: The due date for Schedule CT-1040WH typically coincides with the due date for the Connecticut income tax return, which is generally April 15th.

Q: What if I don't file Schedule CT-1040WH when required?

A: If you don't file Schedule CT-1040WH when required, you may be subject to penalties and interest on the additional income tax withholding owed.

Q: Can I e-file Schedule CT-1040WH?

A: Yes, you can e-file Schedule CT-1040WH if you are filing your Connecticut state income tax return electronically.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-1040WH by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.