This version of the form is not currently in use and is provided for reference only. Download this version of

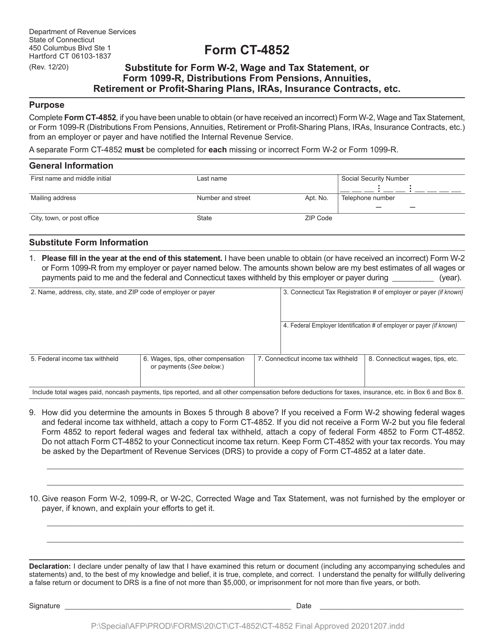

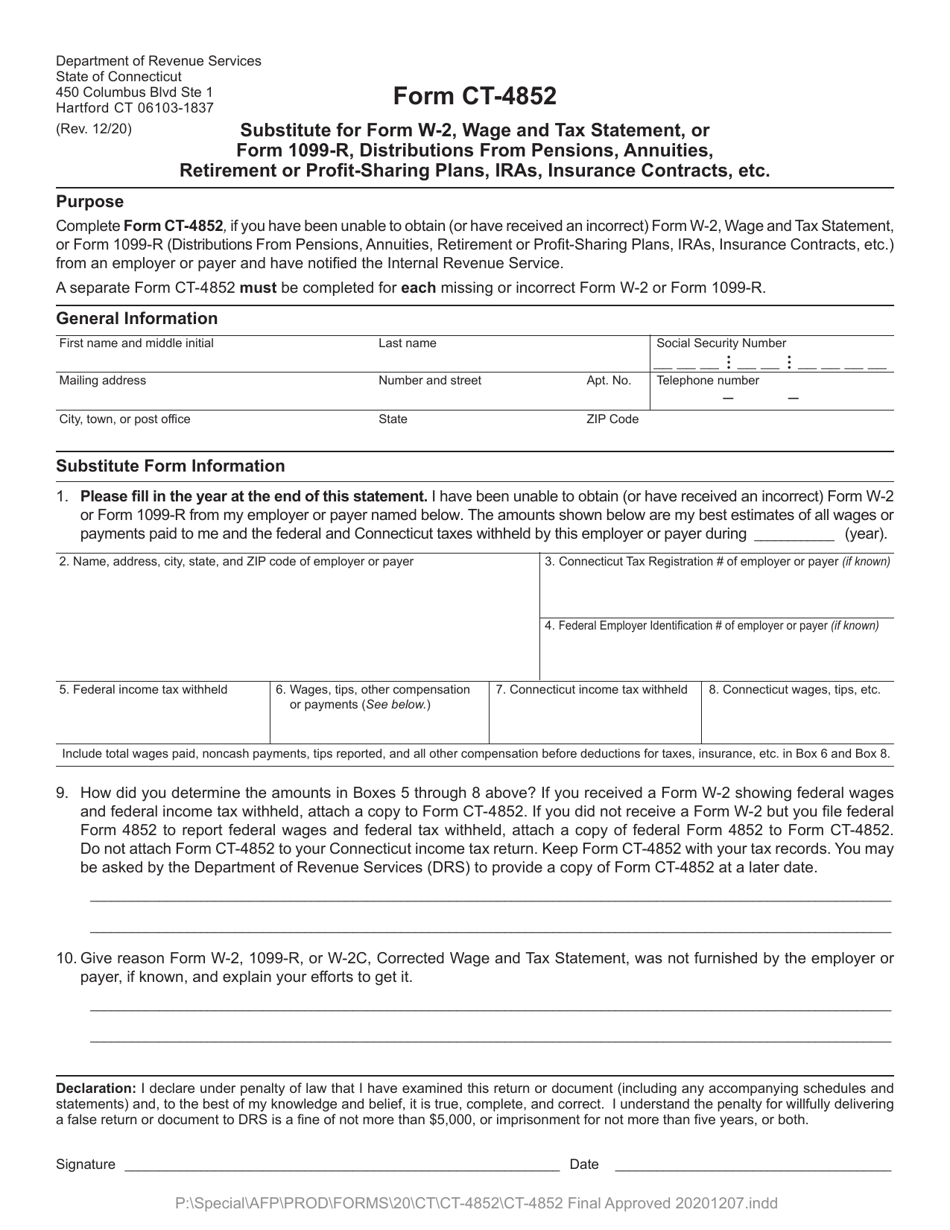

Form CT-4852

for the current year.

Form CT-4852 Substitute for Form W-2, Wage and Tax Statement, or Form 1099-r, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc. - Connecticut

What Is Form CT-4852?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-4852?

A: Form CT-4852 is a substitute form for Form W-2 or Form 1099-R.

Q: When is Form CT-4852 used?

A: Form CT-4852 is used when you need to report wage and tax information if you didn't receive a Form W-2 or Form 1099-R.

Q: What types of income does Form CT-4852 cover?

A: Form CT-4852 covers income from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and more.

Q: Who needs to file Form CT-4852?

A: You need to file Form CT-4852 if you didn't receive a Form W-2 or Form 1099-R and need to report your income.

Q: Can I use Form CT-4852 for federal taxes?

A: No, Form CT-4852 is specific to the state of Connecticut and cannot be used for federal tax purposes.

Q: Is there a deadline for filing Form CT-4852?

A: Yes, the deadline for filing Form CT-4852 is the same as the deadline for filing your Connecticut state income tax return.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-4852 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.