This version of the form is not currently in use and is provided for reference only. Download this version of

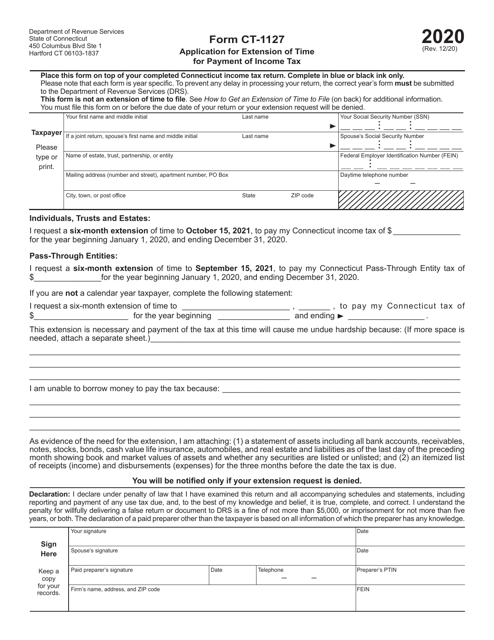

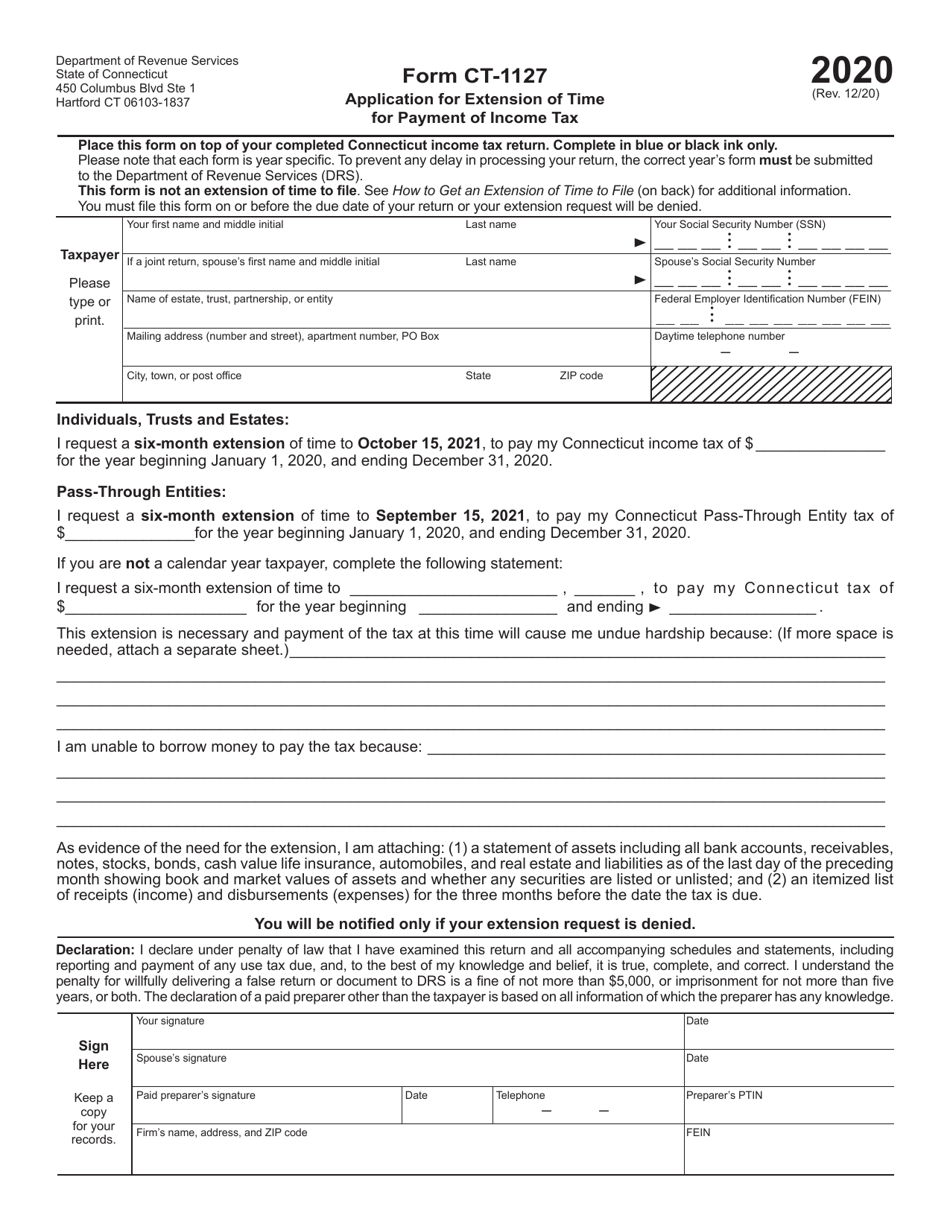

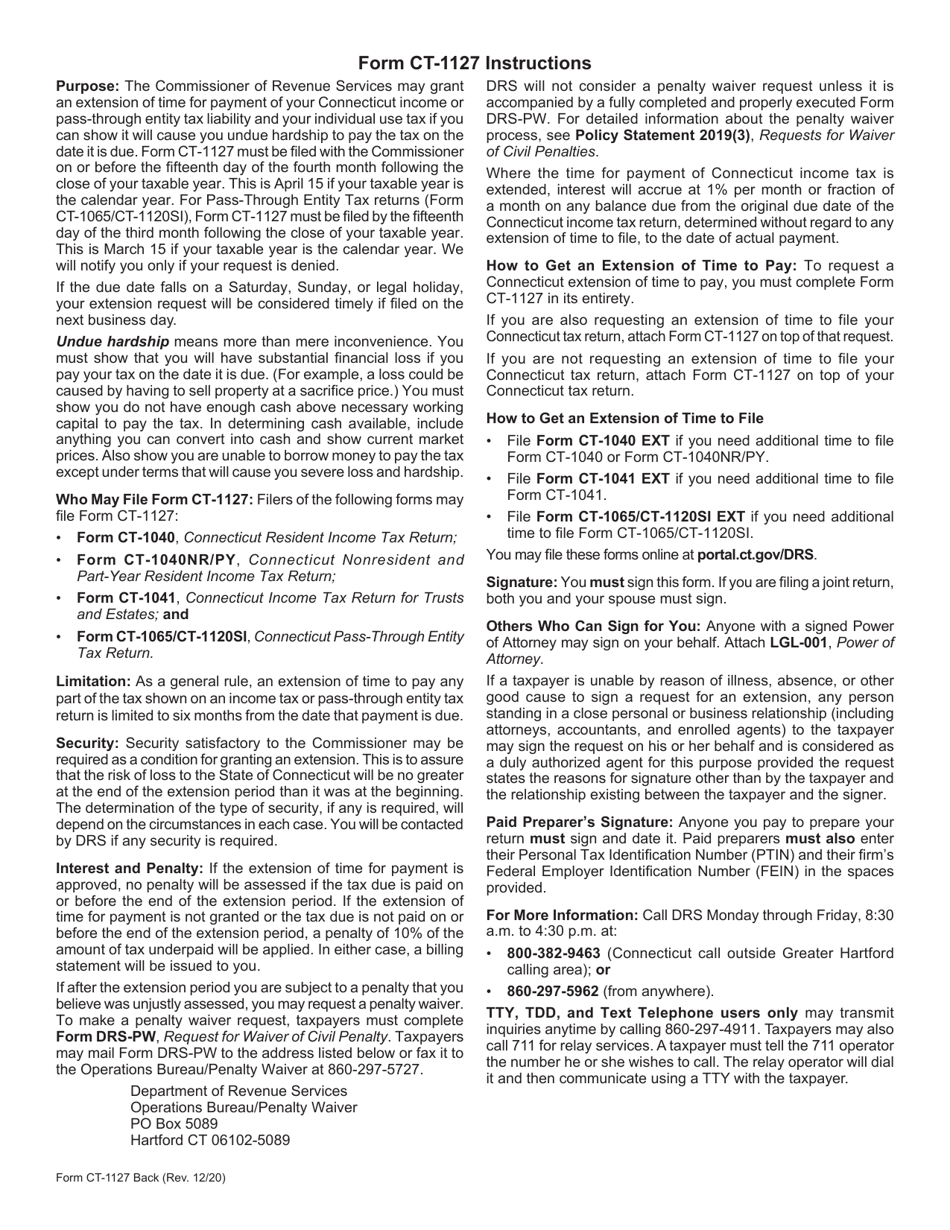

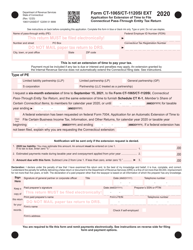

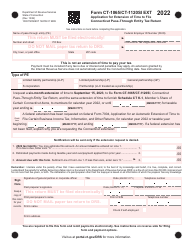

Form CT-1127

for the current year.

Form CT-1127 Application for Extension of Time for Payment of Income Tax - Connecticut

What Is Form CT-1127?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1127?

A: Form CT-1127 is the application for extension of time for payment of income tax in Connecticut.

Q: When should I use Form CT-1127?

A: You should use Form CT-1127 if you need additional time to pay your income tax in Connecticut.

Q: What is the deadline for filing Form CT-1127?

A: Form CT-1127 must be filed on or before the original due date of your income tax return in Connecticut.

Q: Is there a fee for filing Form CT-1127?

A: No, there is no fee for filing Form CT-1127.

Q: Can I still file Form CT-1127 if I have already filed my income tax return?

A: Yes, you can still file Form CT-1127 even if you have already filed your income tax return in Connecticut.

Q: Will filing Form CT-1127 automatically grant me an extension to file my income tax return?

A: No, filing Form CT-1127 only grants an extension of time to pay your income tax, not an extension to file your income tax return.

Q: Will I incur penalties or interest if I file Form CT-1127?

A: You may still incur penalties and interest on the amount of tax you owe if you file Form CT-1127.

Q: How long does the extension granted by Form CT-1127 last?

A: The extension granted by Form CT-1127 is generally for six months from the original due date of your income tax return in Connecticut.

Q: Can I request an additional extension of time to pay my income tax?

A: No, you cannot request an additional extension of time to pay your income tax beyond the six-month extension granted by Form CT-1127.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1127 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.