This version of the form is not currently in use and is provided for reference only. Download this version of

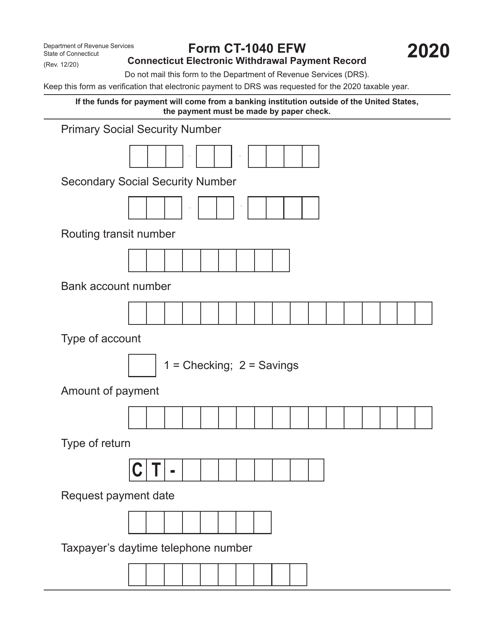

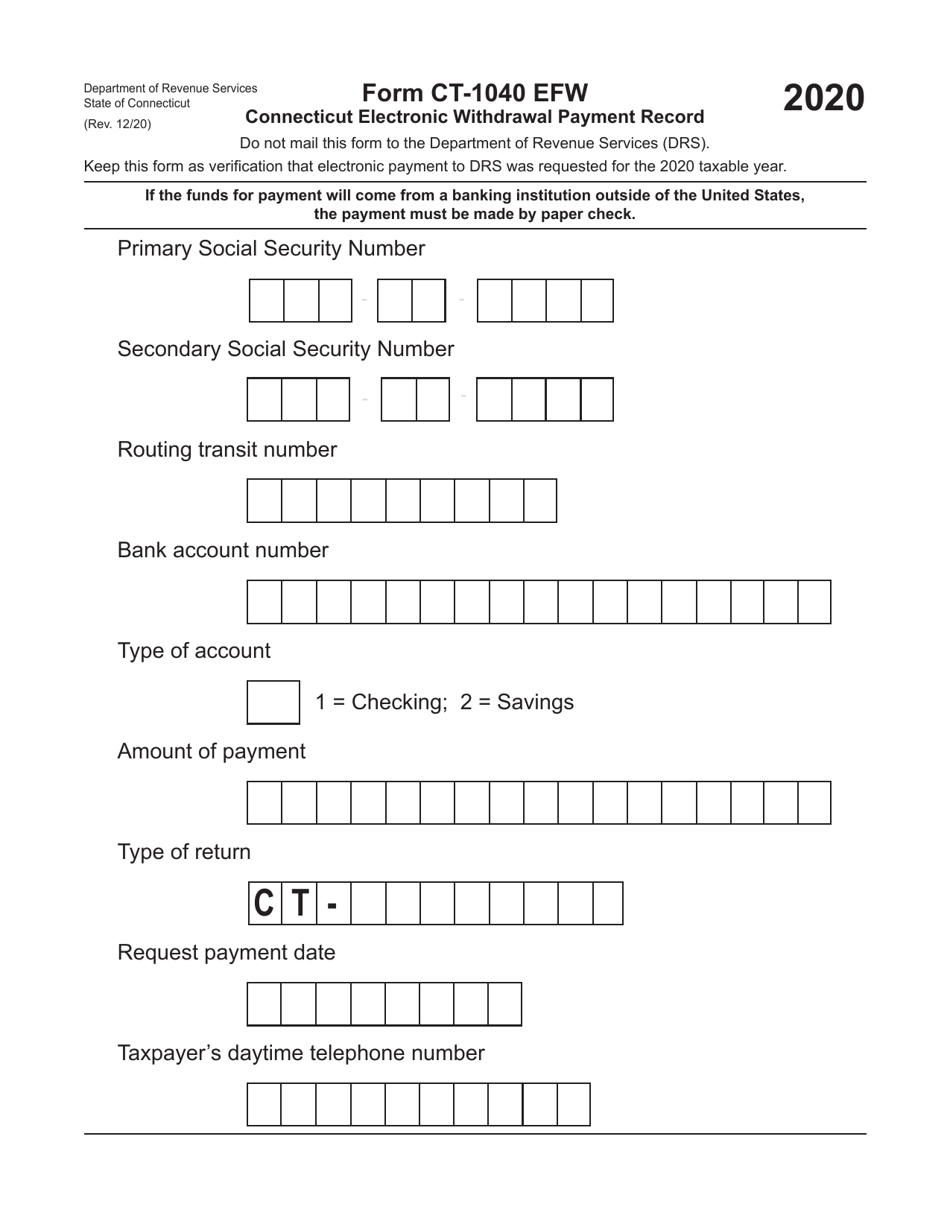

Form CT-1040 EFW

for the current year.

Form CT-1040 EFW Connecticut Electronic Withdrawal Payment Record - Connecticut

What Is Form CT-1040 EFW?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040 EFW?

A: Form CT-1040 EFW is the Connecticut Electronic Withdrawal Payment Record.

Q: What is the purpose of Form CT-1040 EFW?

A: The purpose of Form CT-1040 EFW is to record electronic withdrawal payments for Connecticut taxes.

Q: Who needs to use Form CT-1040 EFW?

A: Connecticut residents who are making electronic withdrawal payments for their state taxes need to use Form CT-1040 EFW.

Q: Can I use Form CT-1040 EFW for federal tax payments?

A: No, Form CT-1040 EFW is specifically for Connecticut tax payments.

Q: What information is required on Form CT-1040 EFW?

A: Form CT-1040 EFW requires information such as the taxpayer's name, taxpayer identification number, payment amount, and bank account information.

Q: When is the deadline to submit Form CT-1040 EFW?

A: The deadline to submit Form CT-1040 EFW depends on the tax year. Check the instructions for the specific due date.

Q: Are there any fees associated with electronic withdrawal payments?

A: No, there are no additional fees for using electronic withdrawal payments.

Q: Can I use Form CT-1040 EFW if I am getting a refund?

A: No, Form CT-1040 EFW is for making payments only. If you are expecting a refund, you do not need to use this form.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040 EFW by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.