This version of the form is not currently in use and is provided for reference only. Download this version of

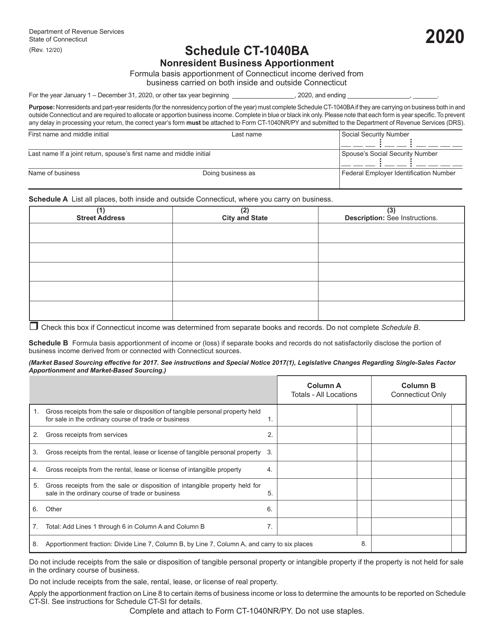

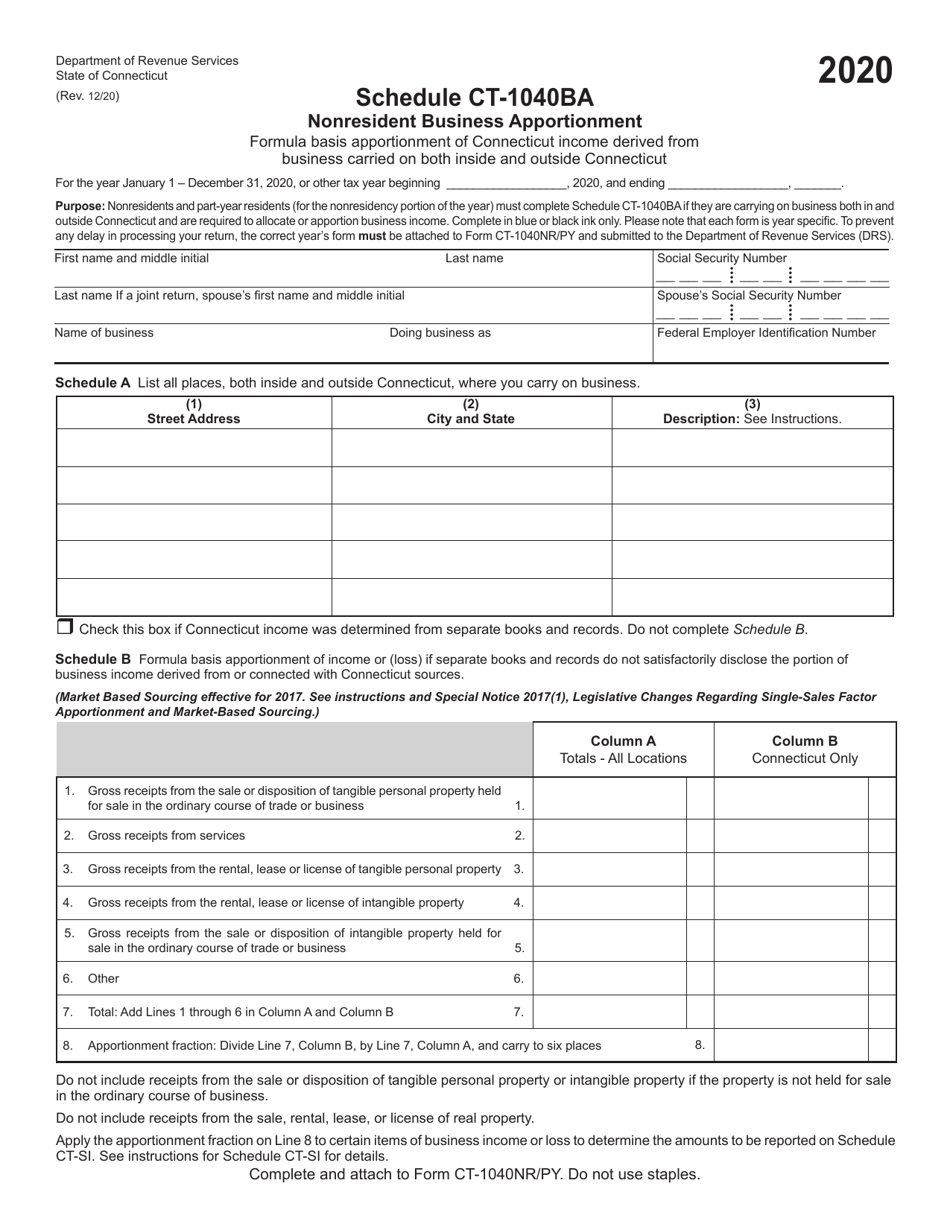

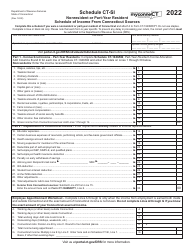

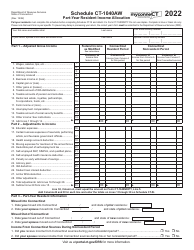

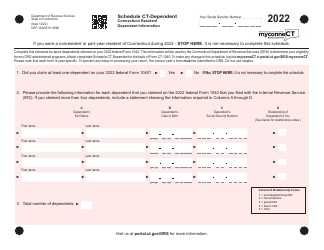

Schedule CT-1040BA

for the current year.

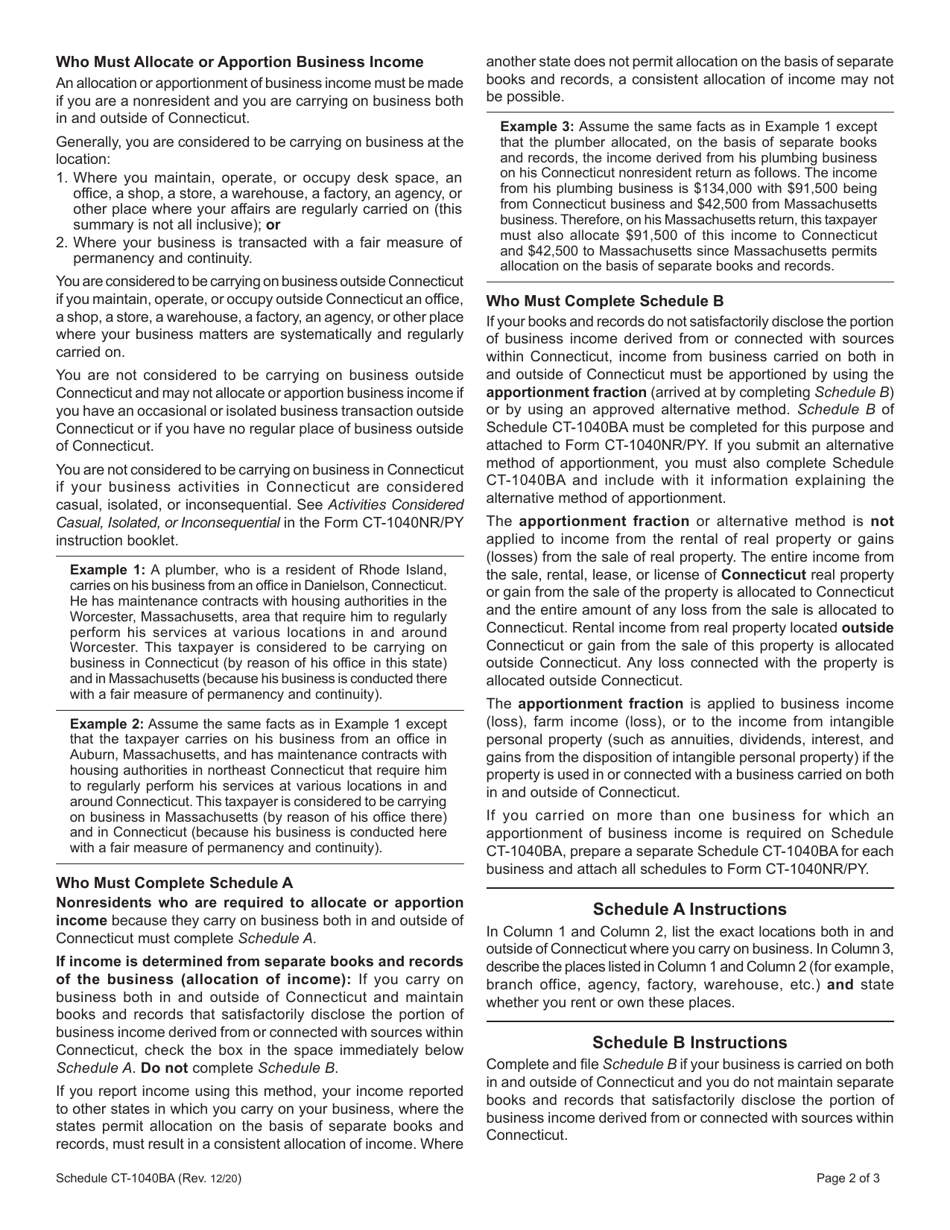

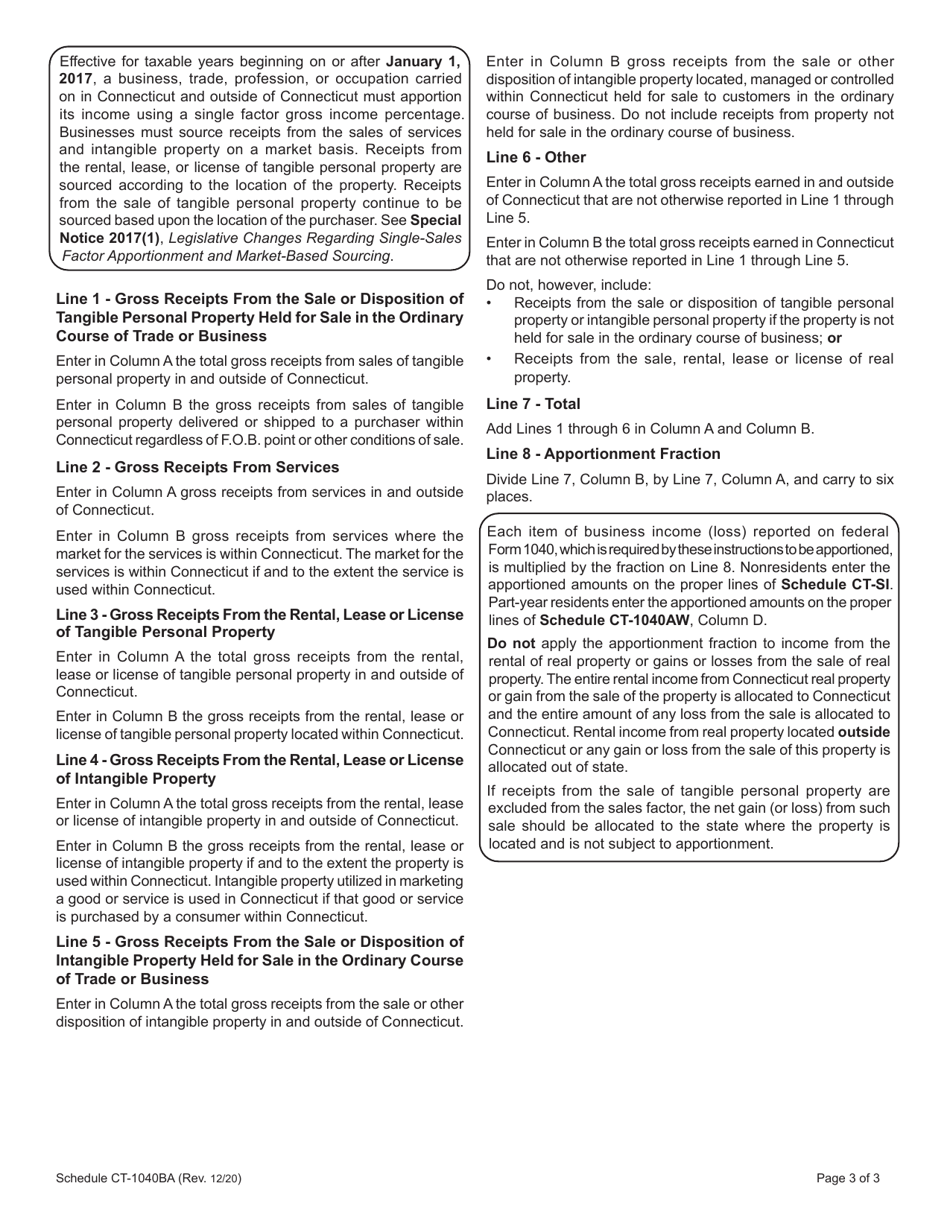

Schedule CT-1040BA Nonresident Business Apportionment - Connecticut

What Is Schedule CT-1040BA?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CT-1040BA?

A: CT-1040BA is a schedule used to calculate nonresident business apportionment in Connecticut.

Q: Who needs to file CT-1040BA?

A: Nonresident individuals or businesses engaged in business activities in Connecticut need to file CT-1040BA.

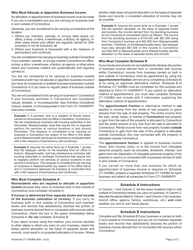

Q: What is nonresident business apportionment?

A: Nonresident business apportionment is the allocation of business income between the state where the business is located and Connecticut.

Q: Why is CT-1040BA important?

A: CT-1040BA is important for nonresident businesses to accurately calculate and report their income allocated to Connecticut.

Q: When is the deadline to file CT-1040BA?

A: The deadline to file CT-1040BA is the same as the Connecticut income tax return deadline, which is usually April 15th.

Q: How do I fill out CT-1040BA?

A: You need to provide information about your business activities in Connecticut, such as sales, property, and payroll, and use the provided formulas to calculate the apportionment percentage.

Q: Can I e-file CT-1040BA?

A: Yes, you can e-file CT-1040BA using approved tax software or through a tax professional.

Q: Are there penalties for not filing CT-1040BA?

A: Yes, there can be penalties for not filing CT-1040BA or filing it incorrectly. It is important to comply with Connecticut tax laws.

Q: Is CT-1040BA only for nonresidents?

A: Yes, CT-1040BA is specifically for nonresident individuals or businesses conducting business in Connecticut.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-1040BA by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.