This version of the form is not currently in use and is provided for reference only. Download this version of

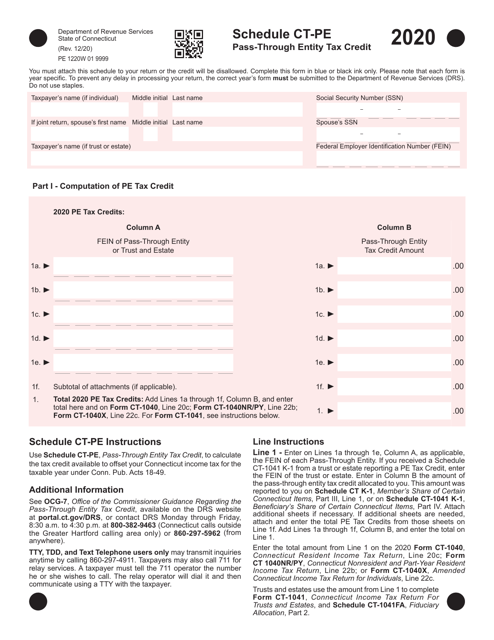

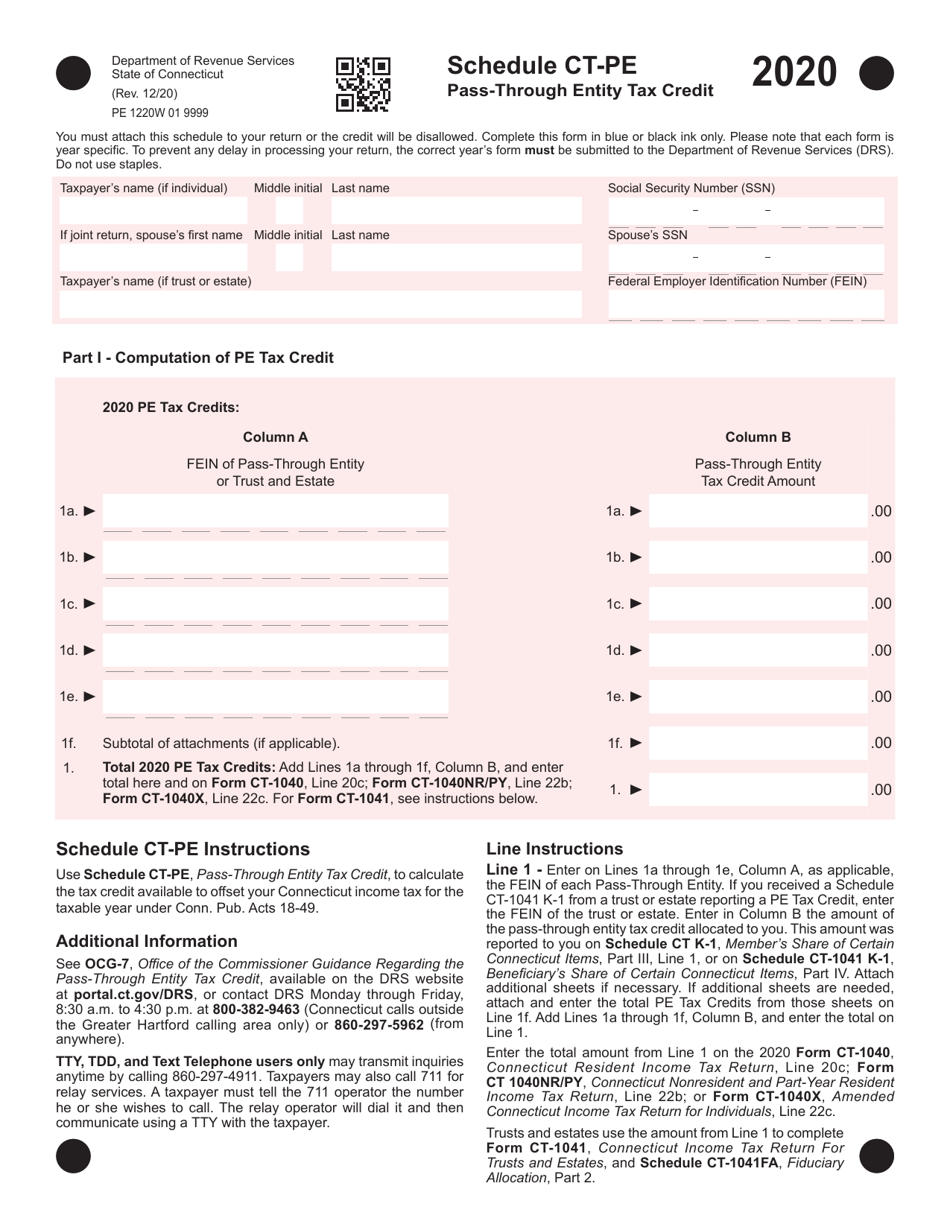

Schedule CT-PE

for the current year.

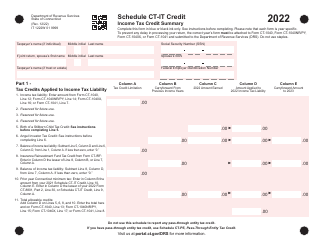

Schedule CT-PE Pass-Through Entity Tax Credit - Connecticut

What Is Schedule CT-PE?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CT-PE Pass-Through Entity Tax Credit?

A: The CT-PE Pass-Through Entity Tax Credit is a tax credit available to pass-through entities in Connecticut.

Q: Who is eligible for the CT-PE Pass-Through Entity Tax Credit?

A: Pass-through entities, such as partnerships, limited liability companies (LLCs), and S corporations, are eligible for the CT-PE Pass-Through Entity Tax Credit.

Q: How does the CT-PE Pass-Through Entity Tax Credit work?

A: The CT-PE Pass-Through Entity Tax Credit allows eligible pass-through entities to claim a credit against their Connecticut state income tax liability.

Q: What is the purpose of the CT-PE Pass-Through Entity Tax Credit?

A: The CT-PE Pass-Through Entity Tax Credit is designed to help offset the federal income tax deduction limitations for state and local taxes (SALT).

Q: Is the CT-PE Pass-Through Entity Tax Credit refundable?

A: No, the CT-PE Pass-Through Entity Tax Credit is non-refundable. It can only be used to offset Connecticut state income tax liability.

Q: How do pass-through entities claim the CT-PE Pass-Through Entity Tax Credit?

A: Pass-through entities can claim the CT-PE Pass-Through Entity Tax Credit on their Connecticut state income tax return.

Q: Are there any limitations or restrictions on the CT-PE Pass-Through Entity Tax Credit?

A: Yes, there are certain limitations and restrictions on the CT-PE Pass-Through Entity Tax Credit, including a cap on the total amount of credits that can be claimed.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-PE by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.