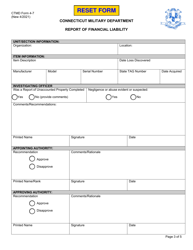

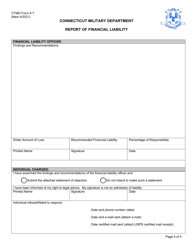

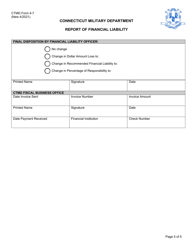

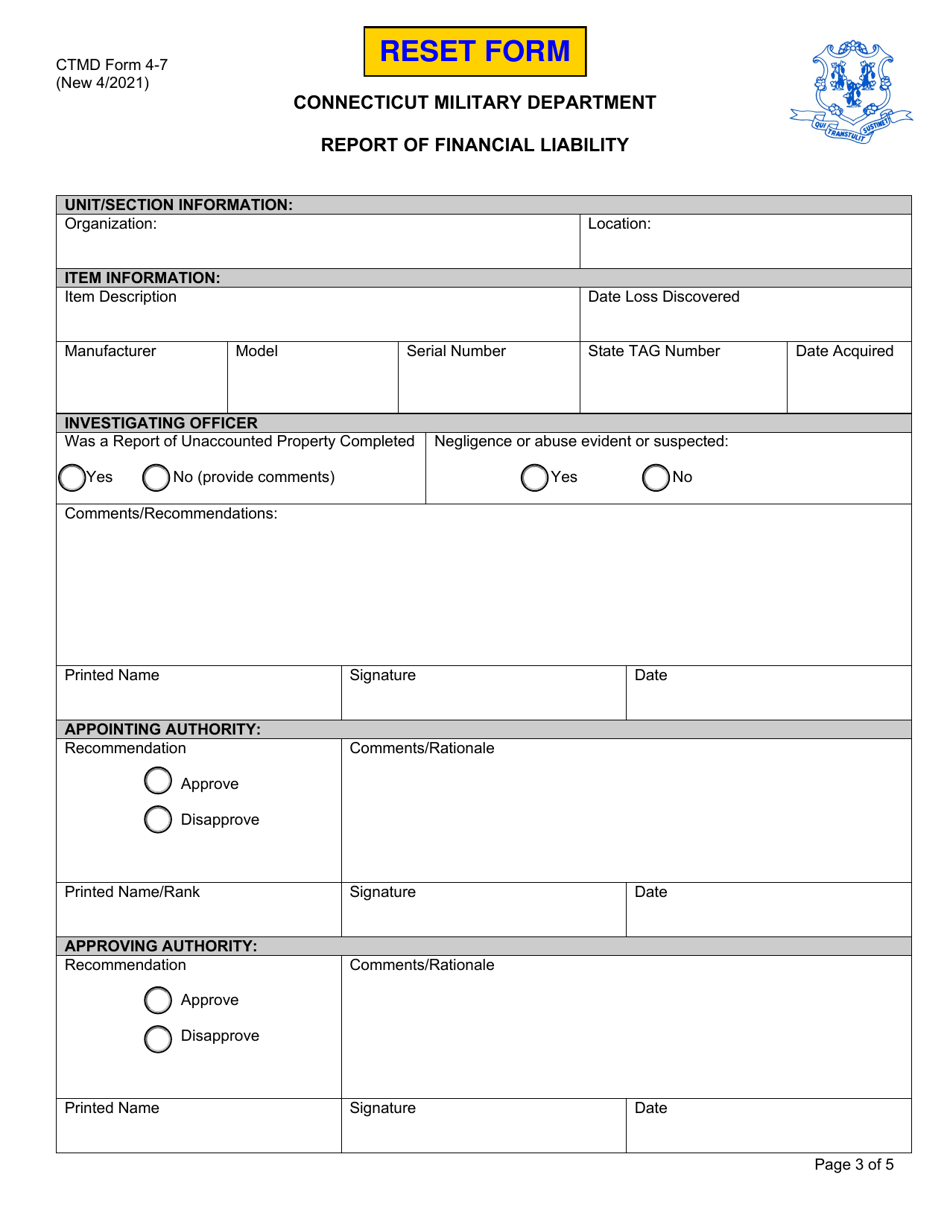

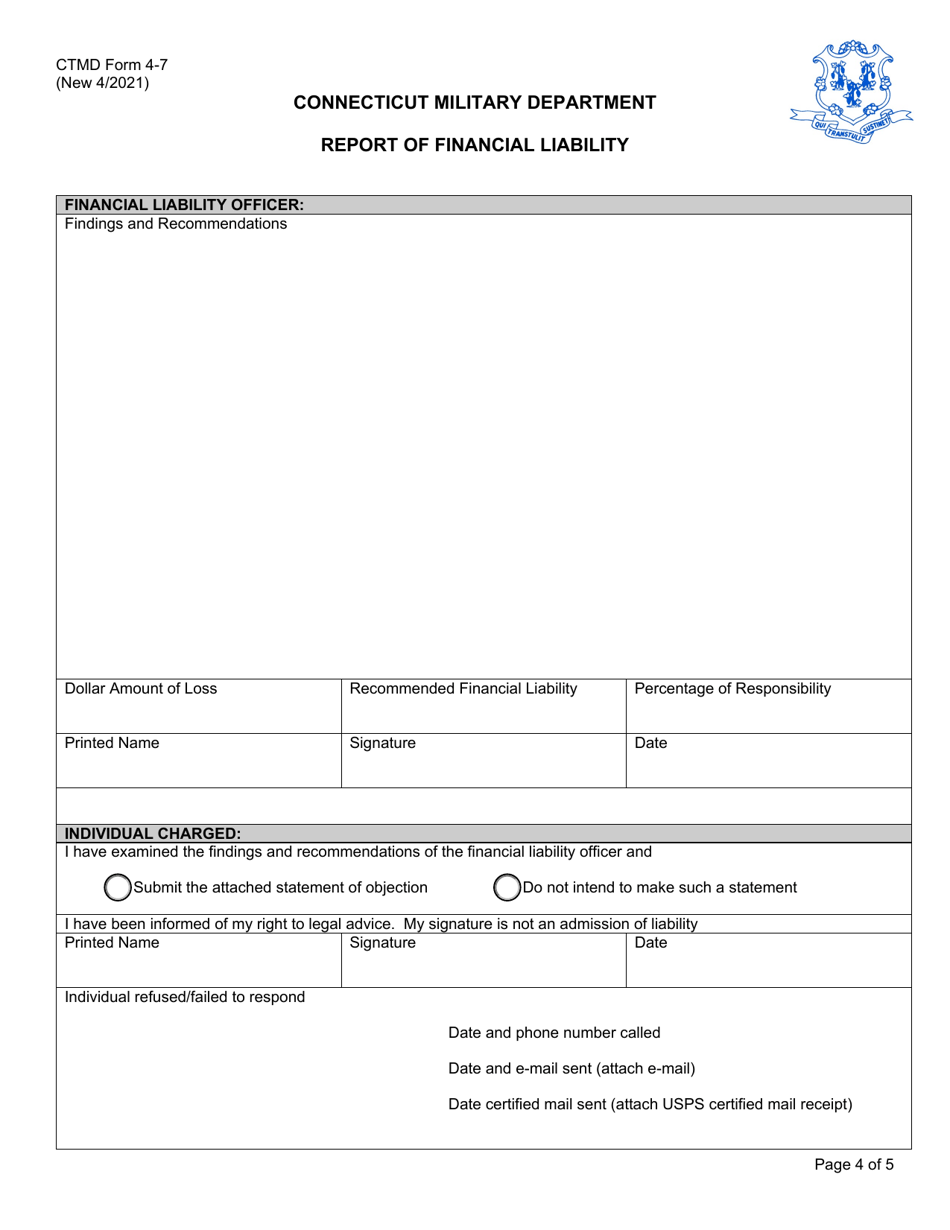

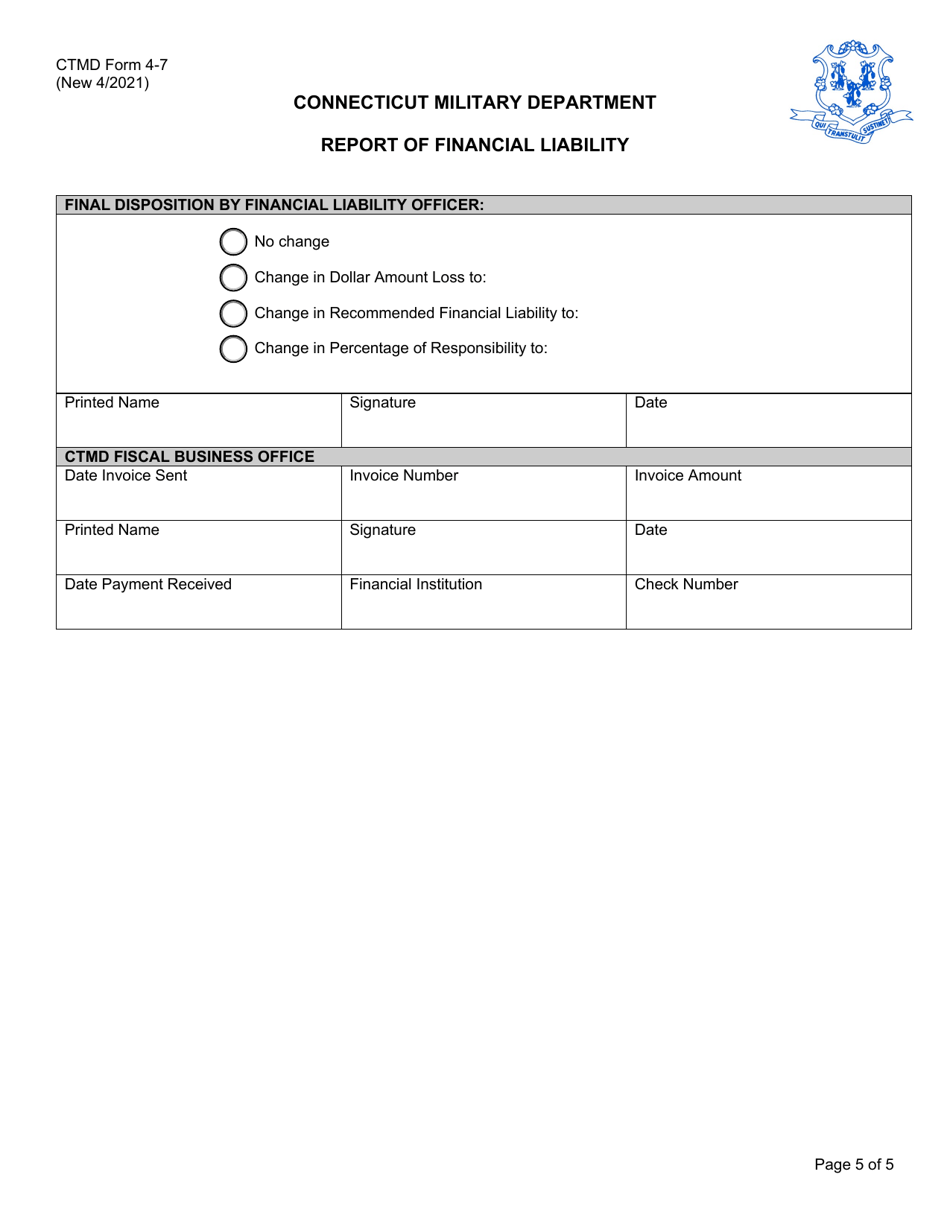

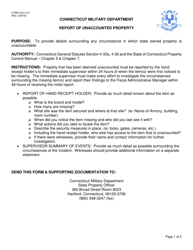

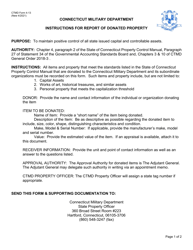

CTMD Form 4-7 Report of Financial Liability - Connecticut

What Is CTMD Form 4-7?

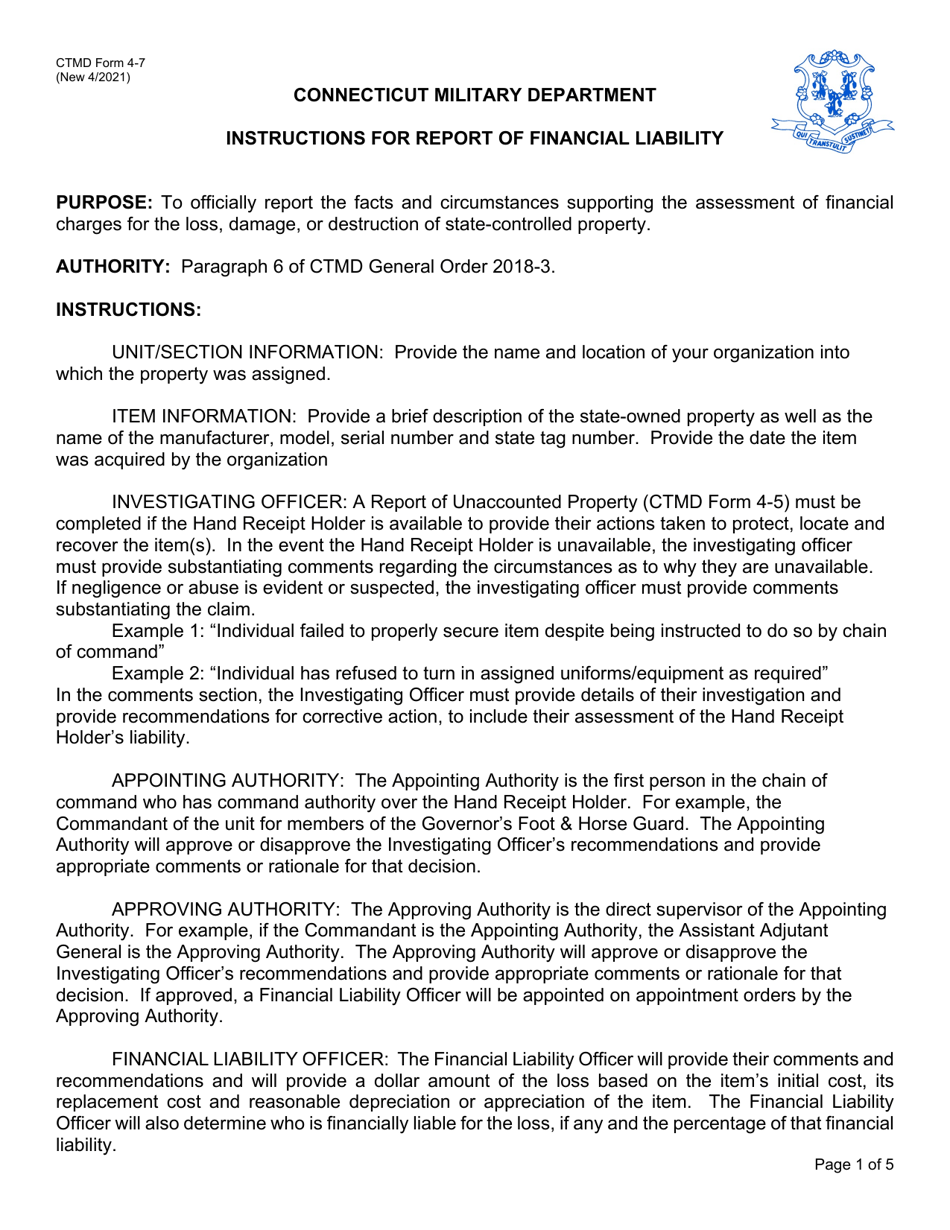

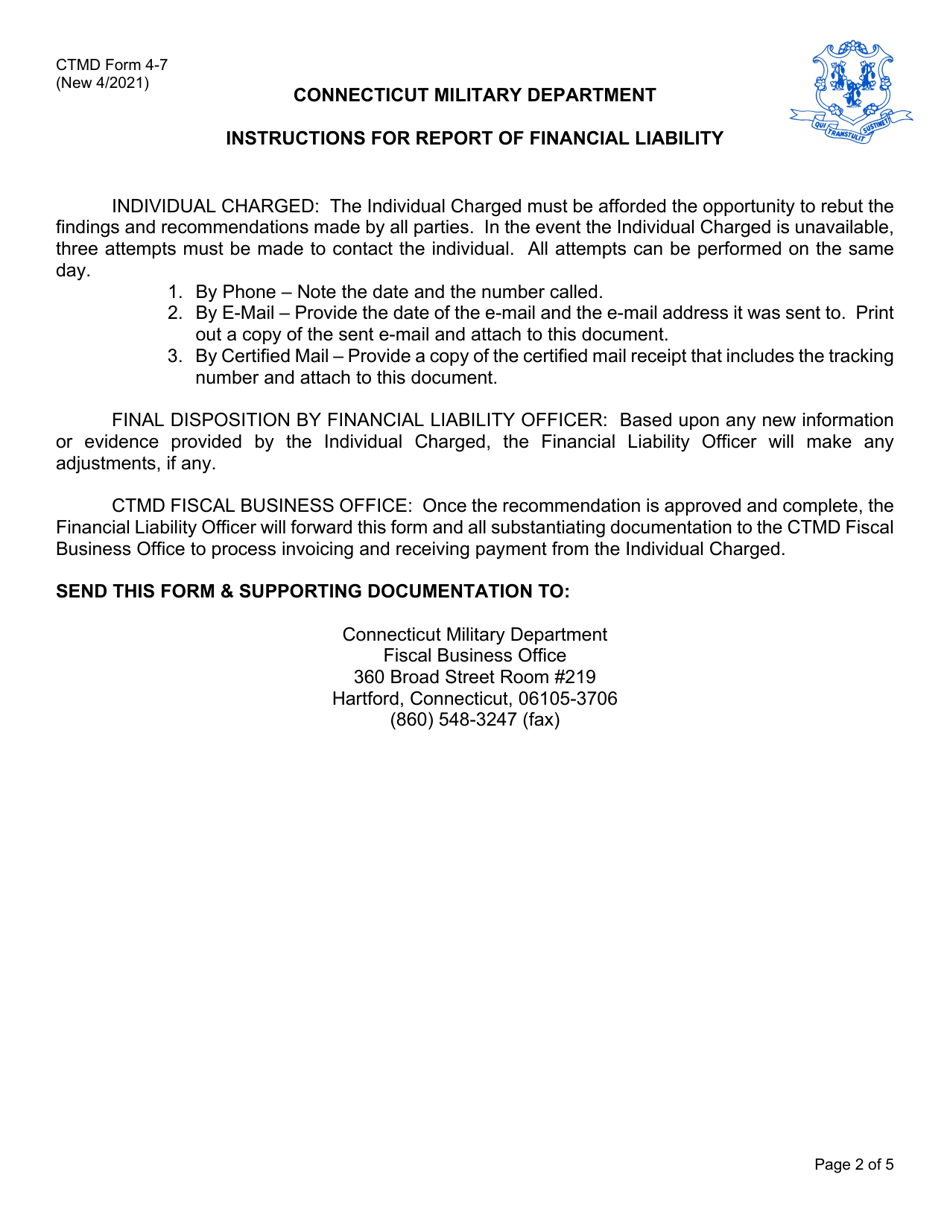

This is a legal form that was released by the Connecticut Military Department - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CTMD Form 4-7?

A: CTMD Form 4-7, also known as the Report of Financial Liability, is a document used in Connecticut to report financial liabilities.

Q: Who needs to fill out CTMD Form 4-7?

A: CTMD Form 4-7 needs to be filled out by individuals or businesses who have financial liabilities in Connecticut.

Q: What are financial liabilities?

A: Financial liabilities refer to any outstanding debts or obligations that a person or business has.

Q: Why is CTMD Form 4-7 important?

A: CTMD Form 4-7 is important because it allows the state of Connecticut to track and monitor financial liabilities in order to ensure compliance with applicable laws and regulations.

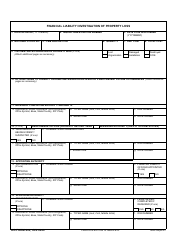

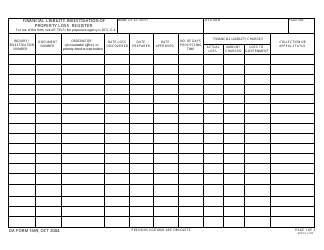

Q: How do I fill out CTMD Form 4-7?

A: To fill out CTMD Form 4-7, you will need to provide information about your financial liabilities, such as the type of liability, the amount owed, and any relevant dates or details.

Q: When is CTMD Form 4-7 due?

A: The due date for CTMD Form 4-7 may vary depending on the specific circumstances. It is best to check with the Connecticut Department of Revenue Services for the deadline.

Q: What happens if I don't submit CTMD Form 4-7?

A: Failure to submit CTMD Form 4-7 or provide accurate and complete information may result in penalties or legal consequences.

Q: Are there any fees associated with filing CTMD Form 4-7?

A: There may be fees associated with filing CTMD Form 4-7, such as processing fees or penalties for late submissions. The specific fees can vary depending on the circumstances.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Connecticut Military Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CTMD Form 4-7 by clicking the link below or browse more documents and templates provided by the Connecticut Military Department.